Aakash Exploration Services Ltd. is an oil and gas field exploration services company that provides services at the production stage after the survey and drilling processes are completed.

Here are the key details about the company and its stock:

Aakash Exploration’s stock price was ₹12.08 as of June 26, 2024, with a delta of +0.35.

The company has a market capitalization of ₹123 crore, a current price of ₹12.2, and a 52-week high/low of ₹15.4 / ₹5.70.

Some key financial metrics:

- Stock P/E ratio: 19.8

- Book Value: ₹5.78 per share

- Dividend Yield: 0.00%

- ROCE: 13.3%

- ROE: 11.2%

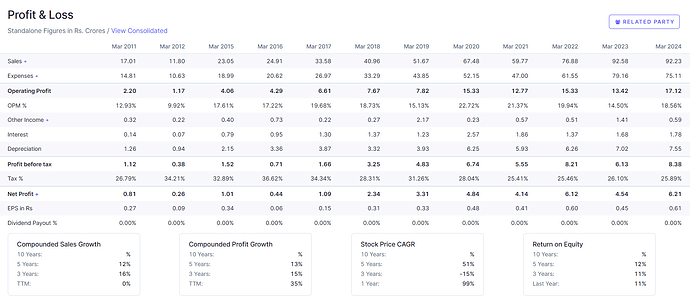

The company has reduced its debt levels, but is not paying out dividends despite reporting profits. Its return on equity is also relatively low at 11.2% over the last 3 years.Aakash Exploration’s standalone Q4 FY2024 revenue was ₹30.89 crore, up 56.7% year-on-year. The company’s quarterly results and financial performance have been mixed, with some quarters showing declines in revenue and profits.Overall, Aakash Exploration is an oil services company that has seen volatility in its financial performance. While it has reduced debt, the lack of dividend payouts and relatively low profitability ratios are areas of concern for investors.

Aakash Exploration’s future growth prospects are mixed:

- The company has reduced its debt levels, which is a positive sign. However, it is not paying out dividends despite reporting profits, which is a concern for investors.

- The company’s return on equity (ROE) is relatively low at 11.2% over the last 3 years, indicating room for improvement in profitability.

- There is limited analyst coverage and forecast data available for the company, making it difficult to reliably project its future earnings and revenue growth.

- Some third-party forecasts estimate the company’s share price target could range from ₹10-₹80 over the next 5-10 years, based on assumptions of continued growth in the oil and gas services industry. However, these are speculative projections without detailed analysis.

- The company’s recent quarterly results have been mixed, with some quarters showing declines in revenue and profits. This volatility in financial performance is another factor that creates uncertainty around the company’s future growth.

Key risks facing Aakash Exploration Services:

- Profitability Concerns: The search results indicate that Aakash Exploration Services has a relatively low return on equity (ROE) of around 11.2% over the last 3 years. This suggests the company may be struggling to generate strong profitability from its operations.

- Lack of Dividend Payouts: Despite reporting profits, the company is not paying out dividends to shareholders. This could be a concern for investors looking for income from their investments.

- Volatility in Financial Performance: The company’s recent quarterly results have shown some volatility, with declines in revenue and profits in certain quarters. This inconsistent financial performance creates uncertainty around the company’s future growth prospects.

- Limited Analyst Coverage and Forecasts: There appears to be limited analyst coverage and financial forecasts available for Aakash Exploration Services, making it difficult to reliably assess the company’s long-term growth potential.

- Competitive Pressures: As an oil and gas services provider, Aakash Exploration Services likely faces competition from other players in the industry, which could put pressure on profit margins and market share.

- Exposure to Commodity Price Fluctuations: As an oil and gas services company, Aakash Exploration’s business is closely tied to the volatility in crude oil and natural gas prices, which could impact demand for its services.

- Regulatory and Policy Risks: Changes in government regulations or policies related to the oil and gas industry could adversely affect Aakash Exploration’s operations and financial performance.

In summary, the key risks facing Aakash Exploration Services appear to be related to its profitability, dividend policy, financial performance volatility, limited analyst coverage, competitive pressures, commodity price exposure, and regulatory/policy risks. Addressing these challenges will be crucial for the company’s long-term growth and sustainability.

Keen to hear your thoughts on this stock and oil exploration space. Thanks.

Individual Holding - Zero