I attended the AGM of 20 microns dated 25th September, 2020 and want to share the notes/ takeaway’s after attending the AGM, this article is mainly to highlight management quality which I think needs to examined & studied more.

(I had taken only 20 micron’s AGM part from my blog article

https://stockactivist.blogspot.com/2020/09/AGMupdates.html)

The meeting started at 3:00 p.m. and all formalities such as reading out resolutions, reading comments from independent auditors report, confirming quorum and then chairman speech was done.

Now came speakers turn to ask questions only 3 speakers were there.

First 2 speaker asked following questions

What is impact of covid on business?

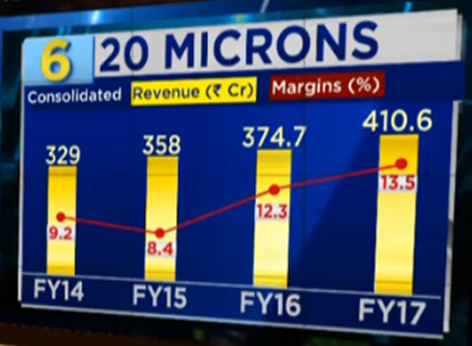

Why operating margins were down?

Why press release was not being published on exchanges along with results?

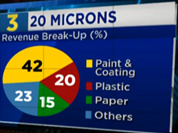

What is the market share of 20 microns in the industry and what is revenue share?

What is finance cost?

What are the plans for IPO of 20 microns Nano?

Answer:

Covid has impacted business and our revenues have definitely been affected from this

Operating margins were down due to transferring high margin business in 20 microns Nano to streamline the process.

Due to covid this year we are not attaching press release, next financial year onwards we shall restart the practice of publishing press releases as well.

20 microns is the leader in the market of micronized minerals

(Also revenue breakup from each segment was given)

The finance cost currently stand at 12%, we are in talks with lenders to bring it below 10%.

We have no plans of IPO for 20 microns Nano due to bad market conditions, we may consider it next year.

Now afterwards I asked my questions

(Which were already emailed to them as per their request.)

-

What is the finance cost? They already had answered that as 12%

-

What is this note number 40.2(b) (page no.98) what is this 1 crore lenders are asking in exchange of permission to pay dividends?

Answer) this is the Adhoc recompensation amount we had to pay as 1 crore to prove to SBI (lender) that we have the intention to pay back 8 crores of amount.

(I did not understood it the first time and even after clarification why you would pay 1 crore rupees to pay 2 crores as dividend, why not clear 8 crores of loan in the first place? Also as a layman I would wonder what does ‘adhoc recompensation amount’ means… Thankfully we can google it…but it’s a red flag for me.)

- 20 microns has launched very innovative and disruptive products such as micronsil 30c, I had seen it on YouTube, and so have you patented your product?

Answer) we have not patented that product, also due to IP rules in India it was not appealing for us to do so, but now the rules are better. also in future we have some innovative products which could be patented.

(They made high claims in their YouTube video about the ability of product but no patent? (Red flag) so anyone else can also manufacture and produce this product going forward.)

- 38% of revenue come from only 2 clients/customers how do you plan to diversify your customer base?

(No answer was given)

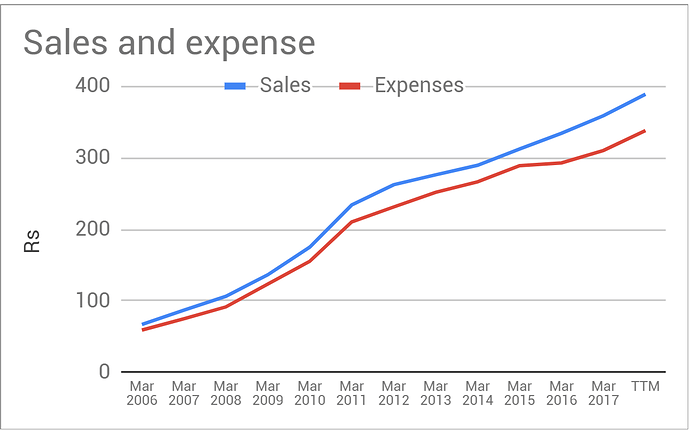

- Cash flow and valuation:

We have 38 crores of operating profit, but if we deduct 13 crores of investing cash flow, and 20 crores of finance expense only 5 crores of free cash flow remains.

This is a big concern as finance cost is very huge (it makes 20% of current market cap)

How do we plan to improve these figures?

(No answer was given)

- What is the business like in herbal division as i see a lot of potential in it (I asked a general view on it?)

Answer) we have been launching products it may take some time to pick up as currently we are only doing online sales as online is the future.

- I had written in email about suggestion on improving the website further.

Answer) we had developed website in-house using 2 to 3 people, but now we are hiring professionals to do this job and in coming time you will see the improved version of website.

I was waiting for answer on cash flows, but then I was muted and company secretary of 20 microns Anuja muley started the formalites to end the AGM.

My views: important question on cash flow was ignored and not answered, this is how management ignores tough question,

I felt bad on not getting answer even when they had my email before hand to answer me appropriately, then what was the use of sending email? Huh?

I was not impressed by the management at the AGM, hence my views could be biased against the company and I wish there would be better communication so I could get clarification and answers to my question.

Conclusion:

The company has great products with great potential, but due to my experience in the AGM, I am not so positive about the company, let the things improve:

In terms of reduction of debt, more free cash flows, more patents being filled and more sales in herbal division

My views on the:

Company: neutral

Management: neutral

Meeting ended around 3:40 p.m.

note:

- i am invested in the stock (for study and tracking)

- my post was to highlight the quality of management, i am not satisfied with them currently would need further investigation.

- may seem a value pick but if we look at cash flow statements they dont look great at all (financials also needs to be investigated further)