However in Screener , the Investments is shown as 21 cr and Cash Equivalents is shown as 13.5 cr

From my understanding 'Investments" are long term investments of more than 1 year and Cash and cash Equivalents are cash investments that has a maturity of less than 90 days? So is it correct to say that the total cash investment at the moment for Premco is 34.5 cr? Can some one please clarify? Thank you…

I was quite being pessimistic about this - since am following for an year.

The Jockey story is still not an realized asset for the company : Haven’t got to hear anything from the management

However, when turning back i thought to give an understanding of their elastic for medical PPE

Found this article from company site wherein the company is advertising for its elastic bands : https://static1.squarespace.com/static/5c6828b12727be3ec46fa3e2/t/5ed3b66171525e120c634782/1590933128687/Premco+Global+Elastics+for+PPE.pdf

Generic uses

Key Players Mentioned in the Global Narrow Woven Fabrics Market Research Report: FILATEX, Daman Polythread, U.P. Filament (India), Bally Ribbon Mills, Great American Weaving Corporation, Dadra Poly Plast, India Braids, Narendra Corporation, McMichael Mills, Premco, Performance Fibers

Global Narrow Woven Fabrics Market Segmentation by Product: Polyester Type, Nylon Type, PP Type

Global Narrow Woven Fabrics Market Segmentation by Application: Garments, Home Furnishing, Other

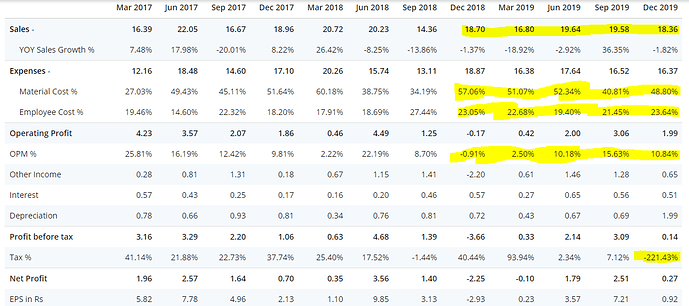

The sales are keeping up since due to capex being done for vietnam building - there is a long way for realization

Material Cost & Employee Cost going in sideways…

OPM is still doing well when compared to 2018

@HIMSHAH, @kk82, @paresh.sarjani1 @ayushmit can you throw some light on this with respect to PPE Kit sales? This might be an turnaround point for the company -

PPE KIT are generically use & throw and depends on new PPE Kit daily - if calculated with whole round of opportunity given an economic worldwide scale per PPE KIT/daily would generate upto a 7 digit number ( am not an expert though - however the pricing for each elastic in terms of mm (Millimetre) price & usage & other macro economic factors affect) but mainly the sales/order book we can rely…

I just checked Premco site and came to know about this. I am sorry I won’t have any sales estimates for this because I feel company has entered into this segment feeling the market size and opportunity going forward.

Being a very well known name in elastic band brand, I don’t think it should have any issues selling to its existing customers.

Thing is getting new permanent customers who specialises in manufacturing masks for e.g. Abbot India. I am not sure where they get elastic from.

I think it would be interesting to check Q1 FY20-21 to get idea on sales due to masks etc… Opportunity is huge no doubt

Disclosure- Holding

Seems like the company had got already into work well before long before April : The company had mentioned in their FB page.

Board has recommended Dividend of Rs. 2/- per share of Rs.10

OPENING BALANCE OF CASH AND CASH EQUIVALENTS 203.37 (2020) — 22.51 (2019)

CLOSING BALANCE OF CASH AND CASH EQUIVALENTS 1,319.19 (2020) — 203.37 (2019)

Profit for the Period After Tax, Minority Interest (XI-XI!) (169.30) -MAR2020 (90.51) - DEC2019

The company has good cash, however the profits are affected badly… Am hoping for Q2 results to be better…

Indian business is dragging the numbers down… Vietnam is doing better.

I expect q1 nos. will be worse than q4

Your views on why the next quarter will be worse?

Your rationale behind it? @Ns1

If you had a chance to meet/discuss with management/co-workers, can you share your comment? I cannot find any concall

We can see that cash flow is increasing in numbers and receivables are recovered

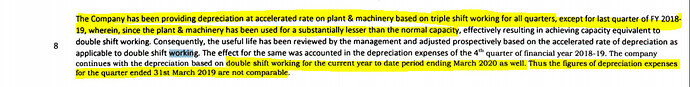

There has been change in accounting standard for their lease term and the depreciation cost has gone up for the same & also the company mentioned that the people are working in triple shift - you can see my post attached given in FB link that people are working 24 * 7 - this justifies it.

No change can be seen in inventory rising for March 2020

I assume that the Indian business may have put to hold from March or i may be wrong.

Negligible operations in April, 30% in May and 55% in June. Plants are operating mainly to manufacture Elastic for PPE materials, which is very thin margin business as it’s very local level unbranded market.

Thanks @Ns1 - did you get any chance to talk to management? can you share your views on it?

If you know someone from the company it would be great to get insights about the Vietnam company CWIP and the contract for Jockey?

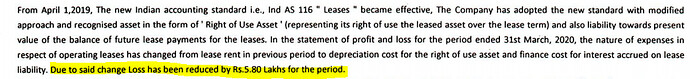

So far the cash has grown 4X - without considering the short term borrowings of the company and also wee see that revision in lease/rent accounting standards has been changed so there was a loss in which company managed to save 5 lakh for the period.

Cash is mainly generated from debtors realization and short term borrowings.

Actually there is pricing pressure for their product and management do not go for further price decrease as they are confident of product quality.

Can you give me your insights in just few sentences going forward with respect to their business in Vietnam and India?

And do they supply to Jockey?

- it seems you have good understanding of the company and am not able to get much insights - it would be great value add to forum. Thanks

Their vietnam business is doing good. They do supply jockey and many other international brands as well, but for last 2 years their competitors are offering better pricing so that’s the weak point.

Some interesting observation from Annual Report

The Company targets to maximize, its capacity utilisation

in India & Vietnam for the financial year 2020-21 by entering

new markets like Europe and Bangladesh and introducing new

Products.

Investments in MFs have doubled 12 to 22 crores almost

Unsecured Loan from director of around 490L…

Missing terms for this… Looks like issue of warrants or shares on the way to increase promoter stake

Their is no proposal for stake increase by promotor as company don’t need cash. Also interesting point is not only 22 cr investment in mutual fund but also 15 cr cash /bank balance

I am not saying there is proposal…

I am not sure why promoter loan when it was not required

Promotor has given loan to company at reasonable rates when it’s needed. May be premco global repaid premature loan Back to parent so it may be still their in books and yet to returned.

For more details please go thru AR.

Isnt’t remuneration of the managing director and whole time director very high considering that remunerations are 87 lakhs and 60 lakhs which is more than 10% to 15% of the profit after tax which is just 5 crs

I think it’s fair when management is honest. They can easily mismanage and transfer funds in many ways. Till today’s date since last more then 10 years I have not found any transaction wich may creat doubt in investors mind. So if they are taking remuneration wich we find higher, I don’t mind.

It’s subjective matter . This is my view.

Can anyone update about what happened in AGM?