@amitayu My comment was in general to canfin and pnbhfl where before comparing book value numbers etc, it is more important to see distribution of lending.

@sgjaclyn Depending on mgmt words is proportional to amount of trust one has in management based on his own experience of tracking Personally, I have never tracked this company as a stock,so, no comments here

@pranav_pratap I have been a customer of this company from past 3 years. During 2013-15 when real estate was going through bad times, lot of developers tied up with real estate financing companies and launched double your money kind of schemes. The arrangement was it is buyer who gets 100% loan amount in advance, takes all the credit risk, passes it to builder. Builder assures that equity money given by buyer will double in 3-4 years and after 3-4 years it is up to buyer whether he wants to retain the flat or take double money (no one suffers, only buyer suffers if things go wrong. Developers get lot of money at the credit risk of buyer else he would have got same loan at 18-20%, financier gets great way to show stupendous growth). Flow 3 years down the line, some of the projects are not closed to delivery,so, buyers fighting with builder and financier. Those who want to retain home may want to shift from NBFC to SBI (buyer had to get loan from a specific NBFC as a part of arrangement). Those who want to get double money are fighting with developers in many cases as it was pipe dream. I am not sure how much exposure of overall lending portfolio each of such NBFCs participating in these schemes have/had and hence can not comment on overall lending quality. However, PNBHFL was involved in some of projects in Bangalore Mantri webcity phase 2 and 3 under similar scheme

@pranav_pratap @amitayu Personally, as a customer, my experience with PNBHFL in terms of service has been good (based on 2-3 interactions), however, i know people who are stuck in such schemes where with Indian mindset of buying real estate and lure to double income, people invested in multiple project and now when real estate prices did not double, developer did not meet commitments, tussle between builder, developer and customer is going on. I am not sure about scale of problem, hence, can not comment if this will have very small or large impact on the parties involved in future but this could be worth digging for someone with strong exposure.

It depends on customer whether he is salaried /Self Employed , Branch network etc. Yield for Self Employed Customer is more and moreover, it has reach on Tier2-Tier 3 Cities where competition is less.

Thanks for the detailed description. This looks like a typical case of greed getting better of the investors; this time in real estate.

It seems market is pushing down PNBHousing, maybe investors are concerned with PNB bank scam and they think it is going to impact PNBHousing also.

I believe it has nothing to do with PNBHousing Finance, inviting your views for the same.

‘Bap Jaisa Beta’ Is DNA effect going to play in people’s mind?

In competitive HFC market, if a company (newly listed) grows AUM too fast compare to old proven guys (Gruh), people see with caution!

In Finance, everything finally ends with how best underwriting HFC/Banks is doing for loan. Is company focusing super fast AUM growth relaxing on underwriting norms or they are OK with reasonable AUM growth without compromising underwriting policy. First could rise fast and fall fast but later one can steadily grow upward in market.

I have observed that you have been trying to spread rumors and speculation without any substance to back it up. Previously also you had speculated that Basant Maheshwari had sold of all his investments in PNB housing without being able to back it up. Now you have come again to start spreading rumours and escape once confronted and asked to back with facts. ‘Bap jaisa Beta’ is an absolute invalid statement in this case as PNB management is in no way associated with working of PNB housing.

Check here who are first two people

https://www.pnbhousing.com/about-us/board-of-directors/

LOL, Since when Non-executive Directors are part of Operation of a company or have Decision-making power on a company operation? In Investment, it is much necessary to know about the financial related terms. Basic understanding of those terms helps a lot.

Few points and your thoughts please.

RBI ask PNB to pay entire 11,300 cr. From where this money will come from?

PNB approximately has 33% shareholding in PNB housing. i.e. valued at 6900 cr.

Will PNB be forced to sell its holding in PNB housing? If yes, as few members said, this should be good in the long term.

However, what happens to the PNB brand? I read somewhere that PNB housing can only use “PNB” brand as long as PNB holding is maintain above 30%.

What happens if the holding falls below 30%?

Also, with PNB fraud headline all around - What happens to the trust of the depositor?

Just think about this. If someone had fixed deposit in PNB, then won’t these people be moving their FD’s to other banks? What happens then?

Common people won’t be able to distinguish between PNB and PNB housing. Post this damage of PNB brand - Would this impact PNB housing finance buiseness? Would people prefer other bank loans instead? What will happen to PNB housing deposits? Will people liquidate that too in panic.

Your thoughts please.

PNB hands over to CBI list of 150 fraudulent LoUs issued to Nirav Modi

Nirav Modi: ED seizes diamond, gold jewellery worth Rs 5,100 crore in searches

Just a reminder for people equating Housing finance with everything else and also speculating arbitrarily:

If there was a huge NPA problem to happen in Housing finance it should have led to trouble first in housing loans of PSU/Private Banks and HDFC by now, as they have done far more business in housing than PNB Housing and they seem to have survived with Unitech and all that in the housing area. Because there are no 45000 crore loans to be given in housing.

As long as numbers speak what they do , PNB Housing remains a good long term bet for me, specially with the new RBI rules : https://economictimes.indiatimes.com/industry/banking/finance/banking/rbis-new-npa-resolution-framework-long-term-positive-report/articleshow/62917062.cms . Doodh ka doodh and Paani ka paani will happen for all of the loan business in the next 2 years anyway.

Parent’s capital may be wiped off and as majority shareholder Govt may step in to infuse capital. That is you and me paying indirectly for the mistake because so far we have voted for a socialist regime which is root cause of this problem of bank nationalisation.

But there will be pressure to get the money and like Canara bank the decision makers can decide to sell off the stake. Let PNB come out with how they are going to handle the hole in the balance sheet. Being a govt. run bank the depositors would not be concerned much and majority of them may not be aware of its implications.

As for the PNB HSG borrowers it should not matter because the lender should be more concerned than the borrower. As for public depositers with PNB Hsg, if they thought it is majority govt owned, the perception would remain. For those who are aware of the difference, they may deside to withdraw if their concern bothers them. The company may face short term redemption pressure and that should be part of their business plan. But their future borrowings may be priced higher because of investor conversation.

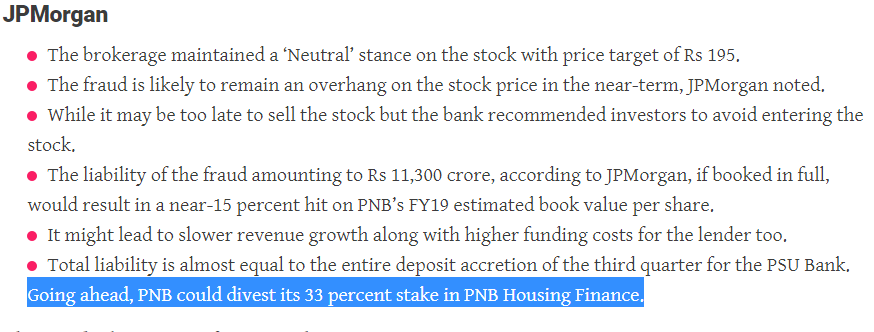

The view from a prominent Foreign broker reinforces the popular perception of cascading impact of Niravgate on PNBHF.

The possibility of a full exit of PNB from its HF subsidiary could throw interesting scenarios.

CanFin was making presentations to several investors in the past couple of weeks to facilitate CanBank, its parent Bank to exit.

Now those investors potentially got another choice. An HFC growing at a fast pace.

Just like ordinary investors who sell their winners in a stock market and hold on to their losers PNB will do the same. It is easier to sell out PNB hfc than give a stake to privatize PNB and bring some better governance (which should be the case). All the more reason for PNB hfc holders to hold on or add .

I was thinking on this comment if it entirely correct. Probably it is not in my view. Bajaj Finance with a RoA of 3+ (don’t have the exact number) still gives out 20+ RoE. That means a leverage of around 6-8 times.

But Can Fin which has 2+ RoA hits RoE of 23+ with a leverage of 10-11 times.

So simply by looking at RoA can we conclude BF is better than CFH in turn is better than PNB Hsg? I don’t think so.

Other parameters like risk management, growth rate etc along with RoE and RoA should help us to judge a financial company and come to some conclusion, but not by ignoring RoE.

More experienced VP’s can comment if this understanding has some faults.

You are doing a very basic Mistake. You are comparing completely two different Line of business (Just like comparing apple with Oranges). Bajaj Finance does Consumer Financing + SME Financing + LAP + Unsecured Lending + Credit Cards (Driver of Higher ROA) where as Canfin ,PNB HFL does Mortgage financing (Secured Lending).PNB HFL is now in expansion mode (Branch establishment,employee cost etc) which was done by Canfin 2-3 years ago. Once this C/I, Opex will stabilize, ROA and ROE will be much higher .There are many threads already available in VP forum, ‘‘How to analyze NBFC Comapanies’’, Gruh Thread ,Canfin Thread , Bajaj Fin etc.Go through all those forum thread from top to bottom, your concepts will be clear. IMHO,nobody can help you to build your conviction , you have to learn yourself and build your conviction and take decision yourself during bad time.