is crude oil price increase in anyway affects the raw material cost for meghmani ?

I dont think so and if it dose then might be very minimal, as if you see the past trend then one observe not very big dependency on crude price and ebitda margin.

But more views on this counter are always welcome.

Usually for companies with crude-linked raw materials, trending up and range- bound crude prices are ideal scenarios. First leads to margin expansion and second leads to averaging of margins over time.

Good Result. Consolidate Eps - 6.74 from 3.45

Standalone Eps - 3.03 from 1.63

70459f5c-5fa7-431d-b2f5-57456147485e.pdf (1.1 MB)

Gr8 point…agreed attractively valued…also since profits have shown considerable improvement QoQ for last few quarters…we can just annualize the latest quarter (assuming no significant seasonality)…eps would be around 8 plus mgl subsidiary eps…

One thing m curious to know…why sales are moving up…is it bcz of favorable pricing or they have done any capacity expansion recently…i could not see anything significant in cash flow in investing activities…

Caustic soda prices continue to rise. There is a price range of 50-500 USD for caustic soda, but now prices have trending way beyond the range at around 600 USD+. Uncharted territory.

On last con-call, management predicted that prices will remain in the range 600 USD per ton (40,000 Rs) for next year or so. But this is not sustainable in long run and prices can crash badly. However, with China cutting capacity and Turkey coming up with new capacity, there are lots of outside variables which can affect company’s bottom line. This is why stock is largely range bound as big money is not hitting the stock like it did when stock moved from 50 to 100 in 4-6 weeks last year.

Thanks for the response. I did notice the majority of the incremental earnings coming from caustic soda (in their segment break-up). Although there has been some improvement in other two segments as well. Good observation on why PE multiples will remain lower due to cyclicality in earnings and cash flows. Majority of the products are commodity in nature and EV/EBITDA of 7.0x 8x seems to be a fair valuation of the company.

The company has also line up 250-300 crore capex plan for next couple of years. It plans to achieve 3000 cr revenue target by next couple of years.

Hence assuming 3000 cr revenue and average margin EBITDA of 15%-16% (trough to peak, the current margin is 25% which is probably at the peak and is not sustainable) leading to EBITDA of 450 crores. Assuming average debt of about 400 crores, 3600 cr can be the EV and market cap could be about 3200.

Now the given the current Mcap of 2500…potential for some upside exists.

EBITDA margins segment wise:

-

Pigment division: Contraction from 17% to 15% on account of raw material prices increase. Company is expecting that they will be able to pass it on going forward. But raw material prices can continue to increase putting further pressure on margins.

-

Agrochemicals: EBITDA margins decreased from 9% to 6% on the account of higher provisioning. Debtor days will continue to be high as company is looking to increase sales in FY 19.

-

Basic Chemicals: Margins of 47% are not sustainable. As per management guidelines, first they said that they are expecting 35-40% next year but on further asking by some analyst, management said that they expect it to be within 30-35%. Management further added that this being a cyclical product, it is difficult to project prices ahead of one quarter.

So all in all, EBITDA margins eroded in two segments and not sustainable in third one.

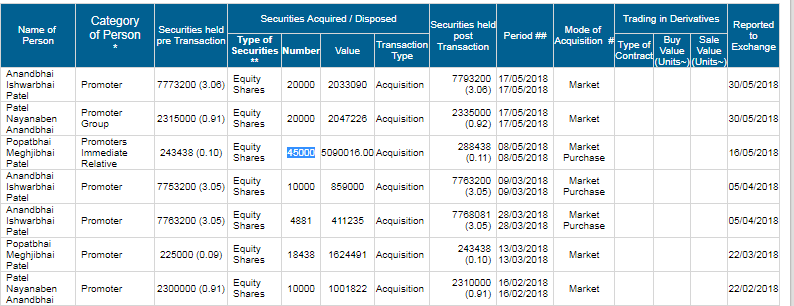

Promoters bought 40,000 shares on 17th May

Financial Statements And Related Announcement - Full Yearly Results

20180530_172436_M30_4LX6IP5Y5M9CGNQ4.1.pdf (980.7 KB)

Online link for the above upload:

http://meghmani.listedcompany.com/newsroom/20180530_172436_M30_4LX6IP5Y5M9CGNQ4.1.pdf

Is it possible to get a transcript of the same

Regarding Basic Chemicals what the management said is usually they can maintain 30-35% margins but this year they should be able to maintain 35-40% margins due to better realizations in caustic potash and CMS plant commissioning. They also said there will be 20% volume growth on absolute numbers in Basic chemicals segment.

Promoters buying since last 3-4 months. It gives some solace when whole mid caps and small caps are in correction.

I have to clear the air of ambiguity that is being surrounded here around Meghmani.

-

This company performs operations in Cyclical commodities like Caustic soda, Agrochemicals (which are extremely dependent on many external factors like seasonality, Monsoons, conforming to rigorous compliance standards of Government Pollution boards). To put it in a context majority of its revenues come from these cyclical segments.

-

Giving a PE multiple above 15 for such a cyclical trading company is purely bonkers and is in no way justifiable that too based on the EPS during its peak cycle is inane to put it mildly.

-

There is lot of euphoria about promoters buying shares, when in fact they have purchased a meagre 1,53,829 shares since 3rd October, 2018 or 0.00060487771 percent of total equity of 25.43 crore.

-

Market never rewards 2 or 3 exceptional quarters but instead looks for consistency and evaluates if these Revenues and EBITDA margins can be sustained over a period of time. Specially if the revenues are coming from cyclical commodities which are controlled by vagaries of external factors

(a) - In Meghmani’s case caustic soda prices are extremely dependent on Aluminium pricing,

(b) - China cutting down caustic soda production,

c) - Europe changing their caustic soda manufacturing process to Membrane cell technology,

(d)- Hurricane Harvey disrupting caustic soda production in Houston,

all these factors confluenced for the exceptional increase in Caustic soda price from where the majority of Meghmani’s revenues come from.

Now all these factors have dissipated and caustic soda (ECU) production has reverted to normalcy across these regions. Smart investors have already known these things and priced in the future earnings for the entire year 2018 way back in Oct-Nov 2017 when the Meghmani’s share has risen to 120 odd from 40s. That is the time where bulk of retail investors have gotten into the share thinking it would raise more but all the while it has been consolidating from the past 6-7 months. I don’t understand why won’t any market analyst share these things.

Calculating PE multiple of a cyclical industry based on present EPS is absolutely unintelligent way of investing. It is absolutely vacuous.

Please please read these research papers one is from Professor Ashwath Damodaran to understand the basics of evaluating cyclical industries.

http://people.stern.nyu.edu/adamodar/pdfiles/papers/commodity.pdf

and the second one from

www.ccsenet.org/journal/index.php/ibr/article/download/70549/39395

This one talks about the complexity in evaluating Cyclical companies and valuing the company based on EPS when the company is in its peak of earnings cycle is absolutely perfect recipe to lose your hard earned money leading to anguish. That is why we should always consider the normalized earnings over entirety of the cycle.

There is lot of excitement over buying of IFC stake but serious investors would look if the growth in the company is being driven by the growth in volumes because of which there is bottom line expansion. If the growth is coming in the bottom line with the stagnation of top line then it doesn’t augur well for the HNI investors who are the price determinants.

If somebody has alternative take on my arguments kindly put forth the reasonings

Your argument is typical for cyclical industry and Meghmani need not follow the same pattern.

- Management has guided that turnover increase of 65% maintaing the margin.

- China factor is expected to stay around for 2 to 3 yrs.

3.Capex on the anvil is expected to contribute revenue expansion n consequent earning expansion. - PE multiple is only 9 giving a margin of safety, though I wd hv liked around 7.

- Marque investors are still holding the fort. Not yet ditched. May be we hv to see June shareholding pattern.

In view of the above, moderate growth can be expected .

are you considering forward PE of 9 , for next year ? at a price of 83 and PE 9 , EPS comes around 9.22 , which means approx 36% PAT growth in current year from 6.74 EPS.

Fy18 NP is 237 cr giving an EPS of 9.32. with earning expansion expected for the next 2 yrs , even maintaining a current multiple, decent upside exists.

Excl: This forms 3% of PF and my views are biased. Pls do ur own due diligence.

Exactly my thoughts. I bought stock around 75 in August last year, just before it rallied to 120. Then, took me a while to understand the cyclical play involve here, by reading various threads here on chlor-alkali cycle. Exited around 95 just after Q3 results, when almost all the questions in con-call was around caustic soda pricing. Not much profits for me, but good learning.

Best time to get into chemical stocks was 2013-15, now the sector is almost at peak. There are some pockets of value left where China is banning production (like NOCIL or Bodal), but overall sector may be peaking. These are strictly my thoughts and I reserve the rights to be wrong.

Disclosure: no holding as on date