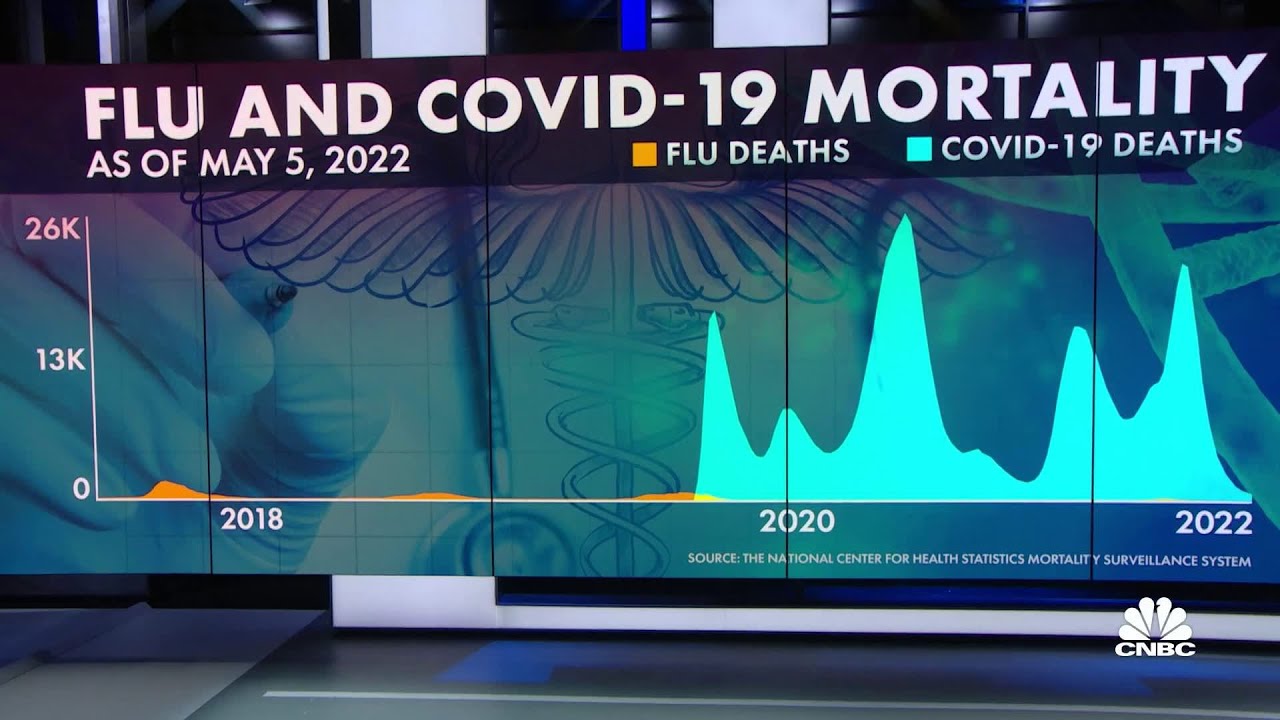

Flu seems to have arrived in US after a break of 2-years. It should be a material positive for cos like Lupin and Natco who have a large product basket for treating flu. Will be good to ask management on this, given company suffered materially due to lower off-take of flu season in last 2-years.

Disclosure: Invested (position size here, no transactions in last-30 days)