Hi,

As mentioned earlier in the thread. Lactose capacity is entirely tied up for Kerry (contract manufacturing). Hence Lactose India isn’t directly impacted by Lactose prices. Lactulose (3rd derivation after processing Lactose )capacity has been set up based on client feedback/insistence. Based on data and management interaction, sense is demand is largely tied up.

Disc - Invested.

Does anyone expect management transparency when it comes to expanding equity base? In the past few years, equity base wasa increased. However, none was offered to retail investor.

When can one expect a dividend for this company?

Board Meeting on Feb 08, 2016 Board Meeting 17:45

Lactose India Ltd has informed BSE that a meeting of the Board of Directors of the Company will be held on February 08, 2016, inter alia, to consider the following:

- To allot the 4,20,000 Equity Shares on Conversion of 4,20,000 Convertible Warrants issued on a Preferential Basis.

Joining this discussion late.

Did some basic digging - companies that have filed DMFs for Lactulose API from FDA site

http://www.fda.gov/downloads/Drugs/DevelopmentApprovalProcess/FormsSubmissionRequirements/DrugMasterFilesDMFs/UCM370722.xls

- Am intrigued by the fact that Bulk manufacture of Lactulose is limited to 7-8 companies effectively worldwide, but unable to fathom why?

- Lactose India has not filed for Lactulose DMFs so far - why? although company mentions - the plant will produce Lactulose Concentrate and Lactulose Solution USP / EP in Commercial Drum packs of 280 Kgs. Is the game plan only to supply to semi-regulated markets?

- It appears there are extensive cross-linkages between Lactose and bulk Lactulose suppliers. That may be a good to establish - in a bid to establish Market size

Hoping some of you will be inspired to take the digging further ![]()

Most of you might have seen this excellent presentation on Lactose n Lactose Derivatives Market dated 2007 I think. Not sure if someone had linked to it before

http://lactose.ru/present/1all.pdf

Interesting Solvay Case study that references a 20% oversupply market in Lactulose in 2007 (the problem was Solvay had a 10% undersupply situation - couldn’t supply enough)

Modern challenges for Lactose and Derivatives

http://lactose.ru/present/1Andy_Williams.pdf

Everything in this company seems to happen on preferential basis (only for promoter holdings)

Donald Sir, do you even consider this company fit to invest for a retail investor?

Mind you, I did buy this company when Kerry news flashed few years back. Have not yet exited… hoping that one day promoters may feel like sharing the company prosperity with retail commoner.

Lactose Quarterly nos…

Lactose continues to do topline in 8-9cr/quarter.

Sharp drop in PAT and EBIDTA QoQ. EBIDTA would be right way to look at nos…since company has just completed heavy capex. Sustainable EBIDTA margins seems to be in 25-27% range.

With ramping up of Lactose (11k tons per annum) and subsequently Lactulose, Topline should move to Rs 100-110cr over FY16-18.

9M EBIDTA stands at Rs 9.3cr (Margins at 34%). With full capacity (including Lactulose), Lactose India has potential to do EBIDTA of Rs 24-25cr.

Disc - Invested

The primary driver of the global lactose monohydrate market is the increasing demand from the industries of food and beverage and pharmaceuticals. The key advantages of lactose monohydrate are its ease of solubility, cheap cost of manufacturing, and a long shelf life. It can even be used as a stabilizer, making it one of the most commonly used milk-based products. From the perspective of the pharmaceutical industry, lactose monohydrate is chemically and physically stable, and does not absorb water, which makes it easier to use in tablets and capsules.

Another driver of the global lactose monohydrate market is the growing adoption of lactose monohydrate in the manufacture of cosmetics. This is expected to propel the growth rate of the global lactose monohydrate market to higher levels.

Asia Pacific has dominated the global lactose monohydrate market in terms of consumption, from a regional perspective. China, India, South Korea, and Japan, are among the topmost consumers of lactose monohydrate in the world, thus pitching the APAC region as the leading one in this global market. All these regions are showing an increase in the use of lactose monohydrate in both pharmaceuticals and food and beverages. This is mainly facilitated by a rapid increase in the population of these regions, especially in India and China.

Europe has also been a major consumer in the global lactose monohydrate market, where the ingredient is usually used as an additive in baby food.

The key players in the global lactose monohydrate market are Merck Millipore, Meggle Group, Mallinckrodt Baker Inc., Hummel Croton Inc., Lactose India Ltd., and Sheffield Bio-Science Ltd.

Would be a bit careful and check this out. Apparently Sandeep Toshniwal of Lactose group dating Karishma Kappor. We have seen how Companies fare once their promoters get into relationship with film stars for example Anil Ambani, Jay Kumar, Yash Birla, Garware etc.

https://www.linkedin.com/in/sandeep-toshniwal-8b875a6

https://www.zaubacorp.com/director/SHYAMSUNDER-BHORILAL-TOSHNIWAL/01223515

Wasn’t Lactose India categorized as a pharma company all this time ? But it seems like the industry classification has been changed now to “Other Food Products”

I personally have believed and highlighted few times that the story is related to other uses of lactose & lactulose (mainly food) and not pharma . So this change in classification (if am right) comes as a pleasant surprise.

Is there a way to confirm if there has really been industry change and what & who drove that ?

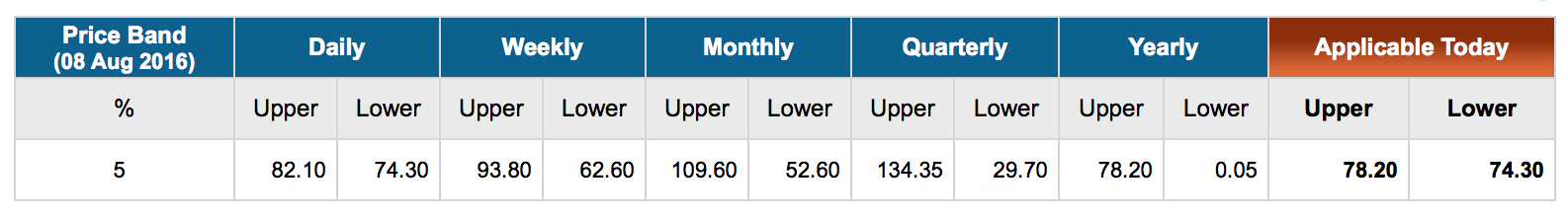

Yearly Limit Supersedes other limits (daily, weekly, monthly and quarterly). So limit of Rs 78.2/share stays till September end.

https://www.crisil.com/Ratings/RatingList/RatingDocs/Lactose_India_Limited_January_20_2017_RR.html

some highlights

- lactulose plant was closed in the first half of fy17. They have got additional regulatory approvals during the period. commercial operations of lactulose plant started in jan 2017

- Increased offtake from kerry group. Kerry group asking for capacity expansion

Disc: Invested

Nothing much has happened on this story, since the thread got initiated (except price multiplying 2-3x)

- Annual revenue is still in range of 30-40 cr. vs which we expected will be ~100 cr. range in 1-2 year time.

- Qtrly EBITDA margin are a little all over the place, but annual basis, it’s still holding in range of 20+ which is not great but pretty respectable. Lactulose full scale operation could bump it up. Last few qtrs. like mentioned above, company did some work on getting regulatory approvals etc which were expense but with no respective revenue.So, hope it can go up or at least remain similar to this qtr.

- No additional capex done this year, which I will take as a good sign. Gives confidence, promoters are not endlessly into doing capex without bothering about utilisation.

- Balance sheet also looks frozen at previous year levels. Long term debt seems to have gone down by the level of PAT for this year (2-3 cr. range).

- Working capital also seems to have not moved much on either side, for better or worse.

- Best case scenario range : ~100 Cr. Sales, 25-30 Cr. EBITDA, Debt at more manageable levels , PAT of 10-15 cr., multiples of 15x ?

- Worst case : nothing much happens on revenue front for lactulose, price might correct badly ?

- It’s a hold for me right now, might buy, if goes back to 70-80 range.

Disc: I don’t advise ![]()

Recently in March, the promoters subscribed to shares at much higher price that CMP. This was seen positively by market and triggered UC. But now it is near to its 52 week low. Can someone share latest view point on this stock? Is Kerry Group still interested on this company ?

I am struck on this one. Ideally i should have sold a big portion of my holding @ 150+ range. But i sold only a small percentage. I guess greed took over me

On fundamental side, like i said one year back, nothing much has happened or at least hasn’t reflected in numbers. I haven’t been able to follow up much with mgmt to get a inside picture. Would appreciate if anyone has any updates on the current status on lactulose plant and arrangement with kerry.

Regards

Kerry supposedly had a 5 year contract that expires in 2018, open for renewal. Not sure what is causing the TTM decline in financials and subsequent stock fall. Is it possible that Kerry chose not to continue with Lactose this year?

Anyone planning to go for AGM of this company Lactose india

It is hereby intimated that the Meeting of Board of Directors of the Company is scheduled to be held on Wednesday, lS’h day of January, 2020, at

AG-02, Ground Floor, A Wing, Navbharat Estates, Zakaria Bunder Road, Sewri (West), Mumbai- 400015 to consider inter alia the following business:

To consider issue of convertible warrants on preferential basis, in accordance with Section 42 and 62(1)© of the Companies Act, 2013 and all other applicable provisions, if any, (including any statutory modification(s) or re-enactments thereof for the time being in force),Memorandum and Articles of Association of the Company, SEBI (LODR), and in accordance with the provisions of SEBI (Issue of Capital and Disclosure Requirements) Regulations.

One more preferential allotment promoters are planning.

Share price at 5 year low.

Business fundamentals also does not seems to be encouraging.