You are absolutely correct. It is ‘individual share capital in excess of 2 lakhs’. Here, it’s not the actual share price which is considered but the face value of the share. For a share of face value 10, someone holding more than 20k shares will come in the list. For a share of face value 5, someone holding more than 40k shares will be included in that category. And for a share of face value 2, some one holding more than 1 lakh shares will be included in the list.

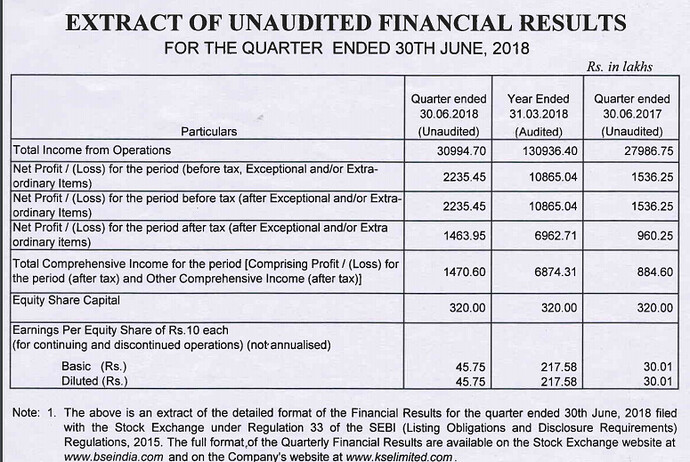

Very good result by KSE Ltd.

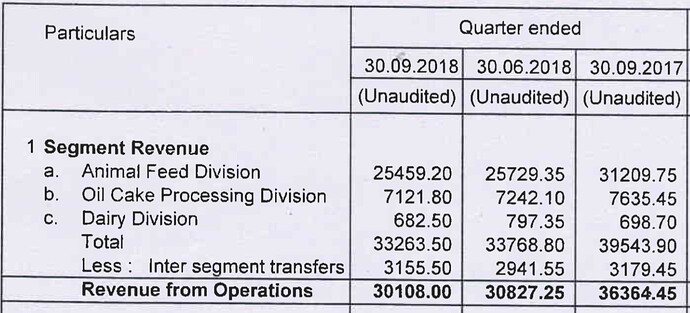

Oil cake processing division has done best.

Diary division is doing very good but small part of overall sales and profits.

50% EPS increase YoY.

Extract from the same PDF

Disc: Invested

If anyone can prepare rough estimates of the flood effects on KSE Ltd! Please share.

This share is rarely discussed publicly on TV, article Online.

Disc: invested.

I don’t know the about the damage. For the last 15 years we are the stockist and supplier of there cattle feeds. Inventories are not affected badly from the floods.Because yesterday we ordered for 300 bag of cattle feeds 50kg per bag And today it got delivered.We are a leading supplier of cattle feeds and grocessry items in central Kerala.We yesterday ordered for various grocessory and cattle feeds items from various companies across Kerala.But only kse delivered their items promptly.I think kse doesn’t got affected from this flood. There factory in kottayam district is working normally.

Reason for fall could be ex dividend date

KSE Ltd has issued clarification on Kerala flood.

Short summary:

- Almost all plants are safe. Only Rs 15 lakhs of items perished.

- How much Animal feed sales will get impacted is not calculated yet as farmers lost everything in the flood.

Company submitted clarification:

Kerala is in the midst of an unprecedented flood havoc. The calamity has caused immeasurable misery and devastation. Many lives were lost. Hundreds of homes were totally destroyed and many more were damaged. For the first time in history, 27 dams in the State had to be opened. Never before had the State witnessed a calamity of this magnitude. We are receiving concerns from some of the shareholders regarding the status of the flood and how our business was affected, as the prime area of operation of the Company is within the State of Kerala. As per our preliminary assessment the situation is as follows:

We have nine production units and one sales depot in Kerala. Though the flood was widespread all over Kerala, all our Units are safe and there was no damage to production facilities. Only we have lost some milk and ice cream worth about Rs. 15 lakhs in Konikkara Dairy Unit, wherein a small portion of the plant was under water for a few days. All the other plants and stock are safe and we taking regular production. As our entire assets are insured, we will be putting our claim for the loss of milk and ice cream with the insurance company in due course.

It is too early to predict the impact of the flood on the volume of our feed sales. Many farmers had lost their homes, cattle and all their life-long savings. The number of cattle dead in the flood is not known. At this stage, we are not expecting any considerable impact on our overall feed sales.

Kindly arrange to announce the above to the members. We also take this opportunity to request all the investor community to contribute liberally to the Kerala Chief Minister’s Distress Relief Fund and help to build back the flood-wrecked Kerala. On the preliminary estimate, the fund required for the recovery of the State of Kerala is stated around Rs. 20,000 Crores. Your Company will be incurring a total expense of around Rs. 2 Crores on account of flood relief.

Disclosure: invested and sitting on loss of 20%.

Wrote this for own use. Comments and feedback invited

KSE Ltd

Market Cap: Rs. 905 Cr, CMP – Rs.2,810

Buy at 5-7% of portfolio value with 3/5 years horizon

What does the company do?

KSE is the largest manufacturer of compound cattle feed in private sector in the country, focused only in Kerala. It has emerged as a leader in the ready mixed cattle feed industry in the country. Today KSE manufactures a range of livestock feed in high volumes, coconut oil from coconut oil cake and refined edible oil. It has also entered the field of milk procurement and processing – A) KS Milk, B) KS Ghee and C) Vesta Ice Cream have become popular in many districts in Kerala.

KSE operates in broadly three segments – Animal Feeds (78% of Revenues in FY18), Oil Cake Processing (20%) and dairy (2%). The mix has been stable over the years; however, Oil Cake Processing is the most lucrative business with ~13% operating margins compared to ~6-7% in animal feeds and breakeven in the dairy segment.

KSE did Rs.1,304 Cr revenues in FY18, up 24.5% from FY17 led by higher feeds sale due to lowered prices but higher volumes (prices declined by ~10%, volumes up by ~33%). It has grown at a CAGR for ~13.5% during the last 5 years. PAT was at Rs. 70 Cr, up more than 326% due to higher operating leverage in both feeds and cake processing division. It has increased at a CAGR of 73% during the last 5 years.

Financial Analysis – Good growth, decent incremental return on capital with worryingly razor-thin margins

- KSE has improved incremental return on capital to ~40% in FY18 from ~16% in previous years. However, it operated at ~35% in F12-14 and it looks like to be moving in cycles. The key would be to monitor the incremental ROC going forward on a quarterly basis. Return on Equity is at 60% and has moved between 10% to 70% in last 4 years, in line with prices of feed input.

- Feed inputs consist of coconut and other agri-commodities. KSE has resorted to importing these from middle eastern markets due to high price differential (15%-25%) from the local market prices. Hence, it is exposed not just to commodity prices, but also to rupee and govt. regulations. As per initial analysis, every 5%-rupee depreciation will lead to 0.3% erosion in net margins

- Management doesn’t think raw materials prices will decline further from the current levels. As such, expect margins to come down to more normalized levels of ~3.5-4% in FY19-20

- KSE operates on very thin net margins and its PAT margin has fluctuated from 0.8% to 5.3% in last 4-5 years. Building in anything more than 2-3% while analysing this would be a mistake

- KSE has manageable debt with Debt/Equity at 0.3x and is adequately covered by cash it generates. Management has been prudent in not over-expanding and over-leveraging

- KSE provides a dividend yield of ~2% from the current prices and can be a major yield machine going forward

- KSE has been maintaining a healthy OCF/PAT of ~1x over the last 5 years with one bad year in FY16. Overall, it has been able to convert its accounting profits into operating cash flows and there are no concerns on this front

- Asset turnover has remained at ~7x with fixed asset turnover increasing from 21x to ~40x. Management reckons they can stretch it up to ~55x after which significant capex would require to be undertaken

Operational & Management Analysis – Highly dependent on Kerala Milk Price (set by govt.), feed inputs price

- Feed prices are a direct result of milk price in the state of Kerala. And the milk prices are set by govt. of Kerala. However, this is not a major concern since milk prices have been increased by an average of ~13% during the last 5 years

- But then, KSE has grown by ~13% during the last 5 years – The growth in KSE revenues are a direct result of growth in milk prices, which in turn impact the purchasing power of farmers.

- Dairy segment, which has been operational for last 13 years, has been an absolute drag on the company and the prudent thing would be to divest it instead of continuing it as a cash burning machine. Overall margins will improve if management focuses on its core competency – Feeds and Oil cake

- Till now, KSE has been active only in Kerala. Now, with new plant in Karnataka, it opens up new growth opportunities for KSE. Key exponentials to monitor would be:

- Milk prices in Karnataka

- Feed prices

- How much of the market can KSE capture?

- Kerala flood impact is being downplayed by the management currently with net impact said to be around ~Rs. 25 Lakhs worth inventory loss. However, we need to monitor Q2 numbers to get an idea of an impact on the revenue – This is the most important thing to track before entering/increasing exposure

- One of the key issues is that management owns only 26% of the company – There seems to be not enough skin in the game. If it declines further, it is a major concern

- Godrej family (Adi Godrej) owns ~1.5% stake in the company and if they increase it, we need to study it further – This would be a key monitorable

Valuation and what should we do?

- The implied growth rate at 15% discount rate at current prices is at around 6.1%, which is ~50% of its historical growth rate. The implied growth rate is at reasonable levels and the street is expecting lower growth going forward

- At a ROE of ~60% (normalized of 30%), PE of 13x, a 13% growth rate and implied growth rate of 6%, this is a decent, if not a great opportunity to enter the stock at current prices. At 15% growth (considering 15% growth rates) and 3.5% margins, we are looking at an exit market cap of ~Rs.1,250 Cr, which is 11% CAGR. We are building our margin of safety in the margins and growth both – a 4% margin will up our return to 17% CAGR

- The above scenario doesn’t consider any growth from Karnataka operations and this has been built in our price as key margin of safety here – Any upside from this will add onto our growth

- If we can get it a lower price (After announcement of Q2 results) at, say, Rs. 700 Cr, our return at steady state growth of ~13-15% and at 4% margins, our returns get bumped to ~27% CAGR – what we should aim

- We should buy this at staggered prices – Buy 30% of our intended investment currently, rest 50% after Q2 results and remaining 20% after Q3 results – If results are as per our expectations

What are the key risks and concerns?

- Inability to pass on costs – There is an upper cap to the prices it can charge of feeds. However, lower feed prices are a boon here and it increases the volumes – Need to monitor this

- Lowered volumes in next 2/3 quarters due to floods and resultant lower cattle count. However, this can provide good opportunity to buy based on margins and loss aversion of management – Need to monitor

- It is a one state wonder and until and unless it manages to grow in other states, there is a probability of it hitting a growth roadblock – We will get out in this case. And this is precisely the reason we need to build margin of safety by not paying for any new growth!

I am looking at this, if farmers lost everything including some livestock the company might not do well until Kerala is rebuilt

KSE always was a one state company, agree they were slowly trying to diversify but hadnt managed much in that respect

I think next 3-4 quarters are not going to be great. Hopefully stocks dont take a beating.

Someone on Telegram app with a good following issued a buy recommendation today so it went up quite a bit but I am not sure if the bottom is reached yet.

It sells in TN and some part of Karnataka also along with Kerela as you have mentioned.

Looks like a leading money magazine recommended KSE today with Rs 3900 as target price.

If sales loss is not more than 20% then I will try to add more. Will see in coming quarter result.

Disc: Invested

Yes, but profit is down by 50%. That could be due selling on credit to help farmers and retain customers. If management could tell us about when flood effects could be neutralized then that would add clarity. Some growth prospect could help in running of the stock. Now, I am tired of waiting. Big amount stuck here.

Disclosure: Invested.

brilliant summation! my compliments. . .

however, without getting into too complex analysis of valuations, let’s alternatively, simplify the whole overview: everything said and done, in a nutshell, essentially KSE is a function of (1) raw material prices and (2) feed / oil sale prices. . . . and as it seems the COMPANY HAS NO MUCH CONTROL OVER EITHER OF THEM!!

- the rise and fall in the prices of RM directly affect them and they have no particular insulation against it.

- KSE sources materials from far away from the north, further affecting due to transportation cost

- The price they can charge is/has to be in line with prevailing market rates influenced by various factors of the trade, Forex rates (they source 50% copra from overseas), vagaries of weather (affecting the pricing of oil-seed crops), pricing by competition (which has different motivation being a non-profit organization)

… at best the company has what we would call " trading margins" i.e. it buys materials, mixes them up / extract oil and sells. simple! . . . there are no “value addition” margins i.e. they can not charge higher sale prices, and are affected by RM prices which too aren’t in their control . . . This gets further substantiated when one refers to the AGM speech of the chairman (Link: http://www.kselimited.com/agm_notice.aspx) you will note the following few excerpts:

.

.

.

.

“…the season for all major ingredients of cattle feed is over and the prices of such items has started increasing. The new season will start only in November. The possibility of increasing the price of feed also is very bleak as a major portion of farmers have already affected by the recent unprecedented rain havoc…”

“…in January 2018 the raw material prices were at rock bottom and in the middle of February, 2018 we have reduced the price of feed to share the benefits of price reduction with the farmers. Then the ingredient prices increased slightly and remained steady at that levels …”

“… the coconut oil price also improved from Rs. 120 per kg. in the year beginning to Rs. 180 per kg. towards the year end, which helped us to improve our profits…”

" …because of the good monsoon rain across the country, we expect a good crop for the next season and that the prices will fall in line. The prices of ingredients are thus likely to fall by December, 2018. Until such time, there is likely to be a reduction in the profits in the animal feed division for the next two quarters…"

“…as you know we are bringing all the raw materials required for the feed from northern States and it involves. Heavy transportation. As such, any significant change in fuel cost will have an impact on our raw material cost also. The cost of diesel and petrol is fixed by the Oil Companies on a daily basis. During the last one year the diesel price has increased by 20% from Rs. 61.21 to Rs. 74.44 a litre. This in turn will increase the cost of all our major inputs…”

“…In the cake processing division, with the support of imports, the copra cake is available at a steady rate. However, the oil price has fallen to the level of Rs. 160 per Kg. in this month. This is likely to reduce further in the coming months. If the price of coconut oil falls, as we expect, it may affect the performance of the cake processing division, unless we are able to reduce the price of copra cake proportionately. We are taking all efforts to mitigate the effect and maintain the profitability of that division at current levels…”

.

.

.

.

So BUYING THIS SCRIP IS AKIN TO ‘WAITING TO GET LUCKY’ that the RM prices fall, weather is normal, fuel prices do not go up, Forex prices remain stable, market prices stay normal, competition doesn’t reduce prices and so on. . .

. . and atop all this there are a FEW CONCERNS

- the management holding is low and is gradually reducing over the years.

- the management is essentially a group of 100s of people and are from a particular religious community (no offense) and all board members (mostly) are from the same group, not essentially driven by merit (seems so)

- they seem to working a lot in interest of the promoter group; in FY 2016 company had -ve cash flow from operations, it’s profit dropped from 44 crores to 7.5 crores (and this little profit too was on a/c of 10 Cr. worth of property sale in Mysore), and still the board declared a dividend of 6.50 crores!, probably to keep the promoter group happy

- this year (ref. result of AGM) the shareholders voted against and did not let adopt the resolution of re-appointment of AP George and increase in his salary, and also rejected proposal to transfer 71 lacs (25 lacs depreciated value) worth of Mercedes car to ex. MD’s wife, posthumously, in reward to his long yrs of service.

- Original promoters are no more

- No young blood (the entire board is very old. every year some members pass away. this year too, two of sr. members passed away)

- No next generation with fire in the belly to reshape the 50 yr old business; they are happy to be chugging along enjoying a gradual increase in volume

- biz is concentrated on a geographical area (lets see how Karnataka plans pan out)

- the factories are prone to unionism (from AGM speech: “…the long-term settlements for a period of three years have been signed with the employees of Swaminathapuram, Palakkad and Koratty Units. Negotiation with Unions for similar long-term settlement is in progress in the case of Vedagiri Unit. The management is confident that amicable settlement can be arrived at by negotiations with the Unions of Vedagiri”

- future sales are also doubtful, as also evident from the latest results of the drop in sales. (from AGM speech: “…Many farmers had lost their homes, cattle and all their life-long savings. The number of cattle died in the flood is not known. On a rough estimate from the severity of the flood, and reports through our dealer network the number may go over 10,000 milk yielding cows. Immediately after the flood, we expected a slight fall in the volume of feed sales. But to our surprise, the current demand is so high so that we are struggling hard to meet the same with all our efforts…”)

So, all-in-all in my humble opinion THIS SCRIPT DOESN’T SEEM TO BE A MULTI-BAGGER CANDIDATE. It at best would sway up and down with a variety of factors. Its commoditization / cyclical. And with no real new triggers or any assurance of improving margins, there’s no PE re-rating expected. . . one can have a view to buying for mean reversions i.e. buy on low PE in 10s and then sell on high on PE in 20s. . . Accordingly, at current PE of 9.50 it does merit a close watch. . . Any further reduction in MCAP / PE in next quarter on a/c of poor sales as expected from August weather impact and rising cost of raw materials could give a good entry for at least 2x gains in mid-term /12-18 months.

. . . my two pennies!

Do you own any view on Raw material especially Rice Husk and Maize?

Other thing is recovery from flood. Every company has variables. Established company used to manage some.

I am sitting on huge loss and want to take call whether to sell or hold.

Agri price is stable from few years but I am unable to find any report regarding Rise and Maize.

Also, no new report I have on sales and margin after Kerala flood.

I see KRBL and ChamanLal setia has not gained in price. Can I assume that rise price won’t rise!

Disc: Own it

Is the question to me? .

. . well i am not capable to reply on this. sry.

regards

Yes, it was too you.

Sometimes, Stock just go down without any reason. Currently, the situation is same here!

Logical mind say, I am safe at this price point but then falling each day from so long takes away power.

Disc: Invested

The article includes KSE…

[quote=“abrahamappu, post:46, topic:1426, full:true”]

I don’t know the about the damage. For the last 15 years we are the stockist and supplier of there cattle feeds. Inventories are not affected badly from the floods.Because yesterday we ordered for 300 bag of cattle feeds 50kg per bag And today it got delivered.We are a leading supplier of cattle feeds and grocessry items in central Kerala.We yesterday ordered for various grocessory and cattle feeds items from various companies across Kerala.But only kse delivered their items promptly.I think kse doesn’t got affected from this flood. There factory in kottayam district is working normally.

- Hi, how are you? KSE has been on my watchlist for sometime now. can you help in understanding how is the ground situation for cattle feeds in kerala now? how are the things shaping up and how do you feel the outlook should be going ahead? Thanks in advance

Nitin

From the last one year after kerala floods the prices of their various products increased considerably by more than 15 percent .(The reason is increased price of raw material) Which forced farmers to shift to alternatives Now a days cattle farming in kerala is not so profitable especially to small farmers. So I think some more downside left.can go below 1000 levels.