Agreed. But the revaluation of machinery to higher value does not make sense and should not be done IMHO. Revaluation of freehold land is ok but machinery is not. In this case the revaluation leads to undue increase in book value.

Revaluation increases the book value only and that is what the impact is. What I feel is that this was done with the view to get better terms from bank. But, since I do not value stocks based on book value, I ignore such adjustments.

However, if such a thing is done by a company in apparently good financial position, it can be a red flag.

Just taking this ahead from an understanding point of view.

Isn’t that precisely the point that the author is trying to make that the additional Rs.5 would have been charged to the P&L account if the asset was valued fairly at the beginning itself. Or in other words this Rs.5 of addtional depreciation is being set off against the revaluation account (whereas it should be charged in the P&L account) and hence the Profit is being inflated to that effect.

Therefore, by revaluing the asset and setting of the resultant additional depreciation against revaluation reserve, one is inflating profits by not charging this depreciation in the P&L account.

Please let me know if I am missing something.

Cheers.

If that would be the case, the asset would have been valued at say Rs. 150 from the beginning. For that one needs to pay Rs 150 but they paid Rs 100. Eg. A land was bought for Rs 1000 in year 2000. In books of account, the land remains there at Rs 1000 forever. In case you want to revalue it to say Rs 2000, you make it by increasing the value of land by 1000 and crediting to revaluation reserve (not p&l account). It is a cashless entry i.e. to say just a book entry. It does not affect the P&L at all. No question of inflating or deflating the P&L.

This is done generally to increase the book value of the company. Eg. When one apply for a home loan, bank does not look at the book value of the house, but sends an approved valuer to value the home. Then it gives the loan after looking in repayment capability and the haircut on the value of home. Now, since this is a company property, company used this valuation parameter to change or increase the book value, may be to gather confidence of the bank or shareholders by showing that they have assets worth x.

So for Cash Profit, yes no impact on P&L as it is a cashless entry but reported profit does get inflated to the extent of Rs.5, right? So its more of a case of following better accounting practice rather than actual impact.

I think you should read the first example again. With Reval & without reval. I showed in both case Rs 10 will be debited from P&L. Others are just book entries and have no impact on cash profit or accounting profit. Now in case the asset was originally bought for Rs 150, there would be no question of reval and P&L would have been charged Rs 15, but the asset was bought for Rs 100 and depreciation will be charged to P&L as per the original invoice.

In case the asset was valued at Rs 150 against invoice value of Rs 100, the profit of Rs 50 would have been credited to P&L account also, but that profit is not credited to p&l account but to another reserve named revaluation reserve. Revaluation reserve cannot be used to distribute profits or issue bonus shares etc but only to write off the revalued asset.

why have the margins improved so drastically from 4 percent in 2012 to more thna 20 percent in 2016? The company says it has been due to backward integration and going into more value added products. But the share of value added products as of 2016 was only 10 percent to the topline, and also majority of yarn production is outsourced…so how does backward integration help significantly in improving margins.? can anyone share the data of how much percent yarn is outsourced , how much yarn is produced internally…how much yarn in kgs is used to translate into correspdoning one metre of finshed product…

Disc - Not Invested

my write up on indocount

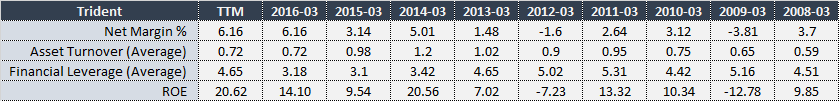

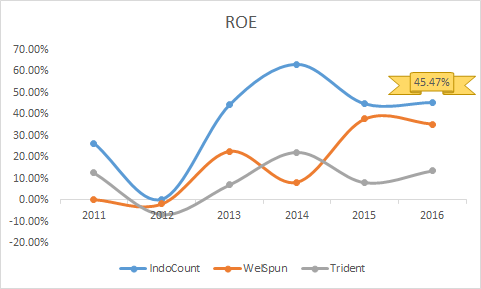

Q4 and full year FY’17 results are scheduled for tomorrow. Since 2014 IndoCount is reporting significant better ROE as compared to other textile export companies. Some broad ranging discussion has already taken place on the stock thread, with some wide conclusions.

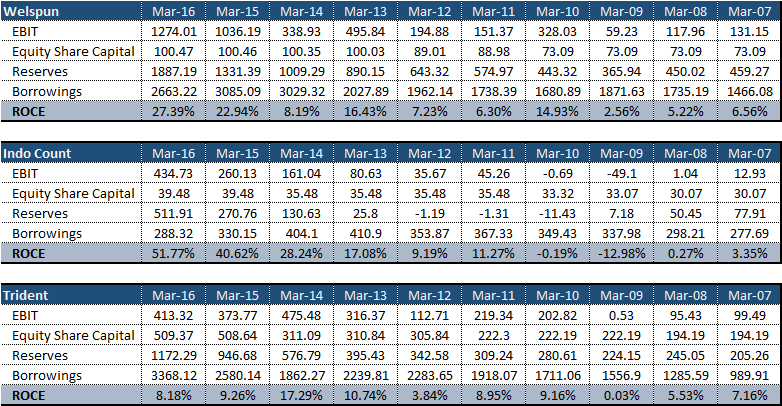

Whats better than a DuPont analysis to understand what is differentiator - variable that is moving the needle in favor of IndoCount. Below is a comparison between Welspun, Trident and IncoCount. Understandably this is not an entirely like to like comparison. Trident being 50-50 between Export and Domestic with added twist of paper business. Welspun has found the range between bedding and bath both. Indocount on the other hand is still predominantly in beddings.

What DuPont analysis of ROE re-affirms in this case is that this claimed asset light model is helping them report better than peers ROE numbers.

In the mid to long term, my assessment is that with the planned and under progress CapEx of 175 + 300 Cr. proposed for mid-future will reduce the assets turnover metric (due to addition of new assets to books). However, at the same time Financial leverage metric will go up by an even bigger extent due to exponential effect of lower denominator (net-worth /equity). (current networth of 551.39 Cr against total assets of 1317.29 Crs.). Provided that they go for partially/fully debt funding for CapEx, and this is very likely since FY’16 Operational FCF was 167 Cr only)

Note: Have used the reported numbers on the face value for calculating the Operational efficiency, assets efficiency, equity multipliers and eventually the DuPont calc, without digressing into establishing veracity (triangulation etc.) of the reported numbers, for the time being.

Hope we will have few new pointers to ponder upon from the results tomorrow. Or at least we will be equipped to put a pointed finger for correct reason code, just in case drop on ROE.

Thanks,

Tarun

Disc: Not invested as of date.

Results Out: https://fintrig.com/alert/f4bc6b71-dd7f-4085-aad6-0a7431916ad3?date=5-2017

Direct PDF: http://corporates.bseindia.com/xml-data/corpfiling/AttachLive/f4bc6b71-dd7f-4085-aad6-0a7431916ad3.pdf

Profit - Down 28%

Revenue - No change

Update:

Sumarised Investor Presentation: http://corporates.bseindia.com/xml-data/corpfiling/AttachLive/b9c811b5-70d7-4b53-8167-314379f42479.pdf

Time for some super Saturday learning. Whats better than to pick up from where I left last week on IndoCount…

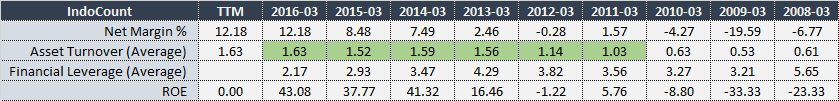

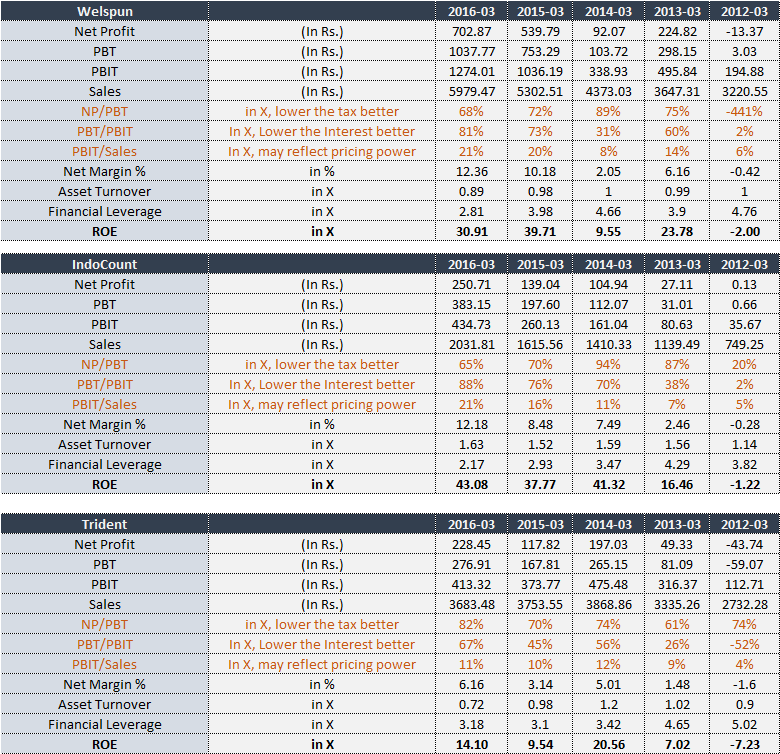

Firstly, due thanks to @amitayu for sharing with us how to drill down the Dupont analysis further in this thread (link). Highly recommend to all for good refresher and condensed learning. Coming back to the work in hand, my evolved Dupont analysis looks somewhat this now:

-

So now, with the new approach I am able to see the convergence of pricing power, Interest efficiency and tax prudence (not to imply any deceitful manner) playing collective role in NPM.

-

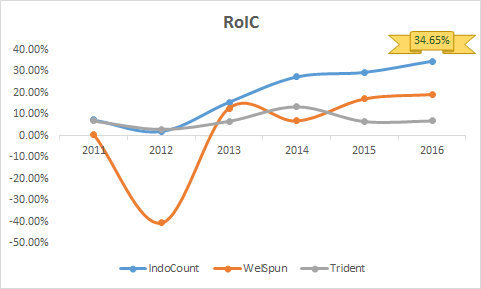

Trident got a NPM of 6% for FY’16 as against Welspun and IndoCount who has 12% each. Observation is that tax outgo and Intrest impact being more or less same for all three. The differentiation is in the form of PBIT/Sales. Trident at PBIT/Sales ratio of 11% whereas the other two at 21% each. What does that implies. Is it any ways suggesting lack of pricing power for Trident?

-

For past 2 years Indo Count has a slightly low PBT/PBIT ratio as compared to Welspun suggesting comparative higher tax out-go. Does that gives some confidence that there is not much issue related to tax evasion/ accounting creativity.

-

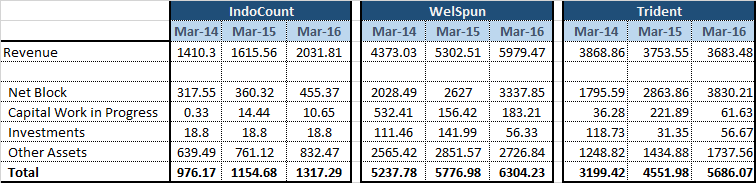

For past three years IndoCount has better PBT/PBIT ratio than Welspun and Trident. Implying lesser interest burden. I am inclined to think that this is again attributed to the asset light model that IndoCount claims to have. Even balance sheet suggests the same. Net Block, capital WIP, and other assets are all much lower in proportion to revenue for Indocount as compared to Welspun and Trident.

- Now, for me, the two questions needs to be understood well much beyond the numbers.

w

1.whats the edge/moat that IndoCount has over its competitors to allow better pricing power and growth rate. whats the differentiation? AR does not explicitly suggest about any distinguished technical superiority, patent power, unique input/process/output dimension. If not about product proposition is it about innovation, market agility etc.?

2. Asset light model - Traditionally most of the textile companies has been with upfront CapEx heavy nature. whats different and how sustainable it is/will be for IndoCount?

Disc: Not invested as of date.

Thanks,

Tarun

ROCE ((EBIT/Capital Employed)) working for the three. Another way to establish capital/asset light model claim:

Thanks,

Tarun

I For past few days I am spending some time on IndoCount as the numbers are looking tempting. Standalone great and way ahead of sectoral peers. Some visuals:

Firstly some trivia to understand what the company does:

- Niche: Focused solely on bedding (sheets, comfortors, fashion bedding etc).

- Strength: ~80,000 spindles weaving 68 Mn Meter/Annum. Additional capacity of ~22mn about to come on steem. Utilization expected to be ~98% (from the levels of 65% in Q3’16.)

- Scale: Export to 49 countries and 4th largest global supplier to US in bed linen category. 2nd biggest supplier from India in the category. 13th biggest in US within overall textile segment.

- Scope: As per industry estimates, India market share currently 45% set to increase to 70%. Growth of 11% against china growth of 7%.

- De-risk: ~45 - 50% sales comes from top 10 customers (WalMark, Target, JCP and Bed, Bath, Beyond etc.)

- Value Ladder: Trying to move up the perception slot in US market with three licensed brands Harlequin, Sanderson and Scion. All three are from same stable and have a rich legacy behind them.

-

New Markets:

Custom created brand ‘Color Sense’ for US online market.

In India, trying to capture aspiration brand position with ‘Boutique Leaving’ Brand. Current reach 200 MBOs. To be expended to 600 MBO. Products positioned at the range of 2000- 8000. Are pure cotton with >400 TC fineness. (some murmurs around the partner heading this India venture) - EBIT improvement: D/E reduced from 6.71 in 2013 to 0.52 as on FY16. Approx 200 Cr INR CFO for FY’16 hence most of the proposed and under progress CapEx can be taken care by accruals only.

Some Open questions:

- Few days back I had worked on a DuPont analysis for IndoCount and other peers. Itwas evident that a very asset light model is helping them immensely in posting superior ROE/RoIC etc. From FY’16 AR the company mentioned that '70% of the spinning and weaving work is being outsourced.) This looks to be case since IndoCount has approx 80,000 spindles and generated a top line of 2031 Cr. whereas WelSpun got approx 300,000 splindles yet only meeting 75% of yarn requirements on Top line of 5979 Cr.

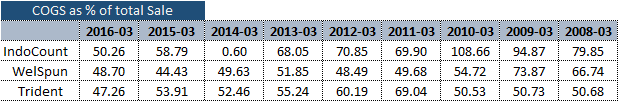

1 (a)However, thinking rationally, (and actually thinking aloud here) this outsourced spinning and weaving work should reflect somewhere on the book of accounts. It should have caused some bit of dent on P&L. My uneducated guess, it should have caused at least higher COGS (cost of goods sold) in case of IndoCount (assuming that outsourced is making at least some money in the contract.)

Below is a table of COGS as % of total sales for the three. As evident, verymarginal difference in COGS between the three.

1 (b). If not for the COGS (lets assume that they got a very good deal where outsourcing vendor is playing on a volume game and ok to survive on wafer thin margins only), at least some part of this should trickle as higher Account payable/liability in the BS to some extent since quantum of outsourced work is huge. Strange that proportionately this number is still very reasonable for IndoCount.

In summary, at this juncture, I am not suggesting any flag (of either colour). This counter looks to be very interesting with tempting numbers (can sustain and improve as well in future with debt reduction). However this asset light model deserves to be understood well and validated firmly.

If this asset light model is true than they have found/created a unique proposition for themselves and may work very very favorably. With the textile industry shift this can be an interesting play. Withing a “processor type” someone became 'Smart processor type".

Disc: Not invested, curious.

Regards,

Tarun

Any reason why the stock is falling day by day. No announcement from company. AGM on 21st August.

Couple of shares in textile sector are going down after kitex results. Like, icil,trident. Also icil trend is down ward in technical chart in last month.

My view is that this could be because of the rupee appreciation. There is a big chance that the rupee can appreciate very significantly from current levels.

GHCL has already given negative commentary during mar’17 results on textile bed sheet business which directly compete with indo count. Would be good to read that in case indo count mgmt is giving all is well message

Indo Count Industries Limited (‘the Company’) held on 10th August, 2017, the Board has inter- alia approved the setting up of a Wholly Owned Subsidiary in United Arab Emirates (UAE) towards promotion of business in UAE and MENA countries.

Massive decline in today’s session. While the stock recovered from 52-week low of 107 to close at 115, the short term outlook still looks negative.

I am planning to invest in ICIL but waiting for the right level for entry.

What do we see as a driver of current/future growth? As far as I can see, the massive growth has not been in the end markets, but rather a geographical shift due to changes in relative cost of production. It seems like it could be a secular shift to me, as cost of labour production is significantly lower in India vis-a-vis china, although employee costs aren’t a big factor - only 5% of total cost. Any ideas on drivers of cheaper costs in India?

If India is a cheaper place to produce though, it seems like Indo-Count could have a temporary moat (say 4-5 years) owing to the higher value part of the chain it occupies vis-a-vis spinning/weaving, and its healthy return ratios could mean profitable growth at 20%+ for next couple years. Thoughts?

Disc. Not invested, but examining an investment at lower levels