yes I think they are working in that direction. In the recent auto expo they showcased electronic auto. Also do you have any update on the agricultural equipment side business. It contributes less than 5% to revenue. What do they plan for the same?

Only challenge is that Mahindra seems to be taking away Electric 3 wheeler market.

“20% of three-wheelers sold by M&M in January 2018 were electric”

Disc: Invested in M&M

Greaves Cotton Ltd

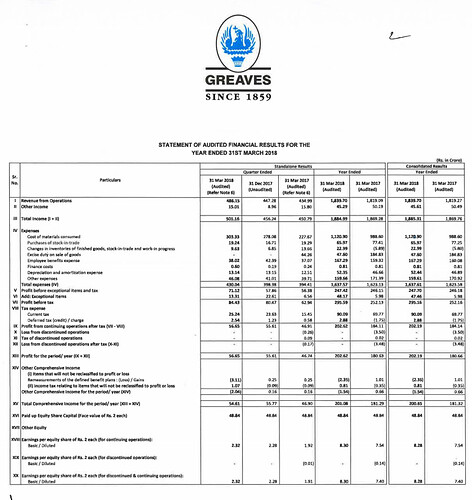

Highlights of Q3 FY18 and Nine Month FY18 Performance

- Financial Performance

o Q3 Performance

Revenue grew 11 % to 447 Cr from 404 Cr same quarter last year

EBITDA grew 3.3 % to 62 Cr from 61 Cr compare to last quarter same year.

EBITDA margin remain 14% compare to 15% same quarter last year

PAT grew 26 % to 56 Cr from 44 Cr same quarter last year

Engine revenue growth 9 % and others grew 89 % this quarter compare to last year same quarter

Gross Margins adverse due to changeover from BSIII to BSIV and commodity inflation

Volume Number sales of each segment

• Three Wheeler= 66,660 units

• Four wheeler = 10224 units

• Gen-set = 1096 units

• Pump set = 19,989 units

• Power supply = 324 units

o Nine Month Performance

Revenue grew 5 % to 1306 Cr from 1244 Cr compare to last year 9M performance

EBIDTA remain 185 Cr which is down 2.5 % from 190 Cr last year 9M performance

EBITDA margin fall to 14.2 % from 15.3 % last year 9M performance.

PAT grew by 9 % to 146 Cr from 134 Cr last year 9M performance.

Engine sales growth 4 % and others grew 32 % this year compare to last nine month performance.

Gross margins continued to be under pressure due to commodity price inflation - Key Highlights

Greaves is re-inventing the Last Mile Transportation space with a wide range of fuel agnostic products & solutions in Diesel, CNG/Petrol & Electric Mobility space along with a fast growing network of Greaves Care to cater to the needs of 3W & micro 4W segment.

Company’s products & solutions are showcased at the Auto Expo 2018.

Diesel and CNG/Petrol portfolio on track for BS-VI launch, customer tie ups in progress.

New breakthrough technology for CNG/Petrol 2W & 3W segment being developed

ED in partnership with Pinnacle Engines.

Electric drive train and full electric solution for 3W OEMs being developed in partnership with Altigreen Propulsion Labs.

E3 Electric concept vehicle with Greaves electric powertrain also on display Auto Expo.

Strengthening Gensets business through focus state approach and marketing initiatives to improve market share and reach.

Expanding pump sets and light agri equipment portfolio.

Expanding 3W multi-brand spares portfolio and network. Entering 3rd party distribution through partnerships.

Piloting Greaves Care business model in 30+ outlets across India.

Q&A - Did company launch an indigenous power tiller and provide some key steps taken by company toward dealer network?

o Company is testing it in market from couple of month. It will launch with a name “Bahubali” with 14 horse power engine. In power tiller, company is in focussed to develop Electric and non-conventional type of energy power tillers.

o Company is working on improving dealer health by bringing better dealer, stronger dealer in addition company also started to provide end to end solution to dealers. - Does farm segment will contribute significantly in coming years?

o Yes it will - Kindly throw some light on multi brand spare segment. How company will scale it up and what is the market size?

o 1500-1600 Cr is market size, Continue to add significant spare parts in own bucket. Currently company have 1000 parts and company will add 200 products every quarter. Company wants to reach 3500+ Spare parts. Focus is on increasing outlets QOQ. - What are the New initiatives and after BS6 norm change in 2020 and what is company outlook for Capex in 2018-2019?

o Strategic focus will be on mobility farm. As said earlier company had total 6200 Cr(might have heard wrong) CAPEX plan. Company will continue to invest it as opportunity comes. This year CAPEX is of 60 Cr next year it will be 100 Cr. - Kindly Elaborate on company transformation journey and how it will impact?

o Moving from a diesel company to a power train solution company. Working on Farm, Service, and Energy business consistently. Company will keep focus on profitable growth. Very much focus will be on market ready technology suited for India at right value. - What is revenue contribution from individual segment wise and how it will be in future?

o Mobility is high above 50 %. Goal is to significantly grow other business also. - Any attraction in BS6 engines from customers?

o Company is working on it with a partner. It is still in developing phase. - Is there any plan in single cylinder expansion and addition of product in double cylinder product?

o Single cylinder platform completely depend on three wheeler segment performance.

o Other Twin segment engines are in talk with OE to demonstrate and bring in market as soon as possible in BS6 segment. Focus will be on CNG three wheeler segment also because it comprise of 40 % of three wheeler market with BS-6 .

o Transforming from Diesel to Diesel +Petrol +CNG +Electric. Company will be working on different fuels - Did company upgrade its two cylinder pinnacle engine?

o It is completely a new technology and company is first to introduce it in India. It is a single cylinder two linear consistent arrangement which is absolute break free technology it use very less heat So it reduce combustion and increase fuel efficiency. - Kindly elaborate about the exceptional income company is getting from previous few quarters?

o That is from sale of surplus property which generate cash flow of 22.2 Cr and there are few more properties. - Did BS6 engines are started testing by OEMS?

o Not yet but company has test it itself and results are very good it will be tested by OEMS soon. - What is company growing in after market strategy?

o Company has enter into New Greaves Care service centre and open 30 outlet till now and have target of 50 outlet very soon. These are multi-brand service centres

o Increase bouquet of spare parts is a strategy for scaling up of service centre business. - How company targets revenue in coming next 3-4 years?

o In Area of mobility company started from diesel engine has move to a new multi fuel engine player.

o Farm: Adding incremental product and incremental sources.

o Company see double digit growth in Farm, Spare parts and Gen-sets business.

o Diesel engine will transform to petrol and then in electric hybrid in future. Company is working on all of these verticals. If diesel goes down then company have technology which save 30 % fuel efficiency with world class technology in petrol solution.

o So company focus is whenever customer shift from diesel to other fuel. Company will be ready for it. - Why company see low growth in auto?

o Because base of auto industry is high and company is in a strategy that if auto moves lower then also other business will grow and if auto business will grow at a moderate level then also company will grow significantly. - Give more light on Greaves Care Service centre business and how company will expand?

o Focus is on three wheeler and lowers four wheeler by providing end to end solutions. Company already have Greaves spare parts and now focus on multi-brand spare parts and white label spare brands and other related categories like Oil , battery , etc to provide all solution. It is a franchisee model in which company provide entire supply of parts , technical training and branding , Mechanical repair , washing , etc. Today it is for Diesel , CNG , petrol tomorrow it will become one stop point for electric vehicle also which include E-way Charging point also .

o It is a franchisee model so company don’t require CAPEX also as Franchisee owner pay the deposit and company will supply the parts to them. - What is company outlook on pump business?

o Company is very strong in Diesel, petrol, kerosene pump. Now looking to expand in Electric and solar pump as well. These are in work and very close to come in market.

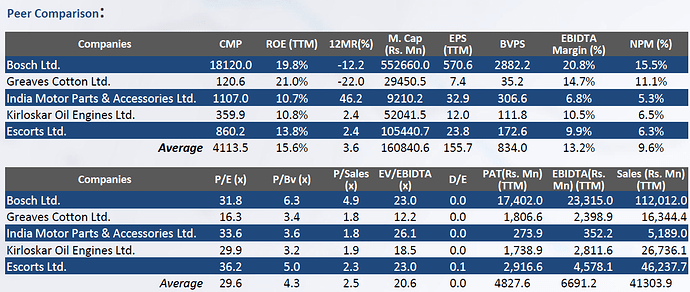

Sounds good strategy overall. can it be a turnaround? Having debt free status makes me interested in this company.

- Management that gives away 50% of profit is investor friendly. Not crooks for sure

- Small debt free company.

3 Valuation reasonable. not stretched. - Nagesh , new Ceo has an impressive track record.

its low risk high reward situation.

How many spare outlets do they actually have? they keep on talking about them since 2016

Hi @Devang, In the previous conf call for q3 fy18, they said they have 30 retail service outlet and targeting to make it 50. Mgt always talking big on the outlets and future prospects, may be a scuttle butt might help to understand how much is the reality.

Greaves Cotton

Highlights of Q1 FY19 results

Financials

- Revenue grew by 13 % to 450 Cr from 408 Cr last year same quarter

- EBITDA grew by 10 % on yoy basis

- PAT grew by 7 % on yoy basis

- Net Worth stood at 1000 Cr

- EPS for the quarter stood at 1.6

- ROCE stood at 26 %

Key Highlights - Revenue contribution from Engine business was 48 % , After Market retail was 24 % and from others is 28 % which include Gen sets , Agri-farm trading.

- Company have total 74 Greaves store which are now present in market

- Company have total 5000 after market retail network presence

Q&A - What was the volume number for the three wheeler, four wheeler , pumps and gen-sets ?

o Engine stood at 74,580 compare to 71,619 last year same quarter

o PK Pump stood at 15,830 compare to 16,992 last year same quarter

o Diesel Pump stood at 3,173 compare to 3,720 last year same quarter

o Tillers stood at 1800 compare to 820 last year same quarter

o Gen-sets stood at 1300 compare to 1100 last year same quarter - What will be the employee cost trend going forward for the year ?

o It increase by 11 % during the quarter and for the whole year it will be in range of 6-7 % - How company will pass the increasing impact of USD INR depreciating and impact on gross margin ?

o Company will maintain the gross margin at current level by some measures like cost control measures. - Why the volumes in Three-wheeler engines is lower as the volumes reported by OEMS are higher ?

o Deals in three-wheeler segment has grown about 10 %. The overall market has grown 15 %. Lot of growth come from CNG side of the market to about 20 %, So compare to that diesel segment grown by 10 % and company grow by 4 %. Now in last year same quarter there was a inventory emptyness in terms of in the market because from the switch to BS3 from BS4 . So while company build the engine there is a lag in the vehicle build so that happened at the OEM side So they had a low Q1 because they were building inventory so compare to that they have shown good growth because of vehicle inventory at higher level so there is lag between engine and vehicle growth. In the overall H1 it will catch up because now it is full from the OEM to maintain the inventory and sales at the same level from Q1 to Q2 so there is full in terms of Engine orders from OEMS. So in H1 engines and vehicles both will be in line in like to like basis. - Can more than 75,000 sales of Engines can be expected in Q2 FY19 ?

o Yes in terms of seasonality it can be accepted and it will be in line with the demand from Vehicle Manufacturers. - Is there any update on High KV launch in Gen-sets ?

o Company have started to get initial orders and first set of delivery will start in August itself . So from Q2 sales will start and as company ramp up then future guidance will be given - Is there any update on Leap Engine ?

o Company is talking to couple of OEE who has expressed their interest and in BS4 the time line was limited So company is moving toward BS6 development . - What is the cash balance with the company currently ?

o 605 Cr - What will be the CAPEX guidance for FY19 ?

o Close to 100 Cr in FY19 that will mainly toward R&D because company have two major projects running BS6 and Pinnacle - Do company see any adverse effect of excel overlap in the three wheeler segment ?

o No company don’t see any impact of LCV coming into three wheel. Three wheeler demand is expected to grow at single digit company had sold 2318 in Q1 FY19 compare to 700 in previous year same quarter CNG engines. Company is offering the 400 CC that is the bigger CNG engine and it has also started to see growth So company is participating in the segment but not in the lower model CNG engines. Company have grown 200 % of CNG sales compare to last year same quarter . - What is the ideal mix of revenue that company is targeting between engines and aftermarket retail from FY19 and FY20 perspective and what is the kind of contribution it bring to the bottom line ?

o In aftermarket business the bottom line is better than the company margins and even better than the engine business also and going forward also this trend will continue.

o In aftermarket company sells each and every part of three wheeler and company is seeing significant attraction there and company have added the greaves care center there also attraction is growing . Development is that company 3500 tiller outlet has now become 5000 tiller outlet. So in any given day company get around 40-50 people and the traditional B2B company is now moving toward a B2C company . On an any given day company is serving 5040 people . Company greaves care is now serving to 7000-8000 customers per month. Company is having reach and expanding this reach to PAN India level. - Is company is in advance discussion with OEMS for BS6 and other engines ?

o In BS6 company is advance talk with all OEMS and building prototypes for the three wheeler diesel engine. In terms of CNG OEMS company is taking it to the next level of validation by testing validation and demonstration as well as home grown CNG is also seeing lot of attraction with the current OEMS the demand had more than doubled compare to last year. - Is there any price hike taken with OEMS ?

o Yes in engine business with overall growth of 8 % and company has grown 4 % price hike. - What will be the EBITDA margin guidance for the whole year ?

o Company EBITDA margin in Q1 FY18 was 14.1 % for the whole year and company will maintain it for the whole year . QOQ there might be little variation and it also depend on the revenue . Don’t compare it on QOQ look for full year. - What is the outlook on the farm equipment and Gen-set business ?

o Both the business are growing in double digit . In farm business company has grown significantly on the power tiller number compare to last year same quarter. Pump set business is continuing its growth from diesel and kerosene to now expanded it to the electric pump set range so that is incremental business for company so base on that Farm business is growing strongly for the company

o In Gen-Set company is now getting into the Higher KV segment . The market was very sluggish in Q1 company have again reported double digit growth there on generic so that again doing good business for company - What is the company market share in the Gen-Set business ?

o 6.5 % - How will these other business contribute in overall business going forward ?

o Slightly higher than current contribution because business is growing in double digit - What is the size of CNG and petrol market except Bajaj on annual level ?

o 6.5 lakhs for the annual basis .Overall spilt between Diesel is 50 % and Petrol + CNG + LPG is 50 % .

o Out of 6,50,000 three wheeler sold last year Bajaj had sold 3,74,000 . Greaves is moving from a Diesel company to fuel agnostic power sales company , company is going to work on Diesel plus CNG plus petrol and also on other options . Company have seen sales triple in CNG engine and also announce that company will bring small engines for the BS6 segment in the market - Do the Non-Baja OEMS source supplies from company or they do it in house ?

o They have make In-house and also source externally and on the larger which is 6 and 7+1 they take engine from company - In Auto Expo company has displayed one Auto so what is exactly company focus key area under EV would it be component or full vehicle ?

o Company had shown running power train technology and there company is working with partners in which company is working on the entire power train solutions and services because it not just the power the power train solution but also the Infrastructure solutions and company is developing solutions and company have several group f concepts. Company is intent is to grow both as the Power train solution provider and the OEM partners - How scalable is greaves care business ?

o It is one of the fastest growing business branded in the country in the area of three wheeler service so clearly company is seeing attraction and company is adding people PAN India through company franchisee low CAPEX model and intent is to be at least in a minimum of 150 store at the end of this year and from there on company will continuing to keep scaling. - Is currently the company is in the EV stage at all ?

o No currently company is in a Alpha stage right now - What is the target of Greaves care by the end of this year and next year ?

o This year target is 150 outlet . - In what time the Pinnacle engines will get ready ?

o Company is getting into the Alpha stage right now and then there ia Beta , Denting , validation Etc So company is in some bit of distance from that . Company will be definitely ready by FY20 and going on company will have OEM sign of happening - What is the after market growth in the current quarter ?

o Double digit or higher than the company average. - What about working capital guidance ?

o It is in line what company has reported in march - Is company is getting sign ups from the New companies also who is launching OEMS ? Is there any update Quality Green in on Hybrid Green engines ?

o Company is growing from current set of OEMS there are not new sign ups in terms of new OEMS coming in and company is working to capitalize the growth with the respected OEM.

o In Quality green the development stage is on and company is still in early phase of technology development . Company is only in the Alpha stage right now . - Does company seen any benefit of tie up with Pinnacle till date or it has been done with BS6 engines only ?

o It has been done only for BS6 engine - What will be the share of CNG in total three wheelers as of now and what company see it probably going ahead ?

o Last year for full financial year it was about 50 % and quarter on quarter there might be some variation and in this quarter CNG is marginally higher than diesel . Shift is happening towards CNG engine from last 4 years and that may continue. - How much company internally have CNG mix ?

o 4 % because company have a small base and growing on it and company will expand portfolio in CNG play in small format as well as large format,

Greaves Cotton to acquire Ratan Tata-backed electric vehicle maker Ampere:

If Greaves Cotton has made the purchase to enter EV market, it is a bad mistake. EV scooters are a failed business right now.

But if this is for the EV technology to replace their diesel engines or complement them, I will start buying as that will be a golden move.

Awaiting clarity on the motivation for the move.

Disc: tracking, not invested.

Results

Revenue 9% high, PAT and EPS flat

Result press release

Investor presentation

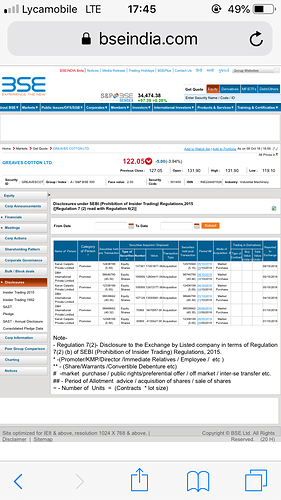

Two promoter entities Karun Carpets Private Limited and DBH International Private Limited out of three are regularly acquiring from the market from the date 1/10/18 where their stake went up from 5.04% to 5.64% and from 40.32% to 40.44% respectively. This open market purchase was after overall promoter holding went down to 51% in June 2015. Now it should stand at 51.72% highest atleast in this decade as per SHP published in the BSE site.

Thanks for sharing this wonderful, insightful and indepth article by Aveek Mitra. I have been tracking GC and I see promoters buying almost daily…

Disc:Invested, will now add more on dips

Q3 results here.

Topline grew ~10% QonQ. However, profit is lower due to higher expenses.

PBT 63 crore Vs 80crore and PAT 43 crore vs 56 crore compared to year ago quarter.

Divident of 200%, that is Rs.4/- with record date 14th Feb.