You are correct but I would seek a negative feedback to correct my thesis. Since I am invested here, I would want to continuously correct my thesis by questioning the general wisdom

Can anyone share analysis of its financials and promoters?

Anyone knows how to track the prices of these chemicals? any particular website for this info?

Motilal_Oswal_SELL_on_Fine_Organic_with_19%_DOWNSIDE_The_promised.pdf (1.1 MB)

please see attached Motilal oswal sell report on Fine organic, below is summary

Fine Organics (FINEORG) reported an in-line EBITDA of INR1b in 2QFY24.

EBITDAM contracted 370bp YoY to 22.1%, while gross margin improved 370bp

YoY to 41.9%, primarily due to a sharp decline in raw material costs. In a

declining input cost scenario, the company would have to pass on the benefits

of the same to the customers, and therefore, we expect its margin to contract

further in the coming quarters.

All plants are currently running at optimal capacity. However, the management

has ruled out debottlenecking the existing capacities due to safety concerns.

Management is currently awaiting land allotment (for close to two years now)

either in Gujarat or in Maharashtra but has not been successful in doing so.

Although the Board has approved the company’s capex plans, the official

announcement will only be made after the land allotment.

**In a utopian world, say, for example, even if the land is allotted to the **

**company today, it would take at least six months for Environment Clearance **

**(EC) and another 15-18 months in setting up capacities. Although, the land **

**allotment news could be a short-term positive trigger for the stock, nothing is **

**going to happen on the fundamental side of things, say, until FY25 or 1HFY26 **

in our view.

FINEORG is considering establishing manufacturing facilities closer to these

customers in the US. This move is expected to enable the sale of products at a

premium, leading to higher margins, given their US-based manufacturing. The

Thailand JV’s Phase I operations has been delayed time and again since Dec’22

(anyway a small part in the overall scheme of things as of now) and Phase II is

likely to start only after process conditions are standardized in Phase I (another

year after this happens).

Considering the above-mentioned medium-term challenges, we trim our

revenue/EBITDA/PAT estimates by 8%/11%/11% for FY24; and EBITDA/PAT by

8%/10% for FY25. We downgrade the stock to SELL. Valuations too are

expensive with the stock trading at ~37x one-year forward P/E, which doesn’t

warrant such high valuations in a company that is going to have YoY earnings

decline for the next two years (-39% in FY24E and -9% in FY25E).

Fine Organics – A Business Analysis, 24th Dec 2024

Background

Fine Organics, founded in 1970, is in the chemical specialty additives business. They produce additives from oleochemicals, i.e., additives derived from vegetable oils, instead of petrochemicals. These are biodegradable. One may say they are renewable but in my opinion that depends on one’s perspective – crops need fertilizers, fertilizers in turn are produced using vast quantities of natural gas and fertilizer use can lead to Nitrogen and Phosphorous pollution. So, I have a somewhat skeptical view on these oleochemicals being called ‘renewable’ and ‘green’, although marketeers can get away with it. Certainly thought, oleochemical have advantages over petrochemicals. That is unarguable.

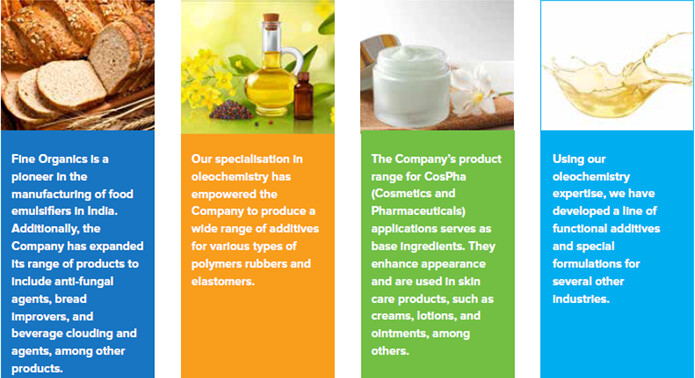

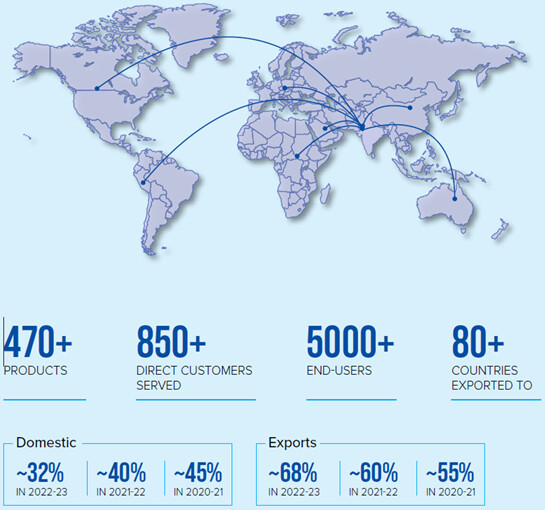

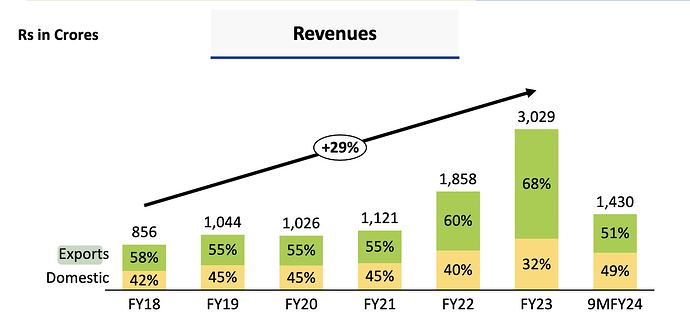

Fine Organic’s target industries include foods, plastics, packaging, coatings, polymers, cosmetics, rubbers and feed nutrition. See Figure 1. They have a diversified product portfolio of products sold to a diverse customer mix and with exports to 80+ countries. In fact, the domestic:export mix is about 40:60. See Figure 2 for details.

Figure 1: Target industries of Fine Organics.

Figure 2: Product and customer mix of Fine Organics.

Business drivers

Additives typically are only a small percentage by weight or volume of a product but they can change the characteristics of the end product tremendously. For instance, anti-fungal agents in foods, polymers that are flame retardant, hydrophobic, non-fogging etc. So, this a value-add industry, the opposite of commodities.

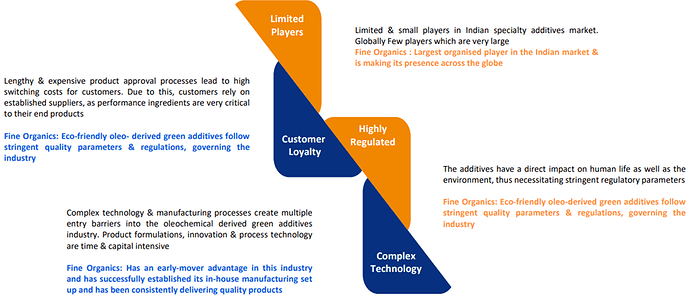

An established player like Fine Organics, the biggest oleochemical company in India and among the top six in the world, has a decent moat, as can be deciphered from this statement in the 2023 annual report: The regulatory approvals obtained from different industry institutions are typically only valid for a specific time. In addition, regulatory compliances are frequently revised depending on the location, industry, end-use, and other factors. It might then take another three to five years for an end client to accept the additives once the immediate customer has given their approval. See Figure 3 based on investor presentation Nov 2021.

Figure 3: Entry barriers into the oleochemical additives business.

So, for a new player, its hard to break into the market. Established players though may have enough stable products to foray into new areas or compete with other established players. The business is simple enough, purchase edible oils, convert them into oleochemicals and sell them to customers like Coca-Cola, Britannia, Asian Paints, Parle, Pidilite, Berger Paints etc. It’s the regulatory process that prevents new players from getting into this business.

Concerning risks, India is a net importer of vegetable oils so there is currency risk, but since half the revenues are from exports, this is not an issue. Oil prices can also vary wildly so Fine Organics has contracts ranging from 3-6 months with suppliers (AR 2023). Any duration mismatch for contracts with customers can lead to wild margin changes, both on the upside and the downside. Based on an analyst report, Fine Organics from 2021, had entered into shorter term contracts with customers. But this may keep changing. My message is that keep an eye on the margins – volatility there may be due to contract duration mismatch with suppliers and customers. The annual report seems to have no info on this.

Regarding growth, as per the AR 2023, the global specialty chemicals market was valued at US$ 612.2 billion in 2022 and is expected to grow at a CAGR of 5.1% during 2023-30. The specialty chemicals industry in India has expanded exponentially in recent years and is anticipated to reach US$ 64 billion (10% of global) by 2025 at a CAGR of 12.4%. A bit more granularity below:

The global food additives market size is expected to register a CAGR of 4.6% from 2023 to 2030.

The global plastic additives market was valued at US$ 51.01 billion in 2022 and is anticipated to grow from US$ 52.45 billion in 2O23 to US$ 83.3 billion in 2030, registering a CAGR of 5.3% between 2022 to 2030.

- The global cosmetic ingredients market is estimated to register growth at a CAGR of 5.3% during 2022-28.

- The global market for coating additives is expected to reach US$ 17 billion by the end of 2032 registering a CAGR of 5.9% from 2022 to 2032.

Since exports are 50% of revenue, even if you assume that the Indian growth is larger than the global growth, the above numbers give a ballpark indication of the company’s potential growth rate.

An unfortunate aspect is that the company offers no granularity on the revenue mix from their different product lines. So, it could very well be that food additives are 80% of the revenue and CosPha only 3%. I don’t know! The revenue mix could shed light on both strengths and weaknesses of the business.

Considering that there are around 6 oleochemical companies in the world, this business can’t really be considered oligopolistic. Further, I don’t think this is a business that can be compared with that of Asian Paints or the like. Asian Paint’s success has been as much about marketing and supply chain efficacy (refreshing stock in the typical tiny Indian stores with limited storefront area multiple times daily) as about the product. Fine Organics is not an end user facing product – they are dealing with other large companies who would go for the cheapest supplier for a given quality, even if it takes a while to onboard a new supplier. Anyhow, who is to say that a business like Coca-Cola does not have two suppliers on board anyhow, as part of their own risk mitigation strategy. And then play of one against the other to not allow someone like Fine Organics to have too much pricing power.

Analysis of Financial Statements

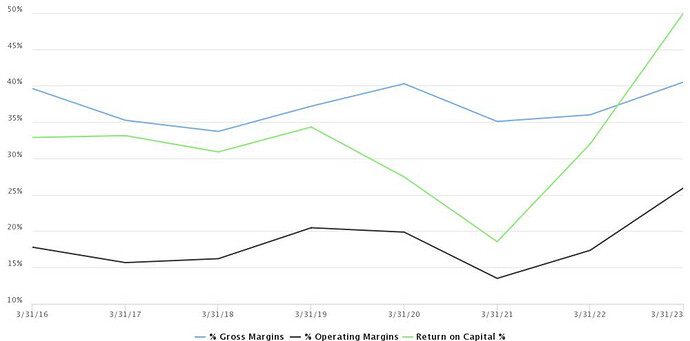

Figure 4: Gross and operating margin of Fine Organics.

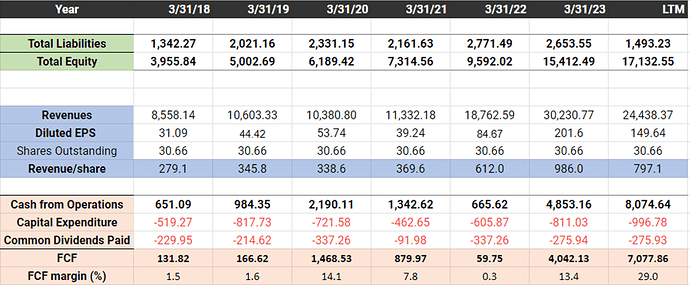

As shown in Figure 4, the operating margin of Fine Organics has been exceptionally high in 2023. This is likely due to contract mismatches between suppliers and customers during this period and is likely unsustainable. One can already see that key metrics (Revenue, EPS, Revenue/share, cash from operations) in the LTM are going down in Table 1. Overall, EV is lower than market cap, so the company has cash on the balance sheet after netting out debt. FCF margins are super volatile, but its clear that the company is growing (equity, EPS, Revenue/share). INR 500-600 million seems to the annual capex – 60% of this seems to maintenance capex (calculated from depreciation and amortization) while the rest is reinvested back in the business for growth at high ROCE. The current ROCE of 2023 is not reliable because current margins are too high (Figure 4) but under normative conditions the business still has high ROCE (>20-25%).

Table 1: Key metrics from financial statements in millions INR over the past five years.

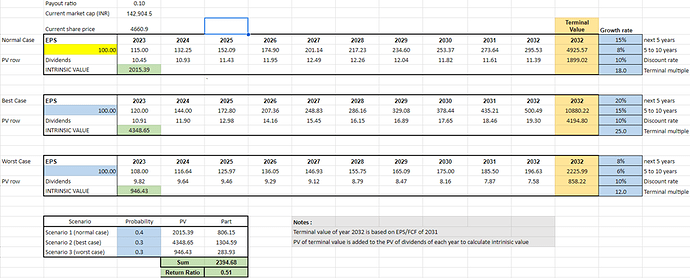

Table 2: A DCF valuation for normal, best case and worst-case scenarios using FCF as input.

For valuation, I prefer to use EPS and taka a more normative EPS of INR 100. 10 years from now, I imagine there is more competition and that the ROCE has reduced and therefore also the terminal value. Under high growth rate assumptions (much higher than the sector that I mentioned above) which are entirely plausible the business is fairly valued for a 10% return. But under normal case assumptions, the share price can half from here – plausible if there is margin contraction for a couple of quarters along with a reduction in PE.

Investment thesis

This is a good business with a high ROCE, secular tailwinds and a long runway. Currently thoguh its priced for perfection.

Company news

Nothing special.

Catalyst

It’s a good business, the question is how much you are willing to pay for it. For me, its richly valued so its one of those that you put on the watchlist and wait. It might be a good one for a classic Phil Town, event-based investment. Wait for a couple of bad quarters, high oil prices, margin contraction, temporary issues with the company and the like. And if you get it cheap, hold on for dear life. For me I need a 50% decrease on the current market cap. A few years from now, if the company grows, I might be willing to pay the current market cap. More likely is that I will never get a chance to get in. Also ok for me, I can live with that. I can’t live with no margin of safety.

Fine Organics — Q3 FY’24

I had already posted revenue forecasts for Mar FY’24, and so far it looks on track with TTM revenue standing at 2173 Cr after Q3 results. In this post, I also want to touch upon a product called Erucamide which is, in my opinion and study, one of the reasons for the fall in demand.

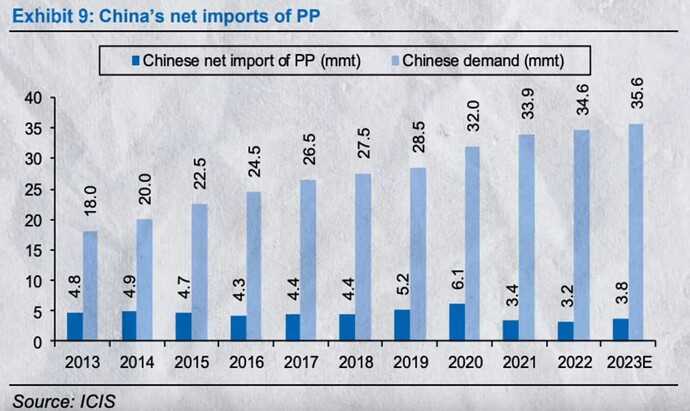

Erucamide is a primary fatty amide that serves as a crucial releasing agent, antistatic agent, and anti-sticking lubricant for polyethylene (PE) and polypropylene (PP). Erucamide is one of the larger contributors to the company’s revenue and they sell them in various formulations for example:

Finawax-e (Erucamide):

FinaFog (PAs, PEs, PPs):

Finalux G 1600

Erucamide, as seen from the examples above, is used in lubricants, plastics, surfactants, automobile interiors and more. The Erucamide market size is expected to develop revenue and exponential market growth at a CAGR of 3.5% during the forecast period from 2023–2030. The growth of the market can be attributed to the increasing demand for Erucamide owning to the Plastics Industry, Ink and Paint Industry, Rubber Industry and other applications across the global level. That being said, in the short term due to the poor economic performance, most international markets are witnessing a massive drop in demand for Erucamide.

Also, China who was a big importer of PP(Polypropylene) has now started meeting its requirement through domestic manufacturing, again hitting FineOrg’s export opportunity.

Remember, Fine organics depends a lot on exports, and in FY’23, FineOrg’s split between domestic and export market was 32% and 68% respectively. That very split has now changed to 50-50% by Q2 FY’24. The exports business is a high margin business, and hence margins are on a declining trend at the moment.

FineOrg’s long term business prospects are still in-tact, and there is no fundamental problem in the business itself. But the short to medium term forecasts don’t look positive. A lot of this is already priced into the stock, and it will not receive the premium valuation it once used to command until the export demand starts to recover. Please note, that it is highly unlikely that this recovery is going to be sharp, instead it will take several more quarters before the prospects start to improve. Another risk to note is the constant FII selling, but the positive takeaway is the promoter holding standing firm at 75%. It might end up being a game of patience.

update on Fine Organics by Motilal Oswal TP -3460

All plants are currently running at optimal capacity, except Patalganga-II,

where there is still some headroom for capacity ramp up. However, the

management has ruled out debottlenecking existing capacities due to safety

concerns. FINEORG is currently awaiting physical land allotment (~30 acres) in

SEZ and expects to complete the whole process before Mar’24. Although the

board has approved the company’s capex plans, the official announcement will

only be made after the land is allotted.

**In a utopian world, it would take at least six months for environment clearance **

**(EC) and another 18 months (minimum) to set up the capacities. Although the **

**greenfield capacity is expected to take care of growth for the next 10 years, we **

do not expect the growth to start until 3QFY26. The plant is expected to cater

primarily to the export market. Currently, exports account for 49% of the total

revenue for FINEORG.

Management is of high quality with great track record of execution, volume growth is challenge here as all plants are already at optimum utilization, they had high share of exports and with global slowdown margin improvement chances are less. they are always trade at premium valuation. I will like to keep this under track and waiting for better valuation to enter.

Motilal_Oswal_sees_23%_DOWNSIDE_in_Fine_Organic_Industries_Slowdown.pdf (658.1 KB)

Nirmal_Bang_sees_38%_UPSIDE_in_Fine_Organic_Industries_Overseas.pdf (1001.4 KB)

please refer to attached Nirmal Bang report on Fine Organics

The management expects at least one quarter of pain in the US and

Europe markets due to subdued demand in the respective segment(s).

Considering the near-term demand outlook, we believe that capacity

shortage is not really very bad news. However, timely commissioning of

Maharashtra SEZ capacity is the key.

As far as expansion in

Maharashtra SEZ is concerned, the management expects final go-ahead for

land allotment in Mar’24. Post completion of EC, the new capacity spread over

30 acres can take 18-24 months for commissioning.

Target price of 6000, based on 40x PE on Dec’25 earning.

Q4FY24 Conf Call Notes [1st ever call]:

- Red sea crisis has increased shipping lead time by 1~1.5 months. Seems small challenge compared to COVID experience.

- All plants running at optimum capacity except Patalganga (started in FY22), which still has some room for capacity ramp up and might need 3~4 yrs to fully utilize.

- Incorporated WOS [Fine Organic SEZ Pvt Ltd] in MH SEZ area, allocated land ~30 acres. After possession of the plot, EC will be applied. Post EC approval, activity to set-up export oriented mfg facility will be initiated. Post land allotment, capacity and investment plan will be announced.

- FY23 was an aberration. There was disruption on the supply side with volatility in the raw material. Hence, FY24 performance is not comparable to FY23.

- Thailand plant’s trial production (small capacity) for one of the product commissioning is expected by the end of Jun24…After that, we need to observe for almost a quarter to decide further course of action about overall capacity needs.

- Europe demand remains subdued.

- 20~22% sustainable historical margins.

- Intend to have a plant outside India. Also, looking for acquisition.

- Before commercialization, a new product takes 3~4 yrs to get approvals.

- Cash Usage Plan: Business growth - New SEZ plant, Plant outside India, and working actively for acquisition (traits: complementary to existing chemistry, new market/customers) opportunities. We may need to borrow more money.

- Key challenge: Long approval (customer as well as regulatory) cycle.

- Will continue to host conf calls at the end of the year.

//--------------------Appended on 14-May-2024------------------------------- - Q4 performance seems sustainable going forward as raw material prices are benign. Don’t provide expected volume growth. All plants running at optimum capacity except Patalganga. Not much capacity available to do more volume growth.

- Thailand manufacturing is for a new product and only 2 companies in the world are making this product. Product already approved for shipping to the customers.

- New product development is a continuous ongoing process.

- Latest sustainable margins would be possible to judge after a few upcoming quarters performance.

- 5 yrs. horizon opportunity for company’s product: Will remain in oleochemistry line of business and expand the product range. 2 Plants: outside India with considerable capacity and in India.

- Overall Inference (Personal Opinion): No visibility on the upcoming growth levers and amount of expected growth, except the available capacity (Amount of additional possible revenue/EBITDA was not stated.) at Patalganga.

Source: Fine Organics | Investor | Investor Presentations

Disc: No position

Concall Summary Date: 13 May 2024 FINE ORGANIC INDUSTRIES LIMITED

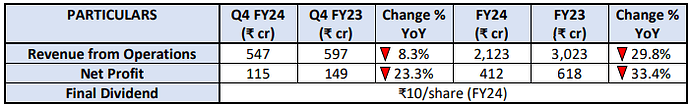

FINANCIAL HIGHLIGHTS

On a YoY basis, the EBITDA declined by 29.1% YoY ₹143.5 crore, and the EBITDA margin stood at 26.2%.

On a QoQ basis, the revenue from operations increased by 12% and EBITDA grew by 21.3%.

In FY24, the EBITDA declined by 35.7% YoY to ₹534 crore and EBITDA margin stood at 25.2% (v/s 27.5% in FY23).

The cash and cash equivalents & bank balance stood at ~₹961 crore in FY24 (v/s ₹497 crore in FY23).

BUSINESS PERFORMANCE

In FY24, ~52% of the total revenue from operations was from exports

The domestic market performance was partially offset by the global slowdown impact.

Fine Organic customers are located worldwide including Europe, North and South America, the Middle East, Asia, Africa, Japan, and China.

Stable demand dynamics have led to a steady pricing environment for vegetable oil. The company does not foresee much volatility in the price for the next few months

The company witnessed some headwinds for exporting goods to Europe and the US due to the Red Sea crisis.

Currently, the company’s all plants are running at optimal capacity except the Patalganga plant.

The Patalganga plant was started in March 2022. It will take another 2-3 years to run at full capacity utilization.

The company witnessed recovery in all the regions except Europe.

FUTURE OUTLOOK

For the Maharashtra Special Economic Zone (SEZ) plant, the company is waiting for land allotment letter. The SEZ land area is ~30 acres. The plant would be commissioned by the end of FY26 and primarily cater to the export market.

The management expects the Thailand plant to be commissioned by the end of June 2024. This is a very small plant. The initial focus would be on small trial production of a product. Further investment decisions would be determined after the performance of the trial production.

The company would incur investment for capacity expansion in the new SEZ plot, exploring acquisition opportunities and it is also considering putting up the plant outside India. It plans to utilize its cash and bank balance for the same.

So this is my take on the results. I am adopting an extremely simplistic view here so feel free to challenge this as I am NO expert whatsoever. The margins are more or less stable (didn’t deteriorate as some feared). QoQ, the improvement is visible across sales, margin and PAT. Given the overall headwinds, I believe the results are not bad. Given their cash on books, no or very little debt, able management and forward looking capex plan to double down on exports, I would assume it can only go up form here. Many risks seem factored into the current price. And another thing that I have started to look at, since recently, is this (I think i read this in some book of Minervini’s), if you cant make up your mind on how the results actually are, given it a few days and the market will reflect it in the price action. Again, this could be a very naive way of looking at things, but I do think it makes sense since the bigger platers are usually smarter than us when it comes to reading the results. So, from that perspective too, I believe the results didn’t spell doom.