Below is my detailed note on Fairchem Speciality Chemicals. It’s basically summary of the information that I obtained from AR, Investor presentation and rating reports etc.

Fairchem Speciality Ltd (FSL), a Fairfax investment company, is a speciality chemicals company formed by the merger of Adi Finechem Ltd and Privi Organics India Ltd.

Adi Finechem:

It manufactures -

- Oleochemicals (high grade fatty acids) and

- Nutraceuticals (tocopherols)

by processing the waste generated during refining of soft vegetable oils like soya, sunflower oils.

Uses of products:

Resins, paints, inks, adhesive, cosmetics & natural vitamin E.

Customers:

Oleochemicals - Asian Paints, Arkema, Micro Inks etc.

Nutraceuticals - BASF (USA), Cargill (USA), ADM (USA), AOMC (Argentina) etc.

1)Adi has expanded capacity from 8,000 MT in 2010 to 45,000 MT in 2015 from internal accruals only.

2)In 2018, it de-bottlenecked its operation and optimized the production process which increased installed capacity from 45,000 to 72,000 metric tons per annum (MTPA) of raw material that can be processed at its plant located at Sanand, Ahmedabad.

3)Capacity utilisation was 54%, giving considerable room to grow.

Competitive Advantages:

1)Low cost of raw material and efficient manufacturing process enables Adi to be highly cost competitive vis a vis global peers

2)Enjoys leadership position in the industry due to high barriers to entry

3)Uses by-products of refined vegetable oils, giving it a price advantage

4)10+ years relationship with key raw material suppliers

5)Favourable competence to pass on the fluctuation in the raw material prices

Management commentary:

• It is India’s only manufacturer of Dimer acid which is growing at a very good rate.

• Nutraceuticals (Tocopherol) market is very volatile and inherently not growing. It is used in formulating Natural Vitamin-E.

Future Growth Prospects:

• In all the major products - market is growing 10-15% , we will grow at 15-20% mainly by gaining market share from others and through new products.

• It has also initiated two capital expenditure projects. Both will be financed by a mix of term borrowings and internal accruals and are expected to enter production in 2020.

• a plant to manufacture sterols and higher concentration tocopherols and

• a plant to manufacture bio-diesel using three by-products of its manufacturing process: palmitic acid, monomer acid and residue.

Privi Organics:

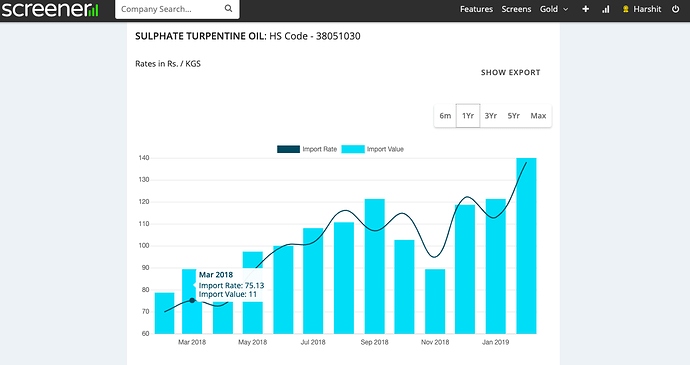

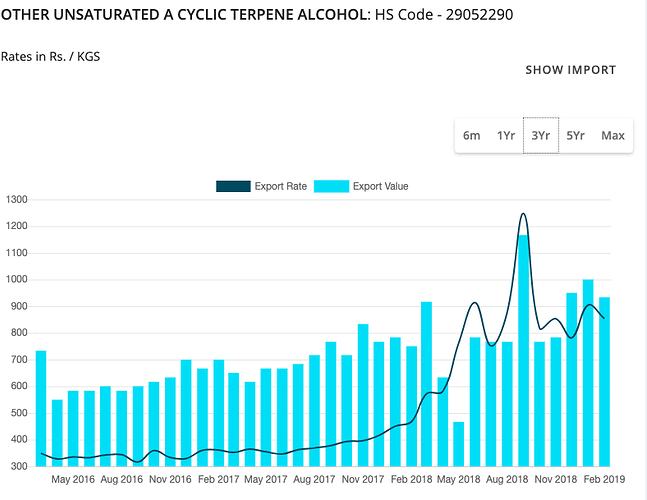

It manufactures aroma chemicals. It started with 2 products in 1992 and now manufactures 50 different products which are used to make fragrances, in turn used in day to day products like soaps, detergents,shampoos, perfumes etc.

Customers:

F&F industry - Givaudan, Firmenich, IFF, Symrise, Takasago

FMCG industry - P&G, Henkel, Colgate

Total capacity - 22,000 tonnes across 4 manufacturing plants. Privi’s 3 manufacturing plants are located at Mahad, district Raigad in Maharashtra and one plant is located in Jhagadia, near Ankleshwar, Gujarat.

Competitive Advantages:

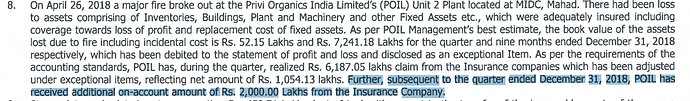

1)It has the largest and the only plant in Asia which manufactures aroma chemicals from the waste of paper mills - Crude Sulphate Turpentine (CST) rather than Gum Turpentine Oil (GTO). The price of GTO is very volatile while CST is less volatile.

2)As it has backward integration with the CST, there is cost advantage and visibility of raw material cost.

3)Entry barrier - Only 4 companies in world have assured supply of CST, including Privi. 60% raw material (RM) is imported from over 30 paper mills in Europe, US & Canada. Long term 2-3 year contracts with paper mills to source RM. Fairfax has invested in Pulp mills in Canada and can help source RM.

4)Privi’s main competitors are international companies. Being based in India, it gets the benefit of lower employee and overhead costs.

5)Privi makes over 50 products – widest product range in the industry. Thus it is one stop shop for many customers – this provides inter-product support.

6)Privi is trusted supplier for over 10 years to all of the top 10 fragrance companies, which control about 80% of the global fragrance market.

Management commentary:

• Company is a leader in Amber Fleur and Dihydromyrcenol. Both these are major products in the Aroma chemicals market. Also looking to get leadership in one more product

• They have the capability to custom-design and manufacture aroma chemical molecules, as per the specific requirement of customers. So, it will be able to further strengthen bond with customers for a long time to come.

• Have 2 R&D labs. One R&D lab is completely focused on developing green products in technical collaboration with UICT, Mumbai through biotechnology.

• In collaboration with UICT, it set up Biorefinery pilot plant to convert the bio waste to value added products like Xylitol, Vanillin by natural fermentation processes. Published 3 international patents.

• In a 4 way collaboration between Privi, ICT, Fraunhofer Institute and Atech Innovation from Germany, a novel 2G Bio Butanol manufacturing process is scaled up.

• Lots of R&D has been done for which benefits will accrue over 2-3 years.

• Have signed Reckitt Benckiser as a new customer.

• 70% export sales. Gross margins typically 24-26%

• 20 year average annual growth - 18%.

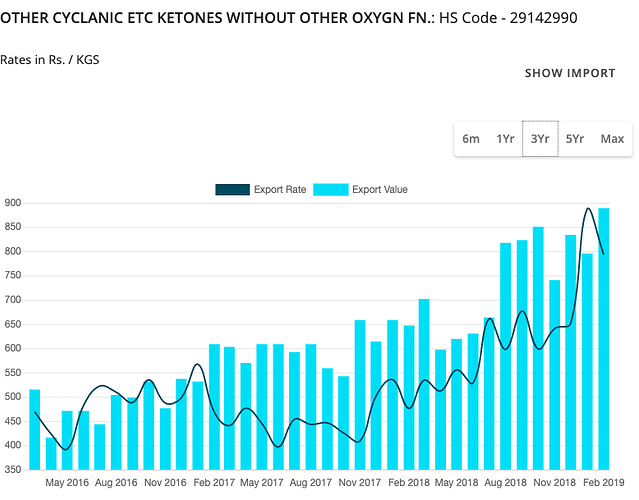

• 2018 was a great year for privi, despite a fire incident that gutted the largest factory at Mahad MIDC on April 26, 2018. Company was able to restart production in a record 29 days - using third party outsourcing to maintain customer continuity.

Future Growth Prospects:

1)Average capex is 75 to 100 Crores - to be largely financed through internal accruals at the existing manufacturing facility at Mahad MIDC in Raigad district.

2)Entering flavours segment using byproducts from existing chemicals. Lab scale trials done, large scale production within 2-3 years. 50-70 cr capex required for flavours. Infra, land in place. Expect 300 cr incremental revenues by FY21 and further 150-200 cr revenues from new biopesticide product.

Future growth comprises of -

i) developing, manufacturing and supplying additional (newer) aroma chemicals to the same set of customers,

ii) making value added products from by-products made in manufacturing of aroma chemicals and

iii) strengthening margins by increasing the backward integration capacities.

Fairfax commentary:

1)FairFax is RoI obsessed, in no rush to close deals/ acquire new companies.

2)We will aim to be the best if not largest specialty chemical company in India.

3)Will not provide any targets on scale and deals to be made as this will create unnecessary pressure and precipitate errors.

4)Will always sacrifice short term performance for long term.

Market size and opportunity:

The Indian market size of aroma chemicals currently stands at $200 mn (3.85% of global market) and is expected to grow at 15% over the next few years owing to increasing per capita income, growing urban population share, deeper penetration of FMCG products in rural areas and expansion of organized retail in tier II & III cities.

Global demand for flavor and fragrance — including demand for flavor and fragrance blends, essential oils and natural extracts, and aroma chemicals—is expected to rise 5.5 % a year. The top 10 players account for 80% of world total flavor and fragrance market share. The global oleochemicals market value is expected to grow at ~ 6% CAGR from around $20 billion in 2015 to $27 billion by 2020.

Positive:

1)ROE and ROCE and Operating cash flow is improving. Need to see what happens in case of any downturn in the chemical industry.

2)The products manufactured by it find application in high growth consumer goods industries like nutraceuticals, paints, printing ink, adhesives, soap manufacturing, etc. which are expected to grow steadily due to factors such as rising population, increase in disposable income, increase in penetration of e-commerce and increasing spending on healthcare and nutrition products.

Risks:

1)Impact on margins due to decrease in the prices of key products because of demand-supply dynamics and competition.

2)Global economic slowdown.