I am not a numbers man but what I like was zero debt;increase in dividend to 4 Rs from 2 rs last year; increasing salesgrowth with bottomline;ROCE of 32%;good promoters with execution n huge opp size.

I agree. Its a classic picks & shovel stock to play the consumer goods boom in India.

But IMHO the cCFO:cPAT numbers must be looked into before we take a investment decision.

Fellow VP members well versed in cash flow,PL analysis please provide your inputs.

Very good observation. The reason for variance between PAT and CFO could be due to change in business model and transition problem which is highlighted Vivek.

Having said that, the company has low debt despite CFO being lower indicate that the company is not at least utilising cashflow in the business.

Also, FY14 balance sheet indicate that inventory increase was the main factor behind working capital utilisation hike.

Let us wait for FY15 balance sheet for more details. As per audited resulted as against net profit of Rs 19 cr, Rs 10 cr has been increase in inventory with another 3.5 Cr being increase in receivable. Creditor has declined by 1 cr. Still the net profit is more than sufficient to finance working capital enhancement and the company can grow operation without debt. I extrapolate that the business require moderately long inventory holding for the company as same being imported (particularly spare). With increase domestic manufacturing, the spare and consumable holding may decline which result in release in working capital and that can only be confirmed in future.

@Vivek_6954, any further thought on working capital management from the company?

Yes may be due to imported RM the working capital wud be on higher side.Hopefully due to increasing R & D and indigenisation it may come down.

I don’t think it will come down drastically. If we drop down why CFO to PAT is poor then we find that the reason is inventories. This I doubt will come down drastically as by nature they have to maintain a lot of SKU’s of after market inks.

As far as the promoter is concerned they may be competent and everything but by no means you can justify their treatment of minority they have diluted minorities every year when the business didn’t really need much cash. That will be a big over hang on this stock. The company may have become listed by mistake and a fair promoter can de- list it. If he really wants to have full benefit of his ‘efforts’.

I don’t think anyone here has talked about competition - Videojet is listed in US and Domino till very recently was (recently acquired by Brother Printers) . both these players have deep pockets and spend more on R&D. It is worthwhile to understand the competitive position because margins may come under pressure if competition intensifies.

Just for reference - Domino earns an OPM of~ 20% similar numbers for Videojet. They also spend very highly on R&D(5-6%) Domino has been stepping up it’s activity in India and has opened its own plant in India and has done management changes to focus more here. They have a specific target to increase their aftermarket sales ratio. This may actually push the margins lower for CP. One needs to be really sure why this won’t happen before making an investment in this company.

The promoter issue is in a way binary. If the promoter doesn’t issue warrants this year then that’s also a clue that he is not a buyer at these prices

I think pie is big enough for 3-4 major players in fast growing market of size of India.

But co seems to have an edge by virtue of its plants being located in tax benefit states,customising the end product for typical Indian environment plagued with voltage fluctuations and weather conditions,having good service network of well trained engineers and having tie up with technical superior German KBA .

Promoter warrant issuance hopefully is gone as promoters are buying from open market as well.

Discl invested recently post results

How much are they buying from open market?

Do you have a figure on how much money the promoter has brought into the company via warrants?

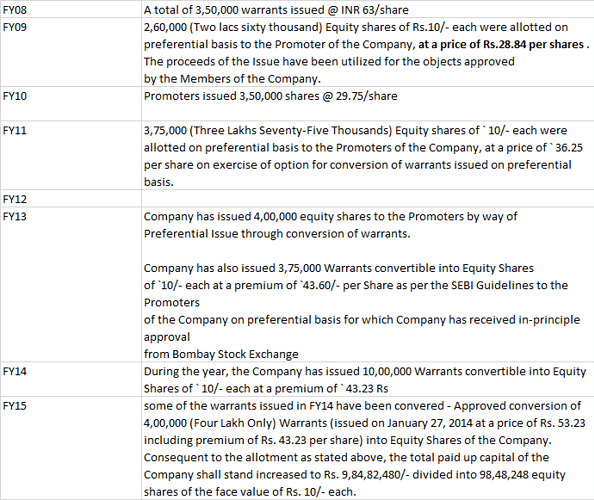

Close to 23 Lakh shares were added to the Shares O/S through warrants. Below is the list of it year by year. The table below is broadly accurate. I have not included the recent warrant conversion that happened in FY15. .

do you have a view on why cash flows are so weak inspite of all this cash infusion and high ROCE’s. Leave alone FCF, even OCF’s hardly keep pace with EBITDA which is counter intuitive to a high ROCE business.

As I mentioned in the above post Its coz of inventories. They have to hold ~ 6 months inventory. Most of this is for aftermarket inks etc which the customers may not keep, but they would need a urgent fulfillment when there is demand. Thus I don’t see this changing much as it’s the nature of the business.

The key interest for me is margins- because of their higher aftermarket contribution (75%) their margins are brilliant. How sustainable are these is a question I am trying to answer.

For market leaders such as Videojet & Domino the ratio of machines to aftermarket/consumables is roughly equally split. Domino in India as per my information is strong on machines but not so strong on aftermarket- but they are ramping up their focus on that segment. Read their AR its clearly mentioned there. Now assume a scenario where the margins for CP fall due to competitive intensity that would certainly coz the ROCE to fall.

From screener.in

- Inventory days Outstanding: 238(8 months)

-Working capital has increased at the same or a higher rate to sales/net profits.

Validates Rohits explanation on the business model with aftermarket sales being the main contributor with a necessity of stocking up different spares/inks etc.

What would be the long term risks of this high working capital model? If working capital is taken into account its not really a high ROCE story is it?

Senior investors, varadharajanr please provide your inputs.

The more I study the company the more I like it due to

-

Moolah in this sector lies in consumables not in selling printers alone.If you sell printers alone you will be in losses only.

-

CP has done a v smart thing by introducing a chip in their system which detects if you are using non CP or duplicate ink and the printer stops functioning.Vice versa is not true for CP so its ink can be used in competitors printers.Videojet too has tried introducing a chip but is not v successful as its security has been cracked.Dominos doesnt have this feature.

-

As such CP is focusing on consumables only and the New Assam plant is for meant for that only.

-

CP is the company manufacturing printers in India under a technology transfer agreement with KBA unlike its competitors who are mainly importing parts and assembling in India.This lowers the cost of manufacturing due to lower costs in India and also due to continuous indigenization efforts of the co

-

Further CP has a smart strategy of focusing only on customers who have bulk demand for consumables.They sell printers only to them.They leave other customers for Dominos and Videojet.

-

Its competitors Dominoz,Videojet and Imajic had a headstart over CP as they were established 25-30 years back and have a good installed based.CP is gradually taking market share away form these old cos as its run by a street smart entrepreneur.Now CP has left behind Imagic and is knawing at the mkt share of its competitors

-

Opp size is increasing everyday.Besides FMCG and pharma its usage is increasing in otehr segments like Auto,Steel,Cement bag and other sectors rapidly.

All in all its a quality small cap to remain invested for next 3-5 years POV.

What capacity is the guwahati plant running at present? Do you have any info on this?

What kind of topline growth is the management targeting for next 3-5 years?

Vivek could you elaborate on how FSSAI actions can help Control Print? I am trying to understand tailwinds for this company and could not decipher this, I am sure you have a good reason behind this.

Since its a new plant cap utilisation wud be low.Opp size is big sales still smal so 15-20% CAGR for next few years shud not be a problem

Good digging @rohitbalakrish_. As per June-15 SHP, total no. of shares are 10448248 so that’s whopping 22% dilution thru warrants over the years on higher base. Were there genuine reasons everytime to issue warrants or as usual it was just a tool to accumulate shares at rock bottom prices?

It was clearly the latter case.

New innovation by Epson in ink technology

Disc:no investment

Control print rose 17-18% to touch 373 today. Results due on 6th August. Its still remains attractive specially if it corrects due to

-

Zero debt co

-

ROCE of 32% for last year n 3 year average of 27%

-

GPM of 64%,OPM of 23% and NPM of 17%

-

PE of 17

-

Profit growth of 100% last year and 35% over last years

-

Sales growth of 24% last year n 20% over last 5 years

-

Mktcap of 310 Cr only vs massive opp size.Sales of inks boosting post Maggi fiasco n FSSAI strictness

-

Business model like Gillette with focus on consumables leading to high margins