Company has been indicating stabilization of existing launches and has indicated new launches but that has been food for thought for over a year. Aggressive building of plants across India , expansion into neighboring countries is a indication of company trying to dig deeper for a long haul. Apart form this there is no publicly available information

Equity Intelligence has entered the stock today 150000@ Rs 650/-

http://www.moneycontrol.com/stocks/marketstats/blockdeals/nse/

Interesting. Let us see how this plays out. Still an undiscovered story.

Something like a local Prataap snacks has Mcap which more than twice of an innovation led food company AgroTech which has national footprint.

![]()

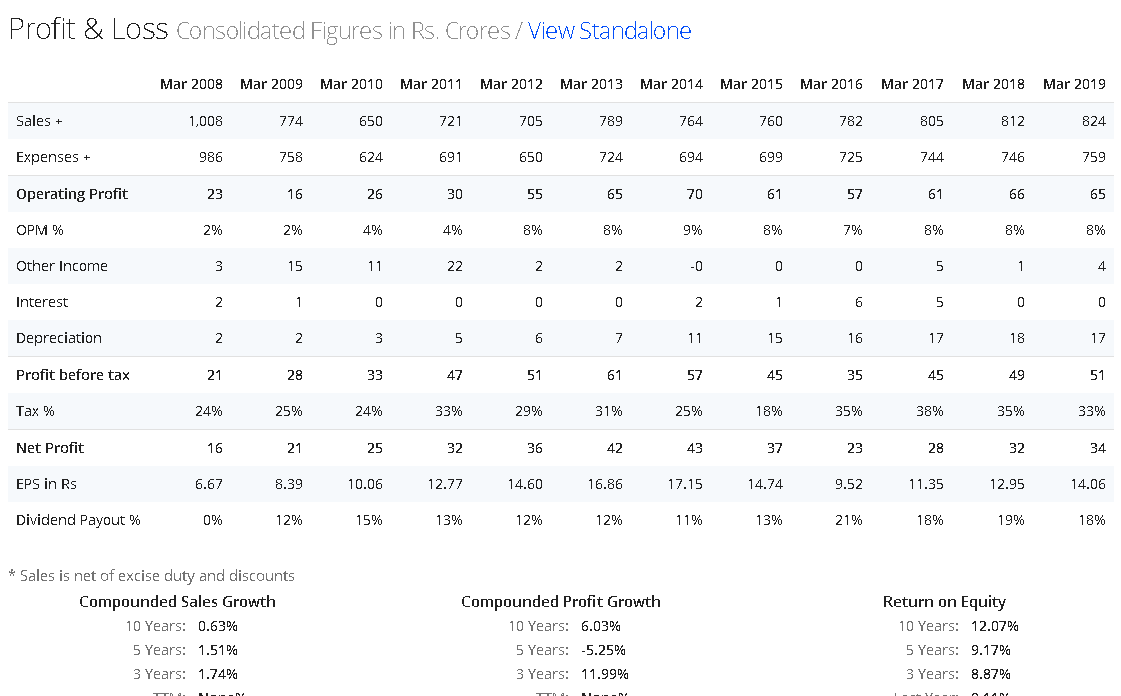

It’s interesting to note that RJ got tired of this theme playing out and actually reduced stake in the recent quarter. While the expectation and price have always been high in this stock, the execution was very poor over the last 10 years and will be interesting to see how it will pan out over the next 10 years.

From activity levels, ATFL looks like a deserted story in the market

I have been following this company for some time and recently attended their analyst meet held in Mumbai. Here are my notes

Agro tech foods Investor day meet notes:

Gross margins:

In last few quarters the gross margins have been impacted due to combination of GST + hike in import duty in oil business and company’s philosophy of playing safe in terms of anit-profiteering clause (they did not increase prices even though they could have taken price hike due to import duty hike as it would have been out of anti-profiteering perview). Total impact of this is around 1.5%. However, in oil business the worst seems to be behind us and things should look up from here on

Ready to Cook popcorn:

Ready to cook has grown at lower rate- one because of much larger base and second we did not support it with enough ad spend due to profitability pressure. However, going forward, we will see some ad support coming in for this category that will help us do better growth going forward. We are also planning to launch one more ready to cook product (apart from popcorn) that will help in growth too. Growth in this category also needs to be accompanied by distribution expansion as this category has the highest retail store coverage among all categories.

It is very difficult to do innovation in Ready to Cook popcorns. However, we have continuously added new products/flavours and some more innovations are lined up in next few months too. This puts us in pole position as we contunue to bring new/innovative products and dominate the category. We have more than 90% market share in ready to eat popcorn. With our launch of DieT popcorn, we have also expanded our offering to health conscious consumers. It is important for us to continue to innovate and fill the need-gaps in the category to ensure no new player enters the market and takes away market share piggy backing on the new product introduction.

On the Spreads: It is a very large and diverse category and we do not intend to compete with most of the large players head on in their well established market. Rather, we want to carve out niches where we are very strong and create right to win. Peanut butter is one such category. However, peanut butter is just an entry into a category of nut based spreads. In fact, in near future, we will launch more nut based butters (almond may be Cashew) to expand our product base.

Today, Chocolate spread + nut based butter combined as category is equal in size to that of Jam as category. This was unthinkable 5 years ago. Jam has been part of our life for last 25-30 years and chocolate/nut based butter has only come in last 5-6 years and still have gained this king of scale. This clearly indicates rapid and perceptible change in taste/preferences. We want to dominate the nut based butter category and peanut butter was a part of design. Even though there are new players who have entered in category, we reamain the most profitable and largest players in the category. According to our internal judgement, our market share is more than 50% in this category. In fact, today all other players are looking at us so we increase our pricing as they are losing money on peanut butter. However, we are not raising prices as we are making enough money even at this prices so why give benefit to competitor when we are making decent money?

Entry into chocolate spread: We may consider entering this category in future but again we will not taken on a well established large player in this category head on by competing in me-too product. Hence, do not expect us to launch chocolate spread to compete with Nutella. However, what we will definitely look out for is considering our expertise in nut based butter and chocolates (that we are going to launch soon), can we create products like dual spreads where we can combine chocolate with some other nut based spread and enter the category. Such product will give us distinct competitive edge as the pure chocolate player will not have ability/efficient cost structure for nut based spreads and hence we will be able to capture the market to large extent.

Ready to eat snacks:

Total category for ATFL has reached 50 Cr sale today however it is not yet profitable. What we have done in last 3-4 years is we have built the distribution network, the product portfolio and manufacturing capability. It is very important in this category that we have a large base of mass products (Rs 5/10 price point) and then build premium product on top of the base of the large base. Even though the base products do not earn company enough money, it earns money to the distributor and hence it is critical for success of this business. As we have now decent base for 5/10 rs product in place, we have started building out premium products on this which will help us earn margins.

Today we have 950+ distributors and 400000 retail touch points which are serviced. It took us many years to build this base. In fact, according to our knowlege, In last 10 years, ATFL and Ferrero are the only two new companies who have built such reach of 400000 touch points. This sets up very well for future. In fact the cost of reaching to touch points has been increasing significantly. For every incremental 100000 touch points, one has to spend 7-8 crores and this cost is increasing by the day.

In Nachos: We have end to end capability to manufacture nachos right from sourcing of corn to making our own packaging. Same thing goes for peanut butter. This sets us apart from competition as all others are not as efficient as us on cost side. Thus, our cost structure has become our advantage. Most of the other players continues to do this through contract manufacturing and hence their cost structure is much higher. We think this gives us “Right to win” in the category. Moreover this category itself has tailwinds and has been growing and expanding its share.so we are benefitting from that as well.

In RTE : it is important to recognize whether one follows a pure retailing model or a distributor led model where typical supply chain is bypassed. Companies like Pratapp, DFM are not pure play retailing model. Direct model works for products upto ticket size of Rs 5/10. However, in order to sell premium product, one has to do old style retailing which is takes time to build and grow. ATFL as a company, want to be present across categories and make products that are appealing to mass as well as affluent and typical ticket size is much larger than possible in direct model. Thus, we have chosen to follow retailing model. In direct model: it is very easy to grow as response times are much lower and hence many of these companies have grown very fast. In retailing, one has to arduously build network over a period of time and hence growth may not be spectacular as such in the early years.

We have also strated experimenting with direct model for our products with ticket size of 5/10 to accelrate growth in that segment. However, it is limited to that only and for rest we continue to rely on pure retailing model.

Chocos: In bagged snacks, we recently introduced “Chocos” which are chocolate cereals but as bagged snacks. These are the kind of premium products in RTE category we want to introduce to get our desired margins. Our thought process here again is : Do we have right to win in this category? IF you look at this category: we compete with Kellogs and Nestle in this category. Kellogs is a dominant breakfast cereals brand. However, in last few years, they gave realized that the market for breakfast cereals is degrowing or not expanding. Thus, they have been trying to offer products that is all day snacks. We think “Chocolate/flavoured cereals” as all day snacks is a good opportunity that we can capitalize on. We have few advantage over large players like Kellogs

- Kellogs has much lesser direct retail touch points than us as breakfast cereals is still largely a modern retail driven product and hence smaller Kirana stores don’t have it. Their coverage is around 150000 while we have coverage of 400000.

- Secondly, the way bagged snacks and boxed snacks works is completely different. Right from packaging to cost structure to distribution. We know bagged snacks game inside out and are much better positioned the competition.

- Lastly, we have good understanding of the “chocolate” part and also we have strong supply chain capability on “corn” side due to our exposure to Nachos. Thus, combing these two expertise, we think we can make a superior or at least equivalent product to that of competition at much lower cost. This puts us in pole position.

New Products:

Company is likely to expand spreads category by launching new nut based butters stregthening product portfolio of peanut butter. (Rationale covered earlier)

Recently launched “Chocos” in ready to eat segment (Rationale covered earlier)

Likely to enter “Chocolate” segment. In this case too, company doesn’t intend to take on Nestle/Cadbury head on as such. It wants to carve out niches “on the sides” in bagged chocolates segment. Bagged chocolate market is around 1000 cr and is mostly dominated by unorganized players. All the advantages of “bagged snacks” will come into play for company. In addition to that, we have developed good competencies in supply chain and handling of “nuts” due to our presence in nut based butters. We would like to leverage this to compete. Look at the Risleys and how they dominate nut based chocolates. We would like to focus on such differentiated niches.

Unlike many other categories, chocolate as category will require some ad support. Logistics also will need to be though through as cold storage may be required too. All these aspects we are evaluating and addressing.

Both cereals and chocolates are world over high margin categories. If you look at companies like Mars/Kellogs, they are immensely profitable. They make 40-50% gross margins and hence these products as they scale up will help us gain margins.

Few other interesting points

-

Current manufacturing capacity is sufficient to reach upto 450-500 Crore turnover and we may not need to put in any additional capacity. Typically, the asset turn for manufacturing is 3

-

Recent fire in one of the plants: It was manufacturing Nachos and Chocos. It will take 5-6 months to restore everything to normal. There won’t be impact on sale of Nachos as company already has a contract manufacturer who used to manufacture Nachos for them. There the production has been increased. Chocos- we have just launched so not much of disruption of supply but the scale up will be postponed by 5-6 months.

-

We wil continue to remain in “Indian snacks” slelectively. Though these categories may not provide margin, they are important from distributor’s profit perspective.We will again focus on making where our stregths lie.

-

As we reach 500 crore for food business, P&L will look very different and better.

-

Oil business is tough- still it provides valuable cash flow to the company. We will continue to do it prudently without investing much in it.

-

Sundrop brand has lot of value and we would not like to dispose it. IT takes years to build brand and tinkering with brands in general not a good idea. We have two separate brands that gives us more flexibility/resilience as business.

-

Parent is quite supportive on our endevours however all decision making is done by Indian management and BoD. Parents have not been pushing products from their basket to us. We evaluate the attractive opportunities from that and if we find a good fit, we go ahead and launch it in market

-

Royalty: It is a very small amount as of now. However, if there is any change in that structure, rest assured, we will inform the stakeholders well in advance

-

Open to look at inorganic opportunities, however it has to offer something niche/unique which we don’t have and should have some scale. Anything less than 100 Cr doesn’t attract us as we are organically adding 50 odd crores every year to our food business. We are not averse to paying value for someone’s effort in building product/brand/distribution network. At the same time, we do not see such opportunities on the horizon.

-

We continue to believe that the growth through “channel partner incentive” is one way route to hell and we will not engage in it. On the Ad spend too we will be judicious. We do not want to spend 13-15% of topline on ad to grow. At the same time, we do acknowledge that current level of ad spend is less than what is required and hence the proportion should go up. We will do so as our P&L allows more. We are not PE funded guys where we can burn money and buy growth, we will spend based on what our P&L allows.

-

As the food business grows from 200 crore to 500 crore, the pace of introduction of new categories/products shall go up.

My Views:

-

Across the listed companies in the foods business (barring well established large FMCGs), there are almost no listed companies other than ATFL that has an ability to create new category/sub category and grow it from scratch. All others in my opinion, are competing in “me too” products that has limited entry barriers and ability to capture large market share. What makes ATFL unique is that unlike most of the listed players (Prataap, DFM) , they are not costrained to one category. In the early years they are already into spreads/ready to cook/ bagged snacks and will soon enter chocolates.

-

I have met lot of people who are utterly disappointed with the rate of growth of the company in last 7-8 years and probably rightly so. However, on the other hand, these 8 years have been spent to build the base for the next 10 years. They have established 6 manufacturing plants, 400000 touch points and created two categories. It is not appropriate to extrapolate the growth in last 7-8 years with next few years. My sense is the growth trajectory is likey to change soon and they are nearing inflection points.

-

There exist significant room for GM expansion as they move up value chain and launch premium products. This combined with operating leverage that exist in manufacturing and existing distribution network, mean significant margin expansion opportunity is available. In last one year, all new products they launched are high gross margin products (Diet popcorn, Caramel blissp popcorn, Peanut butter with jelly, Chocos and potentially chocolates) clearly indicates that base has been made in terms of product portfolio and now company will develop products that sits on top of the base.

-

One must not look at the company from headline numbers and focus on “food only” numbers. That becomes key monitorable.

-

The business architecture that has been built is resilient enough and has been built with long term aspirations in mind. Company has take hit on P&L and growth both for building this architecture. However, it is a very robust architecture and can sustain itself over next 10-20 years. I personally, liked the approach as my impression is that the “long term” view was always considered in most of the cases truming over shorter term gains by alternative choices.

-

For the first time (as far as I remember), company is intending to change growth trajectory from 20% to 30% by giving tangible actions for it (Refer to presentation). I think that is a clear signal that accelaration is likely to be there in business.

-

Current view of management (right or wrong only time will tell) is that they do not want to burn significant money to grow a category either by ad spend or incentives. Hence it will spend as much as it is allowed by their P&L. However, as the current categories mature and large, they will bring cash flows that will allow more flexibility to management on spending money to grow. Till now they were only relying on oil business’s cash flow to grow food business. Once the food business brings positive cash flow, their ability to introduce new categories and support categories grow incrementally.

-

ATFL will enter niche areas where they have ability to capture and dominate market. Thus, they may not target 10000 crore category that is already domnated by large players or is intensely competitive. I think this is a very smart strategy to create entry barriers for business and good for longevity and stability. They also seem to be thinking that they will cross leverage capabilities to create combinations/skill set that is unique (Chocolate + Nuts+ bagged snacks; Chocolate + corn + bagged snacks) and hence gives them right to win in market.

Overall, I think ATFL seems near to inflection point. It is very difficult to get FMCG company at sub 5000 Crore market cap which has global pedigree, innovation capability and strong margin expansion possibility.

Disclosure: I recently added ATFL during correction. It is a reasonably sized position in my portfolio and hence my views are obviously biased.

I am not an investment advisor and hence this is neither recommendation and/or investment advise. Request all to do their own due diligence and/or consult investment advisor before taking investment decision.

Many thanks for the detailed note.

Link to the company presentation - https://www.bseindia.com/stockinfo/annpdfopen.aspx?pname=1c691c51-12ff-4491-bd94-de4ba6c9698c.pdf

I have been holding ATFL from few years and added some recently but very illiquid script. I like the fact that they created and grew the popcorn category. They can surely replicate the same in the food business even though there is lot of competition. But I feel they are not aggressive at all and tend to play very safe. So one should expect only slow growth. It’s a poor man’s Nestle.

Thanks @desaidhwanil for the detailed note and additional insights.

As I understand from your note, AR and various reports - ATFL is creating a base for the existing and new categories at lower price points. Its focus currently is the general trade channel. Would you be able to comment on the margins given to this trade channel. In addition, freight charges are heavy to supply to this channel at a pan national level and going forward are likely to be a meaningful % of the costs. So while gross margins may increase, the ebit % could take some time to move. Would these be valid concerns?

Also chocolate is a difficult category to operate so I am not able to fully understand the rationale behind it. If you could throw some light it would be great. Thanks again for the insights.

Some additional points (most of them covered by author in his note though)

Best

Bheeshma

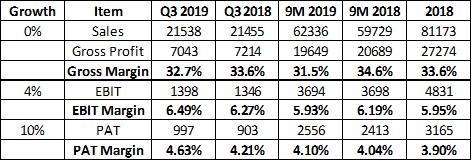

Flattish results

https://www.bseindia.com/xml-data/corpfiling/AttachLive/f54ec367-9fcf-4eb1-bdb3-d914caa63837.pdf

Hi @desaidhwanil , good and some insightful questions from your end on the analyst call. I wanted to understand your reading of the Q4 results and what happened to the choco pops business. I couldn’t find any relevant info regarding this and it wasn’t clear form the call why the need for re-launch and why it was pushed to this year when they already introduced the product in Nov last year.

Thank you in advance.

Ram

I think because of the fire incident, the plans got derailed.

Choco pops had to be withdrawn from the market as Unnao plant was the only facility that had the capability to manufacture choco pops and due to fire they will need to rebuild the same. They had indicated that by H2 FY20, the product should be back in market but in current call he indicated that it can be earlier too.

ATFL Q1 FY20 results.Flat results on Y-O-Y basis and a slight decline on sequential Q-O-Q basis.

Fire accident claim of Rs 25.18 Cr is still pending and company does not find any concern in processing of claim by insurance co as the processing progress is satisfactory.

FY20 Q1 Analyst Conference call Audio recording.

Why are you interested in a company which has always been a story and not delivered any numbers? 10 year sales growth of 0.63% and PAT growth of 6%.

Conagra acquired Del Monte but it never became a part of Agrotech in India. Incrementally even if Conagra takes aggressive steps to grow in India why wont it do the same in its own 100% subsidiary rather than Agrotech Foods.

This has been my major concern in all MNCs with subsidiaries in India. That’s how I missed the HUL, Nestle, glaxo, p&g, 3M so far…i am not saying agrotech is of same league and your concerns are same as mine and very valid. I only want to understand why such concerns arise, why do MNCs put up subsidiaries in India If they don’t want it to grow or introduce products by some other means and why have HUL, Nestle etc not done that and allowed their indian subsidiaries to benefit in long term. We as investors, how to catch this dna early. Thanks

What this company needs is a change in management. Same person has been CEO now for over 10 years with not so spectacular results. And he is supported by the same set of independent directors, two of which are over 75 years old. Parent company needs to shake some trees in this forest.

True, Parent company does not seem interested while RJ keeps increasing stake. I am thinking at times to sell and convert to a nestle or hul but have waited for long for the turnaround…has been a futile wait so far…and 99% will remain futile for next few years…made a mistake of betting on the parent…when child is not honhaar then all he does is destroys parents wealth…except this time it’s destroying ours

My opinion is that it will take a few more years to break free. The kind of ready to eat foods or new kind of spreads they are making needs advertising awareness to build the fad. However, we probably won’t see such aggressive A&P spending anytime soon.

Nevertheless, I like the conservative nature of the management. If they wanted to leverage strongly, or, asked parent / some PE for equity infusion things would have quickened. But they are more inclined to do things from their own pocket, i.e. cash generated from Sundrop oil segment. As an unbiased sideliner I can’t blame them given the slowdown & liquidity crunch. Aggressiveness in these times from a small company may create another  day scenario.

day scenario.

Given their short supply of capital, they are growing the distribution reach and spending on A&P very conservatively, with more focus on strengthening the distribution. Once the distribution is set nationwide then an aggressive advertisement campaign will bear fruit very efficiently (suppose people are getting interested in a campaign & not finding it in local retail).

We can’t deny that financials are slowly becoming better. But the pace is very much disheartening for a small investor to bear. King investors like RJ can afford to throw money in high potential companies like this which are trudging like a turtle but most surely going towards the proper direction.

Disc: Invested recently and moved out very quickly after the foregoing realization.

Agrotech AGM notes:

I had attended ATFL AGM in the month of July. Here are the key takeaway from the AGM

-

Food business continued to grow at around 15% while the oil business faced severe headwinds due to import duty and RM price volatility in FY19. It is endeavour of the management to protect the gross margins in oil business and growth of oil business is not a focus area of business. In Q1, gross margins in oil business has improved again and has grown by 4%

-

Management reiterated it’s stand the GM from oil business is critical as it provides steady cash flow for company to grow it’s food business. howeer at the same time, with food business reaching critical scale of 200-250 cr, going forward the reliance/dependence on oil business to grow food business will reduce. In fact food business is near to the point where it will become self sustainable

-

Inflection point: When asked about the inflection point mentioned by management during various interaction and how it is defined and whether it can be quantified. Management indicated that in their view, ATFL will reach inflection point when the food business starts contributing to around 35%-40% of it’s revenue. In FY 19, it contributed around 28% of it’s overall revenue and in FY 20 or early part of next year it may reach the inflection point. Another way to define inflection point is when GM of food business become substantial enough to support it’s own growth. Again, on that parameter too, company is fast approaching inflection point as food business GM is already conributing to 33% of company’s total gross margins

-

Another point stressed by management is that it is very difficult to build a strong food business with scale and profitability. Hence, world over there is significant M&A activity in this space

-

Company is actively working towards growth trajectory from 18-20% to 25-30%. One of the improtant building block for such growth is faster growth in Ready to cook popcorn segment. at least around 10%. Last year due to sharp drop in gross margins in oil business, ATFL could not spend enough money to support growth in this segment. However, they intend to do so in FY 20 that will spur the growth. ATFL is also planning to launch new product in this segment i.e. RTC sweet corn. This will also help the segment get back to higher growth path. Management indicated that instead of growth of mid single digit, they want to push growth to early double digit given much higher base.

-

New product launches: Company intends to launch 4 new products this year. RTC Sweet corn,chocos (which was earlier discontinued due to Unnao plant fire), different type of nut butters and chocolates. First two products are already ready and are likely to be launched soon. Remaining two too may be launced by Diwali this year.

-

After launch of additional products in spreads segment, ATFL will have one of the largest portfolio in spread category.

-

Once the new launches are done, company will have a very good portfolio of products that can easily take it to 500 Crore revenue. Eventhough company continuously works on it’s product pipeline to ensure that it is able to launch products as and when it sees opportunity.

-

Launching products from the stable of Parent: When asked about why company is not leveraging upon parent’s large product basket to launch new products in India- management said that the selection of product for Indian market is done by the indian company and parent at best plays role of facilitator. They also mentioned that it is important to realize that the product needs to have right fit with Indian market and just because parent has successful product does not mean it will succeed in India. At the same time, Indian company continues to evaluate various products from parent’s product baskets to see if they can leverage up on that. As one example: ATFL wants to explore the possibility of plant based meat alternative products at the parent recently acquired a canadian company in this space and it is the future of food industry.

-

ATFL in 3-5 years: Without giving any numbers, management mentioned that company has done all the hard work required to reach this level and is nearing inflection point. As it moves in it’s journey from food business 220 crore to 300 cr and 500 cr- P&L will look very different as the additional GM generated from food business will have enough money to spend on A&P, take care of increasing inflationary pressure in employee and other expenses and still show significant increase in profit available to shareholders.

-

A&P Spend: as a philosophy, we believe in profitable growth and we want to maintain certain base level of profitability. ATFL as a strategy will not spend tons of money on A&P to up the growth trajectory. At the same time, FY 19 A&P spend were constrained due to pressure on GM in oil business. Eventually, A&P spend may range from 7-8% of food business, however we do not think it is prudent to spend 13-14% of revenue on A&P

-

Growth in Tortila chips was slightly lower due to some quality issues in packaging. However, it is getting addressed and we should see it come back to growth trajectory soon.

-

Unnao plant is likely to be coming back to operation some time in H2 FY 20

-

On the sidelines of AGM during our interaction with some of the representative from the company, I got a feel that building profitable FMCG business and especially by creating new categories is a slow and painful process that takes years. My sense from discussion was that it takes 8-10 years to put building blocks in place but after inflection point, scale up can be fast. ATFL has spent a decade to put buidling blocks in place. NExt few years may represent the scale up phase. One example: company launched 3-4 products in last 10 years, while in one year- FY 20, they may launch 4 new products. It is a positive feedback loop is what I feel where more products gives company more flexibility to spend money, earns good money for distributors and generates enough money to help them launch more products. Let us see how it plays out!!

Again many of the points are not verbatim and is my understanding/interpretation of what management has mentioned.

Discl: Invested with small allocation

Q2 FY20 Results

Consolidated total revenue drops 2.8% YoY, PAT jumps 68.6% aided by a deferred tax credit.