Its just 0.12% acquisition if we sum up all of them

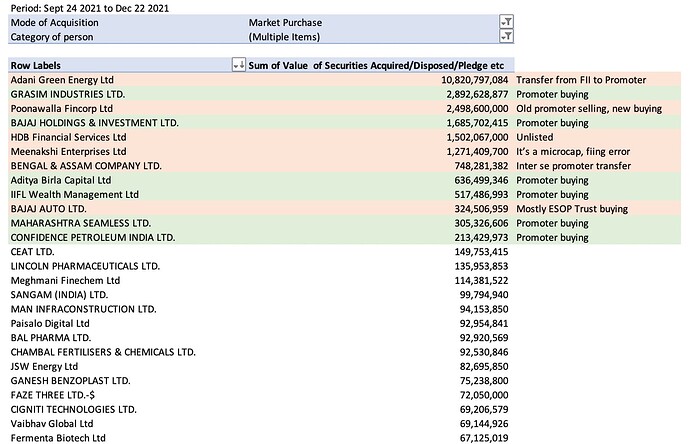

It is significant. I looked at promoter market purchase data for the last 3 months → AB Capital is the third highest after Grasim and and Bajaj Holdings. KMB is clearly bullish!

Note: I analysed the top few companies to qualify actual promoter buying and excluded those (in red) which did not meet this criteria. An interesting finding was that Adani has bought over 8,000 cr (!) worth of shares in Adani Green this year from the market, with Mauritius FII holdings going down in the same period. Coincidence? ![]()

Buying continues…

Hi, which website is this?

Hi, I downloaded the raw data from the BSE website

https://www.bseindia.com/corporates/Insider_Trading_new.aspx

Total Aquisition by Promotor of Aditya Birla Capital in Month of Dec - 2021

| Date | No. of Share |

|---|---|

| 01-12-2021 | 1,72,000.00 |

| 02-12-2021 | 48,000.00 |

| 03-12-2021 | 1,76,000.00 |

| 06-12-2021 | 4,52,000.00 |

| 07-12-2021 | 4,50,000.00 |

| 08-12-2021 | 2,50,000.00 |

| 09-12-2021 | 60,000.00 |

| 10-12-2021 | 1,25,000.00 |

| 13-12-2021 | 1,25,000.00 |

| 14-12-2021 | 2,00,000.00 |

| 15-12-2021 | 2,50,000.00 |

| 16-12-2021 | 7,50,000.00 |

| 17-12-2021 | 3,36,000.00 |

| 20-12-2021 | 5,00,000.00 |

| 21-12-2021 | 4,00,000.00 |

| 22-12-2021 | 2,87,000.00 |

| 23-12-2021 | 3,25,000.00 |

| 24-12-2021 | 2,50,000.00 |

| 27-12-2021 | 75,000.00 |

| 28-12-2021 | 3,50,000.00 |

| 29-12-2021 | 3,00,000.00 |

| 30-12-2021 | 6,00,000.00 |

| 31-12-2021 | 4,92,000.00 |

| Total | 69,73,000.00 |

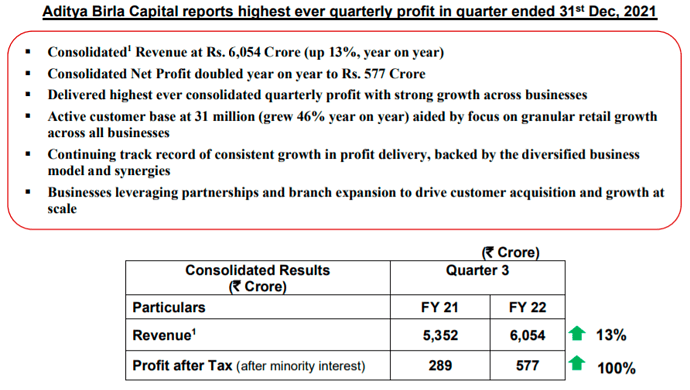

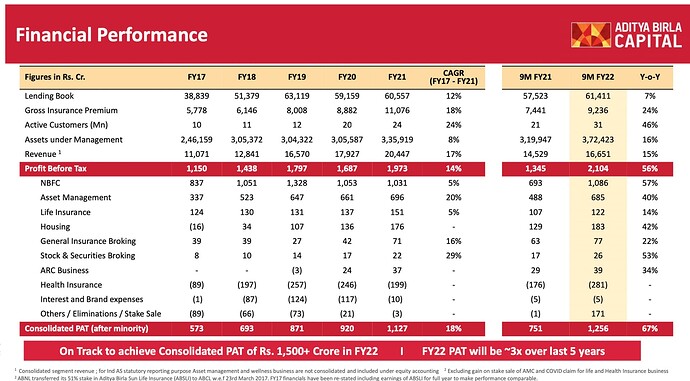

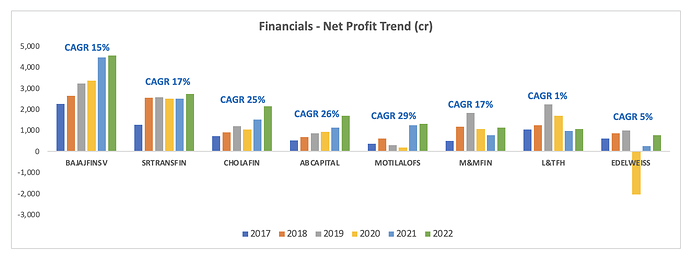

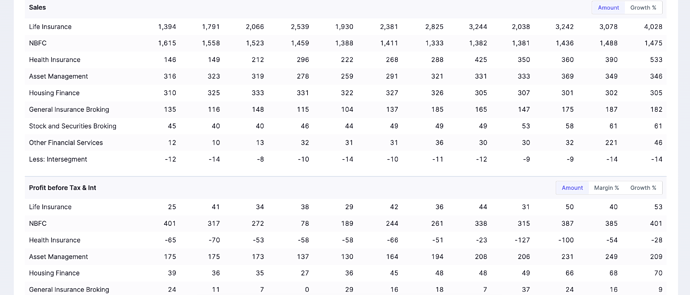

Really like this slide, hope they continue to present this data going forward.

Captures the sustained performance and the visible business transformation post FY21 well.

Lots of interesting datapoints in the Q3 presentation showing growth + transformation across ABC verticals. A couple that really stood out to me:

- NBFC - Customer count ↑ 12x y-o-y at 23 lac; Portfolio ATS at Rs 2 Lacs (PY: Rs 24 lacs) → This is a massive transformation from a largely wholesale book to an incrementally granular book! Retail+SME disbursals in Q3 2022 > Total disbursals in Q3 2021

- ABC Branch Network - Targeting 1,100 One ABC branches by Mar 22, covering all cities >3 lacs population pan India. Aggressively growing NBFC reach in Tier 3-4 cities → From 50 branches in Dec 19 to 150 branches by Mar 22

- Digital - 94% of customers were onboarded digitally across businesses

- Health Insurance - Has been a significant drag on profits so far during incubation and will breakeven in Mar 22, will be an additional lever for profitability from FY 23 onwards

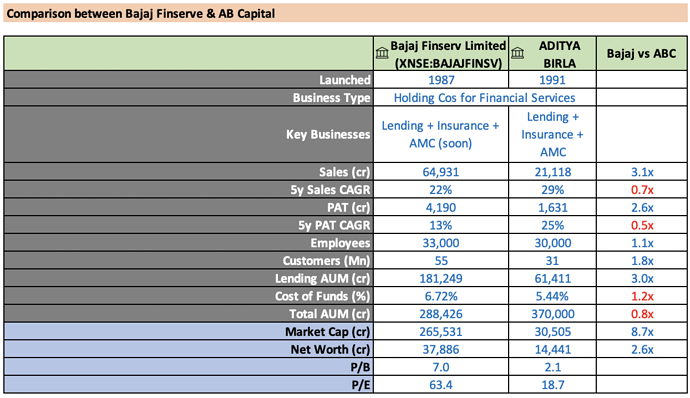

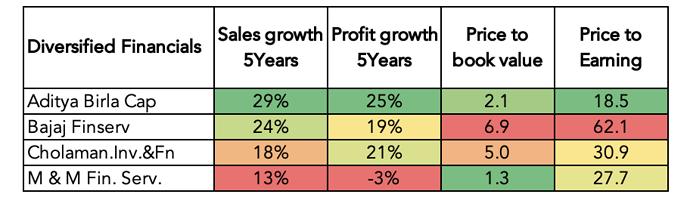

These results really demonstrate that AB Capital needs to be priced as a leader in the financials space rather than a laggard. ABC is performing significantly better than Bajaj Finserve on key metrics, and the rest of its peer group as well. Rerating is imminent imo

disc. Invested

I like your analysis but you should note that 161cr added in profit as listing gain of AMC business.This is one time event. If you present by excluding 161cr from last quarter profit will be a good comparison. I appreciate your efforts

Disclosure-invested

Business Update

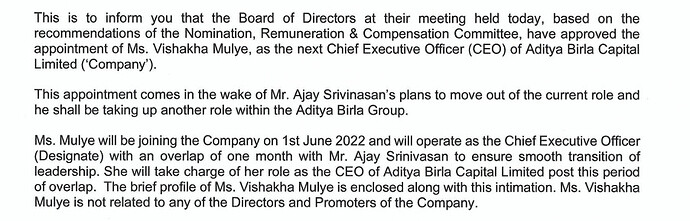

Very happy to see the exit of Mr. Ajay Srinivasan - the highest salaried CEO in BFSI who leaves with a middling track record at AB Capital.

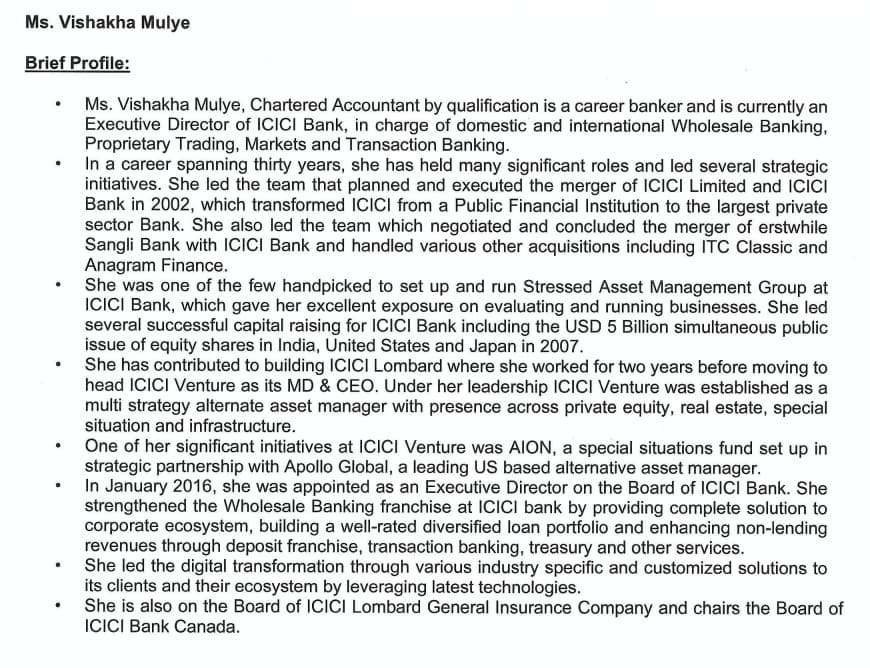

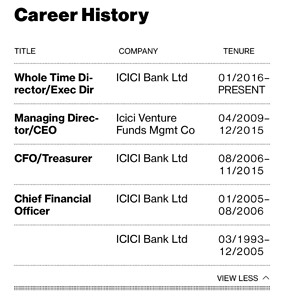

The incoming CEO Ms. Mulye is an amazing hire. Few more tidbits about her background -

- Top 3 exec at ICICI Bank, was second in line to be CEO behind Sandeep Bakshi

- Profiled as ICICI’s digital evangelist by Fortune (Fortune India: Business News, Strategy, Finance and Corporate Insight)

- Previously Group CFO of ICICI Bank

- With Mulye and Romesh Sobti on the board, AB Cap is well positioned for RBI’s new scale-based regulatory framework for NBFCs and eventual conversion to a bank

disc. Invested

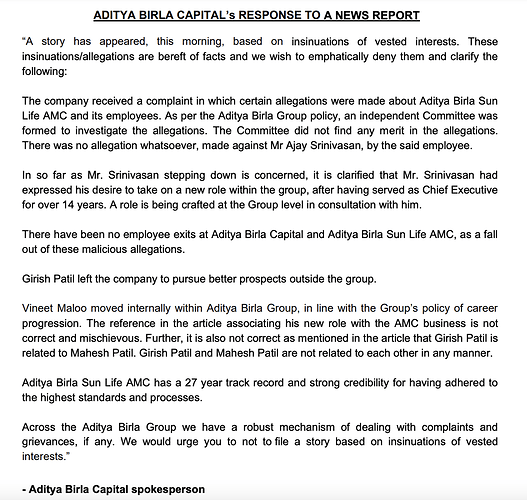

Interesting article giving some background on Ajay Srinivisan’s exit. It is behind a paywall but essentially a whistleblower sent a letter in Feb to the board of ABC alleging the following:

i) Corruption in ABSL AMC’s loss-making investments in CG Power, Essel Group and PayTM IPO

ii) Internal audit gave a clean chit to those named in the letter but Girish Patil (senior equity trader) and Ajay Srinivasan (CEO) are leaving the company because of this

ABC has issued the following clarification after market close:

My view is the issues raised in the article are:

i) not new - the CG Power case was already under investigation, PayTM IPO was a disaster for everyone involved

ii) limited to ABSL AMC

iii) do not clearly establish front running or insider trading like the case of Axis MF. It just talks about these 3 bad investments and says “there must have been some quid pro quo”.

iv) might be a net positive because it will give the incoming CEO a good excuse to clean out the old boys club that existed under Ajay Srinivasan. We should expect more top level changes in the coming months.

Disc - Invested and biased. Bought more in yesterday’s correction.

I am no expert in Financial space but have rather burnt my fingers earlier. Not major loss but seen most of my gains wiped out…

What I have seen that for top valuations, the one thing needed more than top notch results is consistency of results, even though slightly above than mediocre…so i think need to look for that…also many tier 2 financial institutions every now and then present with new negative surprises … Every such new surprise results is another year of suppressed valuations…and the story continues…

Disc. Was invested few years back and sold at loss after holding for few years. Not a buy/sell recommendation

Just to caveat - I have been wrong here for a long time despite my high conviction in this story.

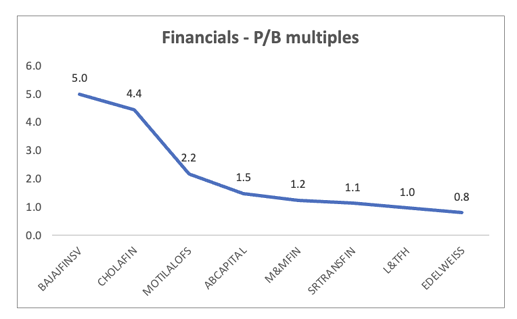

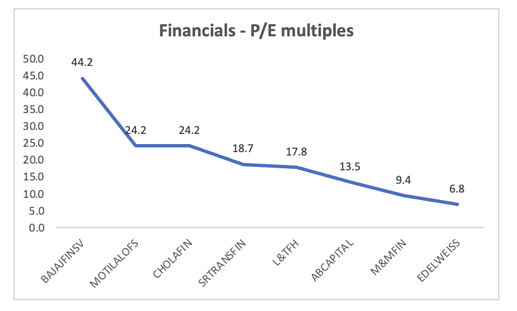

The reason for sticking on with a decent sized allocation (despite my better instincts), is that the results and valuations have been pretty good. In other words I feel the fundamentals have been consistently ahead of the perception of ABC. Here’s some data I pulled together -

What this data shows me is two things - 1) AB Cap has been the most “consistent” in net profit delivery in the last 5 years. The only other co which grew PAT every year is Bajaj Finserve and AB Cap is growing faster than them; 2) Despite (1), AB Cap trades at the median P/B multiple of 1.5 and below the median PE multiple of 15.6. + AB Cap has not presented any major negative surprises through demon, IL&FS, Covid etc and continues to have one of the best cost of borrowing in the market.

If we believe this data then clearly there is a factor other than pure fundamentals that weighs on AB Capital’s stock performance. This could be management perception, asset quality, growth outlook, holdco structure etc. Personally I think it’s a perception issue because the other factors are more or less in line or better than the peer set.

The bet (hope) is that with the new CEO joining there’s an improvement in the corporate culture and perception of ABC. A few other things that make me bullish 1) the NBFC and HFC loan books which have been flattish since IPO are finally on track to start growing meaningfully again in FY23; 2) the health insurance business which has been a 250-300 cr drag on PAT every year is about to break even and 3) promoter/insider buying has been highest among the peer set.

Big picture - why do I bother? I look for opportunities where I can see a 5x-10x outcome eventually. In today’s context that’s a HDFC Life to Bajaj Finserve size of company. I do believe ABC has the platform like Bajaj did to deliver that with the right leadership.

Key risks - 1) Remains a “hope” story and is ignored like previous years because there are better and proven opportunities elsewhere ; 2) cockroaches emerge from the closet once new CEO joins

disc. Invested & biased. Not a buy/sell recco.

Thanks for showing so nicely the consistency of performance. I think you have nailed the reasons for stock not performing above. One more addition maybe the product mix, specially of lending part and also in insurance - the perception of how risky their growth maybe in terms of perception of underwriting…all in all it maybe about perception but how and why this happened in first place?

I do remember everytime something bad happened in Idea and Ab cap also used to suffer…

Question - Why is AB Capital reporting PBT from AMC Business “Aditya Birla Sun Life AMC” as Rs. 209 crores in the latest quarterly result when they only hold 50% of the business.

Can someone shed more light on this.

Same is evident from annual results too.

Abu Dhabi Investment Authority (ADIA) is in talks with Aditya Birla Group to invest around Rs 1,200-1,500 crore in the health insurance arm as growth equity

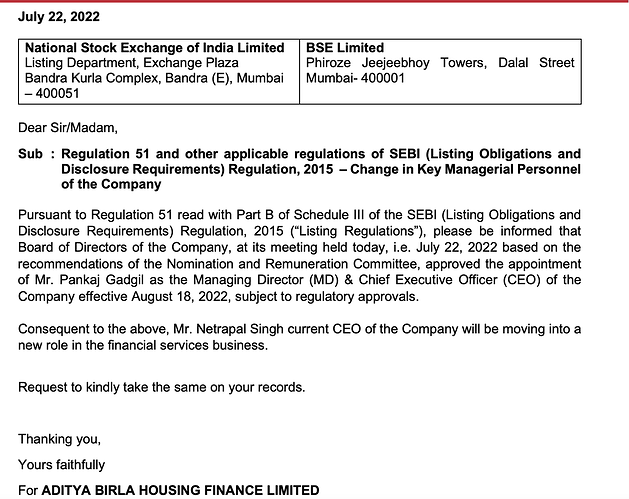

As speculated here, more top level changes happening at AB Cap. Important disclosure from subsidiary - now the Housing Finance vertical has a new CEO, 19 year ICICI veteran Pankaj Gadgil.

He is also ICICI Bank’s nominee on the board of NPCI. Profile here -

https://www.npci.org.in/who-we-are/board-of-directors/mr-pankaj-gadgil

Good article on upcoming changes under the new CEO (paywall). As I speculated when she was appointed, it was a matter of time before the old boys club of Ajay Srinivasan began to be fired. According to this article, 4 top execs in subsidiaries including Balasubramanian (Mutual fund) and Rakesh Singh (NBFC) will be replaced at the end of their current tenure.

D - Invested