There is a huge & unnecessary build-up of cash in this company. This issue bothered me in the past but I thought maybe the management will come out with some clarification on this. However they still have not done the same. The issue and its impact on valuation are as follows

HUGE BUILD-UP OF CASH SINCE THE PAST 3 YEARS

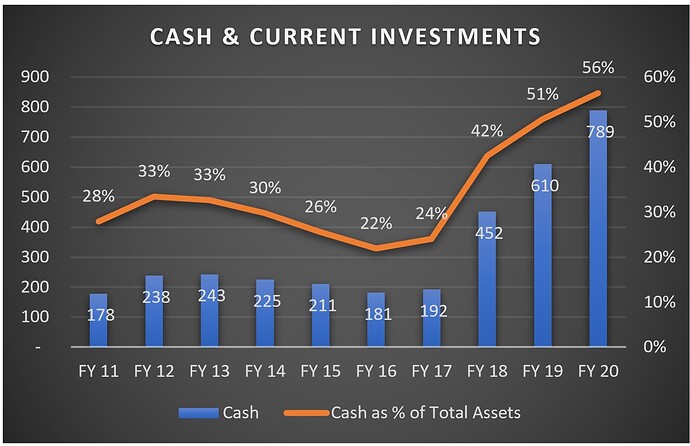

Since the past 3 years, the company has slowed down its dividend payments and is hoarding up on the cash. If you see the Chart below, you will observe that the Cash & Current Investments have steadily increased and have reached to Rs 789 crores

As shown above, cash & current investments now amount to an astounding 56% of the total assets of the company!

Now you can very well argue that some portion of cash the company needs to retain to run its operations and hence not all of the above cash is “Excess Cash.” Thus, how to determine the amount of cash that is in excess? Should we take the thumb rule that 2% of a company’s assets should be taken as required cash and the balance as excess. I think a more nuanced view is necessary.

HOW MUCH CASH DOES THIS COMPANY NEED TO RUN ITS BUSINESS?

As stated earlier, this company has extremely high returns on capital. As per my estimates of its Return on Invested Capital, in the past ten years the ROIC of the company has ranged from 30% to 77% and the median number is 40%. With this kind of return on capital, the company is a cash generating machine!

There is another interesting thing to note. The Net Block+CWIP of the company has increased marginally from Rs 152 crores in FY11 to Rs 200 crores in FY20 (i.e. only 1.31 times). However, in the same time period, the sales have increased from Rs 582 crores in FY11 to Rs 1239 crores in FY20 (i.e. 2.13 times). Why? The reason is because majority of the revenue increase is due to increase in price and NOT volume growth. During the past 10 years, the Cigarette volumes have only grown at a CAGR of 1.5% whereas the revenue CAGR was 10%. Furthermore, the incremental working capital needs of this company are also not very high.

Thus amazing ROIC combined with low (volume) growth leads to very little reinvestment requirements and consequently no need for the Company to hoard that cash.

Thus, in view of the above, can we simply apply the thumb rule of 2% of assets as required cash and balance as excess cash?

I would like still give the company some benefit of doubt in regards to its cash position. This is because when you see the Balance Sheet of VST, you will observe that there is an Item in Other Current Liability called “Statutory Liabilities”. Some portion of this amount is towards demands from various authorities that the company has challenged but as a matter of prudence it has recognised the same in its books. Thus, the company, apart from paying the undisputed statutory dues, would also need to keep apart liquid funds for disputed dues in case it loses its appeals.

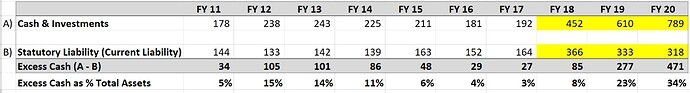

Hence, I am willing to give the company making an assumption that the ENTIRE amount of required cash that the company needs is the amount equal to these statutory liabilities. If you see the table below, you will observe that the amount of Cash in FY 18 (highlighted) increased dramatically with the increase in Statutory Liabilities.

One can also assume that the incremental working capital needs also can be part of required cash but because that amount is not very large, and because I am already considering the entire amount of statutory liability, I have chosen to ignore the same.

Thus, even after considering the required cash, the Company still has excess cash to the extent of 34% of its total assets.

Some of you may think that I am being too liberal with the Company whereas some of may not agree with my method used to estimate the “Excess cash”. However, there cannot be any doubt that the company is hoarding an extremely high amount of cash since the past 3 years.

IMPACT OF THIS CASH HOARDING ON VALUATION OF THE COMPANY

Before we do the valuation, it is important to note that the Dividends/Net Profit % has fallen to 52% from its past average of 70%. Thus, we need to value this company with two models – a FCFE Model and a Dividend Discount Model.

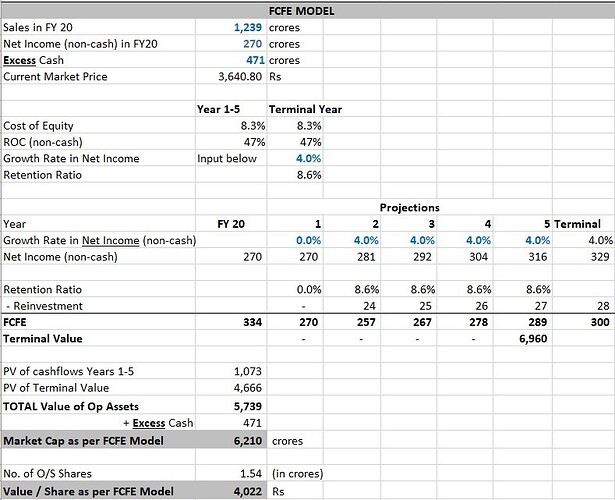

FCFE MODEL

So now my super complicated valuation model is:

Wait… what is this? This looks too simple. Yes, guilty as charged! Since this a mature company in a mature market and with competitive advantages that are extremely likely to persist in the future, the model does not have to be complicated. In fact, the key assumption to make is the growth rate of its Net income. (On this note, I have written a brief post on the Indian Cigarette Industry HERE which can aid you to make your own growth assumptions). I have assumed that the net income of the will not grow in this year and thereafter will grow at the risk free rate. Thus, I have estimated a value/share of Rs 4,022. The stock is trading at Rs 3,640 (as at 21/1/2021) and so I should buy it right away? Not so fast. Remember the cash build-up?

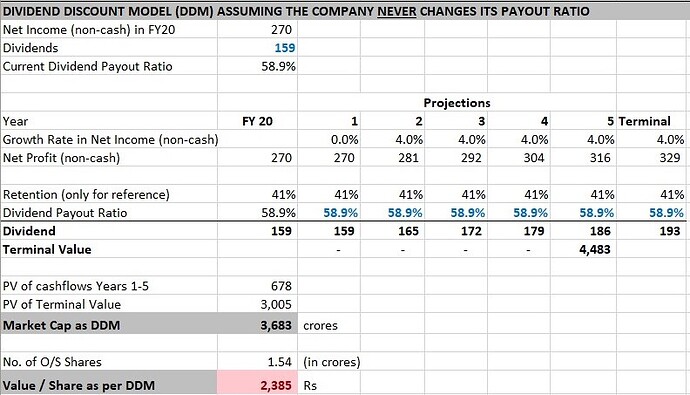

DIVIDEND DISCOUNT MODEL AS PER CURRENT PAYOUT RATIO:

Thus, from a dividend payout perspective, the valuation works out to only Rs 2,385/share and that means that the company will end up destroying shareholder value to the tune of more than Rs 1,600/share. Of course, this is with an assumption that the dividend payout ratio stays at its current level of 58.9%. Obviously, the company can change (AND SHOULD CHANGE!!) its dividend payout ratio. However, the idea in the above model is to point out that if the company doesn’t change course, then the Dividend Discount Model is not only the best measure for valuing this company but also explicitly shows how much value is being destroyed by holding onto extra cash.

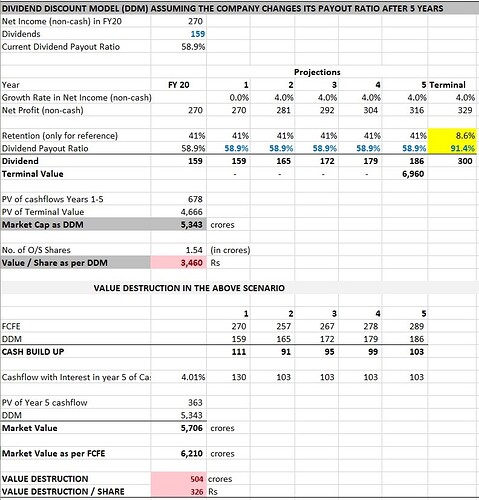

DIVIDEND DISCOUNT MODEL AS PER CURRENT PAYOUT RATIO THAT CHANGES AFTER YEAR 5

The above modification is a more nuanced view of the previous dividend discount model. Here I have assumed that the company will change its dividend policy after Year-5 and also will return back the excess cash along with interest.

In this scenario, after accounting for the interest the value destruction per share works to around Rs 320.

Based on the assumption I have made for the company and the publicly available information out there as of now, depending on the view you take, the build-up of excess cash can cause value destruction to the extent of Rs 320 to Rs 1,600 per share.

Click HERE to see the Google spreadsheet link on my blog and see the “VALUATIONS” tab

Maybe (and hopefully) this excess cash issue would be a benign one and the company is planning to give out a big sweet dividend (according to me, the market is pricing it that away if you see the current valuations) and the cash will return to its normal levels OR…. it could be something else. Whatever the case, the Company ought to communicate to its shareholders and clarify the same.