https://www.icra.in/Rationale/ShowRationaleReport/?Id=135632

June 2025 credit rating report

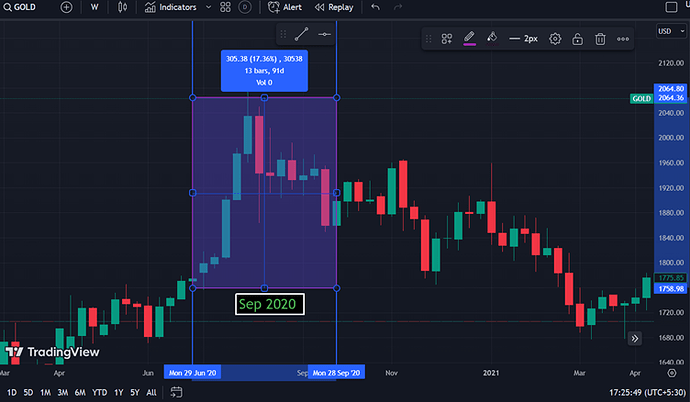

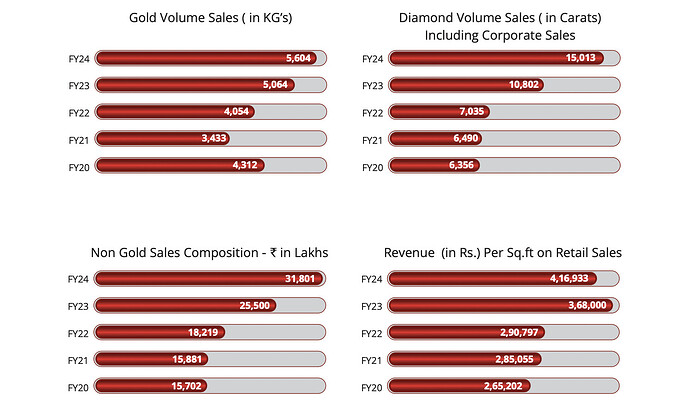

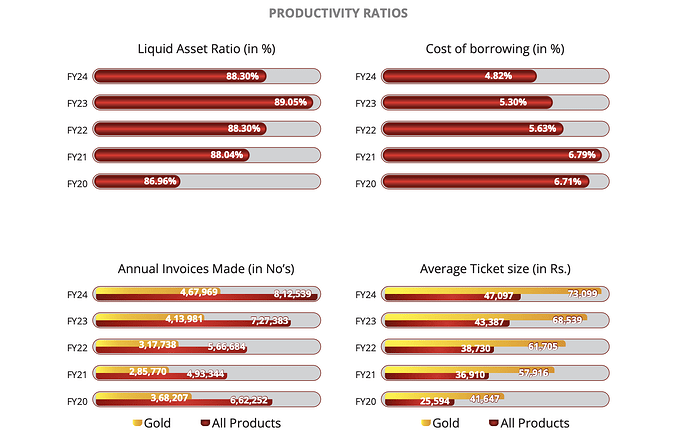

Thangamayil Jewellery Limited (TMJL) has seen steady revenue growth, driven by rising gold prices and store expansions. In FY2025, its operating income grew by 28% YoY to ₹4,911 crore, with non-gold jewellery contributing 10% of revenue.

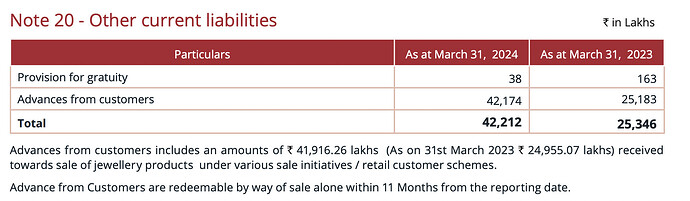

- TMJL raised ₹510 crore through a rights issue, improving its capital structure. While working capital borrowings increased, its gearing ratio improved to 0.7 times, and debt coverage remains comfortable.

The jewellery retail sector is highly competitive, with both organized and unorganized players. TMJL faces pricing pressure due to large retailers expanding aggressively into tier-2 and tier-3 cities.

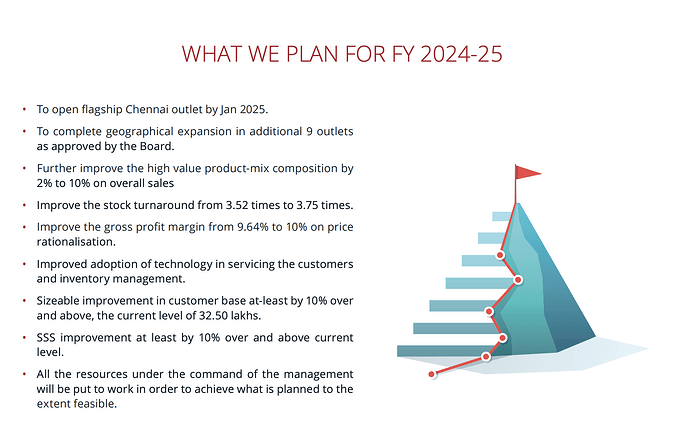

TMJL operates 62 stores and recently entered the Chennai market with a flagship outlet. It plans to open 10 mid-level retail outlets across Tamil Nadu in FY2026.

Cash accruals are expected to exceed ₹180 crore in FY2026, though working capital requirements may keep cash flow negative. TMJL maintains moderate fund-based working capital utilization (71%) and is securing additional banking facilities.

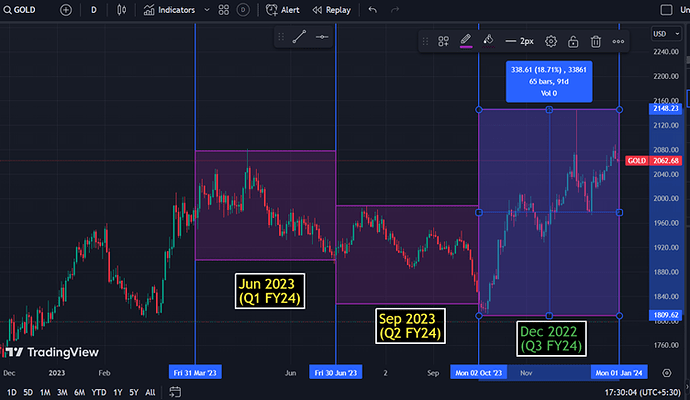

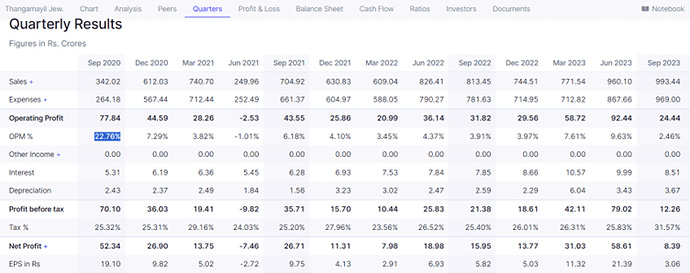

Margin:

Thangamayil Jewellery Limited’s operating profit margin (OPM) declined to 4.4% in FY2025 from 5.5% in FY2024, primarily due to a one-time loss from reduced import duty on gold and increased expenses for store expansion, promotions, and employee costs. However, the margin is expected to recover in FY2026, supported by reduced overheads and economies of scale.

The net profit margin (NPM) also moderated to 2.4% in FY2025 from 3.2% in FY2024, following similar trends.

Future growth :

Thangamayil Jewellery Limited (TMJL) is poised for strong future growth, driven by multiple factors:

- Revenue Expansion: TMJL is targeting over 25% revenue growth in FY2026, supported by rising gold prices and increased store presence.

- Store Expansion: The company plans to open ten new showrooms in FY2026, adding to its existing 62 stores, with a focus on Tamil Nadu and Chennai.

- Profitability Improvement: TMJL aims to boost its EBITDA margin to 6% in FY2026, up from 4.1% in FY2025, by optimizing costs and leveraging economies of scale.

- Market Position: The shift from unorganized to organized jewellery retail continues to benefit TMJL, strengthening its brand presence.

Long-Term Growth: Analysts forecast earnings growth of 34% per year and revenue growth of 19.2% per year, with a projected return on equity of 23.5% in three years