Given the forum name is Value pickr, at what price are you prepared to invest in TataTech on listing?

At what P/E will you chose this company over it’s competitors. At what P/E will it be overvalued

Given the forum name is Value pickr, at what price are you prepared to invest in TataTech on listing?

At what P/E will you chose this company over it’s competitors. At what P/E will it be overvalued

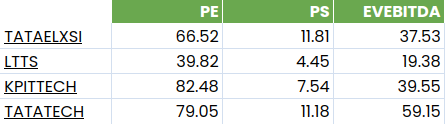

Revenue depends majorly on Auto segment which is cyclical. Hence the company’s earnings seem cyclical. Which is evident from the FY’15-FY21 flat earnings profile. So not being diversified well to counter the cyclicality aspect, I don’t think valuation wise it can be compared with the peers like Tata Elxsi & LTTS. Hence the valuation that its IPO demands i.e. the PE of 35 (approx) based on FY’23 earnings, seems to be overvalued.

Although KPIT seems comparable to Tata Tech on the ground of auto being major contributer, valuation wise KPIT is currently sky high. So I feel its better not to catch absurdity.

Then KPIT tech is too overvalued.

I would like to point out that when a cyclical sector is doing well, the high P/E is also justified

When the cycle ends, then stock price or p/e should decrease to reflect that

Yes that’s true. But you never know whether it’s just the start of upcycle or it has already peaked or near the peak…

Of course. But as long as we are in the bull market, auto sector is bound to do well at least for the next 2 years.

What is Vinfast’s contribution to the total revenues. Title is a misleading, Vinfast’s share value is at 82.35 USD on 28-Aug-2023, from there it gradually fell and is now at 6.63 USD. So, as it happened since the last 3 months, I think it is automatically factored in by now.

Anyhow, if this news negatively effects the listing price, then it is a good opportunity to take new positions in Tata Technologies

Two biggest growth triggers that I find interesting is only 5.5% of the ER&D services is outsourced and india ER&D outsourced services are the lowest. I have known some of the global companies who are consumers of these services and they say the future is very bright for ER&D outsourcing. I see lot of synergy so few years down the line it can potentially merge with Elxsi to compete with the likes of KPIT.

https://linkintime.co.in/mipo/ipoallotment.html

Still awaiting

I had applied under the TML shareholder category as well as Retail Investor. My Retail Investor application has been rejected. My question is : Do TML shareholers have a firm allotment in that category? If yes, why is my IPO Funds block showing as 0.

No they don’t. The shareholder category is also highly oversubscribed.

Estimeed fellow members, I am assuming very few got the Tata technolies shares in the IPO. It made stellar listing today. At current price does the valuation make sense to buy this stock with a long term holding objectives or should one wait for corrections.

Most of the IPOs, especially such hyped and oversubscribed ones are like hot pans just out of the oven. Better not touch them and let them cooled off. Historically many stocks fall below the listing day price very soon once market assesses the true potential.

1. EBITDA Margin: Worst of the top 4 ER&D player

2. Sales Growth: Worst amongst top 4.

I was reading some article from Aloke Palsikar Vice President & Global Head - Aerospace of Tata technologies, some extract from the same,

Please provide an insight into the work done by Tata Technologies in the Aerospace domain?

In the aerospace domain, Tata Technologies is engaged in all the aero-structural aspects and are working on aerostructures, fuselage, doors, wiring harnesses, primary and secondary structures, etc. We also provide engine performance analytics for commercial aircraft engines.

India is now globally making a name for itself as a manufacturing hub for aerospace. How do you see this trend growing?

I am optimistic that we are in the upcycle mode for the aviation industry. When one takes into account the backlog of aircraft orders with both major OEMs, it is enough for the next 7-8 years. We also have new technologies entering the market and I believe that we are in a sustainable growth cycle in the aviation sector.

Full read

Good Numbers by TATA TECH

Total operating revenue up 14.7% YoY and up 1.6% QoQ to ₹12,895 million

Services revenues were up 5.8% YoY

Continued improvement in the customer ramp-up activity, with 39 customers now in the

million-dollar-plus revenue bucket compared with 34 at the end of Q3 FY23Operating EBITDA at ₹2,366 million. Operating EBITDA margin at 18.3%, a 140-bps increase

QoQ driven by improved Services gross marginsNet income at ₹1,702 million; Net margin at 13.2%

Net headcount addition of 172; Workforce strength of 12,623

Some other highlights from the concalls apart from the ones stated in recent posts.

Q3 FY24 growth: ~14%

Interestingly, Services business that contributes >75% revenue grew ONLY ~9%

Earnings have followed revenue growth and grew at ~14% YoY

Headcount growth of ~14%, not sure if huge operating leverage exists.

Narrative:

Considering sky-high valuations, not sure if there is value especially if revenue (and hence PAT) growth don’t pick up fast. ER&D businesses have higher operating leverage than plain IT businesses. Operating leverage is a double-edged sword which works both ways. Let’s see what happens in coming quarters!

Not invested, not a recommendation.

Cheers!

Mahesh

Their operating margins at 20% are much lower compared to more broad-based IT players (e.g. HCL, LTTS etc) across market caps.

On the other hand margins of Tata Elxi, a similar player from Tata house, are 30%. Cash flow generation of Tata Elxi (e.g. sales/FCF) is also much superior to Tata Tech.

Yet Tata Elxi trades at 59 P/E while the latter at 72. In my view based on current performance and projected growth, Tata Tech shouldn’t be getting anything more than 35-40 P/E. Interestingly stock hasn’t corrected much after a tepid quarterly performance.

I am not invested in either, just an observation.

Interview with Warren Harris after Q3 results.

He is expecting operating margin will continue below 20% for next few quarters.

Harris expresses confidence in the company’s ability to protect and improve margins, aiming for a 20% target in the long term. He does not believe they will reach this goal by the end of the current financial year but anticipates making incremental improvements over the next 12-18 months