UPL, Excel and Transpek are all owned by Shroffs. But they are all different families- they are related brothers, cousins, yes, but own and operate separate businesses.

You are right . There is no connection. Excel Crop was sold by Shroffs to Sumitomo Chemicals.

Thank you for the view. I was of the view Mr Arora was still in charge… Has he moved on ? I too have heard good things about him

Mr Arora has been moved to Singapore and has been made in charge of whole Asia, so i feel he is no longer in direct charge of Indian company.

Btw ,I made exit this stock due to following 4 reasons :

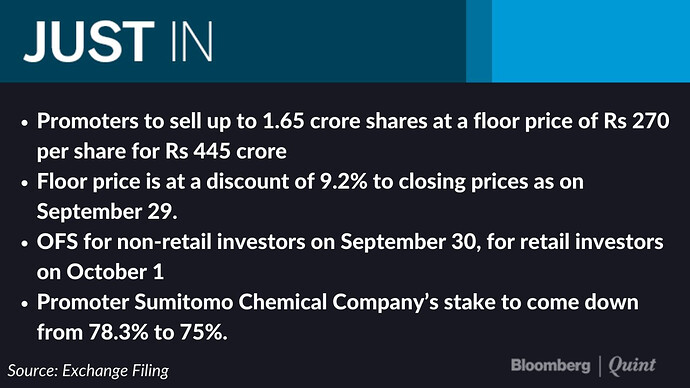

a) I feel stock price went up due to low liquidity (81% with company, 10-11% with Mutual funds and 8-9% only with public , public investors were also those big [passive investors who were invested in Excel Crop for many years ). Now company has announced OFS, that means they are liquidating extra 6% (out of 81% , as SEBI they can’t have more than 75%). So no low liquidity theory in future.Other reason of price increase was a generic company becoming MNC . Higher PE is given to MNC companies.

b) Excel crop care was dependent on one the big molecule which is globally under controversy. In India , this molecule named glyphasate is also under goverenment issues. Sumitomo Chemical has 20% business from this molecule out of total.

This is future risk. Here is the new restriction by the government on this molecule.Glyphosate restriction - only through PCOs-July 6 - 2020.pdf (1.4 MB) But big thing is that rather than decreasing dependency on this molecule, the company is increasing its dependency on the same.

I am a distributor of Sumitomo chemicals, I was selling sell Japanese products only throuh old Sumitomo company … Now old Sumitomo chemicals team also has started selling glyphosate ( excel molecule ) and many other generic products. This may help them in increasing sales IN SHORT TERM. I have seen old Sumitomo company people talking more about generic products and not paying attention to Japanese products which are more stable in business and with high margin. I think company is losing focus now and is becoming a generic company as even old team of private company Sumitomo is also interested in selling generic products as they are easy to sell in short term.

- 3rd Reason of exit was current management team, as mentioned by someone else in this thread the top management is from a small company named Nuchemi ( I was their distributor also ). That company was bought by Sumitomo before 2010 and the owner became an employee of Sumitomo. Nuchemi was started by his father and was better than UPL in 1980.

But that company never become big (like UPL, PI, Bharat etc )and was sold to Sumitomo.

Other people in top management also come from generic companies.So leaders do not have multinational experience. As per my experience of working with many agrochemical companies as a distributor, if top management is from generic company background , special products lose momentum.

- The company may grow for 2-3 years due to pipeline products but the share price is already very high . It is already considering that .I am worried about the future growth if the same management continues. But that may change as current top management is all about 70 years old.

So low liquidity, MNC PE ,past record of growth,future growth -everything is in share price. I don’t know from where price would increase. But market is irrational, retail investors are getting attracted , and this year is agri theme (all agri companies share price has gone up many times , anything can happen.

I can go very wrong in thinking all this , asking other board members on this thread if they can correct me.

de3afc27-1f29-4439-a40b-a34f5ef6f88d.pdf (2.7 MB)

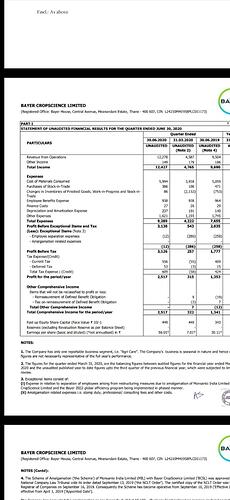

Very dismal & pathetic sales growth! Bottomline and EPS have gone up due to a reduction in other expenses.

Sales growth is only 3.5% … Rallis, Dhanuka, UPL ,Bharat Rasyan ,Coromandal International-all agro chemical companies have given bumper results -30-40% growth in revenue.Even small companies have grown more than 20%.

Merger synergies are not there.

Expense of every company is down - no travel, no flights. no hotel, no meeting , no office running expenses…reduction of expense can’t continue in normal situation.If expenses are down due to synergy of merger ( some back end expenses overlapping functions of two merging companies ), then only this can sustain.

Need to ask the question in quarterly call.

Bayer profit increase 100 core , Sumitomo profit increase 20 crore…Has Sumitomo made mistake by buying excel…Sumitomo was growing 30% every year …now 3% Let us see next quarter.

Is Mr pran Arora still with Sumitomo or has he left?

Investor presentation after Q1:

Going by his twitter bio, he is still with sumitomo

As per company’s employees , he is no longer day-to-day looking into India company operations. He is based in Singapore.

In my personal experience , I work for the group company , Japanese management culture and their practices are pretty solid. They are very very conservative in decision making, you might feel frustrated in the short term but if you look after some time you feel they are right. They might not grow or give returns like 1X 2X etcc but they can deliver a steady and decent growth.

Disc : Invested

Sumitomo Chemical - IC - 201019 - Antique Research.pdf (439.8 KB) Research Report Investment trust of india

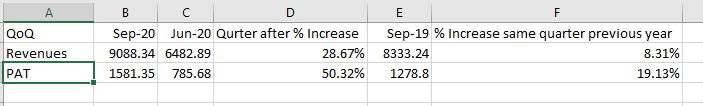

Quarterly results update, some experts @hitesh2710 bhai @RajeevJ @sujay85 please dissect ( am still learning )

Sep 20 - Quarterly results

Notice issued by GPCB to close Bhavnagar plant is now temporarily withdrawn (Positive Sign)

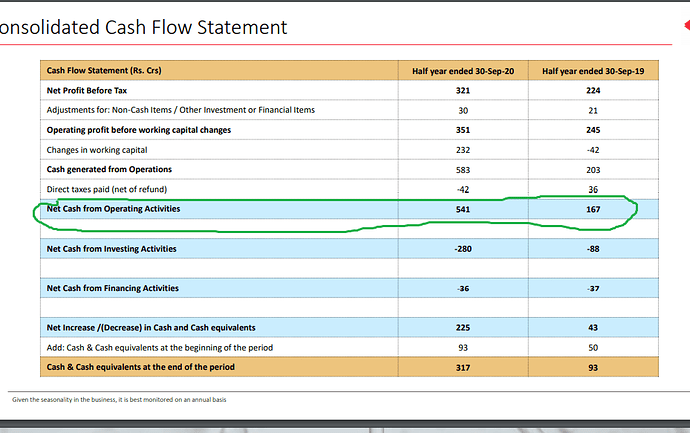

very strong cash flow too, should be re-rated ahead.

Disclosure: Invested from lower levels opinion may be biased

I was going through the transcript http://sumichem.co.in/pdf/WRITTEN%20SCRIPT%20OF%20AGM%20PROCEEDINGS%20(FINAL).pdfof AGM and come across a share holder question, where he expressed his frustration of not finding a suitable chemical in the market to treat bed bugs, this share holder did raised the same question during last AGM also. I am glad to see the response from the management who picked it and launched a product.

"We will be launching one new molecule from Valent Bioscience in 2021. It is a very-very good product and we are looking forward to having that. So, both Valent Bioscience and the products of Sumitomo Japan, both are available to us and we constantly look at the product-fit in Indian climatic zone, Indian crops and Indian pest, so that is an ongoing process and we will continue to get many new products from both Valent as well as Sumitomo Japan "

ESOPS is always attracts some attentions ( +ve / -ve), but these guys a a global policy they don’t have ESOPS option at all.

Have asked this question :

Dear Investors Relations Officer,

I have gone through the AGM transcript http://sumichem.co.in/pdf/WRITTEN%20SCRIPT%20OF%20AGM%20PROCEEDINGS%20(FINAL).pdf

I have a question on the banned (to be banned products). I am sure you are always on the lookout and keep an eye on the government regulations that are related to banning some products.

What is your proactive contingency plan to replace the to be banned product with a like to like replacement which can be offered to the customer ?

Received a response in couple of days.

The proposal to ban 27 pesticide products is currently under discussion between the Government authorities on one side and other stakeholders (the farmers, farmer associations, industry players, industry associations etc.) on the other side. The industry has supplied / is in the process of supplying data / information as required by the Government authorities / otherwise in support of the products. The farmer bodies also have submitted presentations urging the Government authorities not to ban these / some of these products as no cost-effective alternative products are available to them for pest solution which these products offer. The proposed product-ban is also likely give rise to increase in imports of expensive alternative products, cause damage to the domestic industry and go against the spirit of the Prime Minister’s ‘Atma Nirbhar Bharat’ initiative. The proposal to ban the products is also subject matter of litigation and judicial scrutiny.

In view of above, currently, it is difficult to arrive at any conclusion as to whether and when the proposed ban would come into force. It has also been clarified that the ban would not be applicable for exports of these products.

As far as the Company (SCIL) is concerned, the said 27 products include two technical grade products produced by the Company and some formulations for which active ingredients are purchased. For the two products mentioned above, the Company has significant exports which would not be impacted by the ban, even if imposed. SCIL has capability and under-development product-pipeline to launch new products to fill up the gap arising out the product-ban eventuality - both in terms of manufacturing and marketing. Therefore, the proposed ban is not likely to have material impact on the Company.

In the past, SCIL and Excel Crop Care Limited (which merged with SCIL) have successfully met the challenges posed by product-bans and the Company is confident that, if at all the proposed product-ban comes into force, it will be able to meet the challenge effectively and successfully without causing major disruption / damage to its operational and financial performance and stakeholders’ interest.

With Regards,

PRAVIN D DESAI

VICE PRESIDENT & COMPANY SECRETARY

SUMITOMO CHEMICAL INDIA LIMITED

Brilliant cash flow from Operations, richly valued but there is always been a reason behind expensive valuation.

6_Troalen_ABIM_2015.pdf (821.9 KB) Little old but gives more insight, come across the payments made to parent (related party txns ) Related party transactions Valent