hello experts and veterans, revised indicative price announced by the co is 375/-

What are the odds of delisting and what is more probable to happen if delisting fails, considering most shipping cos have rallied? evaluating downside risk

thanks!

Lets hope at least 20% of the small retail shareholders figure out how to punch in their buyback price. See some random bids at over 600 Rs! No way the company will accept such a high price in my opinion. Shouldn’t these people be buying the stock instead of offering it in the delisting if they think it is worth over Rs.600?

You can see the book building here.

With only 20 Lakh shares tendered, would it hit the required numbers tomorrow? I guess we need atleast 43 lakh shares to be tendered at a reasonable price for the promoters to accept and go for Delisting.

The de-listing process for Shreyas did indeed achieve the requisite 90% mark. However the discovered price of Rs 890 may be too high for the Promoters to accept.

It looks like they have the opportunity to make a counter offer by Friday 29th of September?

Thanks for posting, that is what i would expect. Due to the war the shipping routes are extended. the shipping rates have gone up. And why should it be easy to force people to give up their shares? Howard marks top holding 20% portfolio as per data roma is shipping and that is not the only shipping company he holds

A few points

-

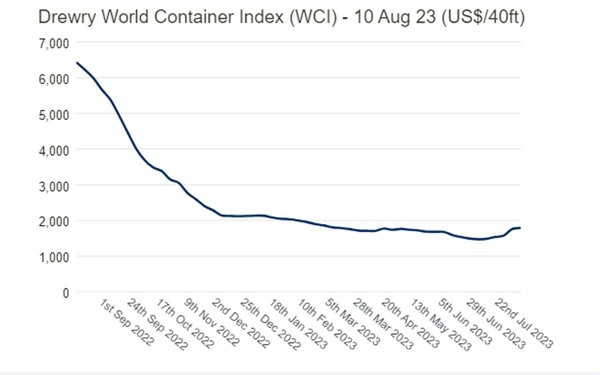

The latest Drewry WCI composite index (global container prices) of $1,479.48 per 40-foot container is now 86% below the peak of $10,377 reached in September 2021. see

-

There is no sign of recovery. Significant new capacity is being added. see Glut of new ocean tonnage inbound as global demand weakens | Journal of Commerce. Vessels on order will add 30% to global container freight capacity over the next three to four years, says Niels Rasmussen, chief shipping analyst at Copenhagen-based trade group Bimco.

-

India is lifting cabotage laws, that previously only allowed Indian-flagged ships from the likes of Shreyas to operate on coastal routes in the past. https://splash247.com/india-lifting-cabotage-laws-to-help-coastal-shipping/

The Delisting offer in all likelihood will not go through, with the counter offer of Rs. 400 being below the price that would enthuse shareholders. The mgt. on its part cannot be blamed as the share price over the last many years has hardly seen 400 levels, & barring the last month or so, anyone who bought the share would be sitting on a profit. The problem comes when we start treating de-listing as an arbitrage opportunity & spoil the party!

On the basis of financials alone, the stock is likely to settle lower & perhaps the shareholders would be better off exiting at current market levels of about 400. The problem however is that the shares lodged for de-listing have to be first received back.

Shareholders should also note that the delisting rules are somewhat unfair. If shares are not withdrawn buy the shareholders, it is assumed that they accept the counter offer of Rs. 400! So much for shareholder protection!!!

Does anyone have an understanding of what happens to those shareholders who offered their shares at say 450/- and do not withdraw their offered shares and the delisting offer fails overall. Would the promoters have to buy those shares at 400/- or will they reurn all the shares including those who chose not to withdraw their shares offered?

What I understand is any share bid below the discovered price of Rs 890 is considered valid for delisting purpose. These shares are also considered as deemed acceptance of Rs 400 offer if they do not withdraw during the current withdrawal process from 03 to 16th Oct.

Any shares bid above the discovered price of Rs 890 will be automatically returned back. However these are also eligible to be offered at Rs 400 buy back when the offer period starts from 11 to 17th Oct.

I will withdraw my offer and wait out this period. While the buyback seems to almost fail, the share price will rise when the dust settles down.

Edit: Just now received a message from IciciDirect that I need to contact the Shreyas if I want to withdraw from the delisting process. Seems IciciDirect do not have the option to withdraw.

All seems to be against the retail investor.

Thanks a lot, would the bidding be updated on bseindia page if you withdraw? that way we can monitor the changes.

would the share continue to trade post 17th october?

Cheers

it depends on the timeframe you have, if you are thinking about next month sure the price is likely to go down but i think in the longer term (a couple of years) there are much higher chances of it go higher.

If the delisting is success, meaning promoters could acquire 90% of the shares, then the shares will stop trading after 17th.

it seems there is a new page where we can see the tendered shares at the price of 400. BSE Bid Details (bseindia.com) as per the page there are hardly any shares tendered. So it doesnt seem to be automatically accepting anyone who had offered before.