Q1 Results were really good and with the steel Cycle turning upwards, re-rating of valuations seems imminent sooner or later. Major Part of the Debt is for the hydro power plant and will not be impacted by covid in case of a third wave, so upcoming Q2-3 results should continue the current upward trend.

any idea what would be the tariff from this 113 MW hydro plant, and what is the total energy going to be supplied from this plant (primary energy and secondary energy). the total project cost seems to be in the range of 12 cr/MW which means the tariff ideally should not be less than Rs 4.5 per unit. In one of the call i heard EBITDA on full year basis is estimated at 225-250 Cr which seems to be on a higher side. on standalone basis keeping 12% interest rate for this project, Interest cost in a year after COD should be around Rs 114 crores and depreciation approx 50 cr. even if we assume assume at 50% PLF, it should generate 49.4 Cr units, with Rs 4.5 per unit, the yearly revenue should be Rs 222 cr and 20 cr will be O&M, so EBITDA on this rate if its gets approved by the commission, then an EBITDA of Rs 200 can be expected. so from year 1 should be in cash positive keeping 1 year moratorium for principal repayment.

The provisional tariff rate is 6.5 per unit. It coulbe be anywhere between 6.5-7, but a minimum of 6.21 given on renewable energy products. Expected topline at 6.5 per unit is 225-240cr and EBITDA of 175-200cr. This is assuming the 50% capacity utilization. The biggest and probably the only risk with hydropower plants is monsoon rainfall. Therefore only 2 quarters produce at peak output levels? Also there are transmission charges of Rs 1 per unit. The interest rate on the project is 11% which they said would be refinancing and brought down.

Brief summary of the Petition.pdf (981.0 KB)

This company continues to post super numbers quarter after quarter. The full impact of its new projects in Ferro Alloys and Power are yet to reflect in the numbers

Disclosure: Invested

Since, GPIL is a big chunk of my portfolio, it is natural that I have studied Sarda energy too.

Sarda energy is physical neighbor of GPIL (mines are on adjacent plots) and business is very very similar.

Now, let us look at the valuations-

- Sarda energy consol quarterly EBITDA = 320 crore, annual EBITDA = 1188 cr.

Enterprise value = 4820 cr

EV/EBITDA = 3.7

- GPIL quarterly EBITDA = 493 cr, annual EBITDA = 2000 cr

Enterprise value = 4600 cr

EV/EBITDA = 2.3 only

Thus, Sarda energy is 60% more expensive than GPIL.

GPIL is also doing expansion projects like almost doubling billet capacity, 20% more sponge iron capacity, solar power plants - all these will start contribution to profits in a few months.

In addition, GPIL is building a pretty big specialty steel plant which will take 2-3 years.

(P.S- Sorry to take the limelight off the sarda energy results, but their business is so similar, that, it makes sense to compare them)

Interested people please connect with me:

I started re-evaluating Sarda Energy after Abakkus Fund increased their holding marginally. Even though the percentage is relatively small it shows conviction of a fund manager to do so.

Coming to the current valuations of Sarda and GPIL, Sarda currently trades at 3.9 EV/EBITDA and GPIL trades at 3.7 EV/EBIDTA. So GPIL has certainly caught up.

So with recent capex of Sarda going live where do you the competition heading?

Also since you have tracked GPIL closely, could you please explain the reason behind drastic drop in fixed asset of GPIL during 21-22 period.

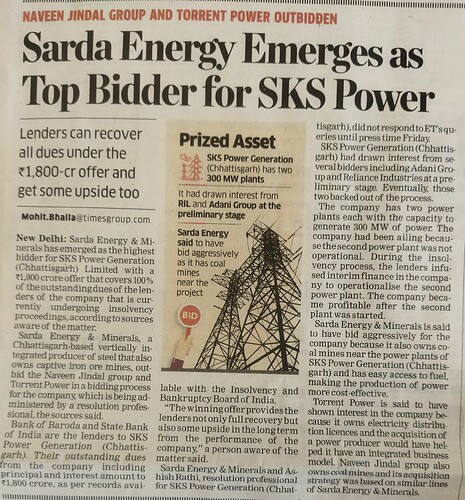

NCLT gives nod to Sarda Energy’s acquisition of SKS Power for Rs 2,200 cr

Sarda Energy do have iron ore block in Gadchiroli District, it’s a joint venture between Shyam metalics and Sarda Energy

Sarda is aggressively expanding its power generation business, aiming to transform from a predominantly steel and iron ore company to a major player in the power sector.

- Acquisition of SKS Power: In August 2024, Sarda successfully completed the acquisition of SKS Power, adding a 600 MW operational thermal power plant to its portfolio.

- Hydroelectric Expansion: Sarda currently operates hydroelectric plants with a combined capacity of 166 MW. Additionally, a 25 MW hydroelectric project is nearing completion, and the company has plans for three more 25 MW projects in Chhattisgarh, awaiting regulatory clearances.

- Solar Power Development: Construction is underway on a 50 MW captive solar power plant, expected to be operational by the end of the current fiscal year. This initiative aligns with Sarda’s commitment to sustainability and reducing its carbon footprint.

- Strategic Coal Mine Expansion: * Increased coal mining capacity at Gare Palma IV/7 from 1.44 million tons to 1.68 million tons.

- New Coal Mines: Sarda is developing three additional coal mines: Shahpur West, Kalyani, and Bartunga Hill. The Shahpur West mine, with a projected annual output of 1.8 lakh tonnes, is expected to begin production by the end of the next fiscal year. The Kalyani and Bartunga Hill mines will further bolster the company’s fuel supply for its power generation operations.

With these initiatives, Sarda is going to achieve a total power generation capacity exceeding 1000 MW in the near future. The company’s management has articulated a clear vision to “decouple” from the cyclical steel industry and establish a stable revenue stream from the power sector. The consistent demand for power, coupled with less price volatility than in the steel and iron ore markets, makes power generation an attractive growth avenue for Sarda.

Management has guided for 2000+ Cr of annual revenue from SKS power. Based on this we can see how revenue split of power is going to become the biggest chunk going forward. To estimate the change, I have assumed the following:

- 11% revenue CAGR over FY24 numbers for all segments till FY26.

- FY26 will be the first year where full revenue from SKS power will be visible. So have not included partial revenue from SKS power for FY25H2.

- Have assumed revenue of 2000 Cr for FY26 from SKS power.

| Segment | FY24 Revenue | % of Revenue | FY26 Revenue Estimate | % of Revenue |

|---|---|---|---|---|

| Steel | 1,969.09 | 51.28 | 2426.12 | 36.04 |

| Ferro | 1,504.76 | 39.19 | 1854.01 | 27.54 |

| Power | 366.17 | 9.54 | 2451.16 | 36.41 |

| Total | 3840.02 | 6731.29 |

Note: Power segment revenue is growing from 9.54% to 36.41% of overall revenue.

Near term tailwinds:

- Q2 FY25 only included a partial contribution from SKS Power because one of the two power generating units at SKS was under shutdown for overhauling from September 1, 2024, and only resumed generation on October 12, 2024. Q3 FY25, will be the first quarter where a full three months of SKS Power’s operations will be consolidated into Sarda’s financial statements.

- Current NPM is 13-14%. NPM for SKS power is ~25%. (Based on my understanding of management’s guidance)

Technical:

- Stock took support at 100 DEMA today. Didn’t expect it to break 461 as it was holding it till last week even when the whole market was falling. Might bounce from here.

Disclaimer: Invested today. Biased. Take numbers with a pinch of salt.

Good set of results for Q3FY25

Consolidated Results

| Metric | Q3 FY25 (₹ Cr) | Q2 FY25 (₹ Cr) | QoQ % Change | Q3 FY24 (₹ Cr) | YoY % Change |

|---|---|---|---|---|---|

| Revenue from Operations | 1,319.14 | 1,158.66 | 13.85% | 925.39 | 42.55% |

| Profit After Tax (PAT) | 200.08 | 203.49 | (1.67%) | 114.45 | 74.82% |

| EPS | 5.68 | 5.67 | 0.17% | 3.25 | 74.77% |

Standalone Results

| Metric | Q3 FY25 (₹ Cr) | Q2 FY25 (₹ Cr) | QoQ % Change | Q3 FY24 (₹ Cr) | YoY % Change |

|---|---|---|---|---|---|

| Revenue from Operations | 1,046.58 | 762.66 | 37.23% | 657.26 | 59.24% |

| Profit After Tax (PAT) | 189.22 | 122.60 | 54.34% | 112.76 | 67.81% |

| EPS | 5.37 | 3.48 | 54.31% | 3.20 | 67.81% |

Consolidated Segment-Wise Revenue

| Segment | Q3 FY25 (₹ Cr) | Q2 FY25 (₹ Cr) | Q3 FY24 (₹ Cr) |

|---|---|---|---|

| Steel | 522.37 | 486.82 | 510.00 |

| Ferro Alloys | 314.55 | 432.26 | 363.23 |

| Power | 670.30 | 390.77 | 212.42 |

| Unallocated | 5.91 | 4.81 | 4.31 |

| Total | 1,513.13 | 1,314.66 | 1,089.96 |

| Less: Inter-segment Revenue | 193.99 | 156.00 | 164.57 |

| Net Sales/Income from Operations | 1,319.14 | 1,158.66 | 925.39 |

Standalone Segment-Wise Revenue

| Segment | Q3 FY25 (₹ Cr) | Q2 FY25 (₹ Cr) | Q3 FY24 (₹ Cr) |

|---|---|---|---|

| Steel | 522.36 | 486.82 | 531.06 |

| Ferro Alloys | 125.77 | 182.74 | 150.06 |

| Power | 531.94 | 176.67 | 70.15 |

| Unallocated | 5.91 | 4.78 | 6.53 |

| Total | 1,185.98 | 851.01 | 757.80 |

| Less: Inter-segment Revenue | 139.40 | 88.35 | 100.54 |

| Net Sales/Income from Operations | 1,046.58 | 762.66 | 657.26 |

Power segment growing really fast as anticapted and becoming the biggest chunk of revenue. Consolidated revenue increased from 212.42 to 670.30. (215% YOY increase). I had previously estimated 2451 Cr as FY26 revenue from power segment. Company looks on track to surpass that.

Source: https://www.bseindia.com/xml-data/corpfiling/AttachLive/86f05269-bef6-406e-b2da-34474154c608.pdf

Disclaimer: Invested, Increased allocation in last 2 weeks.

Sarda Energy

- Focus on the Inflection pt here

Do check out the segmental results too. Power segment grew brilliantly 200%+ increase

Vision is to decouple from the cyclical steel industry and establish a smooth stream via Power sector. (mentioning this coz we should ideally be building the thesis for re rating using this mental model)

Guidance was 2000+cr of annual revenue from SKS power.

- 11% rev CAGR for all segments till FY26

- Full rev from SKS power will be visible in FY26

Contributions per segment

Steel - 34.52%

Ferro Alloys - 20.79%

Power - 44.3% (Contribution was 29% in Q2)

Misc - 0.4%

Q3FY25 Concall Notes:

- Expansion and project updates

- Gare Palma IV/5 - We have acquired another fully explored underground coal mine.

- Shahpur West Coal Mine - The mining lease has been executed. Mine opening permission is expected this quarter, with production targeted within two years.

- Rehar hydropower project (25 megawatt) - The project has begun trial run and is expected to be commercially operational by the end of this financial year.

- Captive solar power (50 megawatt) - While progressing on schedule, delays in the construction of CSPDCL substation bay and transmission line may slightly impact the timeline.

- Mineral wool project - This sustainability initiative is progressing well and should be operational before the financial year’s end.

- 30-megawatt TG set replacement- Work is on track, with operations expected to commence in mid-FY27.

- Next quarter looking even better.

It could have been even better, but for plant maintenance shutdown and lower power prices on energy exchanges, we expect further improvement with January already recording PLF of 97%. Additional capital expenditure has been planned to ensure sustained operations at full capacity.

- Steel and ferro alloys segment suffered due to downturn in prices, lower production & inventory losses.

- Aggressive exports from China weighed on global steel prices. In December alone, China

exported 9.72 million tons, which is higher than average for most previous months. Many

countries have invoked safeguard measures against Chinese imports. - Reversal of interest rate cycle will enhance competitiveness and encourage capital investments, creating demand for steel and other metals.

- Aggressive exports from China weighed on global steel prices. In December alone, China

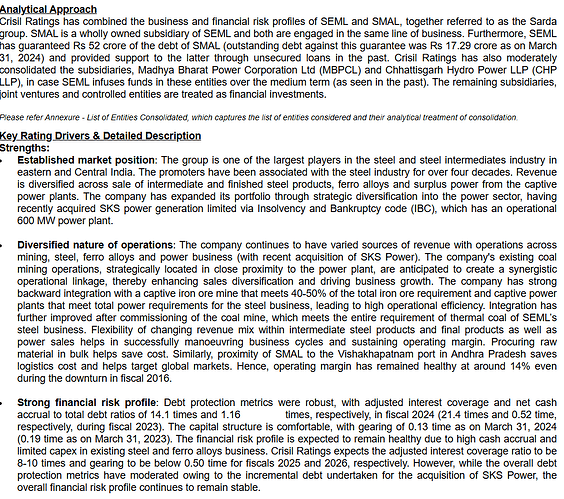

- Credit rating of the company is reaffirmed at AA- by Crisil post-acquisition of SKS.

- Hydro power plants, we have long-term pricing contracts. So, those are supplied at a fixed price. IPP thermal power plant, we are selling part of the power in the long-term, part of the power in the medium-term, part of the power in the short-term, and the remaining power we are selling in the exchanges. Prices of IPP power plant will be subject to the market fluctuations and seasonal effect.

- Hydropower plant, average realization INR 5 - 7 a unit. EBITDA level is in the range of 80%. Because there is no raw material cost.

- Thermal power plant, we can expect INR 5 plus on average for the whole year. EBITDA level is close to 40%.

- Long-term borrowings increased from INR1,000 crores to INR 2,400 crores.

- Should start going down from here as we are starting to repay the loan taken for SKS acquisition.

- Investing in a diversified way. We are investing in hydropower projects also. We

will be taking up two more hydropower projects. We will be going for coal mines also as a

backward integration. We have planned even for the iron ore mine. Expansion of the SKS power plant that will be another major capex. - We have taken two underground mines. One is Sahapur West, and another is Gare Palma IV/5.

- Underground mine as we go beneath the surface the grade of the coal increases. So, the capex and the cost of production increases, but at the same time the quality of coal also increases. Now, we are little dependent on imported coal that we are buying from South Africa. Underground coal mines will help us to reduce our imports of RB2 and RB1 grade

of coal from South Africa. And even for our ferro alloys units, we are dependent on high-grade coal so that raw material will also come from these underground coal mines. - High-grade coal will be utilized for our Sponge Iron plant and Ferro Alloys plant and to that extent, the capacity of our IV/7 will be freed for SKS power plant.

- Underground mine as we go beneath the surface the grade of the coal increases. So, the capex and the cost of production increases, but at the same time the quality of coal also increases. Now, we are little dependent on imported coal that we are buying from South Africa. Underground coal mines will help us to reduce our imports of RB2 and RB1 grade

Macroeconomic overview by Sarda Energy’s management:

Disclaimer: Invested & Biased.

Sarda Energy & Minerals reported a fire incident at one of its independent power plant units in Binjkot, Raigarh, Chhattisgarh, on the evening of 25th February 2025.

The cause of the fire is yet to be determined, but the company stated that the fire was swiftly brought under control and emergency procedures were effectively followed. All personnel at the site are safe. A preliminary assessment indicates that the property damage is limited, though the exact loss will be determined after the machine is inspected.

The restart of the affected unit may take some time, resulting in a temporary loss of production. However, the other unit of the power plant is functioning normally.

Hi, could anyone share the update on the court case?

Nothing new so far, these kind of court cases can take many months if not years.