Dont think promoters are selling the stock, the number of stocks held by them remains same roughly (~ decreased by 3  ) . The stake has reduced from 66.53% to 66.47% primarily due to expansion of equity base (Employee stock options??). Although, holding on to this has been frustatingly difficult, I think its not a bad bet due to high dividends and pretty transparent (maybe slightly overly bullish) promoters.

) . The stake has reduced from 66.53% to 66.47% primarily due to expansion of equity base (Employee stock options??). Although, holding on to this has been frustatingly difficult, I think its not a bad bet due to high dividends and pretty transparent (maybe slightly overly bullish) promoters.

Tie-up with Lightning to help enter B2C biz model: Repro

Short Summary of Q3 conference call:

we have also prepared few other summaries. Sharing here: https://goo.gl/5RTk0o

Read disclaimer for summaries here: https://goo.gl/HELov8

interesting growth in in ecommerce venture . Repro can be proxy to ecommerce and education sector in india. and as Africa c aviable at 5 times cash

Any one tracking this stock. I happened to saw Vijay Kedia Interview in ET (It was dated June 2016 though)…He was super bullish on this stock… For last 3 years this stock baberly moved…

.

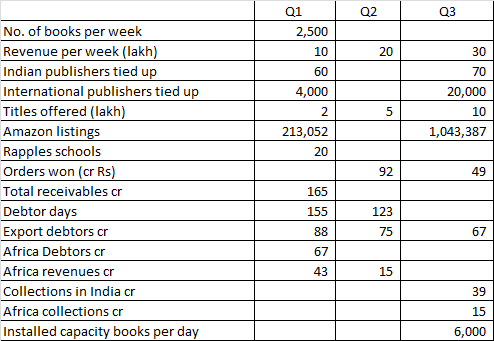

The stock is on my radar. It seems to have run up much ahead of earnings which will take a little more time to reflect in the financials. However the management seems to be taking all the right steps which can be seen from the trend of the operational metrics over last 3 Qs (compiled from their presentations).

Its a good proxy on digitisation. They have transformed themselves from a run of the mill printer to a solutions provider for publishers. However a key risk is piracy. Many still dont think twice about getting books in pdf format, and either reading them in soft copy or printing them out. Ofcourse, many still buy books and for them Repro provides a great service.

The other issue is their Africa receivables, which are slowly getting realised.

Gave a presentation on repro last Sunday during VP Bangalore meet. This was prepared with the help of colleagues from VP ( Raj Sharma). Sharing for wider audience use. Lot of content and analysis was delivered during the talk and slides are for highlighting key points. Would like to put my analysis in detailed words during the weekend once get time.Repro India vp1.pdf (2.6 MB)

First of all, excellent presentation. So I have been following this company for a while

Few questions/observations;

- Do we have any idea on how big some of the other Ingram partners (8 worldwide) have become? Any sales/profit numbers available?

- It seems to me, the major re-rating play here is through the E-retail business. In a sense we are paying about 450cr (market cap) on an option value, which as of last quarter is clocking 30 lakhs per week. For this business to have any meaningful impact on the financials it needs to arguably grow at least 5 -10 times larger. So thinking in terms of opportunity cost, would it make sense to wait for some more scale, more evidence? Assuming some teething issues, competition etc

- If one-book-factory is the best way to deliver books, everyone will be doing it sooner or later. So the only thing of value are the international titles available through Ingram right? The rest of it will be a commodity business with multiple printer’s being able to deliver the same book, resulting in a price war of sorts. Do you agree?

- If the concept picks up in India, what incentive does Ingram have to keep this exclusive to Repro (think you have mentioned this as a risk)? Seems like the real hero here is Ingram and they would dictate/squeeze the Indian player. And even one new tie up could potentially take a large enough portion of Repro’s market share away

Thanks

Presentation made to analysts on 08/May/17:

thanks @akja . Very valid questions. In fact, I was also looking for answer to some of questions you have raised. Today’s concall was a good time to ask some of the, Will post detailed notes later but here is response to your questions:

-

Got to know name of a German partner, Book on demand. I will check its details how it has done. However, management reiterated that Ingram has 8 partners and in none of the countries till now, it has had more than 1 partner till now.

-

Yes, if you see Q1 run rate to Q2, 100% growth rate, Q2 to Q3, 50%, Q3 to Q4 is 60%+. now they are doing 2 crore per month. Your questions r valid that is why i have tried to build multiple views of guesstimates with some margin of safety but agree at the end guesstimates have to play for the success of story. I believe risk reward is on the higher side. The only dampener could be 3% of e-commerce book sell not turning into 10%, thats the only aggressive piece i see in one of the guesstimate approaches based on analyzed data.

-

I would say yes possibilities are there. It is not rocket science with high barrier to entry apart from content tie-ups. Let us see how story unfolds. However, Repro has first mover advantage with a good management in unorganized sector. As I have mentioned in one of slides, i m playing on scale of opportunity, management quality of valuation gap risk reward ratio, not on highly differentiated business. the incoming cash flows from pending receivables r stable traditional business despite lesser export revenue are icing on the cake

-

Please refer to point 1. In none of countries ingram has more than 1 tie-up gives some comfort

Since my company works with Ingram, I can vouch for the one company one country tie-up. Some points about Ingram:

-

It is the largest “print-on-demand” company. Its subsidary, Lightning Source, is the biggest print-on-demand company in the world. Their self-publishing company Lullu.com is also the biggest and they use lightning source too.

-

Amazon also is in print on demand segment and even they could not compete against Ingram. Their self publishing company createspace is their play on print on demand. Publishers never went with Amazon because of the backstabbing they got when Amazon started decreasing the publishers royalty.

-

Ingram has a massive portfolio and it will just keep on increasing as publishers find them honest and economically viable. Self publishing trends also will help them.

-

Publishers find Ingram critical to their business model. Because of print on demand economics. A traditional publisher had to go to a printer and print thousands of books. The more books you print lower your fixed cost. Then these books will go to a distributor and he will sell it. If he can’t, he sends back to publisher.

-

Traditional publisher has massive working capital need. Also, if the distributor defaults he is quickly into loss

-

With print on demand, the publisher has no inventory. Although the fixed cost is same for per product, the gains are much more if you compare it with cost of working capital and inventories

-

And that’s why most publishers are shifting or will have to shift to print on demand

-

This trend would not have been possible if it wasn’t for ecommerce. That was the inflection point for Ingram back in 2004.

-

When a customer orders a book on amazon, Ingram gets that order on its system. It prints there and then and ships it to end customer. So Ingram only prints a book when it has an order from a customer.

-

Going ahead, negative working capital shall emerge as the biggest moat for repro as it is for Ingram.

-

For Ingram too, this tie up is due to compulsion. printing machines are costly so this is a high captital intensive business. Also, understanding the demographics and Indian environment this would have been very difficult. They have more than million books. They just have to convince the publisher and agree on a royalty arrangement for India market.

-

Once repro, Ingram and the foreign publisher agree on royalty sharing agreement, repro just has to put the EPub files on its system which makes it available on Amazon and flipkart

-

That’s it. Whenever a customer orders, repro factory will print it and deliver in three days time to end customer. According to their concall they are working on one third of capacity and don’t need to spend on capacity expansion.

-

Listing of these massive titles should take one years time in my opinion.

-

Rest of the business, exports, rapples, etc are just bad capital allocation decisions which management should reverse once print on demand takes off.

-

My company is a customer of repro and we have seen massive impact on our India sales. To be honest, for an mnc like ours, without repro, this would not have been possible. We also work with lightning source in America and European market. So this agreement with Ingram gave us more confidence on their ability to deliver.

-

Without Indian ecommerce growth, growth in print on demand would not have been possible as brick and mortar stores like crosswords lack such ability. They need physical books to display on their stores unlike Amazon which just has to write description of the book and a cover page. Repro is the best play on Indian ecommerce in my opinion rather than an expensive Infibeam stock which burns cash

-

Amazon pays twice a week to repro so there is instant money on the sale. And repro pays the publisher weekly and sometimes monthly. So there is no credit period like traditional publishing.

-

The growth in ebooks can be a threat. Although repro does have distribution rights, the major money is in their printing business. Our firm is into trade publishing and for the last ten years there has been no decrease in the sale of print books in American and European markets. Actually for the industry, ebooks sales have decreased in the last one year.

-

With high device cost ebooks will find it difficult to penetrate in the Indian market. And there is a strong regional publishing market which will take even more time for this shift if at all the shift comes.

-

Valuations aside, print on demand business, which management calls as one book business, is where the growth lies.

-

Tie up with Ingram is similar to what investor must have seen with lubrizol- astral or pokarna-brettonwood tie up

Disclosure: invested. Please do your own due diligence before investing.

The strike in the mahape plant entered on day 32. Anyone has idea how it will affect the topline and bottomline of the company.

disc. accumulating from last 01 year.

I asked this question in the conf call. They said that they are managing the plant with some employees who have not joined the strike. The strike started after Q4(heaviest quarter for them) and since Q1 is the lightest quarter, they won’t have any revenue impact.

Regards,

Raj

Nice article on Bloomberg

Another article:

Some additional notes:

Valuing a loss making company is difficult. Current market cap of Repro is nearly 520 crore. This is nearly 1.78 times the sale.There are three moving parts of the business: E-retail(print on demand), Rapples and traditional business. I would not like to take valuation of rapples and traditional business as according to my thesis, these are areas which company shall cease to invest in the near future and in the long run, company may completely stop allocating capital.

E-Retail:

a. Demand: According to management, there are one lakh books sold in a day. If we take into account the Neilson India book market report, by 2020, the book market would be 739 billion( 73,900 crore). The industry, according to Neilson, is growing by 20% CAGR.

According to KC Sanjeev, the managing director at Welbound Worldwide, current book market is Rs. 35000 crore. “Of the Rs 35,000-cr book publishing industry in India, more than 70% is education publishing. The distribution models have changed; more than half of books sold in India are through e-tailers.”

So this gives us an estimate that current sales of all e-commerce would be Rs. 17,500 crore.

As has been seen in US, Europe and other developed economies, e-commerce will take almost all the distribution business(currently, it is 70% in USA) as physical stores like crossword will not stand a chance against Amazons of the world. They might survive, but the major marketshare will be dominated by e-commerce.

I estimate the e-commerce share of book business to by Rs. 60,500 crore(20% CAGR growth according to Neilson). This is the total market size opportunity for Repro India till 2020.

b. Supply: They have an existing capacity of 6000 books per day which they intend to extend till 12,000 books for 2017. Currently, they are working on 1/3rd of supply but in my opinion, they should go up to 6000 in six to nine months as more and more titles are added. And in two years time, they should be on 12000/per day. This will give them a sale of 43,80,000 books in a year.

c. Revenue Per Title: An important metric in the publishing business is Revenue per title. As mentioned before, Repro makes 2 crore a month with nearly 1.2 million titles from Ingram. This gives them a RPT of Rs. 16.6. Now this is a very low number which will go up as the books have been just uploaded on the e-commerce sites. Generally, trade publishers track 18 months as shelf life for their product. Education books are seasonal. Typically, after the first three months, publishers get an idea of total sales of their products. Soon we will get a clear picture of what is the average RPT for Repro books-on-demand. This will be an important metric for us to track as it will give us an idea about the quality of content that it has from Ingram. With this figure we will be able to extrapolate how much sales they can generate with additional content that gets added to the system. They are still suppose to add 13 million titles to the system which they should be able to do by this year. If we can get a good sense of RPT, we will be able to generate a better valuation model.

d. Ingram pricing: This is a key risk which I hope they tackle properly. Foreign publishers price their books in USD or GBP according to their country. When the deal with Ingram is done, it will be crucial how the Indian market reacts to this pricing. India is a very price conscious market. Simply adding the exchange rate would not help expand this market. Publishers will have to come up with pricing models which are in-line with the Indian market. How Repro navigates through this challenge will be interesting. If the price is too low, all the three stakeholders i.e.Ingram, Repro and Publisher will make less money and if it is too high, they may lose sale to ebooks, second-hand books or piracy. So how Repro addresses this challenge at a management level will be interesting.

e. Superior SLAs: There are two disruptions that Repro is doing. One is on the print-on-demand front and the other is on the distribution front. On the prin-on-demand there are smaller players but they lack content. So content from Ingram is the moat or competitive advantage. On the distribution front, Repro has superior SLAs compared to their competitors. They are able to deliver books faster to e-commerce players compared to competing distributors. This is because they are located in Bhiwandi where almost all the warehouse of e-commerce companies are there. This is very critical as e-commerce companies rate seller highly on price and speed of delivery front. So Repro will always be on the top seller for major books as they have unique content and speed of delivery time. Rarely, you will see that there are other sellers who are on the top and Repro is the second best. If this is the case, it should be a signal for us that Repro is losing its competitive edge. So if one is ordering a book from Amazon, one should always look for seller

f. Academic publishing: As mentioned before, 70% of market is academic. E-commerce companies are finding it difficult to increase their market share here because of solid distribution in offline(I had read this on printweekly but cant find the link to this claim). This is another challenge for Repro and we should ask management how are they planning to tackle this going ahead. Although, we have assumed that e-commerce companies will takeover giant marketshare, this assumption has to be tested especially for academic segment in the coming year. For trade or fiction, it would not be a problem. Also, the share of fiction should go up which is very low right now.

Thanks,

Kunal

Following are my views & some back of the envelop calculations for Repo’s Books-on-Demand part of the business.

Few data points to keep in mind,

-

Indian book market to touch 74000 crores by 2020 ( Current year estimates around 37000 crores).

-

70% of this market comprises of K12 school books (higher education comprising 22%) as per Nielsen (http://www.nielsen.com/in/en/insights/news/2016/read-all-about-it-indias-book-market-is-poised-for-growth.html)

-

eBooks seem to have peaked out in 2015/16 and people prefer printed books (google to find out more).

-

Per Repro’s recent conf call, 1200 crores is the online book market (around 3% of overall market). Based on current running rate (2 crore revenue per month), Repro can do 24 crores per year (of course this number will keep growing). This is 2% of online book market share as of today.

-

Another number to keep in mind is the number of books sold online per day. This number was mentioned by Repro’s management in one of their earlier conf call, which is 2 lakhs book per day. Repro is currently selling 2000 books per day (around 1% of total books sold online).

-

Another data point specific to Repro, They are now selling 2000 books per day and are making 2 crore revenue run rate every month. This roughly translates to Rs. 333 per book sold. According to me the two key numbers for us to track are

– How many books they are selling per day and

– The average selling price of these books. -

Misc: If you keenly noticed in last conf call Q&A, management mentions that $75 million worth of printed books are imported into India. Repro seem to be talking to Ingram to see if they can print these books in India rather than printing them in US and import them here (with freight costs etc.,). This will add to Repro’s business if they can convince Ingram.

Few questions to ponder over (and I’ve tried to answer few of them and welcome you to disagree which is what will helps us to understand the business better),

-

Can the % of online book market share increase from current 3% to 10-15% by 2020 ?. Repro seem to believe so and from the recent conf call management believes this market to be 7000 to 10000 crore market (which is 10-15% of 74000 crores).

Is it possible ? Yes.

Is it believable ? Yes. Given the recent surge in internet penetration (Jio effect). -

Can Repro’s Books-On-Demand business mode scale big ?. Yes. As management puts it, Books-On-Demand is the Uber like model for books. They aggregate books (and so asset light with no working capital). So I believe scale can be really good.

-

Can Repro claim at least 10% of the online book market share by 2020 ?. I don’t know. But I’ve tried to extrapolate some numbers below to see if that’ll indeed be possible or not.

-

Who are the leaders today in the K12 school books space ?. Does Repro have a chance here at all ?. I’ve no answers here, would like fellow ValuePickrs to pitch in.

Estimating Repro’s one book’s share in 2020 (we have to be really careful with this projection, else one can go wrong big time). These are back of the envelope calculations,

Current capacity: 6000 books per day

Capacity increase (to be ready by end of 2017): 6000

( https://www.bloombergquint.com/markets/2017/05/10/repro-india-plans-to-double-book-printing-capacity-in-fy18 )

Total capacity for FY18 : 12000 books/day

My view on how may books/day (at least) they can sell by end of this financial year: 6000

This would roughly translate to 6000 * 30 * 333 per month revenue (~ 6 crores). 72 crores of revenue contributions from Books-on-Demand looks feasible from one book factory.

Note: Management says they’ll reach the full capacity current year, if you keenly watch his answer in his interview above. But I took 50% capacity utilization for my rough projections above.

For Repro Books-on-Demand to take 10% online book market share by 2020, at the current rate/book (Rs. 333), the need to sell around 10 times more books per day ( at the lower end of market estimate which is 7000 crores).

The key question to answer now is, Is this doable ?. I believe this is where we need to be watchful on how Repro’s Books-on-Demand progresses from here. This is achievable if they maintain the growth rate.

Biggest moat & risk for Repro is Ingram tie-up. It’s a moat as they have access to millions of books through this tie up and a risk, if Ingram ties up with other sellers (currently management thinks Ingram is happy with them and won’t see a anyone else getting such partnership with Ingram).

My view is that the opportunity is pretty huge and its upto Repro to capture this. Management seem to be confident, as they say they want to be a substantial player in the online book selling business by having significant market share. I hope the management delivers here.

Views and counter views welcome

@hitesh2710, @donald, @ayushmit would like to know your views here on Repro’s Books-on-Demand business model.

Disclosure: Invested post recent qtry results.

Dear Siva,

Any idea about export of printed books to INGRAM or others such as AMAZON?

Books on demand is only restricted to India?

Regards,

Prasad.