Redington – A business analysis, 28th Dec 2023

Background

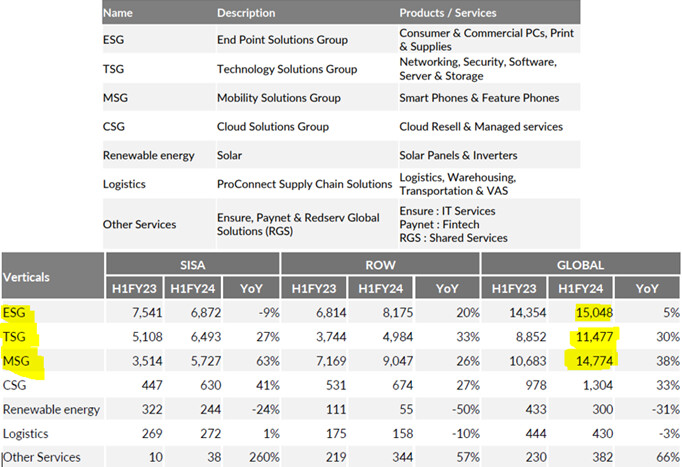

Make no mistake about it, superficially Reddington is just a middle man between IT manufacturers and customers, be it individuals (via retailers) or enterprises. Figure 1 shows the portfolio offerings of Reddington.

Figure 1: Portfolio of Redington across the IT spectrum (Q4FY23 Presentation).

As Figure 2 shows, the business is still dominated by the selling of standard IT equipment, PCs, printing supplies, networking equipment, servers, software and phones. There are a few new age verticals around cloud services and solar energy but these are small in relation to the total revenue. They might very well be good growth opportunities for the future though.

Figure 2: Clearly, ESG, TSG and MSG pillars dominate the business while the others are relatively small (Q4FY23 Presentation).

On closer inspection one realizes that Reddington is more than just a middle man – it is actually in the business of supply chain optimization for IT equipment. Why is that?

Well, it sells 300 brands (see Figure 3), across 38 countries (Figure 4) via 42,000 channel partners with a revenue of INR 869,000 million (US$ 10 Billion). Channel partners consist of Sub Distributors, Retailers, Large Format Retailers, Multi Brand Retailers, Branded Stores, Resellers, Corporate Resellers, Value Added Resellers, System Integrators, Independent Software Vendors (ISVs) and E-Commerce Players.

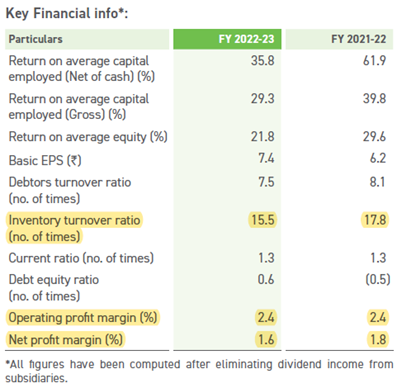

Half the business comes from SISA (Singapore, India, South Asia), the remaining from the ROW. The margins are wafer thin, just 1-2% (Figure 5). And across all geographies, Redington is the number 1 or 2 player. It’s the market leader in the Middle East and Africa while in India, it is a major distributor alongside its closest peer, Ingram Micro India Private Limited. The business quite literally revolves around supply chain optimization to maintain margins.

Figure 3: Reddington is the global middle man between the brands (300) and the channel partners (42000). For their solar business, banks, NBFCs may help with the financing.

Figure 4: Reddington is active in Africa, Middle East, India and SE Asia. A total of 38 countries.

It might also seem like a no-moat business. It certainly has no pricing power. The question is given enough money, who would like to compete for this business, one that operates at such low margins and on such a massive scale? Especially since efficiencies only start coming in once you reach scale. It’s a simple business but not an easy one. Good luck to a new entrant who wants part of the pie.

Business drivers

Risks don’t really come from competition, rather from the nature of the business itself. It’s a capital-intensive business because working capital includes huge inventory as a well as sales on credit. However, the inventory turnover ratio is >15, i.e., you refresh and sell you inventory 15 times per year (Figure 5). I don’t see much issue with inventory becoming redundant.

It’s also a business sensitive to global slowdowns since consumer and enterprise cash spend gets delayed by 6-12 months during recessions. That would affect Reddington’s numbers but these would only be temporary. You can postpone buying new IT equipment but not forever. Redington is geographically diversified so local recessions are not much of an issue.

Figure 5: High inventory turnover ratio and thin margins.

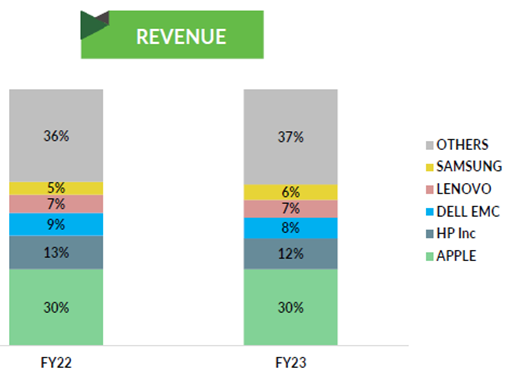

Figure 6: Top 5 vendors by revenue.

There is always a risk that one of the top vendors, say Apple can twist Reddington’s arm by playing of one middle man against the another. That’s just the nature of the business.

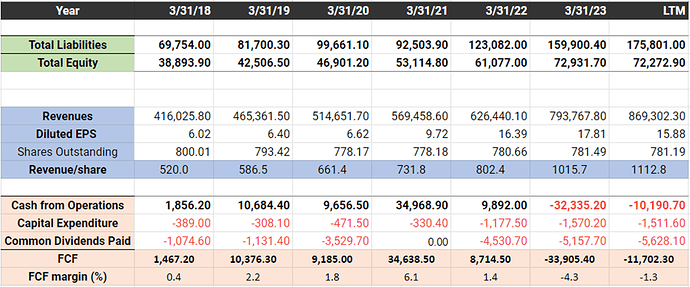

Analysis of Financial Statements

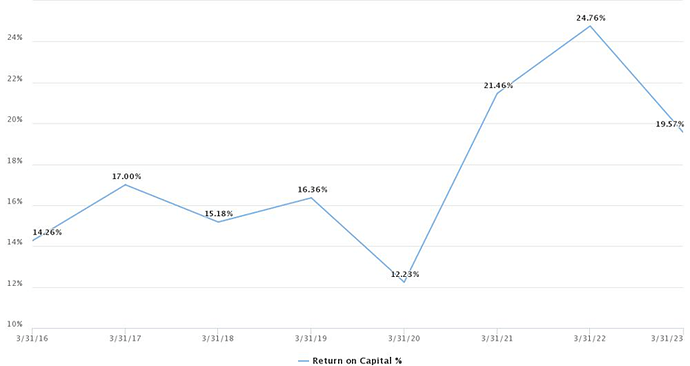

This is not a business to be analyzed based on yearly FCF or cash from operations since working capital changes can make these swing widely. EPS is a good metric. Based on Table 1, five-year growth rates for equity, EPS and revenue are all respectable. As Figure 7 shows ROICs are respectable between 15-20%. I can’t see this business maintaining an ROIC higher than 20% sustainably. As the business grows, working capital will grow, that’s inevitable.

Total current assets are very similar to total assets and these are comfortably higher than total current liabilities (which are very similar to total liabilities). Debt is very limited and a non-issue.

Table 1: Key metrics from financial statements in millions INR over the past five years.

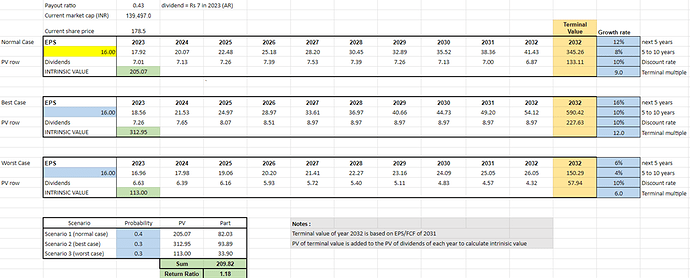

According to the annual report, the company is committed to paying 20-35% of PAT as dividend and will try to maintain or increase dividends every year. Valuing Redington on an EPS of INR 16, its currently priced for about a 12% return (Table 2). Realistically, 10 years down the line you can expect a 10-12% dividend yield on cost with the stock a double.

Table 2: A DCF valuation for normal, best case and worst-case scenarios using FCF as input.

Figure 7: Historical trend of ROIC.

Investment thesis

A straightforward company to value that is in an essential but mediocre business. Not a business that you would expect is a multibagger, but slow, steady, predictable growth which every now and then would get derailed due to global slowdowns.

It’s a classic dividend buy. It will be hard to make money on the upside so buying it cheap is important. The tangible book value of INR 83 gives the absolute floor. If bought cheap, can be a good option to park money while one looks for better businesses. Certainly not a buy it and forget it kind of business if you want a compounded return higher than 10-15%.

Company news

Nothing noteworthy.

Catalyst

A couple of bad quarters can lower the price enough to give a good buying price. I would be interested at around INR 150.