100% this guy is siphoning money out from his business and into his own pocket. He’s on the low for a reason. The more he discloses the more likely it is he’ll get caught. Calling this poor corporate governance is an understatement, this is most likely fraud. All the large actors including the auditors are complicit, being blinded by gold.

bizarre, a Fortune 500 company, 1lac cr+ revenue, and playing market and duping small investors, should be punished to the full extent of the law, if found guilty.

Money Laundering is what i sense !

There are some serious issues within in company and now I found out about its recent credit rating rating report dated Nov 24, 2023, done by Brickwork ratings and it has reaffirmed ISSUER NOT COOPERATING* for the loans amounting to 1100 Cr., most of it is NPAs and it is not submitting any data about it. Also company has a pending NCLT case filed by the lender at Bengluru branch of NCLT.

http://bcrisp.in///BLRHTML/HTMLDocument/ViewRatingRationaleINCNew?id=124169

I have copied this from the rating report dated Nov 24, 2023.

Brickwork Ratings (BWR) had reaffirmed the ratings of Rajesh Exports Limited (REL or the company) at BWR D and continued the ratings to the ISSUER NOT COOPERATING* category on 25 Nov 2022 taking into account the continued lack of support from the management, continued NPA status of the account with the lender and based on the best available information.

The rating has fallen due now and BWR has consistently taken up with the company to provide financial and operational information for the periodic monitoring and surveillance of the ratings. Despite the best efforts of BWR to get at least the minimum required information for a review, the company continues to be non-cooperative. Further, the company has not been submitting the monthly ‘No Default Statement’ (NDS) in deviation from the extant guidelines. BWR continues to take note of the Company’s ongoing litigation in NCLT, Bengaluru Bench filed by its lender. Due to the continued lack of management cooperation and in the absence of adequate information from the company, BWR is unable to assess the company’s financial performance and its ability to service its debt and maintain a valid rating. Hence, based on the best available information, continued lack of management cooperation, non-submission of NDS and in terms of extant regulatory requirements, BWR has reaffirmed the ratings at BWR D and continued the ratings in the ISSUER NOT COOPERATING* category.

@Donald what do you think ?

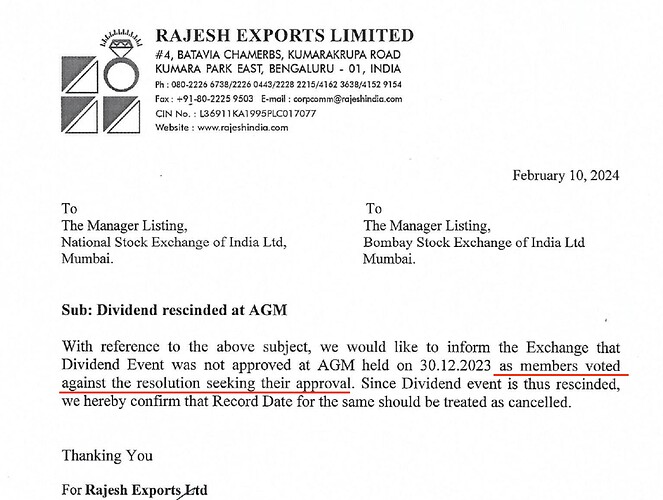

Loll never seen this happen. Atleast mention the reason the dividend was not approved.

Any suggestions or updates on this. I can not find any new relevant information for this stock anymore. Is it time to book looses?

Too many red flags.

TTM PAT decreased by 97%

Management is silent and doesnt do concall

Employees decreased from 135 to 111 in 2023.

Employee cost is 180cr, rather high for a non technical company. Although that may be justified.

4b039cc2-c648-47c4-9722-e3212b9cfb94.pdf (677.3 KB)

Any updated views on this company? They haven’t even published their Q3 results yet. No update from the management as well!

Yes , it seems mgt is not at all bothered about retail investor. I thought Rajesh Mehta is good ethical person but seems they are not at all bothered about retail investor. their website is also poorly desinged and not frequently getting updateda about latest news and all.

Infact, there are many such companies Not just this company where they raise capital from the retail investors and don’t bother to update or make the use of capital for what they asked for. As an Invester community we should take this and many such issue with SEBI. They should be held accountable for our money. SEBI should intervene and take actions such as audits.

Sebi doesn’t do anything. I have written multiple mails regarding a couple of fraud companies with proper details of dubicious transaction. But no revert from sebi.

Can you share the details with either Sucheta Dalal - foundation@moneylife.in from Moneylife or Hemandra Hazari - hkh@hemindrahazari.com -Independent researcher.

Both are well known investigative journalists and activists.

Finally they have informed that tomorrow (May 16) there will be a board meeting to consider Q3 results. Wonder when they will announce Q4 results!

This company is most likely fraudulent; Clues:

- Repeated disclosure lapses - NSE sought clarification in Nov 2023 after the company filed quarterly results without a cash-flow statement or a proper audit report. Similar lapses had been flagged in FY21-FY24 (missing cash-flows, delayed AGMs, late secretarial compliance filings, etc.)

- Regulatory scrutiny - SEBI told the company on 4 Dec 2024 that a “Forensic Accounting and Investigation Assignment” had been initiated; exchanges asked the firm to explain the audit and its trigger but no reply had been filed as of May 2025

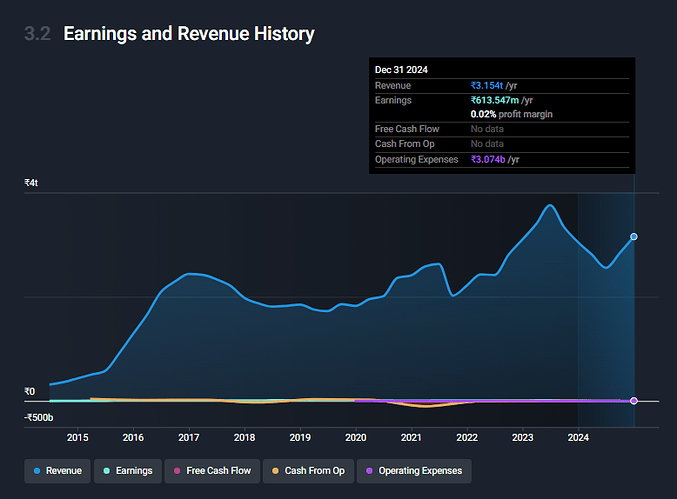

- Huge revenue (₹3.15 lakh crore FY24) on sub-1 % margins and chronically weak cash-flow conversion (CFO/PAT negative or far below peers).

- Very high trade receivables, repeated write-offs, and discrepancies between Q4 “full-year” results and final annual report figures.

- Primary statutory auditor is a small local firm (BSD & Co); no Big-4 involvement since 2018.

- Brickwork downgraded borrowings to “BWR D / Issuer Not Co-operating” (Nov 24 2023) after the company stopped sharing information.

Hopefully, SEBI concludes the investigation soon and de-lists this company.

No normal business can have margins like this - the operating cash flow / earnings seem to have been randomly made-up:

Disc: not invested; I never short-sell, as market can remain irrational longer than I can remain solvent.

Best,

Sharad

OpenSourceInvestor @ Substack

A lot of companies exist on our bourses which are fraudulent.

Considering the size of parallel economy in India. Investor interest is commonly sacrificed.

I have personally made it a point that no matter how attractive a company looks, if there’s a doubt on credibility and ethical aspects. I am out.

Then there are companies with bad reputation.

It makes sense to steer clear of them as well.

As an investment community. It is also our duty to promote only trustworthy companies. We should also call out such fraud companies.

However the damage is already done by the time such companies are called out. Money has already changed hands. So a severe punishment is the only thing that can discourage such things in future

Registering complaints with proofs on https://scores.sebi.gov.in/ might help. SEBI has to resolve these complaints in 21 days time.

Moreover, It records our complaints in writing. Anyone who takes up this matter legally can use it as a written record of proof that SEBI had information on this.

Finally less gap in sharing, quaterly results. June month company earnings will be shared on 19th sept.

Also fines imposed on various points.