Piramal’s entry into Solar business

AP is surely putting money to good use.

Piramal’s entry into Solar business

AP is surely putting money to good use.

Piramal buys 4 pfizer brands…

the article mentions that Ferradol has been in India since 1982. It was available much earlier because as a kid in the 1970s I used to ingest a lot of this delicious stuff on doctors advice!

Yes, my father owned medicine shop back in 70s and I used to help him as a child. I can remember selling lots of names like sloan’s balm and waterbury’s compound, ferradol etc. Piramal is trying to revive many old OTC brands, which is a unique strategy. If executed properly, it can bring good returns.

Demerger of healthcare and financial services division news in economics times

Can someone please explain how demerger would help those holding PEL. Thanks!

Hi Umang,

When the businesses are demerged, the PEL share holders will be entitled to shares in each de-merged entity. For example, in recent de-merger of Crompton Greaves into Crompton Greaves and CGCEL, shares holders of erstwhile CG got one share of each entity.

Most likely market may see the value of those separately listed entities differently (hopefully more) than how it views the PEL as conglomerate. That will mean more value for the share holders.

Hope that answers your question.

Thanks Raj, much appreciated!

Piramal eyeing Lafarge india business…he may use personal and family funds than via PEL

Piramal is eying tie up with TPG capital for stressed asset fund

Ajay Piramal is shrewd businessman and seeing huge opportunity in stressed assets /NPA on bank books. Most of these assets would be bad and there are always few which are valuable if received at throwaway prices.

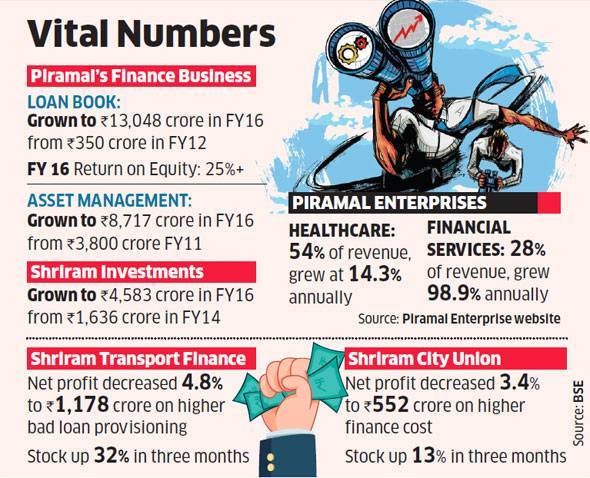

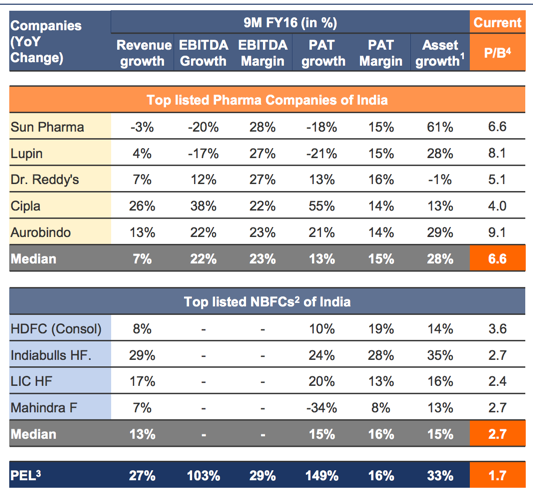

I invested 10% of my PF at 970. I discovered it here in this website, got conviction after going through the thread (especially after reading your valuation post in Feb’14 ) and going through the investor presentations. Would like to invest more for long term(more than 5 years) and I’d really appreciate if you can give your take on current company valuation after the results. Wondering what could be the value of this without the conglomerate discount (hoping he will split and list the parts in next 24 months). Based on the following info from Investor presentation, this seems to be attractive. Last couple of weeks it has gone up a lot and wondering if it makes sense to invest now… Thanks in advance for your help!

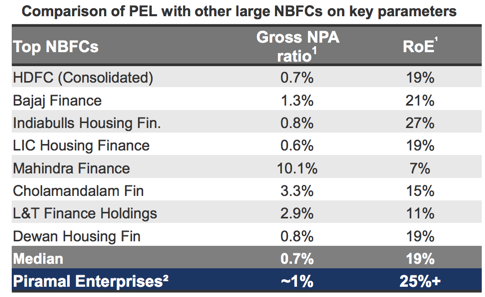

I would refrain from making comments on valuation considering the SEBI guidelines on research analyst. However, the right way to value PEL would be through sum of the parts basis especially considering that management has indicated its intention to unlock the value by demerging various businesses. Thus, NBFC should be valued in multiples of its book value; Pharma and information management business on Multiples of Sales or EV/EBIDTA (and management has already given some numbers in its presentation for peers of DRG business). You will be able to find both listed/unlisted peers against which you can benchmark the valuation. If you add this up, you will come to a number, which will provide you with a fair value of the individual business. Considering the level of disclosure and AR information, one can do this exercise relatively easily.

On whether at this level, one should enter or not depends on the return expectation and risk tolerance. Obviously, the margin of safety is much less than what it used to be at 800-900 levels. On the other hand, if you feel confident about the capital allocation skills of Mr. Piramal and sustenance of his track record of value creation (in the past he has done a stellar job on this over long period), you may want to partner with him in this journey even from current level. Personally, I feel he is one of the very few businessmen who has the right attitude, skill and temperament to generate long term compounding on one’s capital. Though, you may not get the delta on P/E expansion, you may still end up with very decent returns on the money you invest(over a long period of course!). At the same time, you should be willing to bear the period of under performance/volatility, because he has always been an “contra” guy and has bet against the market which creates short term negativity but yields superior return in long term.

Hope this helps.

Disclosure: Invested with very low average price with more than 10% allocation

Hi Dhwanil,

How can we get the book value of the NBFC business. I think, it’s not given in the latest presentation. Is there a way, we can derive from the information that’s already provided by PEL ?

Regards

While we wait for @desaidhwanil to reply, here is one of the crude method -

Average Yield on Loans = Interest Income / Average Asset

Average Asset = Interest Income / Average Yield on Loans

Average Asset = ~1650 / 0.17 = ~9706 cr

RoA = Net Profit / Average Asset

Net Profit = RoA x Average Asset

Net Profit = 0.07 x ~9706 = ~680 cr

RoE = Net Profit / Equity

Equity = Net Profit / RoE

Equity = ~680 / 0.25 = ~2720 cr

Book Value = Equity / No. of Shares

Book Value = ~2720 cr / 17,25,63,100 = ~Rs 158 (wholesale lending FS business)

Disc: I hold PEL shares since longgg.

@desaidhwanil Thanks for the reply! Answer is clear to me…Since I am in this for long term, I will accumulate more!

Book value for Piramal NBFC business has to be a derived number at the moment. I think the method suggested by @lustkills gives a good idea of ball park number. We can take this base and work from there.

On another note, going by the improvement in disclosure standards over last 2-3 years, we will get this number too directly from their presentations/AR. I have found their IR quite responsive, so we may suggest them to include the number (book value) and other relevant parameters for NBFC business in future presentations. I will pursue on the same line with them.

All, any idea why Piramal is showing weakness in a bullish market? Or is this mere profit booking.

Thanks Butun