As per the bloomberg and moneycontrol article…it says Piramal and TPG will be provided exit…piramal invested in 2013…this investment hasn’t been fruitful i think

It says TPG and Piramal and will be provided an OPPORTUNITY to exit.

TPG for sure wants to exit. Ajay will do if he gets an attractive price. Piramals went into it hoping that they will be able to control the companies in the group with their stake in the Shriram capital and the two listed companies.

But cultural differences have rocked the the two groups. Revankar was asked to leave STFC and Gujral was brought in and Piramals found Gujral a tough nut and brought back Revankar leaving a trail of heartburn.

Somewhere the two are looking for a mutually agreed divorce.Thiagarajan has stated that he wouldn’t mind Ajay continuing as chairman of the group even if he sells his stake.That is a giveaway on the likely course of future events.

Piramals need money to grow their business and the foray into real estate and housing finance has not yielded the desired results.Someone in the Shriram group told me Ajay handles investments in 149 countries and has little time to parent the Shriram group.

For Piramals the succession plan looks a little clouded now that his son is married into the Ambani clan.

For Shrirams they are keen to maintain their identity and would prefer a financial investor with a hands off approach.

Nowadays everyone want PEL to buy some or other stake in their companies

I am not surprised.The reports that Piramal wants to exit STFC and SCUF is linked to the greater requirement of funds by Piramal for his real estate and housing finance business and now the compulsion to help the son in law of Ambanis.

Once Shriram capital reverse merges with STFC and SCUF he will exit Shriram Capital also

The Shrirams know that he needs money in his finance venture which hasn’t done creditably.

Piramals could not get control of STFC and SCUF due to sharp resistance from the two companies.

The PE investors of Shriram housing finance also raised the conflict of interest of Piramal as chairman of Shriram and as Chairman of Piramal Enterprise and being in competing business and poaching of staff.

The Shrirams can see the writing on the wall.The Ambanis need a finance company to accelerate the growth of their retail business.Shrirams have steadfastly refused to be dictated by Piramal and hence this divorce and monetising of the investments in Shriram by Piramal.

Finally there is the role of SGurumurthy who has been an adviser to Thiagarajan for decades and the Ambanis know there is no love lost between them.

Gurumurthy wouldn’t like the Shrirams to be used by either Piramals or Ambanis and that has led to the decision by Piramal to exit the Shriram group.

Business needs capital given its growing at a rapid pace as opposed to it not doing well…

Hi friends,

I have a question regarding Rights issue for the compulsorily convertible debentures (CCD) of piramal. Would appreciate if anyone can throw some light on the below stated query.

I am having 1 CCD of Piramal which was converted to equity shares on April 22,2019 in the ratio of 40 equity shares for 1 CCD held.

Now they have an offer of rights shares for the CCD holders where one can apply for 1 rights share for every 23 equity shares held.The rights is coming at a price of Rs. 2,380 a share.

When I contacted Piramal asking if I can apply for more than 1 rights share in case where other CCD holders do not apply they clearly refused the same. This was their response:

“CCDs holder can apply only for Rights Shares which they are entitled and not for additional shares. Rights shares are reserved for CCDs holders in proportion to their entitlement as this pursuant to conversion of CCDs into equity shares”

Shouldn’t we be allowed to bid for more rights share in a case where other CCD holders do not apply?

Is it because of the gap in the market price that they are doing this?

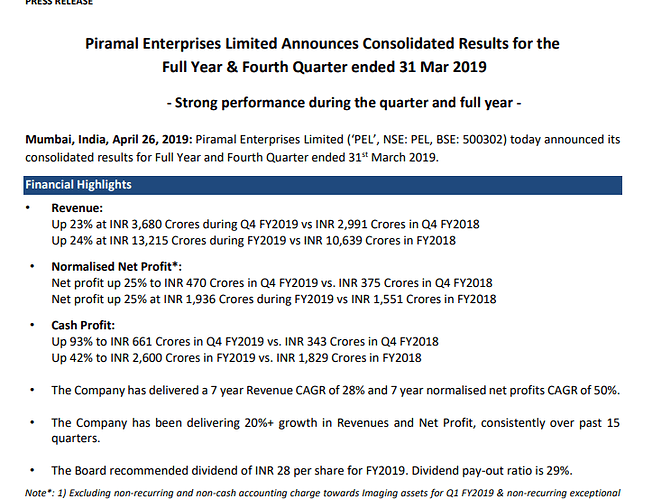

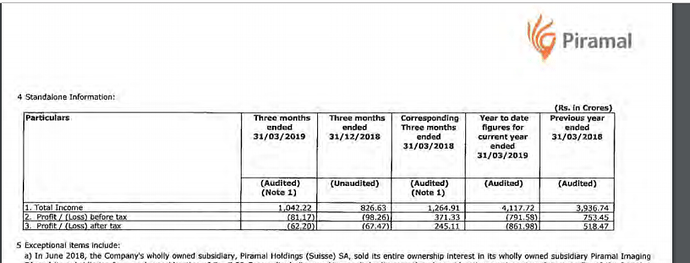

Please look at the consolidated result.

news share

I think the doubts/hypothesis that you are proposing needs to be validated logically in order to add value to the forum. I feel it is our collective duty to present an analysis/hypothesis/views supported by logical reasoning and supported by facts/figures or else the whole forum will turn into a highly opinionated debate which in the end will still not lead to any conclusion.

A different/deviant view or flagging or risks is more than welcome as it has been a great value add for the folks in this forum and has helped many of us avoid risky bets or do course correction where we had made mistake.

My understanding of the situation: First of all PEL has made it amply clear on call that they may considering buying " retail loan portfolio" of a company and will not buy the company. Moreover, they have also elaborated on contours that they have drwan in shortlising/buying that portfolio that includes quality of the underlying asset, valuation and the quality of the team that comes along with that. Hence, given such public statements, logically, it will be very difficult for them to go back and blame the “acquired portfolio” not being good.

If we go back and look at PEL’s history, their acquisitions have been in areas where either the company and/or industry is going through tough times and there is a “motivated seller” so that they get good value. I think a similar situation is prevaling in NBFC space where there are many motivated seller due to stress in the industry and hence looking out for opportunities gels in with their past track record. I do feel that in FS space acquisitons are riskier as the “see through” that one can have on problems associated with acquired company/portfolio may be much lesser. However, that in no way means PEL may be buying out a portfolio to wash their old sins.

Here are some thoughts to mull

-

Base-rates for success in lending is mediocre. Blow-ups are common in the medium-to-long term. This is why many wise gentlemen avoid financials.

-

Base-rates for success in risky-lending is even lower and only increases the odds of said blow-ups from #1.

-

Base-rates for success in real-estate is low and most of these business don’t even make returns over cost of capital in rolling 10 Yr periods

-

Base-rates for success in risky-lending to real-estate is bound to be lower further - this is how conditional probabilities work.

-

Base-rates for success when loan book grows in a sector that doesn’t itself grow at the same rate are very low. There is possibly ever-greening, rolling over and possibly incentive-driven fee/commission based sales involved. These do not contribute to economic value and are mere PnL/balance-sheet gymnastics, waiting to unravel.

-

What you are holding is worth what you say it’s worth, only if there is a buyer at that price. More often than not, when the going is bad, there is either liquidity crunch in the economy/markets or the bad loan book is worsening at a rate previously unforeseen, depressing what you have said it’s worth in the past.

-

When your RM, product, profits, commissions, equity, debt are all measured by the same unit, the fungibility of the unit makes accurate, verifiable measurements very difficult - if the intention is to obfuscate.

The above is not specific to PEL but applies to other NBFCs, PSU banks and also some private banks that lend to power, infra, real-estate etc. Retail is currently made out to be the holy grail in both liability as well as the asset side - while I believe this is true on the liability side, I don’t think manias will spare any assets in the long run (sub-prime crisis). Reckless lending is always just a bad incentive away.

Any view is welcome: postive or negative. However the author has to give the rationale behind it based on data/micro/macro… If it’s just an opinion there would be no difference between VP and the moneycontrol forum where posts like “This scrip is going to hit x price. mark my words” are the norm.

Concall link

Data does not always tell the truth. How many investors were aware of aggressive accounting practice of Yes Bank in case B/S is concerned…in fact RBI also has also given …All is Well certificate

But in case you are in twitter and read blogs of some good investors, people multiple times mentioned all is not well with Yes Bank and there are people who asked others just ignore those negative vibes…

Today Macquarie research publicly mentioned …that they were wrong. Just go and see Darshan Mehta’s tweet and UBS is the only research group which has consistently given Sell call based on Yes Bank’s aggressive accounting practice since 2015.

Hope people will not find this post offensive and ask me to withdraw.

Disc Invested in PEL…