Thank you for the notes, Sathish!

Transcript of Conference Call with Investors/Analysts

http://corporates.bseindia.com/xml-data/corpfiling/AttachLive/8EE0855D_EE06_4E30_80A1_6B11B740A27C_165423.pdf

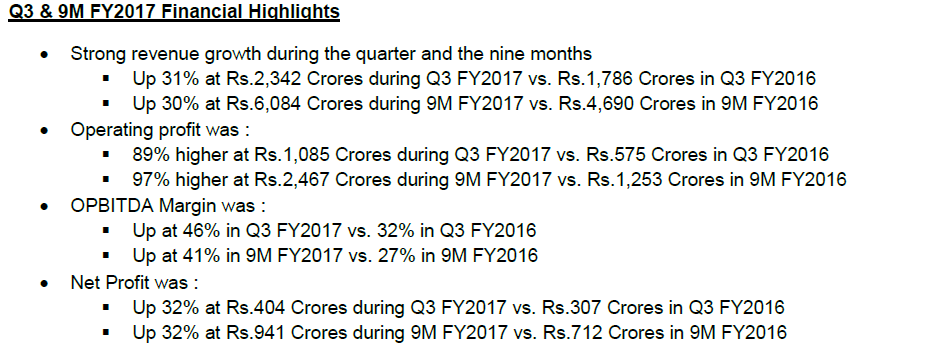

Excellent Q3 results from Piramal

see the attached link

Disc - invested for last 2 years

does anyone know Piramal’s yield from LRD business?

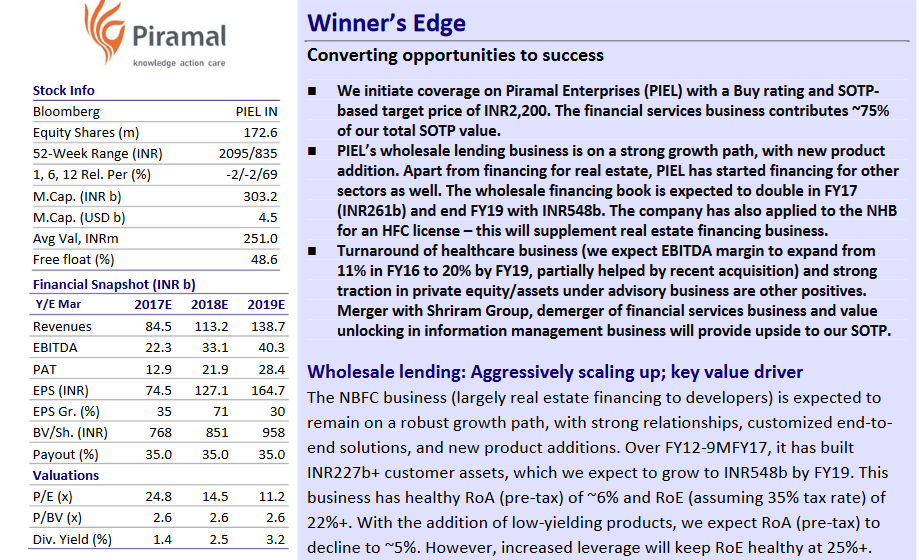

Piramal Enterprises : Motilal Oswal Initiating Coverage - Target Rs. 2200/-

Read More: institution.motilaloswal.com/emailer/Research/PIEL-20170217-MOSL-IC-PG038.pdf

One really has to appreciate Mr. Ajay Piramal for his excellent timing and business acumen skills !!!

If we look around currently all Indian telecom players are bleeding, but Mr. Ajay Piramal made 19% IRR on his Rs 5.8k cr investment in Vodafone IN by timing his exit to perfection.

All Motilal Oswal’s report can be accessed from this link

Piramal eyes 3rd spot in domestic OTC market by 2019

Consumer Products division has grown by 44% in 9 months to December 2016

Piramal Ties Up With Canadian Pension Fund To Invest In Real Estate.

Piramal COO Vijay Shah says they have sufficient cash for acquisitions

Piramal’s Structured Finance Group (SFG) credit disbursements continues

A Good read Link

Ajay Piramal deserves a podium place. Efficient capital deployment, along with long periods where he sat on cash, is something he has demonstrated, and benefited from, through the course of his career. In 1986, his Piramal Enterprises was worth Rs 7 crore. Over the next 28 years, all he raised was Rs 477 crore. But by spotting the right opportunity—he left the family textile business and entered pharma—and then deploying cash efficiently and returning it to shareholders, Piramal Enterprises’ share price has clocked a compounded annual growth rate of 34 percent since 1986. Clearly, firms trying to solve their surplus cash conundrum have a precedent in Piramal.

Piramal Realty to invest Rs 1,800 crore in new suburban Mumbai project

Piramal Realty has pre-launched its eight-acre project Piramal Revanta in Mulund and will sell homes at around Rs 12,000 per sq. feet.

is this a subsidiary of listed business?

11 to 12 % as per their investor docs

Shapoorji, Piramal look beyond CPPIB

Bus. Std 16-03-17

20170316a_004101002.pdf (93.9 KB)

Next gen of Piramal shaping up quite well and maintaining value system of AP

This is what I like in this company. Not only they have provided great shareholder returns over last many years but they have maintained business ethics and value system which is bit uncommon in Indian business. No wonder Foreign PE players line up to have tie up with Piramals.

Piramal adding capacities in US. Phase 1 of $25M investment in Lexington, KY plant is now complete doubling the filling line capacity.

http://finance.yahoo.com/news/piramal-pharma-solutions-augments-integrated-140000613.html