Q1 FY23 CONCALL 08 Aug 2022:

- Capex execution on track, Knitting and Weaving capacities to come within this financial year, spinning capacity will be added in Q1 and Q2 of the next financial year, new capacity can be fully utilized for man-made fibres also when required.

- Cost of debt long-term = 3% (state subsidized), new Debt will be at similar or lesser cost.

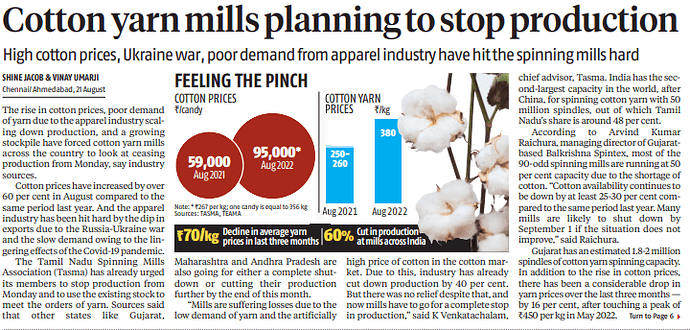

- Cotton price is 92000/candy, December Future @ 70000/candy

- Domestic cotton price is abnormally higher than the international cotton prices.

- Physical cotton not available domestically.

- It is uneconomical to sell the yarn by buying cotton at current market prices. As a result, during the quarter(Q2) expect the production to be lower.

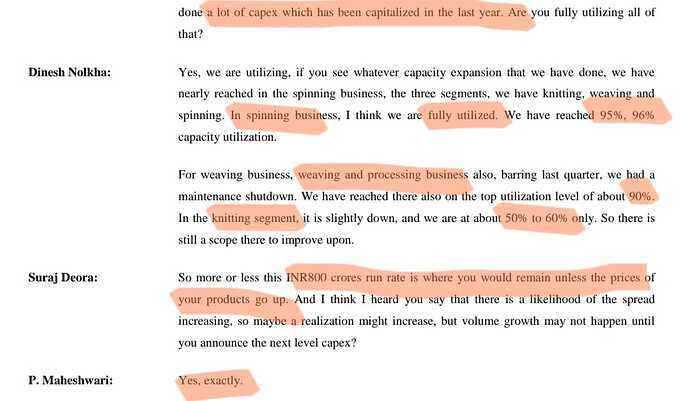

- Current capacity Utilization:

- Spinning – 70%

- Weaving and Processing – 90%

- Knitting – 50% (Normally its 75-80%)

- Guidance

- Q2 will be hardly break-even quarter

- Q3 – Demand & Crop uncertainties still there

- Q4 – Can expect to be normal

Notes from Q2 results call.

Capacity as of Sep 2022:

Spindles - 332000;

Rotors - 3488

Airjet Weaving Machine - 168

Circular Knitting Machine - 63

Production capacity as of Sep 2022:

Yarn - 75000 TPA → Proposed to add 1.55 Lacs of Spindles (totoal to be 4.87Lac Spindles) to make it 110000 TPA

Woven Fabric - 30 Mill meters → Proposed to be 40 Mill meters

Knitted Fabric - 8500 TPA → Proposed to be 11000 TA

CAPEX plan execution:

Weaving and knitting capacities will be ramped up within this year i.e. by end of 2023.

Spinning capacity will be ramped - 50% by Q1 2024 and other 50% by Q2 2024.

Debt drawdown for Q2 from teh planned 900Cr CAPEX was only 20Cr. Expect this to be 70-80Cr in Q3.

Export profile in H1 2022:

Bangladesh: 20%

EU: 24-25%

North America: 10%

South America: 10%

China: 10-12% but has come down due to 2-3% due to COVID situation

-

US demand has gone down due to inventory reduction pressure on customers due to perceived upcoming recession

-

EU demand has gone down due to their inflation and Euro depreciation situation causing the higher costs of imports

-

Demand for woven product is good while demand for knitted is not good. Latter is a cause of concern for management and working on it but no traction so far. Management is focusing on high value/high margin products to compensate the low demand for knitted fabric.

-

Capcity utilization is being ramped up slowly and will be to normal level by Jan 2023.

-

Business scenario still depends on the cotton season production and new produce levels, however the cotton cost is coming down though ncertainty exists. Demand pickup still remains an uncertainty.

-

In summary though situation is normalizing, there is still uncertainty remains in business environment. Expectation is it gets normalised in Q4.

In the recent Q2 FY24 concall, management mentioned that the interest cost is expected to be ~145Cr for next FY. This seems to be a huge jump as compared to the past. Though some jump is expected due to the recent Capex and the corresponding debt, but the number given by management seems to be unexpectedly high. I remember management had given the commentary earlier that they do not expect the overall avg interest rate to be more than 7-8% as they are using the different govt schemes for the low cost debt, hence this number seems to be much higher that what i can expect even at say 8% on ~1300-1400Cr debt.

Does anyone have any view on this - why figure of 145Cr? I am a bit concerned that this number has potential to depereciate the EPS to a large extent.

Disclaimer: I sold out this scrip in recent run up to book profit. However I may enter again if the price falls below say 300-290 as i think it may run up again as the textile industry showing signs of recovery and cotton prices have stabilized to a better level + the recently completed Capex is expected to give the boost to the revenue.

Q3 FY 24 Concall summary

BUSINESS

- Revenue for the current quarter was INR750 crores 40% YoY increase.

- Profit after tax for the quarter is INR31.75 crores

- Cotton prices have remained stable and marginally below international prices.

- Capacity utilisation is 90% it may go to 95%.

- Due increased capacity utilization and favorable cotton prices, margins have improved during the current quarter, the margins are not at the normal levels due to the pricing pressures.

- We are exporting nearly 100 million to 110 million kgs of yarn per month at the moment.

- our raw material costs are around 60%.

- Debt, total long- term debts are about INR1,000 crores and the short-term debts are about INR375 crores. repaying as per the repayment schedule, which is about INR130 crores, INR140 crores every year.

- EBITDA levels are in the range of 16% to 20%, that is quite a reasonable level where we can think about adding the capacities, especially in the yarn side. Whereas in the fabric side, it is on a higher side.

- This demand, this downturn which we saw in the last one year was because of the de- stocking. stock levels have been substantially reduced in the last one year. And that is, so they have reached a non-sustainable level.

- 15 months back, the cotton prices were like INR1,10,000 a candy, which is INR55,000

- We are consuming about 24%-25% yarn both in knitting and weaving. 20% on the woven side and 5% on the knitted side.

- increasing our inventory levels, especially on the raw cotton side because it is a seasonal product.

- Production of yarn, our rated capacity is about 110,000 metric tons. So traditionally, we should be able to do about 105,000 tons to 106,000 tons every year.

- The major increase in the margin expansion has been because of the reduction in the raw material prices.

MANAGEMENT GUIDANCE

-

At this point of time , we have not contemplated any major expansion.

-

interest incentives, INR20 crores every year, which is not being considered here in these numbers. Interest subsidy per annum will be in the range of about INR20 crores. So, it should be INR5 crores every quarter.

-

Secondly, we will also be eligible for capital subsidies, which will also be in about next 7, 8 years, we will be getting about INR200 crores plus of capital subsidies. Subsidiaries of 40 crores every year.

-

Bottom of the cycle, not expecting any further decrease in cotton prices.

-

We have already seen the lowest level of the raw material prices and there is no room from here to go down. At that point of time, normally people start increasing their stocks or bringing it to the normal levels.

-

much increase in the raw materials in the coming four, five, six months. Maybe they should remain at this level.

-

next financial year interest cost net of subsidies will be about INR90 crores.

-

depreciation INR36 to INR37 crores.

-

we would be, we are okay with 1:1 debt equity.

-

Our average cost of borrowing is about 6.5%.

RISK

- Global challenges are still prevailing due to which margins remain below the normal levels.

- I have not seen this kind of low cycle of 15, 18 months on a continuous basis for a long time.

- Unless something drastic happens internationally with regards to geopolitical situations.

Bangladesh Crisis Impact on Nitin Spinners:

Nitin Spinners has about 60% recevenue contribution from Exports market (About 1800 cr) and out of that 60% it exports about 20% yarn to Bangladesh (about 360 Cr) which comes out to be around 12% of sales figure (of about 3k cr) which might be impacted severely due to Bangladesh crisis. If the Management clarifies how much of business is impacted that will make more sense. Let us share here if there are management comments on the topic in any public forum. Thanks

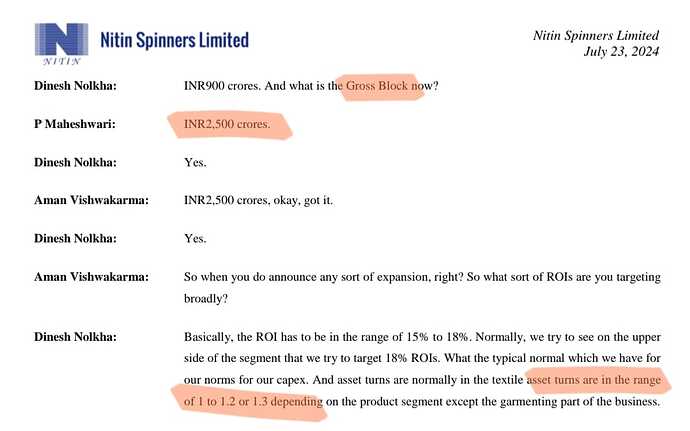

Revenue forecast as per management guidance and basic calculation -

Revenue for FY2025 : 3500 cr.

Quarterly run rate to be in the range of 800-900 cr.

Asset turnover ranges between 2.1, 2.2 and 2.3

Net block being 1700 cr also gives the same revenue run rate of 3500 cr.

This is the normal case scenario, bear case scenario will include Bangladesh crisis impact on the business.

Revenue for 2026 : 5500 cr.

Gross block valued at 2500 cr and taking asset turnover at 2.2

Management to fully utilize entire capacity expansion immediately.

This is the bear case scenario as the cotton industry is at trough phase in terms of price and demand. Realization is very likely to recover from here on which will result in more revenue and EBITDA margins.

Disc - not holding any position right now

https://indianexpress.com/article/business/economy/cotton-exports-to-bangladesh-hit-as-dhakas-western-garment-orders-dry-up-9542291/

Although I have not seen or heard anything from the management, I did come across this article today. This might help explain the recent poor performance of the stock - despite a strong Q1 results.

@Naval : where did you get this rev figure of 5500 for 2026 from?

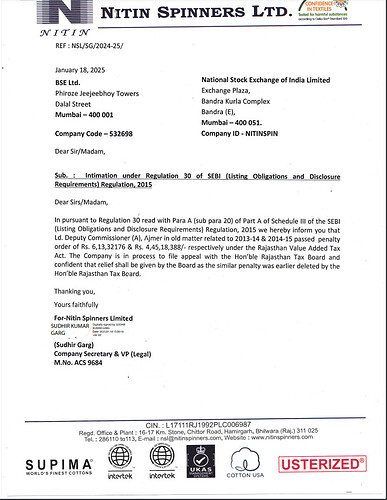

The Deputy Commissioner imposed penalties of ₹6.13 crore and ₹4.45 crore under the Rajasthan VAT Act for matters related to 2013-14 and 2014-15.

The company plans to appeal to the Rajasthan Tax Board, expecting relief, as similar penalties were previously overturned by the Board.

Nitin Spinners: Transition from Yarn to Fabric?

Read out our in-depth analysis -