Well, since my PF re-allocation in this market correction is over and now is my sitting time (boring too) unless there are really negative surprises, I’m going on looking at my investments from broader picture and overall sense as this give me vision to hold on during blips if the story is intact still. This may sound crazy, but I save the photos of the below top guns in my tracker, you could call it conviction building or face reading - crazy?

I also know that there are at least 3-4 other excellent stocks that I did not invest in. I did not because they will probably give as much return as my existing stocks and too many stocks will lead to concentration dilution both in my brain and PF. However, if any of the below were to disappoint me, I will look at these buffer stocks.

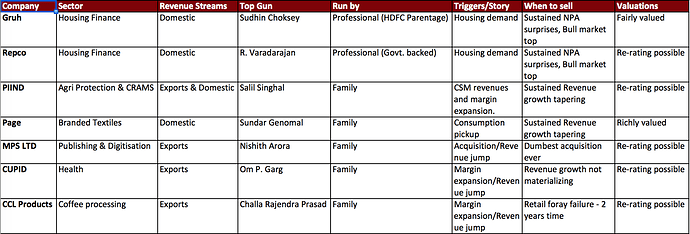

Interesting aspects,

- Majority are family run

- Almost equally split between domestic and export revenues (protection during both INR appreciation or depreciation?)

- 6 different sectors (good diversification? - not intentionally done though)

- Stock selection is bottoms up and not top down. Top down involves macro study, being sector expert, sector tailwind etc.

Something missing feeling within me:

- The fact that I do not have any stocks from Pharma even though I realise from broader perspective that few stocks from this sector could give good returns. As indicated earlier, I’m unable to understand what molecules will give revenue visibility what do not, the whole process of USFDA etc etc.