This is a relatively detailed and informative interview with Umang Vohra of Cipla. Some of the interview questions are quite good. This interview actually gives one the sense of where CIpla is planning to go over the next few years.

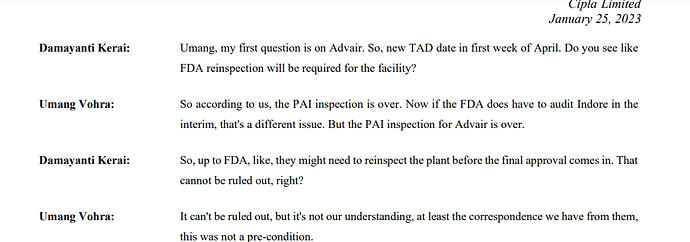

With Goa plant also facing observations and now these 8 observations for Pithampur plant, will

Cipla find it difficult to launch Advair by April as earlier planned??

Since someone bought it up, I was actually wondering why a company like Cipla finds it so difficult to pass such inspections. Are they negligent, or are the inspections just extremely demanding? Or is there some other issue that I am not aware of?

Surely in the light of the importance of these inspections, the company should do everything it could to make sure it passed without issue?

Also, is this the reinspection (audit?) that is referred to in the earnings call quoted above? As in “So, up to FDA, like they might need to reinspect the plant”? If so, it seems that Umang Vohra was not expecting this?

Good results by Cipla for Q4. Looks like it is well poised til 2025 with both India and USA biz seeing good traction. Only caveat is that FDA issues should be managed well and shouldn’t go out of control.

Cipla Q4 and FY 23 ending concall highlights -

Full yr results -

Sales - 22753 cr, up 5pc ( up 11 pc adjusted for COVID products )

EBITDA - 5027 cr, up 22 pc

PAT - 2984 cr, up 13 pc

Q4 results -

Sales- 5739 cr, up 9 pc

EBITDA- 1174 cr, up 20 pc

PAT- 708 cr, up 12 pc

In Q4 -

India business (branded generics+trade generics+OTC) grew 16 pc adjusted for COVID sales

US business sales at $ 201 million, up 27 pc

SAGA (South Africa+ Africa general)business de grew

in Q4

R&D at 371 cr, up 15 pc yoy. Currently at 6.5 pc of sales

India OTC sales crossed 1000cr in FY 23 (their return ratios, in some time will be better than any Indian FMCG business)

FY24 geography wise sales break up-

India-9869cr

North America-5909cr

SAGA ( SA + Subsaharan Africa)-3166cr

Intl Mkts ( Europe + RoW )-3028cr

APIs-134cr

India branded growth (ex Covid) grew 13 pc vs 8 pc Mkt growth

Chronic share in India business improved by 300 bps to 59 pc vs 56 pc YoY

21 Indian Brands in top 300. Each of these are 100 cr plus brands

In trade generics, there are 08 brands clocking 50 cr plus revenues

Have licensed Novartis’s Diabetic combination drugs(Galvus) that clocked 250 cr+ revenues last yr for India

Also entered into an agreement to market Scapho (injectable) … a monoclonal antibody used to treat psoriasis for India

Acquired Endura Mass for India consumer business

Added 800 MRs in India

Three complex generic products in pipeline. Filing to commence in FY 24

FY23 Gross Margins at 64 pc

ROIC for FY23 at 23 pc

EBITDA margins at 22 pc

Full yr EBITDA and ROIC includes high RM prices in first 8-9 months of FY23

Gross Debt at 783 cr

Should see significant growth in US business in FY 24. $ 190-200 million should be the trajectory for US base business. This translates to a sale of 6260-6560 cr annual sales vs 5909 cr in FY 23

India OTC business is skewed towards summer months

Expect Advair launch in 12+ months in US

All big products for US Mkts to be filed from 2 sites to de-risk the business

Investing heavily in respiratory and peptides portfolio for next 3 yrs

India business to see impact of price hikes taken by the company in Q1

Continue to be bullish on Galvus sales going fwd

Another 200 or so MRs to be added this year

Revlimid numbers are already in the company’s US business performance

Albuterol is growing well in US

Cipla holding 18 pc mkt share of Lanreotide Injection

Strong growth in Tier-2 to 6 towns in India specially in Respiratory and Anti-Infectives

Aim to hit 22 pc EBITDA margins in FY 24 as well

Simbicort Inhaler to be filed by Q4 of FY 24

Respiratory revenues from US at around 1400 cr range vs total US sales of 5900 cr

SAGA mkts to show some growth in FY 24 plus improved margins

Current cash balance around 5500 cr. Aim to invest most of this in India business

Disc: Hold a small tracking position… mostly for trading purposes unless US Mkt’s pricing pressures go away ( US, by the way is reporting highest drug shortages since 2012-13 ) or they end up acquiring some good India focussed Assets with the 5000 cr+ cash they have on the books

I understand that Cipla in not facing major pricing pressure due to niche portfolio. Any insights you got from con call regarding pricing pressure for Cipla portfolio.

There was no direct question on that. But their confidence on maintaining at least $ 190-200 million base US business did, in a way indicate that their portfolio is not facing too many pressures

Plus the drug shortages in US are at 10 yr high. So …maybe we can take a leap of faith here

Good set of numbers from Cipla

Revenue +14%

EBIDTA +25%

PAT +32%

US revenue run rate of 230M USD - Up 18%

CIPLA Ltd -

Q4 FY 24 results and concall highlights -

Revenues - 6163 vs 5739 cr, up 10 pc YoY

EBITDA - 1316 vs 1174 cr ( up 13 pc YoY, margins @ 21 vs 20 cr )

PAT - 932 vs 522 cr

R&D spends @ 444 cr, @ 7.2 pc of sales

Segment Wise revenue break up -

India - 2417 cr, up 7 pc

North America - 1876 cr, up 11 pc

South Africa - 560 cr, up 26 pc

EMs - 830 cr, up 5 pc

APIs - 190 cr, up 40 pc

Total Debt @ 560 cr

Cash on books @ 8270 cr. Company is open to inorganic growth initiatives

Investments made in FY 24 -

Acquired Actor Pharma in South Africa for 400 cr. It has a portfolio of branded generics and OTC brands in SA

Got into a marketing and distribution partnership with SANOFI to distribute 06 of their CNS brands in India

Acquired OTC brand portfolio of IVIA beauty and Astaberry in India for 130 cr

Company has 21 brands ( branded generics ) in top 300 brands in IPM. These brands have a turnover > 100 cr each

Company has a booming Speciality - InLicensing business with FY 24 sales @ 761 cr. Last 5 yr CAGR here has been @ 39 pc

In addition, company has 5 OTC brands with sales > 100 cr / yr. These are - Omnigel, Nicotex, Prolyte ORS, Cipladyne, Cofsils

North American product pipeline -

Respiratory pipeline - 05 assets filed assets in last 12 months. Going to file 02 more assets in next 12-15 months. Major launches expected in next 12-15 months

Peptides and Complex generics - 12 assets already filed. Going to file 08 more assets in next 1-2 yrs. Multiple launches expected over FY 25-27

505(b)(2) assets - have filed 02 assets. Launches expected in next 1-2 yrs

Company has reached no 1 spot in the prescriptions business in SA

In India, Chronic portfolio’s share is now at 61 pc. Chronic business has a far superior gross margin profile vs Acute business

Company has hit 20 pc mkt share in Lanreotide

( injectable peptide - a 505(b)(2) products )and 13 pc Mkt share in Albuterol ( complex generic - inhaler ) mkt

Guiding for an EBITDA margin band of 24-25 pc for FY 25

30 pc of company’s total revenues come from Respiratory products

Company has set up a manufacturing facility in China. Have got US FDA approval for the same. Have spent aprox 430 cr to set up that facility. Also looking to penetrate / expand into the Chinese market

Company is likely to see 2 more years of strong Revlimid sales ie FY 25, 26

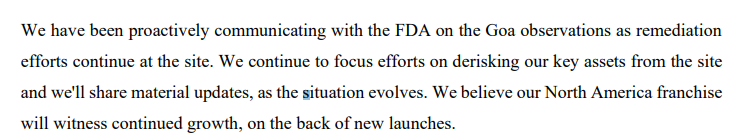

Company’s Pitampur and Goa plants are yet to resolve their USFDA issues ( warning letters ). Once company resolves these regulatory issues, there could be significant bump up in the US business ( company expects Goa resolution and commencement of supplies only towards the end of FY 25 )

R&D expenses to continue to remain in the band of 6-7 pc of revenues

Disc: holding, biased, not SEBI registered

[quote=“Mayank.mail, post:65, topic:34567”]

With Goa plant also facing observations and now these 8 observations for Pithampur plant, will

Cipla find it difficult to launch Advair by April as earlier planned

[quote/]

Could this be connected with the recent resignation of executive vice chairperson??