Good book I read it, for me most words and terminology used was like I was batting on Perth pitch

Cosmos, Carl Sagan, 1980 - I like books which are multi-disciplinary and Cosmos is one such as it goes beyond astronomy/astrophysics to molecular biology, game theory, mathematics, history, geography, philosophy, spirituality and anthropology - probably the only way to view something as infinitesimal and infinite as the cosmos. The ride is exhilarating as we shift perspectives from a telescope to a microscope to a mirror and sometimes perspective shift by shifting the vantage point, both in space and time.

Another thing Sagan does beautifully is to describe proportions, be it of distance or time in a way that is easy to visualise so that the vastness of space and time is not linear or flattened but has the depth and density. It is amazing that from venturing out across the seas only a few centuries ago after discovering (reaffirming rather) that the earth was round, we have sent space probes that have now traveled as far as 13 billion miles (Voyager 1) in such a short time (500 odd years is such a short time in the grand scheme of things).

Sagan is bitter in more places than one in the book for the burning of books in the library of Alexandria and the onset of the dark ages that lasted a good 1000 years that set back science and set loose superstition until Copernicus, Kepler and Newton revived the scientific tradition and set the ball rolling towards the industrial revolution and the space age. 9/10

Hi

Couple of more books I read in the last month or so:

-

Factfulness

Helps one look at viewpoints objectively. Though this focuses on global healthcare but what we can carry from this is a questioning mind. An important read and makes one feel optimistic. -

Astrophysics for people in a hurry

I see Cosmos as a recommendation one of my favourites in childhood. But this one is a real short compressed version of the Big Bang theory.

one of my favourites in childhood. But this one is a real short compressed version of the Big Bang theory. -

Zen in the art of archery

Got this as a recommendation on twitter. A very short book but requires slow reading. Again an important read for us. -

Endurance

This has become my favorite adventure book now (earlier it was Annapurna). If you were to read one non investment book this year let this be the one. Learnt more about the indomitable human spirit, near flawless teamwork and inspirational leadership in these pages than any real experience so far. -

Between Parent and Child

Very good advice on how to bring up a child. Unknowingly as a parent we commit errors which can have a long term impact on a child’s attitude. Have underlined portions and handed it over to my wife.

Rgds

Deepak

The Fifth Discipline, Peter Senge, 1990 - I was always interested in seeing the holistic picture, of how the parts interacted with each other, of what short-term fixes did to a system in the long-term (say side-effects of a medicine that addresses the symptoms), or an intervention/incentive did to the ecosystem (what MSP in sugar is doing to the farmers, mills and waterbodies), thought experiments in manipulating variables and speculating on outcomes in a dynamically complex system etc., so this book piqued my interest as it pioneered systems thinking at an organisational level. I absolutely enjoyed the first part of the book on systems thinking archetypes of “limits to growth” and “shifting the burden” and several related archetypes like tragedy of the commons, success to the successful, erosion of goals etc.

For someone interested in some of the archetypes, read on (the examples are mine) - limits to growth is when a positive feedback loop (reinforcing process) inevitably meets a balancing process (negative feedback) - eg. sales and market saturation, learning a new sport where skills are picked very fast early on but slowly later on, mining cryptocurrency etc. shifting the burden is when a short-term solution is used to address the symptom successfully and is repeated without seeking fundamental solutions leading to catastrophic effects - eg. alcohol and stress, deficit spending, debt refinancing etc. tragedy of the commons is when a shared resource is used by members of the system for their individual benefit successfully until the shared resource dwindles and it ends up affecting everyone in the system. success to the successful is when the winner in the system accesses more resources as a result of that success while the loser continues to lose - income inequality. erosion of goals is when parameters for success are redefined to remain successful - govts do this all the time, as do individuals.

I did not particularly care much for a bulk of the management related topics on openness, localness, shared vision, team learning etc. which could be very useful to someone leading key position in a large organisation. I had to trudge through these like a man stuck in a swamp but I managed to wade through to safety. I did however enjoy the parts on personal mastery and mental models. 8/10

I liked your notes on books you have read . I am curious to know about your reading style. Do you take notes while reading? I tend to forget the theories, interesting idteas in books.

I don’t take notes, annotate or even use a pen, pencil or highlighter when reading. I re-read interesting sections a few times (I am a very, very slow reader) and put the book away and mull over it. I take lots of breaks every few pages and this allows me time to absorb the essence of it.

Once it is absorbed, I feel it becomes part of your latticework of mental models and unconsciously affects the way you think. For eg. thinking fast and slow has changed so many aspects of my life from portfolio management (money management, risk management), trading psychology, general decisiveness to spirituality. When I sit back and think, I can point to the sections of the book the thoughts and ideas stem from but not during the process of it (happens subconsciously). I believe this is how each one of us is and there shouldn’t be a need to remember - it becomes part of you.

The Most Important Thing, Illuminated, Howard Marks, 2011 - This book is quite famous among the equity investing community and not without reason. It talks of second-level thinking, market efficiency, value vs price, market cycles, economic cycles and the distinction and relationships between the two, contrarianism, a bit of investing psychology which it briefly touches upon, the importance of patience, aggressive vs defensive investing, the role of luck and skill and how the two tend to get mixed up irrevocably and my favourite of all - risk - understanding, recognising and controlling risk - in three distinct chapters.

Having read a fair number of memos online on oaktree capital website and other derivative works and from personal experience, there wasn’t much here new but sometimes reiterating what works, has worked and will in all probability work for a long time to come, isn’t a bad thing. The problem I had with this book is the repetitiveness - For a book based on memos written over many years which are already famous by their own right, this doesn’t add a terrible lot more over them. Marks describes what he has already described so well in his memos and to add to the annoyance the ‘illuminated’ edition has almost completely worthless annotations by joel greenblatt, christopher davis, paul johnson and seth klarman. This will however be one of the best books for beginners alongside one up on wall st. and the little book that beats the market - the two other beginner level books I have read. 8/10

Hi

Three books I read in the last few weeks which I thought to share.

-

Shoe Dog

It was a brilliant read about how Phil Knight started to build Blue Ribbon then Nike from scratch and what tenacity he displayed in life. The last 50-75 pages is inspiring. -

The Subtle Art of Not Giving a F*ck

Good light read. The essence in our words is ‘Bhaar me jaye duniya hum bajaye harmonia’

-

Thinking in Bets

It is important to also share books which one doesn’t like. I feel this book could be written as a 2 pager document. Very poor. Must avoid.

Regards

Deepak

Deep Simplicity, John Gribbin, 2004 - It is hard to classify a book such a this that interweaves thermodynamics, biology, systems thinking, chaos theory, fractals and power laws and yet makes it so interesting that its unputdownable. A complex system with seemingly random variables and events could sometimes be summarised by very simple rules - like the unpredictable and random movement of molecules of gas still yielding to rules of temperature and pressure. as feynman says, someday all the complexity of the universe might be explained by something as simple as the rules of checkers.

There is a deep dive into fractal geometry in the book in terms of discussing the koch snowflake, calculating dimensions and explaining the fractal nature of so many things in life - from borders of countries to stock market price movements. There are a lot of examples of how things get very interesting at the edge of chaos, from eddies in a river to dripping water taps to noise on a telephone line. The lorenz attractor, concept of phase space, systems in equilibrium, period doubling and some things which were entirely new to me - lovelock’s gaia hypothesis and turing’s morphogenesis - excellent models for understanding how life may have originated on earth. phenomenal book that would complement dawkins’ the selfish gene in understanding life. 10/10

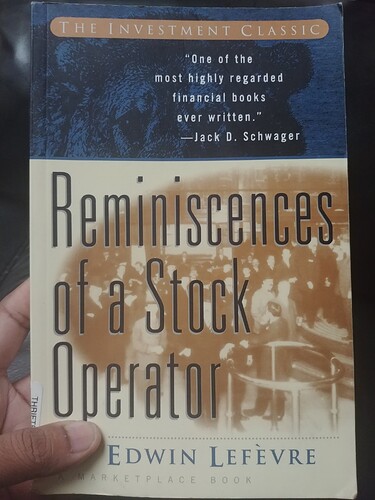

Reminiscences of a stock operator, Edwin Lefèvre, 1923 - Its fascinating that this book was written almost a 100 years ago based on experiences even older than that and yet its relevance today hasn’t diminished one bit in all its years of existence. “There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again”. True to that quote from the book, nothing really has.

The tape is now the ticker, people speculate on anything and everything that may or may not even have an underlying value. Tip seekers continue to remain tip seekers and the sucker class has burgeoned. Mass hysteria, manipulation, liquidity crunch, stock splits, expensive bull market IPOs, paying the fee for one’s foolishness - absolutely nothing has changed. There are instances depicting authority bias, cognitive dissonance, confirmation bias, sunk-cost fallacy, endowment effect - all laid out almost as dispassionately as the instances when things go right, as long as the price paid for the mistake was worth it. I absolutely loved the last part of the book on operating the markets, market manipulation at an institutional level to market a common stock.

This book is based on the events in the life of Jesse Livermore (fictionalised as Larry Livingston). Unsure of how much creative liberty the author took in the “fiction” bit, but it makes for a fabulous read, written in a simple language of the time, reminiscent of a Hemingway or Maugham, and that is some serious high praise. 10/10

For a long time I have been admiring at the list of books you’ve been recommending in this forum and all posts that you make which is equally superior to all other posts I’ve seen in this forum. Im a little curious as to know from where do you source the recommendation of such books if it is the case and hope I’m not offending you in any way.

Thanks in advance

@phreakv6

Thanks for the kind words @cathene. Most of the books I read are from the bibliography/further reading sections of the books I read. Some of the investing related ones are from VP. Few are from goodreads/amazon recommendations. I keep a wishlist and add interesting books to it and tag a book to pretty much every amazon purchase. This helps in building an anti-library which eggs me on to read more and to continue reading. Recently I found that there is a word for this condition - tsundoku.

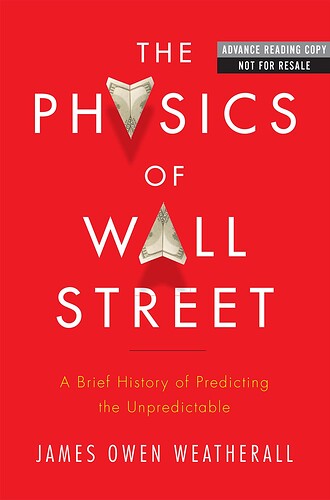

It was just pure coincidence that I stumbled upon this book while doing a random search in LibGen. Good ratings on Amazon.com propelled me to have a glance at it.

The introduction starts with Jim Simons’ journey from being a Mathematics Professor to the chairman of Renaissance Technologies, one of world’s most successful hedge fund. Then it proceeds to talk about influence of Physics and Mathematics to the field of Finance and Investment. It starts with a Chapter on the work of Pascal, Fermat and Bernoulli work on the field of probability and its use in gambling, thereafter proceeding to Bachelior’s work on random walk hypothesis.

In subsequent chapters, it moves to works of Osborne and Mandelbrojt talking about normal distribution, log normal distribution and fat tail Mandelbrojt distribution in asset prices. Afterwards, it moves towards expedition of Thorp and Shannon in the field of gambling theory.

Later on, the journey towards Block Scholes Merton model of option pricing and the usefulness and limitations of it. Finally the book goes towards chaos theory in predicting market crashes and gauge theory predicting inflation.

In the epilogue, the book tries to defend mathematical models and the use of mathematics/physics in the field of finance against the criticism of Nassim Taleb and Warren Buffett.

The first half is really enchanting, second half a bit less so. But still, over all a good read. Recommended for anyone acquainted with the works of Taleb and mathematical model of financial assets.

Goodreads rating : 3.79/5 (1092 Ratings)

Sort of explains why I hang around threads where I will never invest. Been a bit slow in reading lately due to work on phreakonomics. Hope to resume soon.

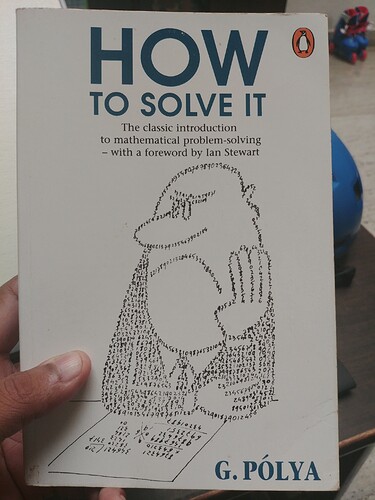

How to solve it, George Pólya, 1945 - This was a nostalgic read as I enjoyed revisiting algebra, logic, geometry, progressions and so on and it reinforces the principles of problem-solving, not just in math but in all aspects of life. The book addresses both the student and the teacher and I liked that approach as problem-solving has to be approached from both these standpoints and it is important for the teacher to induce the solution from the student in the least intrusive way.

It boils down to understanding the problem, devising a plan of attack, executing it and then reviewing it to see if it could be done more efficiently. Some of the tips like solving an auxiliary problem trying use its solution, introducing a variable to see if it helps the solution, solving an analogous problem (human-beings do this intuitively and its something to be wary of in fact as it induces cognitive ease), decomposing/recombining, generalisation/specialisation, working backward (like Munger’s inversion) are useful in a lot of real-life scenarios, including investing. 9/10

Thank you for sharing your list of books.

Can you suggest any book that discusses skills/ground rule around “From Planning to Execution” ?

Hi

Two of the books which I re-read recently after many years. Both these books makes one look inwards and think deeply on what is life, how one should pursue it, what principles should govern decision making, how one should observe, how not to say or say things, how to be cognizant of the final end and many other learnings.

If one is interested in Buddhism the book by Thich Nhat Hanh is the one to read for certain.

Rgds

Deepak

Mastering the Market Cycle- Howard Marks

Essence of the book- understanding the current position of market cycle will help us position our portfolio either in an aggressive manner or defensive way, by choosing appropriate asset class and generate great returns. Being aware of the market cycles would generally deliver great results only during extremes (either over optimism or over pessimism). Superior investors does not in any way know future outcomes better than an average investor. They are only better at identifying position of the pendulum swing (which they will not get 100% right all the time) and accordingly decide their course of action. More than anything else, they are prepared to be lucky by waiting patiently for adequate MoS before buying a stock. Cycles are definitely not series of events that follow each other in a pre defined manner. So, a long downward spiral may not quickly be followed by an equal and opposing upward swing. Markets may remain irrational for a longer time than one 's expectation (current state of Indian markets).

Having read The Most Important Thing and HM memos, I am bit disappointed with this book. Got a deja vu feeling while reading some parts. May be, his memos and earlier book have set the bar too high and expectations did not match with the outcome  Like all the great works, may be multiple rereadings may bring out more wisdom.

Like all the great works, may be multiple rereadings may bring out more wisdom.

Hi

Have been a slow reader in this month. But one of the interesting books I read which was highly recommended to me becasue of my work area in startups as ‘Bad Blood’ by the Wall Street Journal’s John Carreyrou.

In summary it’s written like a gripping thriller and I read in one sitting late into last night. It is about the company Theranos (stood for Therapy+Diagnosis) which claimed to detect multiple ailments by a needle prick worth of a blood drop. How the founder Elizabeth Holmes lied her way through. Its horrific that investors in this company even the famed ones didn’t ask basic questions and were swayed by the ‘charisma’ of Holmes. They should read the book ‘Spy the Lie’ ![]()

I heard that this is being made into a movie by the guy who made The Big Short.

Rgds