Summary part #2 of The Unusual Billionaires- covering Marico, Page Industries and Astral Poly (have not summarized Axis Bank and HDFC Bank due to Financial Services being more “opaque” than other businesses like manufacturing)

Marico: From a Commodity Trader to an FMCG Giant

Phase 1: 1972–91 Establishing Parachute and Saffola as Consumer Brands

-

When he (Mariwala) joined BOIL, both the brands were doing reasonably well, but remained business-to-business (B2B). Mariwala wanted to switch to a higher-margin, business-to- consumer (B2C) model. He started with small steps such as switching packaging from bulky tin cans of 15 litres to smaller packs of 100 millilitres. He followed this up with seeking professional help in four critical areas: advertising (hired Clarion Advertising agency for the Parachute advertising campaign), marketing (sought advice from renowned professor Labdhi Bhandari of IIM- A), human resources (sought advice from his friend Homi Mulla, HR head at Monsanto) and distribution (recruited Basutkar, a veteran from Hindustan Unilever). Consulting professionals would become a defining trait for Mariwala and a founding principle for Marico.

-

By 1991, Marico became the market leader in edible oils commanding about 14 per cent market share. ITC came a close second with a market share of 12 per cent.

Phase 2: 1990–96 Laying the Foundation for a Sustainably Profitable Edifice

-

Harsh Mariwala realized that there was no synergy between his B2C and the other BOIL businesses, which were pure B2B.

-

Marico pushed dealers to achieve stretch targets and rewarded them with foreign vacations—a first in the FMCG sector at that time.

Phase 3: 1997–2006 David (Marico) vs Goliath (HUL)

-

By this time, Marico’s success in Parachute had put the firm on the radar of consumer giant HUL

-

HUL started with aggressive advertising and sales promotions for Nihar and Cococare. Parachute responded by increasing distribution and improving the packaging and product quality to avoid any loss of market share. In 1999, Marico also acquired Oil of Malabar and relaunched it with a lower price tag to compete with HUL. After failing to make inroads into the category despite several product relaunches, HUL finally gave up and put Nihar up for sale in 2005. As poetic justice, Marico acquired the brand for Rs 220 crore, giving it more than 80 per cent market share in the perfumed coconut oil category along with stronger geographic presence in the erstwhile weak markets of north and east India.

-

Marico introduced several new brands over 2000–05. Not all the new launches were successful. However, these launches helped the company reduce its dependence on its existing portfolio of Parachute coconut oil and Saffola edible oil.

-

In 2000, Marico increased its focus on IT and decided to implement the Enterprise Resource Planning (ERP) and Supply Chain Management (SCM) suites from SAP, one of the first FMCG companies in India to implement both the packages.

Phase 4: 2007–12 Pursuing Inorganic Growth

- On the international business front, Marico had become a significant player. In Bangladesh, it had 67 per cent market share of coconut oil. To fuel its ambition of becoming an emerging market FMCG player, Marico made several acquisitions over FY07–13

Phase 5: 2013 onwards Change of Guard and Focus Back on ROCE

-

In order to cross-pollinate products and know-how between Marico’s Indian and international businesses, Marico undertook a restructuring of its businesses in January 2013.

-

Marico’s domestic and international businesses were merged to create one FMCG business while Kaya was demerged from the FMCG business in order to allow it to run in an entrepreneurial manner as a retail business.

What is Marico’s Secret Sauce? Section 1: Focusing on the Core Business

Since the firm’s incorporation, Marico has consistently focused on three key factors which drive a consumer staples company’s growth rates:

(i) maintaining brand leadership;

(ii) extending winning brands; and

(iii) divesting low-margin brands.

Protecting winning brands and maintaining leadership:

-

HUL entered the coconut oil category to take on Marico.

-

Marico retaliated by relaunching Parachute:

(a) with a new packaging;

(b) with a new tag line highlighting its purity (Shuddhata ki Seal—or the seal of purity);

© by widening its distribution; and

(d) by launching an internal sales force initiative.

-

This leadership has ensured that when one visits the hair oil section in a retail store, about 80 per cent of the shelves are occupied by Marico-branded hair oil.

Divesting low-margin brands:

-

Despite Sweekar’s success, it had low margins. Subsequently, Sweekar was divested in 2011 to Cargill India.

-

Marico’s single-minded focus on Saffola has made it the market leader in premium edible oils (FY15 market share of 58 per cent).

Extending winning brands across categories and geographies:

-

Marico has chosen its turf carefully for extending its winning brands. Given Parachute’s success, Marico has focused on hair nourishment where it believes it has the ‘right to win’—a term frequently used by Marico employees. Similarly, Marico saw Bangladesh as a right-to-win market since consumer habits in Bangladesh are similar to those in India.

-

Marico is the market leader in coconut oil in Bangladesh with a whopping 80 per cent market share.

Section 2: Deepening the competitive moat

Innovation

- Marico has a strong culture of innovation which can be seen in several areas: packaging, products, HR, and finance.

Packaging innovation:

-

In the 1980s, in a first in the category, Mariwala innovated with plastic containers, to replace the unwieldy, bulkier tin containers.

-

Within fifteen years, 100 per cent of the market changed to plastic packaging.’ The savings generated from the low-cost plastic packaging were invested by Marico into higher advertising and publicity spends to drive market share gains.

Product innovation:

-

It follows the concept of strategic funding where a portion (around 10 per cent) of the annual profits is invested in pursuing product innovation.

-

Seeing the growing trend of light hair oils in the 1990s, Marico innovated and launched Hair & Care, Parachute Jasmine and Shanti Amla. Each of these brands is at least Rs 200 crore in size and has helped Marico become the market leader in value-added hair oils, ahead of other credible manufacturers such as Dabur, Emami and Bajaj Corp.

Financial innovations:

- Despite having strong brands, Marico was still perceived as a commodity company, given its vulnerability to copra—a key raw material whose prices were cyclical in nature.

Brands/Reputation

-

In FY15, Parachute had sales of more than Rs 2,000 crore and controlled more than 55 per cent of the coconut oil market.

-

Saffola’s FY15 sales were Rs 880 crore, with the brand controlling 58 per cent market share in the premium edible oils market and more than 65 per cent of the flavoured oats market.

Section 3: Controlled capital allocation

-

FMCG companies are well known for their high ROCE due to:

(a) Low capital intensity: Manufacturing of FMCG products isn’t capital-intensive and can be outsourced. This result in high asset turnovers—typically, one rupee of fixed asset investment results in four rupees of sales.

(b) Low working capital requirement: Most FMCG companies have negative working capital as their creditors exceed debtors.

© High operating profit margins: Market-leading brands command a price premium which results in higher margins.

-

An FMCG company receives money from sales quickly, while it has to pay for its raw materials over a long period of time. This is called a negative working capital (or, in financial analysis terms, when creditors exceed debtors) and this means that an FMCG company’s cash balance remains high (hence the cash-generative nature of operations).

Page Industries: Jockeying from Manila to Bengaluru

Phase 1: 1959–92 Establishing Jockey’s leadership in the Philippines

Phase 2: 1993–97 Jockey re-enters India through Page

-

He named the Indian company Page after the initials of his mother, Parpati Genomal.

-

On the distribution front, unlike competitors like Liberty, Rupa and VIP, which had set up wholesale-driven distribution networks, Page expanded solely through individual distributors.

-

The early 1990s was a good time to set up a consumer brand in India. In the first few years, post-liberalization, consumer confidence and aspirations were high. Coke launched in 1993 and slugged it out with Pepsi. New private airlines were being launched (Jet Airways in 1993) as were new private sector banks (HDFC Bank in 1994). In 1994, Sushmita Sen won the Miss Universe crown, soon followed by Aishwarya Rai wining the Miss World title—an achievement celebrated in India almost like a cricket World Cup victory. On 15 August 1995, Videsh Sanchar Nigam Limited (VSNL) launched Internet services, only a few weeks after the first mobile telephone call had been placed. Thus, change was in the air when Page launched the Jockey brand of men’s innerwear in November 1995, coincidentally a month after the release of the Bollywood blockbuster, Dilwale Dulhania Le Jayenge.

-

Genomal’s vision was bold. He set Page’s mission statement: ‘To be the brand of choice for innerwear and leisurewear in our target market’.

Phase 3: 1997–2003 Gearing up for competition

Phase 4: 2004–15 Beating the competition

-

The biggest testimony of the strength of the relationship between Jockey USA and Page is the fact that in 2010, Jockey extended their licensing agreement with Page for a twenty-year period, instead of the standard practice of five years. Moreover, in the new agreement, the UAE was added as a new territory of exclusive licence and, in 2011, Page made its first shipment to the UAE.

-

Genomals added another brand to Page when they signed a licence and distribution agreement with swimwear brand Speedo for an exclusive right to manufacture and distribute Speedo products in India.

What is Page Industries’ secret sauce? Focusing on the core business

-

Four generations of the Genomal family have run the business and have no intention of diverting their attention to anything else.

-

Page’s business model generates large amounts of cash, given its FMCG-like nature of business—sales are paid for in advance, while raw material supplies are paid over a period of time. Page has established significant dominance in the mid-to-premium innerwear segment. Sustaining this dominant position has taken focused attention from the promoters given that, unlike FMCG companies, Page has a highly labour-intensive business model, and that customer loyalty is a function of product quality. Any shift in focus would have put both these factors—labour and customer loyalty—at threat. Therefore, the fact that Page’s promoters stuck to innerwear and associated categories like leisurewear, and with Jockey as the only brand, is a significant driver of their consistent performance over the past two decades.

-

Page’s executive director (finance) told me, ‘The promoters historically know Jockey and Speedo in and out and understand the intricacies of the business, and that is one of the reasons why competitors have not succeeded against Page.’ Indeed, a testimony to Page’s dedication to Jockey is the fact that it handled labour relations better than its competitors did; TTK and Associated Apparels were left behind due to labour-related problems.

Deepening its competitive moats

- It has mastered manufacturing processes and used operational efficiencies and R&D to help it produce a high- quality product. It built a very strong front end, with innovative marketing, retail and distribution.

Innovation

-

Page has been ahead of its competition with regard to the pace of new launches (at least one new product range every year in each of its categories), the quality of products as well as innovations in these products. The licence agreement with Jockey ensures that Page has access to Jockey’s innovations.

-

Page’s management has highlighted that at any given time, at least 110 SKUs are on the shelf with the R&D team to help deliver ‘fresh and good’ products to consumers. This keeps distributor loyalty alive since not only does Page launch new products, it also removes products that don’t work. Distributor feedback is heard and acted upon.

-

Page has also leveraged off the customer loyalty that it has built with its premium products. After establishing itself in men’s innerwear, it moved to the women’s innerwear category (in 2005), followed by expansion into leisurewear in 2009.

-

Page has also been innovative in many aspects of labour/workforce management. For instance, more than ten years ago, Page pioneered the practice of offering free lunch to its workers. This practice subsequently became popular in the garment-manufacturing industry. This, along with several other initiatives highlighted in the sections below, has helped Page manage scalability of a labour-intensive manufacturing process without disruptions related to labour unrest over the past twenty years.

-

Page has employed another unique strategy. It makes its own elastic, compared to the industry practice of outsourcing this from small cottage industries. Over the years, Page has steadily expanded these elastic manufacturing capacities

Brand

- Loss of aspirational value is a big risk for any brand. This is because the definition of aspirational consumption in every category changes over time, and hence, the brand recall of leaders needs to evolve accordingly in terms of price points, type and mode of branding initiatives, and product characteristics. How has Page beaten its peers in this regard? Part of Page’s success arises from consistently spending around 5 per cent of its revenues on advertising. More importantly, Page’s approach towards advertising and brand building has been unique compared to peers in two key aspects:

Nature of advertising/media initiatives:

-

Page’s approach towards advertising has been unique on several fronts. Firstly, its advertising campaigns have consistently been high-impact affairs like Just Jockeying in FY10–14 and Jockey or Nothing launched in FY15.

-

Secondly, Page has placed significant emphasis on in-store advertising to the extent that in most Multi-brand Outlets (MBOs), Jockey’s advertisements cover the bulk of in-store advertising space.

-

Thirdly, in a neat play on Indians’ world view, Page has made consistent use of Caucasian models in its advertisements and thus firmly entrenched its brand recall as an international brand. This unique approach in advertising has helped Jockey emerge as the sole aspirational brand in the mid-premium innerwear segment.

-

Maintaining pricing discipline across India through the year: Page refuses to offer any discounts on its products. In a country obsessed with discounts, deals and offers, this obstinacy is unique. In my discussions with Page as well as with Jockey dealers, I found that there are no end-of-season sales in any Jockey store. As a policy, retailers and MBOs do not even offer on-the-spot discounts to persistent customers

-

As a result, the management believes that at least 90 per cent of annual sales from retailers to the customers are carried out at MRP consistently every year. Unsuccessful SKUs/unsold products in the firm’s inventory are sold at a flat 40 per cent discount through seconds sales twice each year.

Architecture

-

The owner of a chain of six EBOs of Jockey in Bengaluru told us, ‘Quality of product and supply chain management are the two strongest aspects of Jockey compared to its peers. When you order Jockey’s product, it comes within two days. Other brands outsource manufacturing. If you have outsourced factories, there is no confirmed timeline to make product delivery at stores.’

-

As I learnt later, women account for as high as 88 per cent of Page’s labour force. The primary benefit of this is reduced probability of labour unrest as compared to a male-dominated workforce.

-

There are a number of welfare officers in their factories whose job is to make sure that workers are not unhappy about their working conditions. Page also provides various benefits and facilities to their workers like good- quality free food in the factory canteen, transportation for shift workers, crèche for children of workers, proper sanitation and health centres in the factories. Page has also employed qualified doctors and nurses who provide free medical aid to the workers. The company also provides medicines free of cost to their workers, a unique feature compared to many other textile manufacturing set-ups.

Strategic asset

-

Genomal’s relation with Jockey International, USA, is Page’s biggest strategic asset.

-

Accessing Jockey’s innovations in the US and bringing them to a steadily growing market like India is a formula that has worked since 1995 for Page, and should continue in the foreseeable future.

Capital allocation

-

‘At Page, we are very careful about our capital allocation and will not invest in projects which are not directly related to the core business. Even core projects will not be taken up unless they promise an ROCE of at least 20 per cent.’

-

A high dividend payout ratio—anything above 50 per cent, as in the case of Page—indicates that the company has sufficient funds for its operations and is confident enough in paying out surplus funds to shareholders. Page’s internal accruals account for more than 75 per cent of funds generated in the past decade, with the remaining being external borrowings and IPO proceeds.

Astral Poly: To the Brink and Back

Phase 1: 1997–2003 To the Brink of Bankruptcy

-

Sandeep Engineer’s fascination with CPVC began in the mid-1990s. During this period, in the construction and plumbing industry, pipes were still made of iron and copper. Engineer saw that corrosion was a major problem with galvanized pipes and India was materially behind the evolution curve in the use of plastics for pipes.

-

In the United States, CPVC was the new anti-corrosion solution for plastic pipes, which was swiftly replacing metal (iron and copper) pipes in industrial applications. CPVC was also a superior product compared to PVC because of higher ductile strength, which gave it the ability to handle hot water up to 200 degrees Fahrenheit (93° Celsius) (PVC can handle hot water only up to 140 degrees Fahrenheit [60° Celsius]).

-

B.F. Goodrich (now known as Lubrizol) held the patent for CPVC resin technology, and Engineer decided to tie up with them to bring CPVC to India.

-

Astral began its CPVC journey by launching industrial pipes (Corzan) in 1999. In those days, GI pipes were used for fluid transportation and were prone to scale (blockage due to water impurities), pit (pinhole leaks) and corrosion. At a time when the biggest players in steel pipes were giants such as Tata Steel and Jindal Steel, and plastic pipe segment was dominated by Supreme Industries, Astral chose a product that was 20 per cent costlier than metal pipes. Engineer was aware of the scepticism and scorn.

-

Despite selling the pipes at a loss, Astral’s CPVC products flopped. GI pipes were so well entrenched in India that no one wanted to switch to an expensive product.

-

By the end of 2003, Astral was staring at imminent bankruptcy.

Phase 2: 2003–06 The Building Blocks

-

He simply could not compete with established industrial pipes players like Tata Steel and Jindal Steel. So, on B.F. Goodrich’s recommendation, he shifted his focus to selling CPVC pipes used for plumbing. He had his job cut out for him: first, he had to convince prospective clients to shift from metal pipes to CPVC; second, he had to convince dealers and distributors to stock his products alongside those of his competitors.

-

As was the case with industrial pipes, Engineer realized that the dealers refused to pay a premium for CPVC despite its benefits over conventional GI or PVC pipes. This premium was thus the main entry barrier in the retail segment. Engineer then priced CPVC pipes on a par with GI pipes. He made a loss in the process but recovered this with the sale of CPVC fittings at a premium, since customers were not aware of the price of fittings.

-

Unlike other pipe manufacturers who ignored plumbers, Engineer saw that the plumber was the influencer and decision maker and hence the most important person in the value chain.

-

Astral became profitable in FY03 and invested significant sums on advertisements

Phase 3: 2007–15 Building Scale and Pan-India Brand Recall

- However, this last phase was not without mistakes. The first mistake was an ill-thought-of overseas foray. Astral ventured into Kenya in FY08, initially through exports and then by setting up a manufacturing capacity in the country through acquiring a 26 per cent stake in a JV (with Ramco group of Kenya), Astral Technologies Limited. Whilst capital employment in this expansion was insignificant (less than 1 per cent of its capital employed) and no active management was required from Astral, global expansion is a less-than-ideal step by a small-scale company as it reduces management bandwidth. The second mistake was not hedging its currency exposure on its CPVC resin imports from the United States, leaving the company vulnerable to a sharp depreciation in the Indian rupee, compared to the US dollar.

What is Astral’s secret sauce? Relentless Focus on Seemingly Simple Things

- Deepening the competitive moats

Innovation

-

Instead of copying foreign technologies, Engineer forged technical partnerships with global majors to launch innovative products in India.

-

Astral has consistently launched new products through partnerships with global majors

-

Astral’s innovation in processes continues with increased adoption of automation; recently, it installed robotic truck-filling machines to reduce loading time by more than half (from two hours to thirty minutes), thereby reducing the probability of work disruption.

-

Astral was also the first company in India to train plumbers, and that too on a scale which was unheard of— 10,000 plumbers during 2005–08.

-

Astral was also the first Indian company to start barcoding on pipes to prevent counterfeits. The company also innovated in its branding.

Brands and reputation

Architecture

-

During training sessions, Engineer would tell plumbers not to see themselves as plumbers, but as doctors who treat the big problem of leaking pipes in homes.

-

From the promoter to the watchman, all employees at Astral wear the company’s uniform of a light-blue shirt with the Astral logo on the shirt pocket.

Strategic assets

-

Astral’s manufacturing facilities, well-entrenched network of distributors, and reputation with plumbers provide a strong entry barrier against any new player who wants to sell CPVC pipes.

-

Astral’s second strategic asset is its relations with global majors. Lubrizol, a company owned by Warren Buffett, is the pioneer of the CPVC compound globally. Astral is one of the two manufacturers (Ashirvad being the second) in India with access to CPVC technology from Lubrizol. The company’s tie-up with Lubrizol enables it to produce best-in-class CPVC pipes and also launch new products ahead of competition.

Capital allocation

- With the CPVC business still going strong, Engineer’s entry into adhesives holds promise since it will leverage on his distributor network and client relations. Astral is now a popular brand with real-estate developers and plumbers alike.

CHAPTER 9 Greatness Is Not Everyone’s Cup of Tea

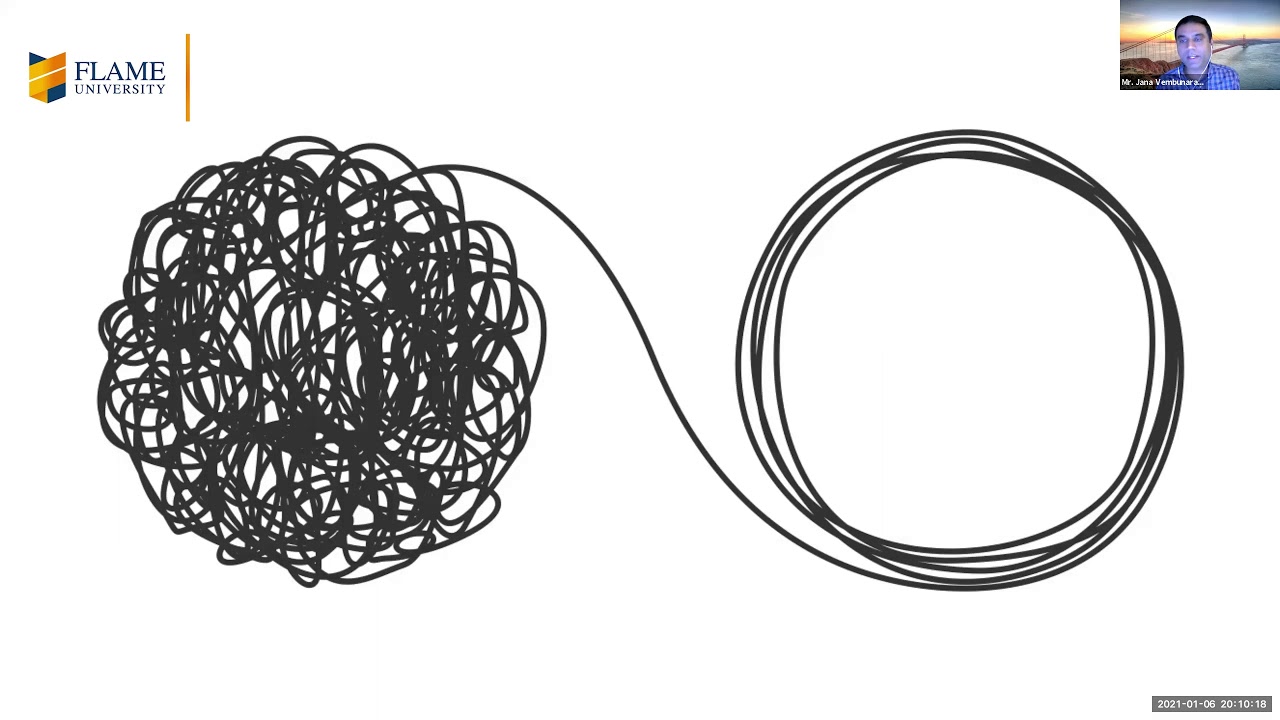

My case studies and discussions with observers of the Indian business landscape over the past five years have led me to conclude that three factors are central to building a truly great company.

Firstly, the management team has to have an obsessive focus on the core franchise instead of being distracted by short-term gambles outside the core segment.

Secondly, the company has to relentlessly deepen its competitive moats over the course of time (I’m talking about decades here).

And thirdly, the people calling the shots at the company have to be sensible about capital allocation, i.e. refrain from large bets (especially those outside core franchise) and return excess cash to shareholders if the cash cannot be deployed to good effect by the company.

In the FMCG trade, it is routine for salespeople to aggressively push the company’s products into the dealers’ inventory. Marico does not do this. Instead, it has moved to an auto-replenishment, demand-driven model wherein the company sends fresh supplies to the dealer once the dealer’s inventory has been depleted. This helps in matching demand with supply. One could argue that dumping more products with dealers and retailers would mean greater visibility resulting in sales. Indeed, this could be a potential benefit, but if demand for any product is low, retailers remove products from their shelf and carry them as inventory and as inventory rises, a manufacturer’s sales will fall because the dealer/retailer already has sufficient inventory. By using an auto- replenishment model, Marico matches demand and supply more accurately.

As Bandyopadhyay says in his book: ‘In many segments, HDFC Bank learns patiently from the experiences of others before it steps into a new business, whereas ICICI Bank loves playing the pioneer. ICICI Bank is volatile; HDFC shares are range-bound. The same applies to earnings. ICICI Bank is often unpredictable, both surprisingly and shockingly. HDFC Bank is monotonously predictable on most financial parameters.’

“Why will we be better at doing that than other people?” will have a clear and affirmative answer, and it is typically those firms that can give that answer and act on it that are successful.’

Failure to create and sustain moats using technology will result in loss of market share to industry leaders and, eventually, severe losses in the core business. As an example of this crippling loss, I reproduce a quote from Captain Gopinath, founder of Air Deccan, which was eventually sold to Kingfisher Airlines in spite of being the pioneering low-cost carrier (LCC) in India. In his book, Simply Fly (2012), Gopinath laments: ‘Given a little more time, Deccan could have weathered the storm and overcome the cash crunch but time was running out. I might have pulled it off had my IT system not collapsed. We had to bear in mind the welfare of four thousand employees; the public insurance funds and retail investors we had to answer to.’

CHAPTER 10 A Checklist for Long-term Investors

Car ownership in India is at around sixteen per thousand compared to Brazil which is at around 120 per thousand. In contrast, mobile telephones, for example, have reached near-full penetration in India.

Personal care products such as soaps, hairoils are amongst sectors with high penetration . . .

ACs, cigarettes and cars on the other hand have low penetration

The two-wheeler penetration in India is somewhere close to 9 per cent.

Developed countries have a much lower two-wheeler penetration level as compared to developing countries. In developed markets such as the USA, Japan and Germany, two-wheeler penetration levels are lower at 3–9 per cent. On the other hand, in developing countries, the two-wheeler penetration levels are higher, particularly in China and the East Asian countries like Indonesia (26 per cent), Vietnam (32 per cent) and Thailand (29 per cent). Plotting this on a chart shows that as a Third World country gets richer, two-wheeler penetration steadily increases. That, in turn, suggests that India’s two-wheeler penetration should continue to rise for some time to come.

APPENDIX 1 John Kay’s IBAS Framework

‘No formula in finance tells you that the moat is twenty-eight feet wide and sixteen feet deep. That’s what drives the academics crazy. They can compute standard deviations and betas, but they can’t understand moats. Maybe I’m being too hard on the academics.’ —Warren Buffett

In his 1993 book, Foundations of Corporate Success, Kay states that ‘sustainable competitive advantage is what helps a firm ensure that the value that it adds cannot be competed away by its rivals’. He goes on to state that sustainable competitive advantages can come from two sources: distinctive capabilities or strategic assets.

Whilst strategic assets can be in the form of intellectual property (patents and proprietary know-how), legal rights (licences and concessions) or a natural monopoly, the distinctive capabilities are more intangible in nature. Distinctive capabilities, says Kay, are those relationships that a firm has with its customers, suppliers or employees, which cannot be replicated by other competing firms and which allow the firm to generate more value additions than its competitors.

Perhaps the most striking demonstration of architecture (Architecture is a system of relationships within the firm, or between the firm and its suppliers and customers, or both) in India is the unlisted non-profit agricultural cooperative, the Gujarat Cooperative Milk Marketing Federation Ltd (GCMMF), better known to millions of Indians as Amul.

This farmers’ cooperative generated revenues of Rs 20,700 crore (around US$3.1 billion) in FY15, thus making it significantly larger than its main private sector competitor, Nestle (CY15 revenues of Rs 8175 crore or around US$1.2 billion). Furthermore, GCMMF’s revenues have grown over the past five years by 16 per cent as opposed to Nestle’s 5 per cent over the same period.

GCMMF’s daily milk procurement of thirteen million litres from over 16,000 village milk cooperative societies (which include 3.2 million milk producer members) has become legendary. The way GCMMF aggregates the milk produced by over three million families into the village cooperative dairy, further aggregates that into the district cooperative and then feeds the milk federation has been studied by numerous management experts.

The following appear to be the dominant factors at the core of this cooperative’s success:

(a) its fifty-year-old brand with its distinctive imagery of the little girl in the red polka-dotted dress;

(b) the idea of a fair deal for the small farmer and the linked idea of the disintermediation of the unfair middleman; and

© the spirit of Indian nationalism in an industry dominated by globe-girdling for-profit corporates.