I have my own screening criteria. I use 2 different universes. Smallcap 250 and microcap 250 and select 10 top stocks from each universe. I also put within 20% from All time high, as well as within 20% from 52 week high. For me volume criteria is 1 cr. Price should be above 100 day ema as well as 200 day ema.

Refer to this article to understand what strategy Viraj uses to build his momentum screen.

@Raghul_Kuduva .Yes.Before subscribing to his website and committing my 25% of funds to this strategy, reading above article is the minimum you can expect from me. ![]()

I have selected different universes. And screening criteria as well as re-balancing frequency is different , as my universe of stocks require that.

On top of that, I have added one more layer for eliminating stocks. Along with strategy criteria of lower than Worst held rank, I am also applying Stop loss at entry as well as Trailing stop loss, based on moving averages , using GTT feature of zerodha.

This will help me in retaining my major gains, at the cost of may be higher churn. But after advancement of more than 70-80% returns from my buying price, giving back those returns, while waiting for the stock to move beyond worst held rank, is too much for me…Again, the strategy is not straight away taken from Gita, Bible and Kuran, so if I am changing some parameters as per my thought process and to safeguard, there is very little chance of me going to hell. ![]()

I will keep on fine-tuning it…I may add some fundamental filters too in future…but not immediately.

P.S. You might have observed from momo website where Mr. Khatavkar also gives his monthly performance transparently. From last 2 months, that I have started this strategy, I have outperformed his returns by 3-4% , but its not comparable as my universe is different.

Excellent. I’m closely following your thread and impressed by your strategy on the downside risk. If one takes care of the risk, the profit will go up like anything. I think it’s from buffett quote - Rule1. don’t lose money, Rule2. Don’t forget Rule1.

That’s great to hear and I also see some people have these set rules when exiting an individual stock.

- If the stock price falls more than 20% from its 52W high

- If the stock falls below the worst rank during rebalance

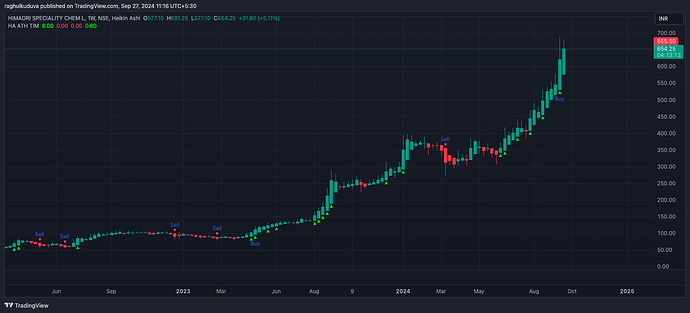

I have also recently started investing in this strategy since August and I also combine Heikin Ashi candle charts to confirm the momentum in the stocks and then take my Buy/Sell decision. One of my friends has developed an Indicator in Tradingview that tracks momentum and gives timely signals to take action. I am attaching an example screenshot also.

If you see this chart you can it show the Buy and Sell signals. So far it has been working well for me and will update periodically about the performance. I bought Himadri chemicals at 455 range and now it’s trading at 650 range. After I bought it showed a few other buy signals also and I did accumulate once.

My screening criteria itself includes only those stocks which are within 20% from all time high as well as within 20% of 52 week high…So if stock falls below 20% of 52 week high, it automatically goes out of list itself.

1727420943760.pdf (2.6 MB)

Anand Sridharan From Nalanda Capital…Talk at IIM Ahmedabad

What is the name of indicator?

@Raghul_Kuduva , Thank you very much for directing me to Momentum Lab. I saw most of their videos in last 2-3 days. Awesome work they have done. After their recent Backtesting, specially for 10 year rolling return data, its now beyond doubt that doing DIY momentum strategy for Nifty 200 is not at all worthwhile, since it hardly creates 1% alpha compared to respective mutual fund. For the strategy to be viable, we need atleast 4-5% alpha , considering the increased STCG taxes and transaction costs, not to mention the stress developed due to frequent monitoring and trading. So I have come to the conclusion that I will keep invested in UTI Nifty 200 momentum 30 and TATA Midcap 150 momentum 50 Index funds.

DIY strategy I will restrict to small cap 250 and microcap 250 universe.

If you have any source for checking backtesting data for these universes, pls direct me to this.

For making big money, in our Compounding equation

A = P ( 1 + R) ^N… We focus too much on R, completely ignoring N= no of years. Warren Buffet and Charlie Munger reminds us that. So to increase our N, Life span, we need to adopt an investment strategy, which will create less stress and help in living a long life.

Hey, @Sumant19 you can reach out to the creator of this Indicator on Twitter directly and he will give trial access to the indicator. It’s a paid indicator, so if you liked it during the trial version you can pay and get full access.

I was going through Value research online and found that they also have started using momentum in their stock recommendations. We can check using the below link:

Hi @Mudit.Kushalvardhan, wanted to know did you consider Nifty MidSmallcap400 Momentum Quality 100? In one of the videos of momentum lab they said that this is probably the best index to find stocks. Or do you think adding another parameter, quality in this case, tends to bring down the returns.?

An article that goes on to prophesy the virtue of Sharpe

Yes. I have seen that video. In Midsmall 400 universe CAGR returns are good as well as drawdown are also low. But that was just a pure index of midsmall400 not quality …Pls check that video again. They are quoting the paper of Raju.

About your quality factor question, if you add quality factor, it will reduce return but it will also resuce drawdowns, so its upto you, whether you want to apply it. In my personal opinion, if its reducing drawdown, then I am ready for lower returns. Because sticking to strategy in thick and thin is more important than 2-3% less returns.

how they are calculating momentum score? . They have just mentioned score more than 9

In their another video, where they compare the sharpe ratio, Momentum 150 and midsmallcap 400 momentum quality comes on top. midsmallcap 400 momentum quality has least risk and comparable returns.

Wanted to know your view about Nifty 200 momentum 30 also because this has the highest risk and least amount of returns. I’m also invested in it and rethinking.

paper_811.pdf (331.4 KB)

The implications of applying stop loss to rank based momentum