can u plz post a diagrammatic representation of this mental model for a better understanding of novices like us…thanx in advance…

Nice write up.

As an aside to round this off, one thing I’ve noticed is how innovative companies like google/amazon plough back a part of their profits above a certain benchmark into a bunch of smaller J-curves at any given point, hoping that one of them would succeed. They double up on the J-curves that work and make them bigger and bolder and dial back on the ones that don’t.

This part reminded me of how VC funds investing in tech startups work as well, in terms of being ready for a bunch of write-offs in looking for that one big winner that will contribute to the overall portfolio rising above water and earning reasonable returns - which again follows a J-curve. I think I came across this first in Thiel’s book. Taleb calls this approach as collecting positive black swans. The beginning of your piece with the Nietzche quote I think is what inspired Taleb to write Anti-fragile although he has reiterated earlier the idea of lack of volatility or forcing an order to keep uncertainty and risk out will blow-up bigger in the long run and systems should be allowed to experience stress so that they become more robust and durable. Enjoyed reading your model, looking forward to reading more! Thanks.

The only investing truth that has lived through the generations (In my opinion), is the simple concept of thinking against the market, as opposed to thinking with the market, or Warren Buffet’s famed “Be greedy when others are fearful.”

Loss Aversion is a strong behavioral bias which is related to this kind of behavior, from which a rational investor can profit. I always quote Warren Buffet’s purchase of the Santa Fe Railways as the simplest illustration of this. I wrote this as an answer on Quora here:

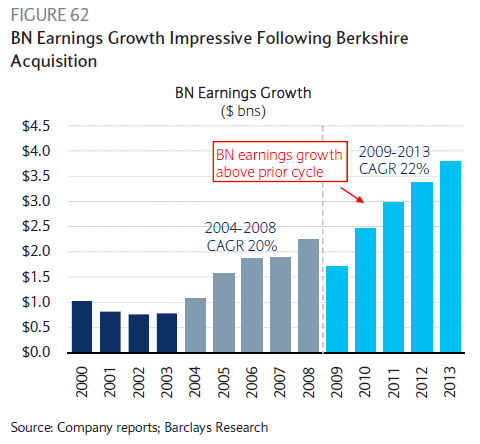

A classic Value Investing example I love discussing about is the purchase of the Burlington Northern Santa Fe (A private railroad company) by Berkshire Hathaway around the end of 2009. The WSJ wrote this article after the purchase: Warren Buffett: Buying Near the Bottom … Again. Other investors and ‘financial analysts’ were critiquing Warren Buffet, saying that the old man had lost his game, going around buying out railroad companies during a recession. But that’s precisely why Warren Buffet bought BNSF — it was available during a recession, with dwindling profits and at a rock-bottom price of $100/share. This was a company which had shown tremendous business results in the past, but was momentarily handicapped by the recession. Warren Buffet knew that, eventually, the economy will revive and companies would then want their raw materials transported. And guess what, it happened. This is the P/L of BNSF for the 4 years following the purchase, taken from a research article by Barclays Research:

Since the company is privately-held by Berkshire Hathaway, nobody really knows its value, but a rough estimate shows that it’s given at least a 15% CAGR in all the following years. The purchase of BNSF by Berkshire Hathaway under Warren Buffet is the embodiment of the Value Investing philosophy and a proof of concept of his own famous quote “Be greedy when others are fearful.”

Brian Barish once said “The ability to scare the hell out of people is much greater than the ability to attract them to equities.” How true is that!

A detailed & nicely explained. We are waiting for other mental models.

Thanks