https://asirvadmicrofinance.co.in/wp-content/uploads/2025/10/Financial%20Results_September%202025%20(2).pdf asirvad micro finance Q2 result out. Not so great. Still loss of 214 crores before tax in Q2 2026 Vs Q1 437 cr loss vs 101 crores profit of Q2 fy 2025.

-

Coming back to profitability may take couple of further quarters. Will it happen in Q4FY2026, or in Q1FY2027 or further down .. but the pace & amount of provisioning has been reducing for sure.

-

As an investor (hence, a bit biased views) an interesting fact which is getting executed post Bain Capital has taken driving seat i.e. Introduction of qualified finance professionals in Manappuram & it’s Key Subsidiary (Asirvad).

Look at the new jockeys https://asirvadmicrofinance.co.in/management-team/ CEO, Co-Ceo (https://asirvadmicrofinance.co.in/wp-content/uploads/2025/10/Intimation%20_appointment%20of%20Co-CEO.pdf), CFO, CRO, COO, CCO .. all seems with credible finance experience vs erstwhile puppets of Mr. Nandkumar (deputed from Manappuram, to run the show) -

Quarter Ended Sep 2024 was last profitable quarter, now 4 quarter of losses are complete. During this time, Interest income reduced more than 50% (on account of AUM reduction, as well as Yield compression - RBI ban impact), Interest expenses also reduced (on account of repayment of loans), but Provisions increased (on account of bad debt), and fixed cost such as Employee cost just slightly reduced, other expenses (major chunk of operational & administrative fixed cost) also almost same.

-

A year down the line, with a possible change in MFI perception, Magic of Bain acting as base, New Jockey’s building a good new foundation, Increase in AUM resulting in operational leverage - Numbers may look beautiful again.

-

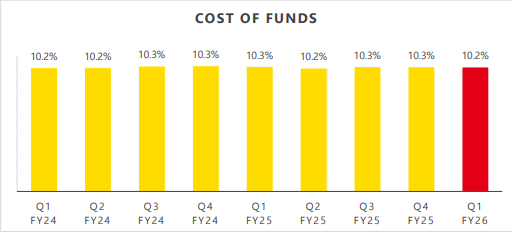

RBI’s 100 bps repo rate reduction resulting in MCLR reduction by bank resulting in reduction of Cost of funds resulting in better net yield. Recently company raised NCD via private placement, with maturity in Aug 2028 - Sep 2028. ROI on these NCD was around 8.7%.

-

Last 2 years blended Cost of funds trend was above 10%.