There has been intervention regarding personal attacks and the same has been taken back. The posts where those quotations are all posted by you and you have all the rights to remove/edit the same. By your denial to participate in the fundamental discussion, rather than defending your stock story, you are running away from it. As I have messaged, it is your onus to carry on the discussion further and genuinely evaluate the stock story. Hope you respond to the questions raised by Anant Jain and carry on the healthy discussion purely aimed at genuine evaluation of the stock fundamentals.

The personal attack is not acceptable on this forum and I had already interacted with him & after that he has taken back his posts. I do not know him nor the author of this thread and hence there is no question of any bias. Now the responsibility is on the author of this thread to either defend his stock theory or accept the holes in the stock story. By just mentioning about the personal attack, he should not try to move away from his responsibility. For your information, Prasenjit has posted only on this thread. He had never posted on valuepickr though he is member of this forum since march 2015.

[quote=“manish962, post:32, topic:12355”]

By just mentioning about the personal attack, he should not try to move away from his responsibility.

[/quote] I don’t know from where I am moving away. I asked about the clarity whether anyone can say anything without any proof/evidence and the consequences of that.

[quote=“manish962, post:32, topic:12355”]

For your information, Prasenjit has posted only on this thread. He had never posted on valuepickr though he is member of this forum since march 2015.

[/quote] As clearly mentioned at the very beginning that I have my own advisory company so I can’t post/discuss here about my recommended stocks. This is a stock that I can’t recommend (only due to trading volume) but have my own significant investment and also there is no discussion about the stock anywhere else across the internet as it is a new company from lesser known BSE SME segment. So I posted it here. I request you to delete the quoted part as it no way concludes anything.

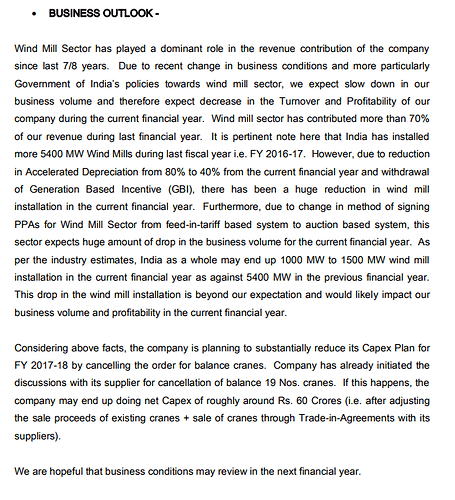

Just to continue on the sectoral side of thesis, here is an excerpt from a recent presentation of Sanghvi Movers uploaded on BSE:

Key sectoral points to note:

a) Accelerated depreciation is changed from 80% to 40%

b) The capacity addition this year can come down from 5.4 GW to 1/1.5 GW.

c) The generation based incentive (GBI) of 50 paise per unit has been withdrawn.

d) The states have consistently been reluctant to draw Wind Power.

Here is the BSE link to Sanghvi Movers presentation where they have indicated reduction of capex due to the above since Wind Power is their major segment. contributing to nearly 60% of their revenue.

http://www.bseindia.com/xml-data/corpfiling/AttachHis/14c2052f-eae3-4934-969b-9e740d8ab327.pdf

What they mentioned me is they have leased landbank and the lease rental is very nominal as those are generally unused land located in the remote area.

[quote=“Anant, post:26, topic:12355”]

What is very interesting is that the company is operating cash flow +ve but if you dig a little deeper you will see that the company’s assets have gone up significantly. From an asset base of 9.85 cr in FY15, the FY17 assets have gone up to 50.28 cr and a Capital work in progress of 17.85 cr a total of 68.13 cr. The very obvious question that comes to mind is if the company is moving its working capital into fixed assets thereby showing a +ve operating cash flow. What beats me is why does a company which is pretty much an EPC company needs so much of asset base

[/quote] The asset base is due to the fact that they also own few wind turbines (minuscule contribution in revenue). They utilised IPO money for the establishment of their own turbine and also in few project site they keep one turbine for their own. They sell that power to a nearby industrial unit. However, income from selling Wind Power is very negligible.

Now, I would request to email (karmit.sheth@kpgroup.co) directly to the company for the remaining clarification. As I am not running the business so even I don’t have clarity on each and every points. As per my experience they response email queries quite satisfactorily.

[quote=“Anant, post:34, topic:12355”]

Key sectoral points to note:

a) Accelerated depreciation is changed from 80% to 40%

b) The capacity addition this year can come down from 5.4 GW to 1/1.5 GW.

c) The generation based incentive (GBI) of 50 paise per unit has been withdrawn.

d) The states have consistently been reluctant to draw Wind Power.

[/quote] I want to mention the same thing that I am mentioning from the beginning. FY18 is surely a bad year for Wind Sector due to the transition. However, we invest depending on the future outlook, not based on the present/past. Now, the transition to auction based tariff made the sector very attractive if we look at FY19 and afterwards. Suzlon, Inox Wind etc also echoed the same point in their Investor’s presentation and concall. (On a sider note, stocks like Inox Wind, Suzlon can also be a good contra bet)

I am not sure what their intended business is, is it generating power or setting up wind turbines. Why is the company deploying over 25.75 crores + 17.85 crores (43 cr) in setting up your own wind turbines, which is way higher than their own Net worth of 32.86 cr?

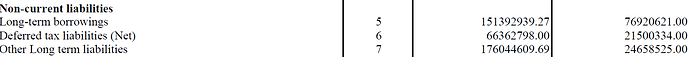

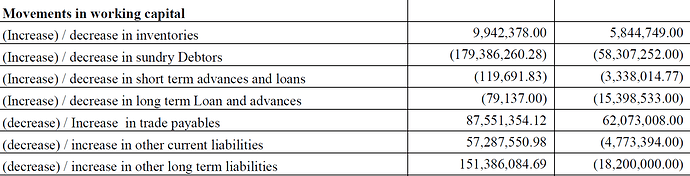

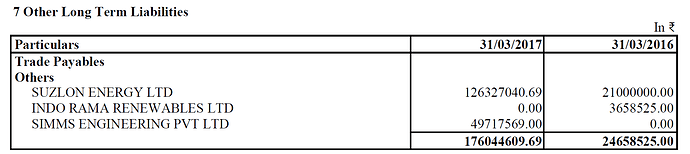

Let me tell you one more way of making operating cash flow +ve:: From balance sheet take a look at other long term liabilities:

From cash flow statement please take a note of other long term liabilities:

Now from the notes:

What are Suzlon and SIMMS Engineering doing here? Is this some kind of loan that Suzlon has extended to the company? Is it like saying I will give you a few wind turbines and you make power with them and it will not cost you a thing?

I am absolutely not going to do this i.e write an email, for that matter I have spent enough time on a story that just doesn’t warrant a second look, of course I am going to respond to your queries on the forum. Since you have started the thread the onus is on you to get these clarified. The responsibility is much higher just because of the strong positive view you have on the business and also because you run a very successful advisory. In my opinion there are too many glaring issues in the company’s books which requires further attention.

I recently had a conversation with the management and i am getting to know that, the company has to keep their operations at a halt and convince the villagers to issue a no objection certificate for carrying further work. This had to be done because the company was setting up it’s captive power plant.

The management also suggests that they focus on 2-3 projects at a single point and these projects take up 4-6 months.

To set up a 2.1 MW wind mill, the cost comes to 15 cr, out of which the OEM take up 9-10 cr ( Suzlon ) and the remaining is in the hands of KP energy. Now, the government has come up with a tendering system where in the company having the lowest cost gets the tender, Due to which the margins will squeeze. The company wants to increase it’s volume in order to increase the bottom line. There are 2 stages on how the revenue is recorded. There is an agreement of approximately one year to complete the whole project. The customers come in agreement with Suzlon and Suzlon forwards it to KP energy for site clearance. Half of the payment is to be made after the site is approved and half after completion of the project. Suzlon will have to make half the payment otherwise KP energy does not continue its work, and since Suzlon has a deadline, they make payments on time.

Talking about the order book, the management comments that they have sufficient orders to cater to till 2018.

On asking why any other company cannot replicate the business model, it was informed that it takes a lot of regulatory approvals, right from approving the land till the erection of the project, and this seems to be quite difficult at this junction.

Everyone is requested to stick to the fundamental discussion and avoid any personal slug fest. Any further violation of discipline will not be tolerated.

Seems KP Energy is not without competition:

http://www.mytrah.com/wind-energy.php

I do have investments in Suzlon and actively tracking it, hence my interest in Renewables space especially WE and any news which pops up there. No other investments in other entities in Wind Energy.

JP

How is a land bank a moat or a competitive advantage?

If it is land taken on lease, anyone with enough capital can replicate the same land bank with no sweat. If it was purchased land at a historically low cost I would still be sceptical as land is an exhaustible resource. Once a project is commissioned on it, the land is exhausted. The co. forever needs new land to commission newer projects. At the size of the current land bank and FY17 installations mentioned by you, it would imply just enough land to maintain a no-growth scenario of revenues for 10 years. That means after 10 years of the FY17 installations land bank will be exhausted.

Then there is the escalation effect, once villagers, landowners realize the demand for their land they escalate their leases, hence pressure on company’s margins.

Detailed investors presentation shared in AGM http://www.bseindia.com/corporates/anndet_new.aspx?newsid=36954194-93ca-4508-b187-aab7ec79b142

One can easily estimate the expected revenue for H1FY18 and the full year FY18 from carefully following the presentation.

Personally, I am also impressed with regular detailed business update from such a small company. Less than 5% companies in the SME segment comes with such regular business update.

Wouldn’t this preferential allotment reduce the EPS and consequently the share price, as and when it happens?

They have done 81 MW in FY17 and it looks like they have a order book of 95 MW for FY18. It is quite a far cry from this estimate of doing only 200-250MW projects.

Kindly re-read the AGM presentation. In FY18 they are doing 70+95MW = 165 MW (approx) against 81.9MW in FY17. Out of 165 MW in FY18, 70MW (Mahuva 1) might be complete in the next month or so and remaining 95MW is for Mahuva 3,4,5 starting soon.

Who is saying that doing project of 200-250MW from the current financial year? The central bidding started from this year only.So those are viable only from second half of 2018.

Another take away from the AGM presentation, project site selection is done for 400+400= 800MW in Kutch 1 and Kutch 2. They also applied for transmission line to Power Grid for 800MW which is visible from webapps.powergrid.in/ctu-data/view-details.aspx?type=3&status=2 (Sl No. 22 and 23).

So this 800MW (10 times than 81MW in FY17) is very much possible over FY19 and FY20!

They are already working on everything for making themselves 10 times bigger over the next 3-4 years!

Are you sure of your words “10 times bigger over the next 3-4 years”? Are these words of the promoters or it is your interpretation? Please clearify.

[quote=“manish962, post:51, topic:12355, full:true”]

Are you sure of your words “10 times bigger over the next 3-4 years”? Are these words of the promoters or it is your interpretation? Please clearify.

[/quote] The answer lies in the previous write-up itself. From the AGM presentation and Powergrid website link that I shared, it is showing for 800MW which is around ten times higher than 81.9MW that they did in FY17.

CRISL report on KP Energy. Although the report is old, its gives good information about the company’s strengths, risks & business opportunities.

https://www.crisil.com/Crisil/pdf/capitalmarket/sme-ipo/KPEL_SME_Fundamental_Grading_GR.pdf

What it means for wind energy sector prospectus?

What I told months ago, the recent November 2017 Crisil Report is saying the same in an elaborated way with the fair share price of Rs. 402 against the current market rate of Rs.300 (Disc- My average purchase price was around 200)

http://www.bseindia.com/xml-data/corpfiling/AttachLive/edcc39e0-1bcd-410e-b8ad-228d1c43f384.pdf