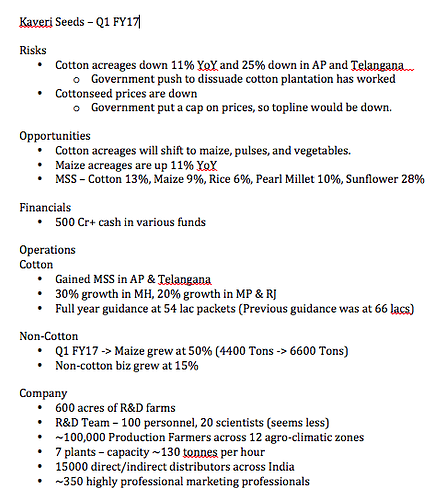

Kaveri Seeds – Q3FY17 Conf Call & Investor Presentation Notes

The acreage reduction in cotton are being offset by maize, pulses etc.

Cotton

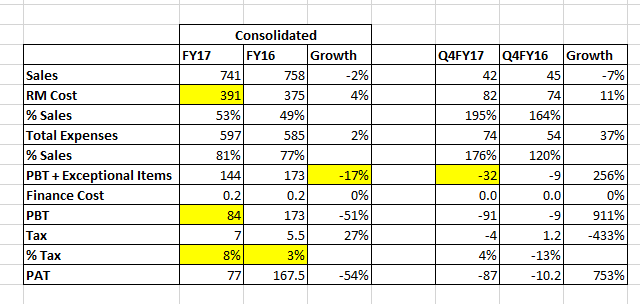

The cotton industry size is estimated at 3.7 Cr packets which is a reduction of 11-12% compared to last year. Kaveri managed to sell 54L cotton packets compared to 55L last year on 9M basis, lesser reduction than industry average of 14%. The company regained market share in states such as AP, Telangana, Maharashtra, Gujarat. The company lost market share in Karnataka. Telangana & AP contributed 49% of cotton sales. The cotton acreages are down by 28% in these two states where as Kaveri sales are down by 20% resulting in increased market share. Company’s product Jadoo continued to perform well in AP & Telangana whereas ATM performed well in Gujarat & Maharashtra. These two products would continue to drive the growth. The company registered growth of 20% in Gujarat & Maharashtra in volume terms & company’s market share stands at 7% & 10% respectively.

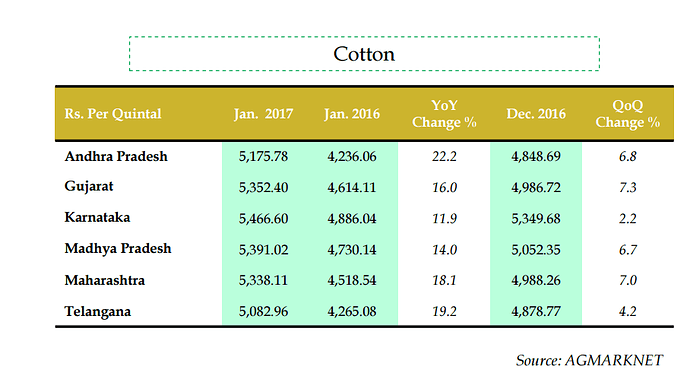

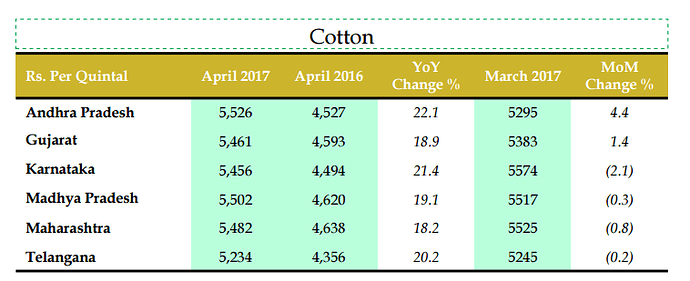

The appeal of cotton crop is back amongst the farmers due to increased commercial price of the cotton (~20% hike) & it remains most profitable crops among others in current situation. Led by this, the company is hoping that overall cotton acreages would go up in Kharif season next year by 10-15% primarily led by AP & Telangana.

For the current intake (production) of 50% of cotton seeds, the company expects lower production cost due to better quality & quantity of seeds. This has resulted due to favorable climatic conditions to grow & lesses infections caused by Pink Bollworm. The cost for entire intake would be known only when it is complete.

Maize

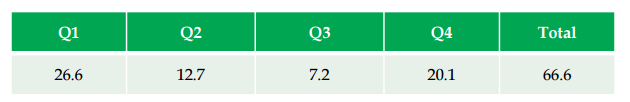

The company registered growth of 20% on 9M basis with volumes growing to 10449 MT from 8721 MT. The revenue for the same period grew to 188 Cr from 148Cr. The company is planning to change this portfolio to higher price & higher margin products.

Rice

Rice business performance moderated a bit due to decline in hybrid rice (1500MT). The total volumes were down down from 7080 MT to 6956 MT on YoY basis.

There are two fold reasons for subdued performance in rice business. Firstly, as an industry, rice is not growing as expected due to reduced government support. The model of subsidy program got changed in UP contibuting to this. Secondly, Kaveri lost due to high dependency on one hybrid. The company has already launched 1 new rice hybrid & plan to launch 1 more in the next few quarters. The other segment of rice business, namely selection(?) rice performed poorly because company had production, processing & packaging issues. Molangoor plant shall help to resolve some of this. The company has also consiously shifted varietal rice production in kharif season & it did well this quarter. Company expects rice business to do better coming years.

Research & Development

The R&D outgo of company reduced to 9.2Cr from 9.7Cr. R&D has been reduced in sunflower & realigned to cotton, pulse millet, rice, corn, vegetables. The company claims that its Sunflower portfolio robust enough to supply to market for many years & hence the reduction. There was 50% drop in volume on 9M basis, (10.77Cr last year). The sunflower business by itself is very profitable but company took a hit due to some returned orders this quarter.

Cash on Balance Sheet

Company is aware of 500+ Cr cash in balance sheet & plans to announce dividend/buyback policy on or before Q4 FY17 results

Write-offs

The write-off would be a recurring expense as & when seeds are discarded. The amount would be based on Monsoon, quality of seeds, rejection ratio etc. For non-cotton seeds, the ratio of write-offs to sales would be between 5% (good year) to 10% (bad year). The company had write-offs of 7.5 Cr in Q3FY17 (NIL Q3FY16) for non-cotton crops.

Subsidiray - Kexveg

The company has invested 6.6Cr till now & planning to invest 9Cr over next 2 years. The investment is primarily in the form of share capital. It is intended to be export oriented unit for premium vegetables.

Management Bandwidth

The company has hired new senior person as supply chain head. This person was working with Syngenta before & is very experienced in working with MNC. The company has also hired senior sales manager in 2016. Kaveri has carved out vegetable business separately, building a team focused on vegetable business (R&D, Sales etc.).

Disc - I hold as contra bet, 3% of portfolio at average price of 355, this is not a buy/sell reco.