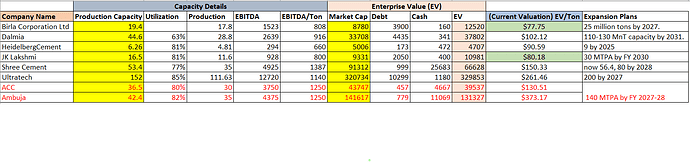

Total Installed Cement Capacity for 2024: 16.5 million tons, including Udaipur Cement Works Limited.12

% of Revenue from Cement for 2024: The sources don’t explicitly state the percentage of revenue from cement, but they heavily imply that it constitutes the vast majority. The company is referred to as a “leading manufacturer and supplier of Cement and Cementitious products” and there is extensive discussion on cement production and sales, with limited mention of other product lines.34

Utilization Rate for 2024:

JK Lakshmi Cement: 81%

Udaipur Cement Works: 80%

Production for FY 2024:

Clinker Production:

JK Lakshmi Cement: 6.996 million tons8

Udaipur Cement Works: 1.975 million tons8

Cement Production:

JK Lakshmi Cement: 9.51 million tons

Udaipur Cement Works: 2.097 million tons for the full year, with 6.42 million tons in Q411

EBITDA for FY 2024: Rs. 928 crore12

EBITDA per ton in 2024: While the provided annual report doesn’t state the precise EBITDA per ton figure, it highlights achieving Rs. 1,000 EBITDA per ton for two consecutive quarters.13

Total Debt from the balance sheet for 2024 annual report:

Standalone: Rs. 700 crore14

Consolidated: Rs. 2,050 crore14

Total Cash & Cash Equivalents from the balance sheet for 2024 annual report:

Standalone: Rs. 375 crore14

Consolidated: Rs. 400 crore14

Capacity Expansion Plans and Timelines

Durg Expansion:

A new clinker line with a capacity of 2.3 million tons per annum (MTPA) will be added at the Durg integrated unit.15

Grinding units with a total cement capacity of 4.6 MTPA will be added, including 3 split location grinding units and 1 at the integrated plant.1516

Estimated cost: Rs. 2,500 crore1516

Targeted commissioning: By March 202715

Phase 1: Clinkerization and a grinding unit at Durg, and a grinding unit at Prayagraj, Uttar Pradesh, to be commissioned by the last quarter of FY 2026.1617

Surat Grinding Unit Expansion:

Capacity doubling from 1.5 million to 2.7 million tons.18

Phase 1: 0.7 million tons to be commissioned in October 2024.19

Phase 2: Remaining capacity to be commissioned by March/April 2026.19

Split Location Grinding Units:

Three units planned, with a total cement grinding capacity of 3.4 MTPA.20

Locations: Prayagraj in Uttar Pradesh, Madhubani in Bihar, and Patratu in Jharkhand.20

Timeline: Not specified in the sources.

Northeast Expansion:

Estimated cost: Rs. 1,800 crore, including Rs. 1,500 crore for the project and Rs. 300 crore as a balance payment for the acquisition.21

Capacity addition: 1.5 million tons.22

Timeline: Expected to start from FY 2027 onwards.22

Agrani Cement Expansion:

Timeline: Dependent on obtaining environmental clearance and completing land acquisition. Expected to be operational by March/April 2027.23

Overall Capacity Target: The company aims to reach a consolidated capacity of 30 MTPA by FY 2030-2033.1824

Recent Developments from Conference Calls

Cost Saving Initiatives:

The sources don’t mention specific cost-saving initiatives, but they highlight that JK Lakshmi Cement Ltd. is known as one of the least-cost producers of cement in the industry.25

The company is focused on increasing Thermal Substitution Rate (TSR) and Alternative Fuel Rate (AFR) usage to reduce reliance on conventional fuels and lower costs.17

Current Valuation: Fairly valued with $80 EV/ton