Time for some super Saturday learning. Whats better than to pick up from where I left last week on IndoCount…

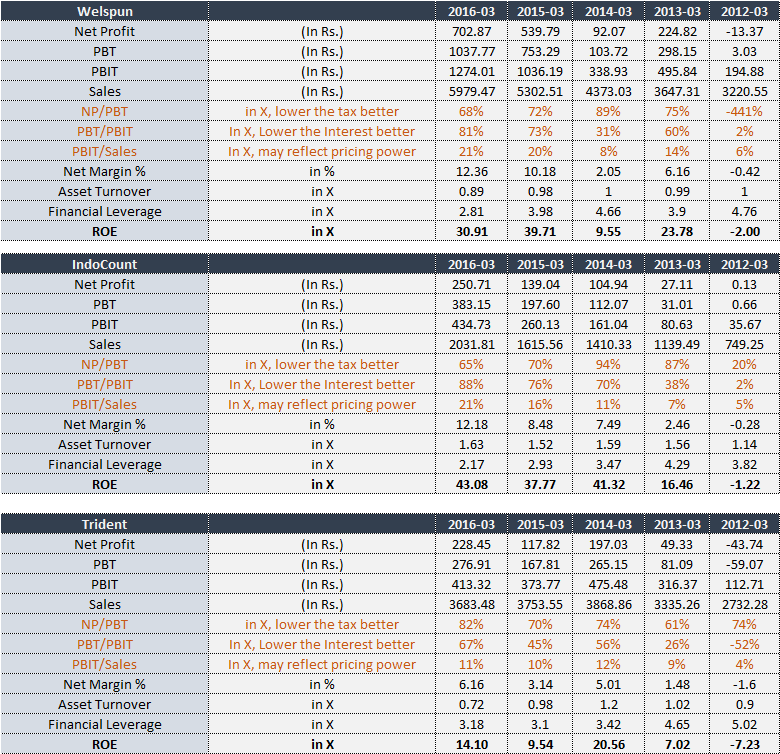

Firstly, due thanks to @amitayu for sharing with us how to drill down the Dupont analysis further in this thread (link). Highly recommend to all for good refresher and condensed learning. Coming back to the work in hand, my evolved Dupont analysis looks somewhat this now:

-

So now, with the new approach I am able to see the convergence of pricing power, Interest efficiency and tax prudence (not to imply any deceitful manner) playing collective role in NPM.

-

Trident got a NPM of 6% for FY’16 as against Welspun and IndoCount who has 12% each. Observation is that tax outgo and Intrest impact being more or less same for all three. The differentiation is in the form of PBIT/Sales. Trident at PBIT/Sales ratio of 11% whereas the other two at 21% each. What does that implies. Is it any ways suggesting lack of pricing power for Trident?

-

For past 2 years Indo Count has a slightly low PBT/PBIT ratio as compared to Welspun suggesting comparative higher tax out-go. Does that gives some confidence that there is not much issue related to tax evasion/ accounting creativity.

-

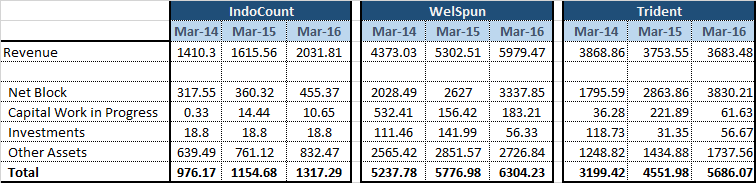

For past three years IndoCount has better PBT/PBIT ratio than Welspun and Trident. Implying lesser interest burden. I am inclined to think that this is again attributed to the asset light model that IndoCount claims to have. Even balance sheet suggests the same. Net Block, capital WIP, and other assets are all much lower in proportion to revenue for Indocount as compared to Welspun and Trident.

- Now, for me, the two questions needs to be understood well much beyond the numbers.

w

1.whats the edge/moat that IndoCount has over its competitors to allow better pricing power and growth rate. whats the differentiation? AR does not explicitly suggest about any distinguished technical superiority, patent power, unique input/process/output dimension. If not about product proposition is it about innovation, market agility etc.?

2. Asset light model - Traditionally most of the textile companies has been with upfront CapEx heavy nature. whats different and how sustainable it is/will be for IndoCount?

Disc: Not invested as of date.

Thanks,

Tarun