The Company and Its Business-

• IndiaMART, a 20-year-old company and the largest online B2B e-commerce marketplace with a 60% market share, enables prospective buyers to discover products and services and connect with suppliers registered on the platform.

• Buyers and suppliers meet on the platform to engage and trade their products. The IndiaMART service is free for buyers, suppliers can list themselves for free but can also take advantage of subscription packages like Silver Monthly, Silver Annual, Gold, and Platinum to gain better visibility and higher order traction.

• The company operates on a desktop and mobile application-based platform, offering diversified products across 95K+ categories with 90M+ listed products (as of December 23)

• IndiaMART has a strong pan-India presence with length and breadth covering 1,000+ cities, with a total of 7.4 million+ suppliers and a registered buyer base of 165 million (as of December 23)

Let us find out within the B2B wholesale ecosystem where IndiaMART fits-

• Purely offline transactions - where buyer and seller discover each other through offline intermediaries

• Online connections, but offline transactions- where buyer and seller discover each other through an online platform, but the actual transaction happens offline. This is where IndiaMART fits.

• Fully online model- where both discovery and transaction happen online. Most new-age platforms such as Udaan and Moglix fall into this category.

Competitive Advantage-

• IndiaMART’s business is well diversified across 56 industries and 95,000+ categories.

• The paying suppliers are dispersed across various categories, with no category of paid supplier contributing more than 8% of the total paid subscriber base, and only four industries account for more than 5% of paid suppliers.

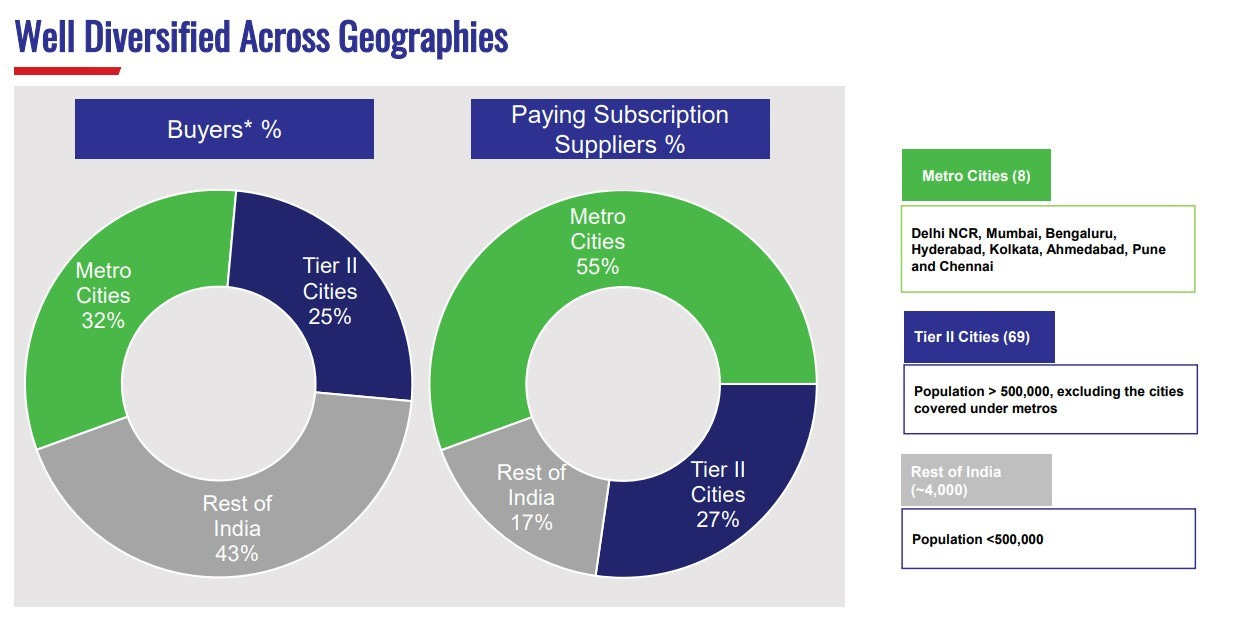

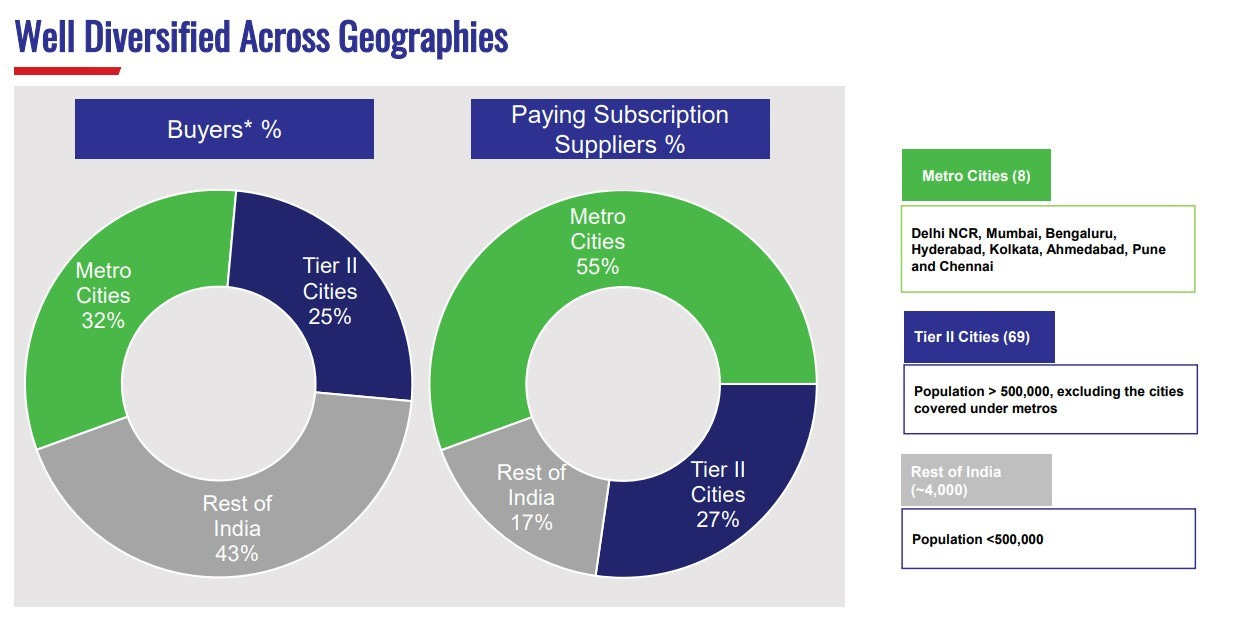

• IndiaMART is able to minimize the impact of region-specific and industry-specific risk on its business with its diversified presence across Metros, Tier II cities, and the rest of India.

• The buyer base is reasonably distributed across India.

• However, the supplier base on the platform is concentrated in the metros (which leads to undiscovered penetration potential for increasing the suppliers from Tier II and the remaining cities of India)

Network Effect-

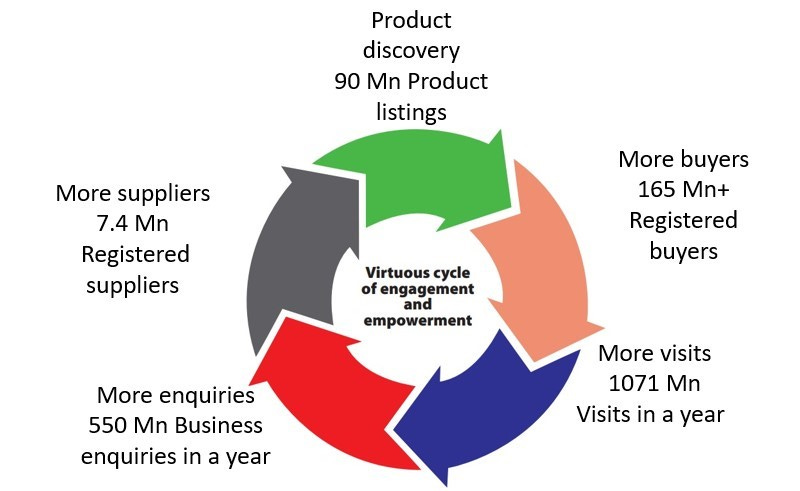

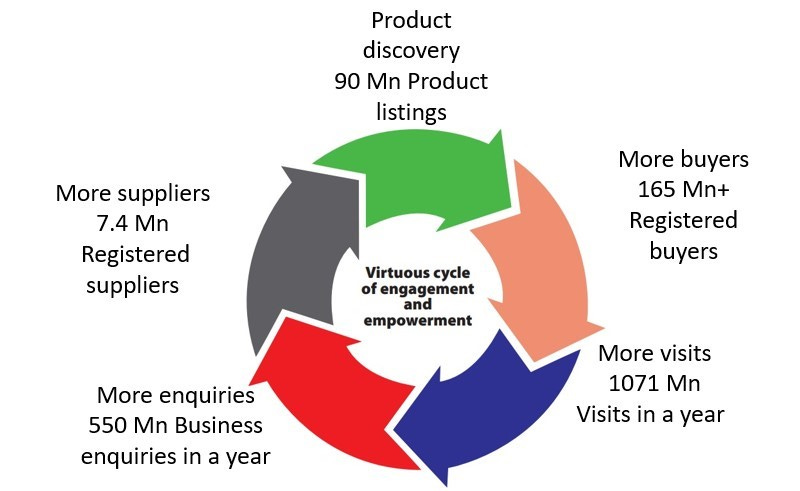

• I believe Network Effect leads to a virtuous cycle that leads to a large and growing number of buyers and suppliers on the platform. Buyers generating more inquiries attract more sellers, and an increase in sellers attracts buyers on the platform.

• In other words, sellers know that consumers are on IndiaMart, so there are more sellers on IndiaMart. The same goes on for consumers, they know the sellers are on the IndiaMart platform, thus bringing more consumers on board.

Critical Mass-

• For the network effect to kick in, you need to get a minimum number of users on the platform, and then the network effect starts playing its role. The biggest challenge lies in getting these users on board.

• To build up a minimum number of users on the platform, i.e, to gain critical mass, companies dole out benefits such as free services for a limited period, providing discounts, etc. Once critical mass is gained on the platform, the value increases owing to the rising number of users of the product, which results in more users joining the platform. As more users join, it further increases the value of the product or service, thereby creating a self-fuelling machine.

Critical Mass for IndiaMART-

• In the case of IndiaMART, the company made continued investments in tech, employees, better matchmaking, and onboarding new buyers and sellers on the platform even at an insufficient profit, as the company was chasing critical mass. However, as the company reached critical mass, the network effect started playing out. Hence, revenue grew while costs plummeted, which resulted in ebitda margins turning positive.

How the network effect has led to almost zero advertising expenses for IndiaMART-

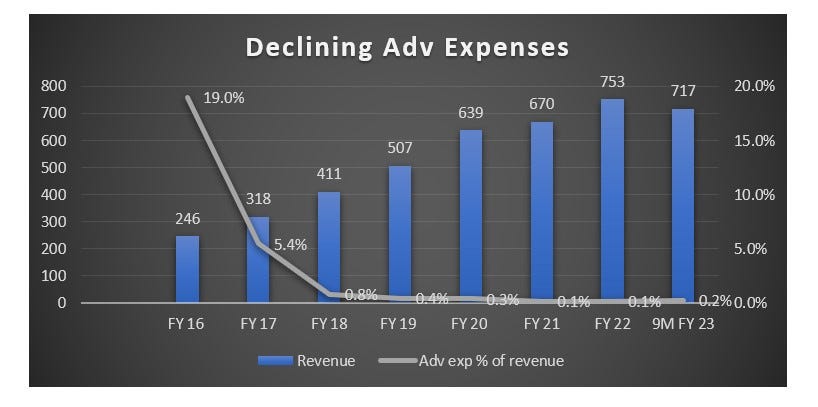

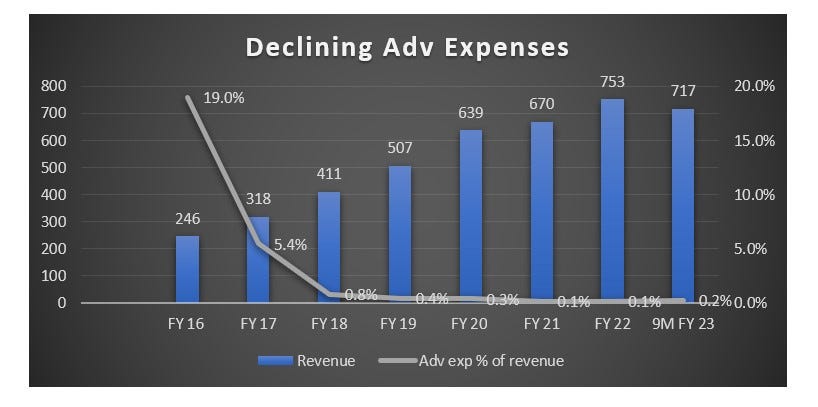

• Network effects resulted in increasing buyer fulfilment rates from 20% (pre-2016) to almost 40%+ now.

• As brand grew in popularity, the network effect began to play a role in generating organic traffic.

• Management shared that, going forward, advertising spends would be limited to enhancing brand recall and not increasing traffic.

• Advertising expenses have decreased from 19% of revenue in FY 16 to almost 0.2% of revenue in 9M FY 23.

Community effect: Self-fuelling business model

• A large number of listings on IndiaMART create a strong community effect as suppliers for one product or service category on the marketplace become buyers for products and services in the same or other categories, thereby increasing organic traffic to the marketplace. Out of total 7.1mn Indian supplier storefronts as on 31 March 2022, 39% were also buyers over the last 12 months.

Let’s understand how IndiaMART earns revenue-

• IndiaMART makes money primarily by selling subscription packages to suppliers, which include a variety of benefits depending on the package, such as priority listing on the supplier’s storefront, access to RFQs, premium number service, and access to an advanced lead management system.

Different Categories of Subscription-

• Platinum and Gold categories are available in annual, semi‐annual, or multi‐year package, while silver packages are available in monthly, quarterly, semi‐ annual, and annual packages.

• You can visit the company’s website to know more about the pricing plan of each category and the benefits of each category.

Revenue Recognition-

• IndiaMART runs a subscription business and has different packages of different durations, the entire money with respect to that subscription is collected upfront at the time of signing up itself.

• Unlike traditional businesses, where a sale enters the P&L first and then comes into the balance sheet, here the money comes into the balance sheet first as deferred revenue and then moves to the P&L.

• Collections from Customers is a key number reported by the company. It represents the actual cash paid by customers to the company. Collections add up to deferred revenue on the balance sheet, which then moves to the P&L as revenue from operations. Basically, after transferring the promised services to the customer, revenue is recognized.

Example to understand the concept - f someone has paid for a three-year subscription package upfront, the entire thing goes into deferred revenue, and in year one, only one-third of that revenue will get recognized and two-thirds will stay in deferred revenue.

TAM (total addressable market)-

• India has 12.8 million GST-registered businesses, and presently, IndiaMART only targets GST-registered entities.

• 98% of their paying suppliers are GST-registered. As per management, out of these GST-registered suppliers, around 2 million to 3 million will be B2B product-oriented suppliers in India, which becomes the total addressable market for the company.

• Management aspires to have a 15%–20% penetration rate amongst these B2B product-oriented GST-registered suppliers. Considering 3 million as B2B product-oriented suppliers will lead to a 0.4 million to 0.6 million paying supplier base.

• Going forward, make in India should boost manufacturing intensity, potentially enlarging IndiaMART’s TAM.

MSME’s Contribution to the Indian Economy-

• The MSME sector consists of all businesses that have investments in P&M of less than Rs 0.5 billion and turnover of less than Rs 2.5 billion.

• Currently, MSME contributes to nearly 30% of India’s GDP.

• The government believes that the MSME sector would provide 50% of India’s GDP on its march towards becoming a Rs 5 trillion economy. To ensure and support the momentum, the government has earmarked Rs 157 billion in budgetary allocations for FY 23 towards various schemes that benefit MSMEs.

MSME’s expanding IndiaMART’s TAM-

• IndiaMART revenues depend on the trend of more and more MSMEs getting onto the internet and those businesses getting used to running their businesses through the Internet.

• MSME’s adoption of digitalization will be one of the biggest drivers for IndiaMART. So, with GST being successful and Aadhar being pushed, and with digital adoption being pushed by the government, there will be a higher adoption rate. So it looks like IndiaMART is probably one of the best-positioned companies to exploit the digitalization of MSME businesses.

• India is growing, India’s per capita income is growing, the number of SMEs is growing, their overall turnover is growing, and this might increase IndiaMART’s overall TAM.

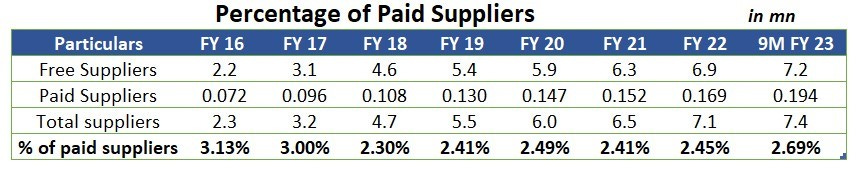

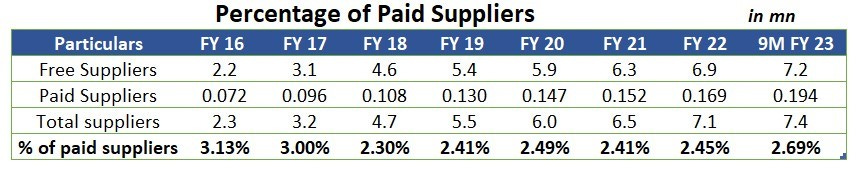

Adoption of paid suppliers is just 2-3 percent of total suppliers -

• A comparable company, which is Alibaba subsidiary company 1688.com in China, has an exactly similar model as IndiaMART’s domestic B2B marketplace, they have about 1 million paying customers, or 10% of total suppliers. China has a 10x bigger economy, and its higher conversion rate of 10 percent is led by the higher digitalization of businesses in China.

• By and large, the product industry and manufacturing industry in India are accustomed to either a dealer distribution-based sales network or a walk-in-based sales network. Going forward, there will be a rise in digital adoption among businesses, but the question remains- can IndiaMART’s management capitalise on this opportunity and focus on increasing paid suppliers as a percentage of total suppliers?

Now let’s talk about risks-

• Competitive intensity: With VC money, B2B companies are very aggressive and happy to spend on marketing and see red P&L statements. If the competitive intensity increases, IndiaMart might have to spend on advertising, which may further lead to a reduction in ebitda margins.

• Pricing strategy: IndiaMART charges similar prices to players across various industries. Some industries that inherently generate thin margins may find subscription packages expensive. This, in a way, also limits the company’s ability to pass through meaningful price hikes across packages. I guess a dynamic pricing model would be more efficient, wherein subscription packages are linked to specific industries and consider various factors, including their margins. This would allow the company to increase its paying supplier base while creating customer stickiness.

• Fake suppliers: The listing of fake products by the suppliers can cause trust issues in the marketplace. To mitigate the risk, the company has turned very stringent and is only registering those suppliers who have done their GST registration.

• Data breach: Leaked information about customers can lead the company into huge trouble.

• Advertising Costs: India MART had incurred losses a few years back when they were bang on in advertising. As of now, they have stopped advertising. The P&L statement can take a hit again if they have to go aggressive on advertising again in the future.

• Niche Platforms: New players are entering the B2B market and focusing on a particular segment. This allows them to grab a particular segment of customers and build platforms with network effects, But for network effects to play a role in these companies, they have to first focus on building critical mass, which is a tough job. These 5 start-ups (Infra Market, Zetwerk, Moglix, Of Business and Bizongo) have cumulatively raised funding of about $2.1 billion in the last 2 years. These startups operate in niche areas and have the potential to affect IndiaMART’s supplier base, but most certainly not right away.

• Capital Allocation: The company has invested in more than 13 startups in the last two years for inorganic growth. However, there is no guarantee that every business will end up on expected lines, which may lead to a loss of significant capital. In many cases, internet-based businesses turn profitable only after attaining critical mass. Hence, the bigger question here is how these investments will play out in the future. (One needs to continuously track these investments.)

Churn Rates-

• First, let me explain churn rate in simple terms: churn rate is expressed as the percentage of service subscribers who discontinue their subscriptions within a given time period.

Churn rates for IndiaMART-

• For Silver monthly plans, churn rates are around 5–6% per month, with a minimum subscription period of 1 month, but churn rates fall as subscribers move to higher plans.

• For Silver, the annual and multi-year churn rate remains at about 2% to 2.5% per month.

• Gold and Platinum members rates remain less than 1% per month.

How high churn rates make scalability difficult-

• Even if a company is gaining new customers each month (paid suppliers are customers for IndiaMART), if it is still losing a part of its customer base, the net addition of customers will be low, and this makes scalability difficult.

Initiatives the company has taken to reduce the churn rate-

• Management continues to work on product market fit.

• Increasing number of registered buyers on the platform.

• Quality of buy lead and RFQ generation.

• Efficient Matchmaking.

Investments-

• IndiaMart successfully raised Rs 10.7 billion (share price: 8615) via QIP in February 2021 (a master stroke by management). Raising money at such a high valuation led to a reduction in dilution of equity.

• This amount has mostly been used for inorganic growth. IndiaMART invests in those companies that have synergies with IndiaMART’s overall ecosystem.

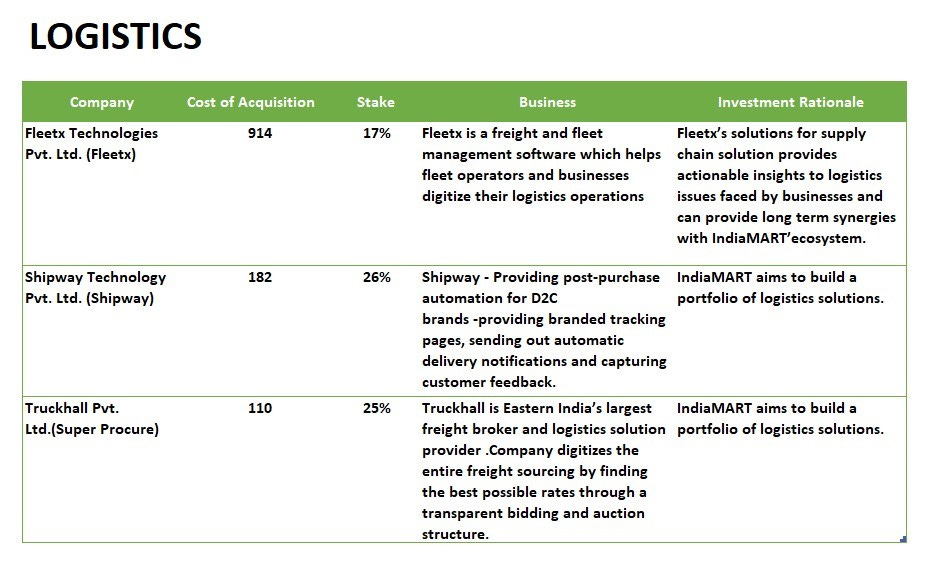

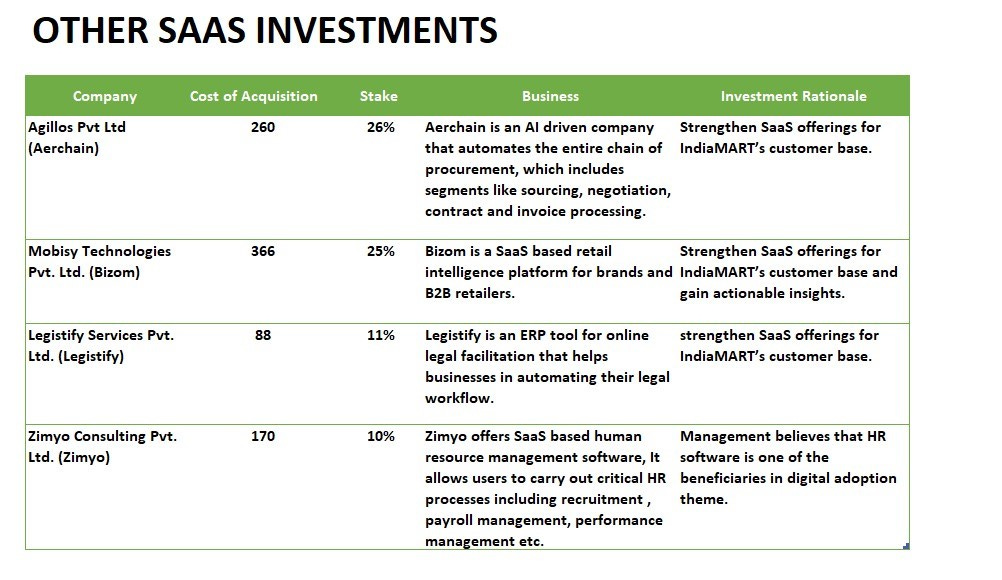

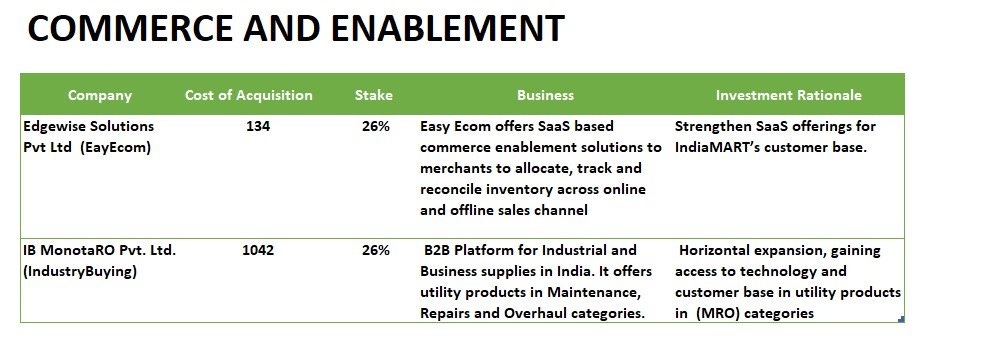

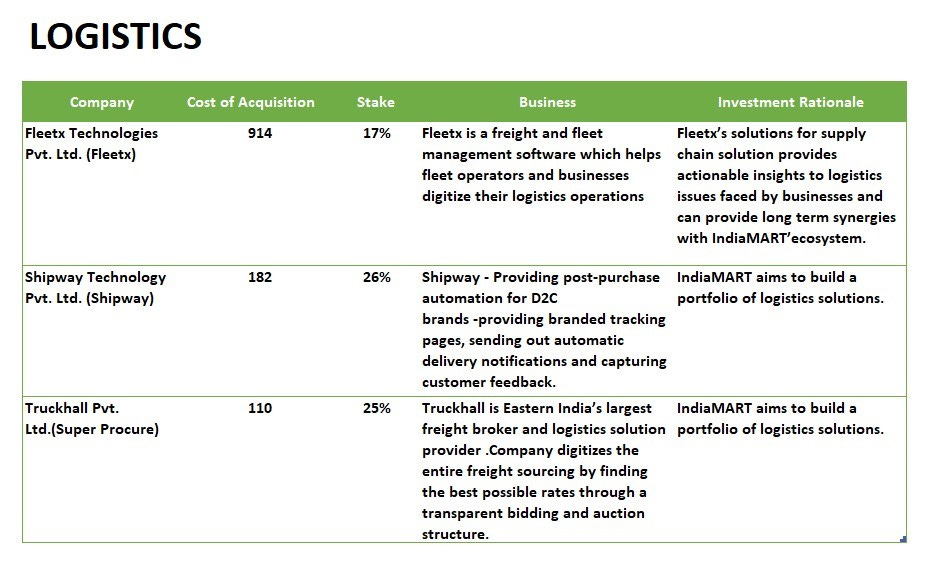

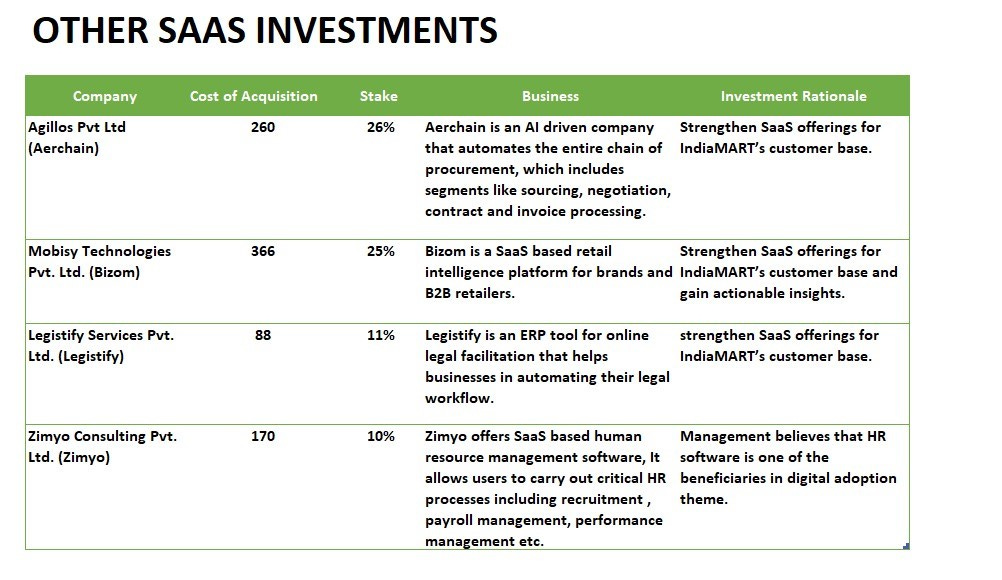

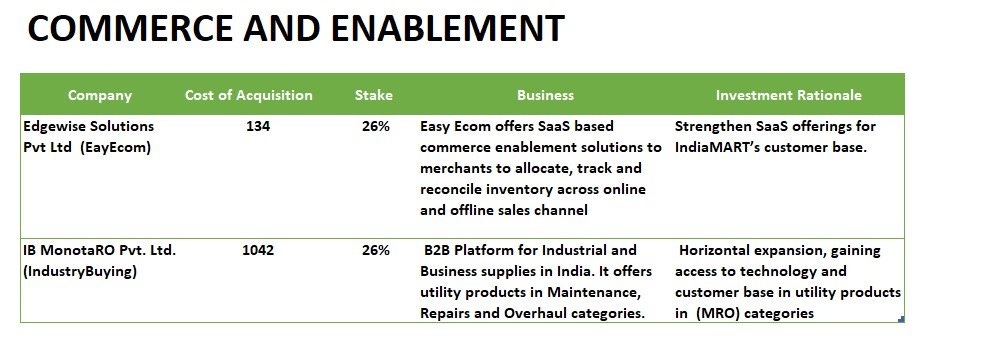

• The company made several strategic investments that will help enable businesses or commerce on the platform in the long term. These investments are in the areas of accounting, logistics like freight and fleet management, procurement management, order, inventory, and warehouse management, human resource and litigation management, sales force automation, and invoice discounting exchange.

• The broad rationale behind these investments is to become a “one-stop shop” for MSMEs, which would keep moving IndiaMART towards commerce and business enablement and expand the network for monetization.

IndiaMART has 14 key investments, which can be classified into five categories-

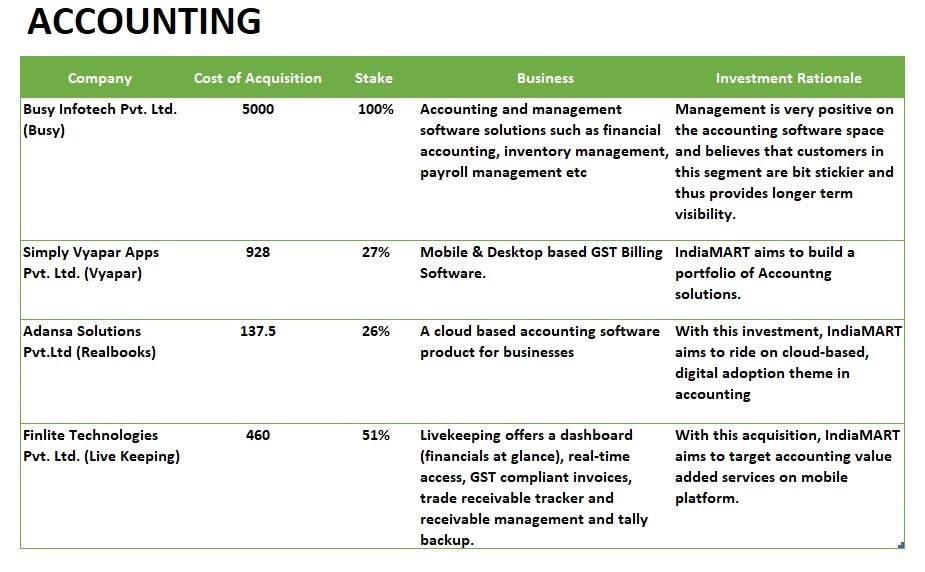

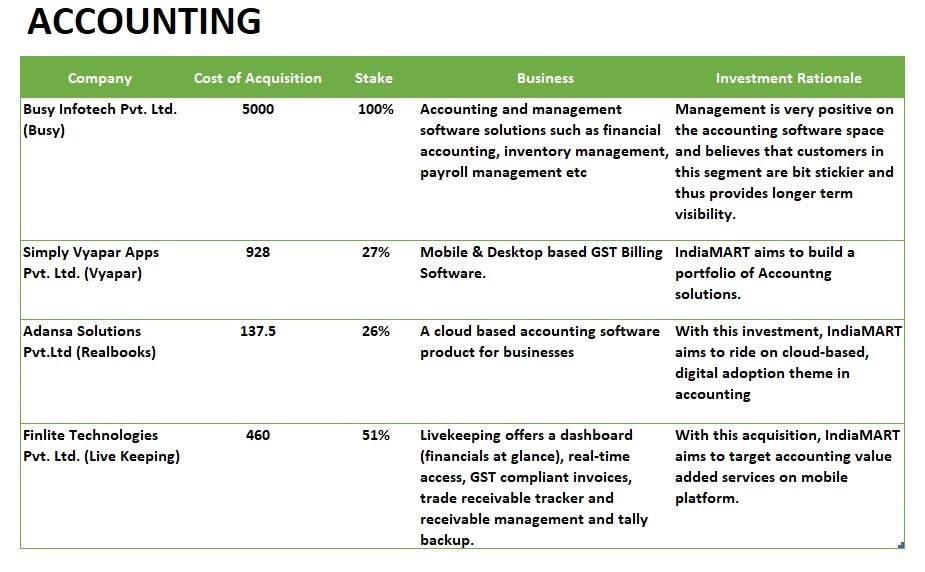

• Accounting

• Logistics

• Payments & SME Finance

• Commerce & Enablement

• Other SaaS investments

Summary on Investments-

• The majority of investments are in the accounting space itself, i.e., 65 percent of total investments.

• Accounting space might have improved focus from the government on tax compliance, making GST more friendly for businesses.

• Management expects overall business usage of accounting software to continue to grow at a good CAGR in double digits over the next 5 to 10 years. Therefore, accounting space in itself will go ahead and may actually become something that is worth a billion dollars in revenues or more.

• Secondly, management believes that ARPUs are very low as compared to the value that is given. There might be an improvement in the ARPU over the next decade as well, because a lot of customers will start to adopt cloud solutions, which will come at a much higher cost compared to the desktop software products that are currently available.

• New customers adopting accounting software as well as an increase in usage make this space a billion-dollar plus opportunity.

• Now, it depends on how IndiaMART will be able to go ahead and execute their plans and what share of this revenue they will get for themselves.

• Capital Allocation Plan Going Forward: Management aims to distribute 1/3 of the cash generated via dividends or buybacks. A balanced amount would be used for organic and inorganic growth.

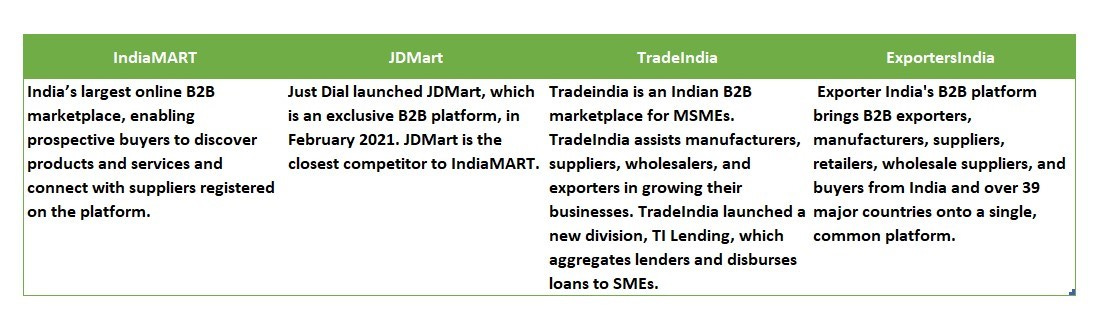

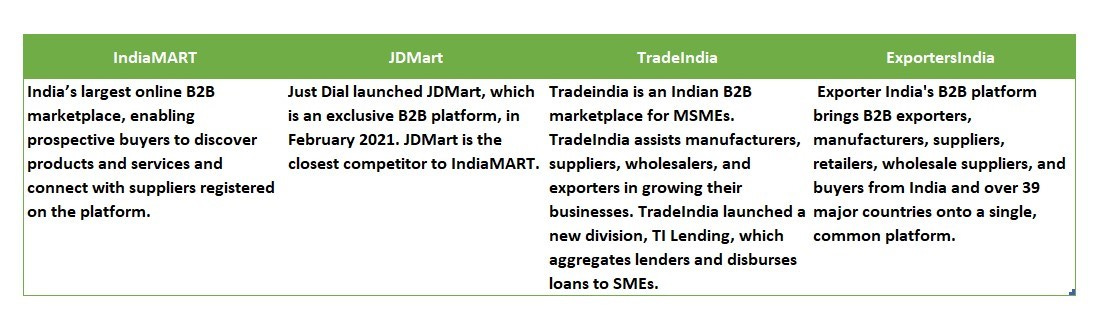

Peer Analysis-

Operational metrics for peers-

IndiaMART is way ahead of its competitors, but JDMart’s aim to spend heavily on advertisements and lower pricing may have a dent on IndiaMART’s share (needs to be monitored)

Key Startup Peers-

• These are 7 key start-ups (Udaan, Infra Market, Zetwerk, Moglix, OfBusiness, Elasticrun, and Bizongo).

• The majority of these peers focus on a particular set of sectors, whereas IndiaMART has a diversified supplier base from various sectors.

• Of business and Infra Market, both are profitable ventures, while the rest are loss-making.

• Threat to IndiaMART: With new players entering the market, burning cash and developing B2B platforms for particular sectors might reduce IndiaMART’s market share in the B2B category. (It needs to be monitored how many of these B2B platforms would be able to sustain themselves in the next few years.)

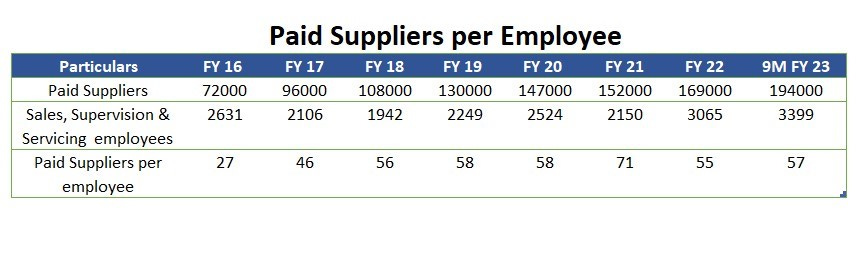

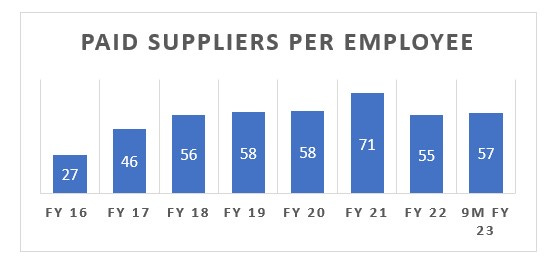

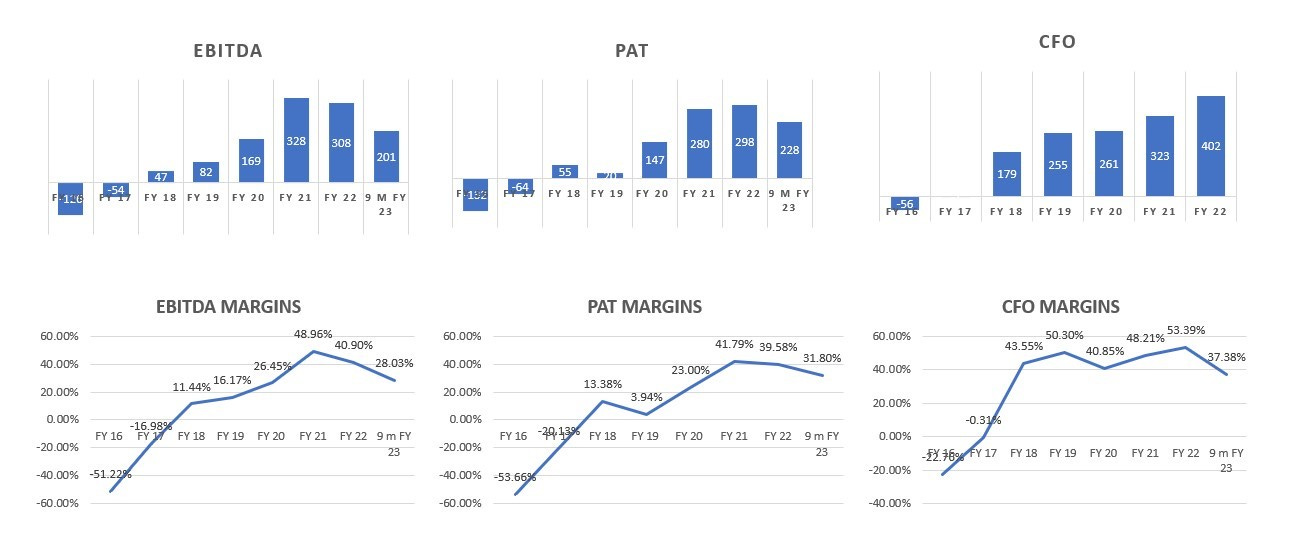

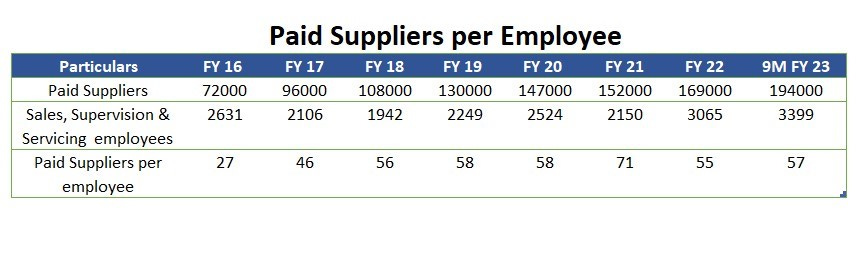

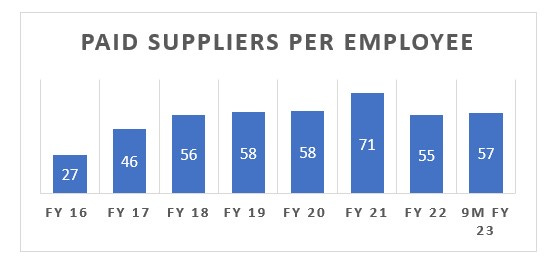

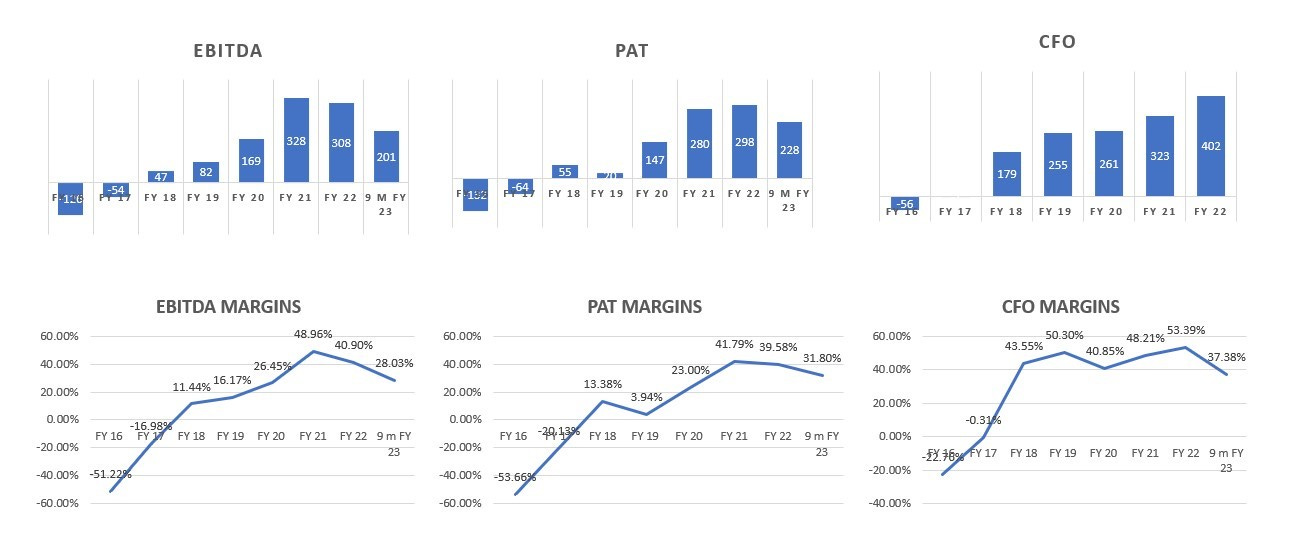

Operating leverage (imp metric to track)

• In FY 21, the company had massive operating leverage as the number of employees and their wages decreased, hence, ebitda margins were also at 50%, but as the employee count and their wages increased in the following years, there was a reduction in ebitda margins and no more operating leverage.

• Management mentions that the current team base is enough for growth or scale-up plans, and going forward, employee additions would be in line with (actual) customer growth.

• We need to monitor this metric to see if there could be any operating leverage going forward.

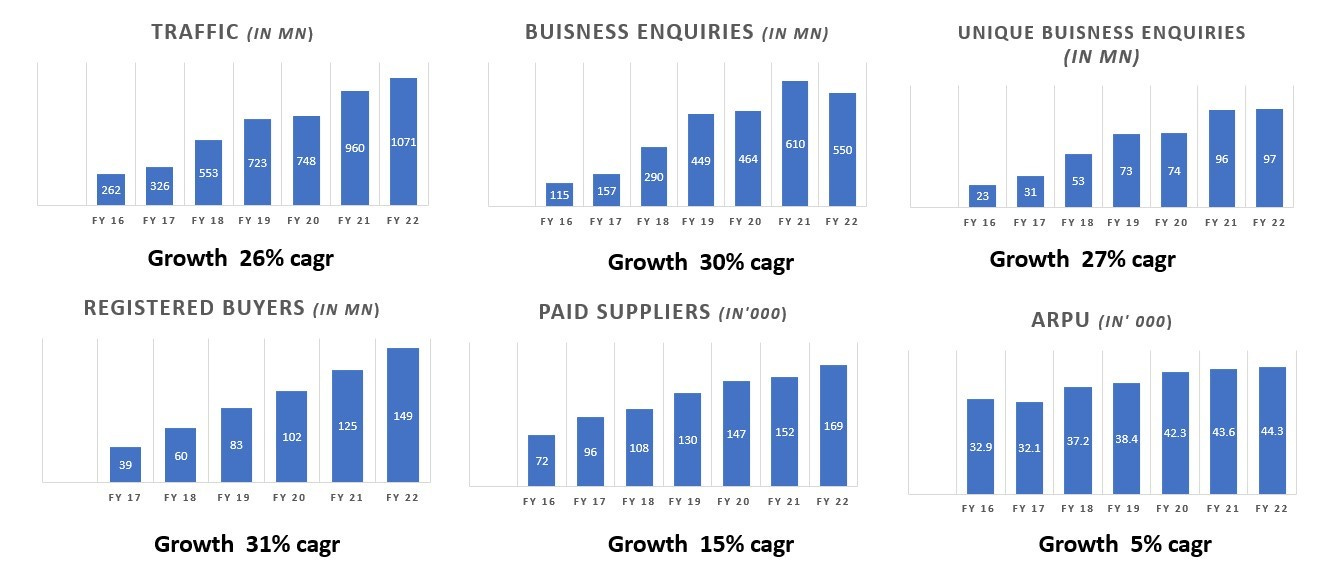

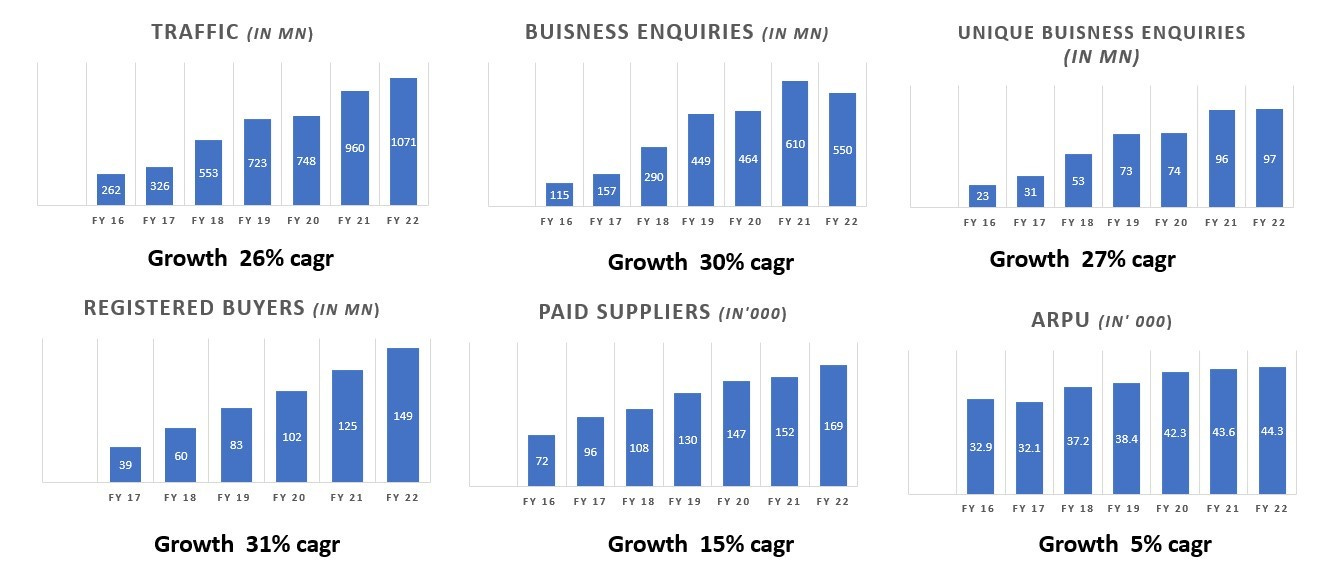

Operational Metrics-

• Traffic- Traffic is defined as the number of visits on the desktop website, mobile website and mobile app of the company.

• Registered buyers- This number indicates buyers who have registered on IndiaMART.

• Unique Business Enquiries- Buyer posting an enquiry is one unique buyer for that day. If the same buyer posts another enquiry on a different day, he is considered as a different unique buyer.

• Annualised Revenue Per Paying Subscriber- ARPU Represents Revenue from operations for the period divided by Paying subscription suppliers at period end.

Financial Metrics-

Management’s Guidance on Revenue and EBITDA Margins Going Forward-

• Management has guided revenue growth of around 20% from FY 23 to FY 27.

• Ebitda margins would be in the range of 25 to 28 percent for FY 23, and going forward, if there is no threat from competitors and IndiaMART does not spend on advertising expenses, ebitda margins could sustain at the same level.

VALUATION-

• Valuation on the basis of PE ratio will not make much sense according to me, in good times when company was having a massive operating leverage and good ebitda margins, company was trading at triple digit PE ratio.

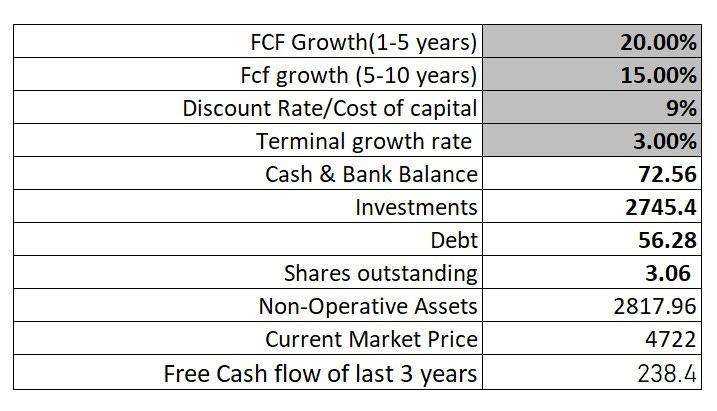

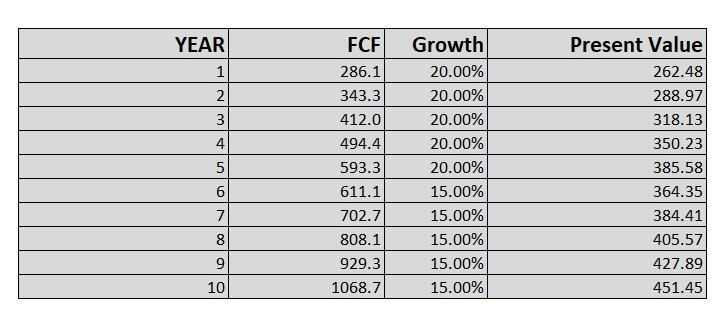

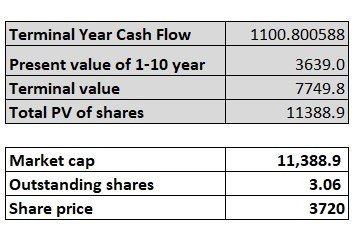

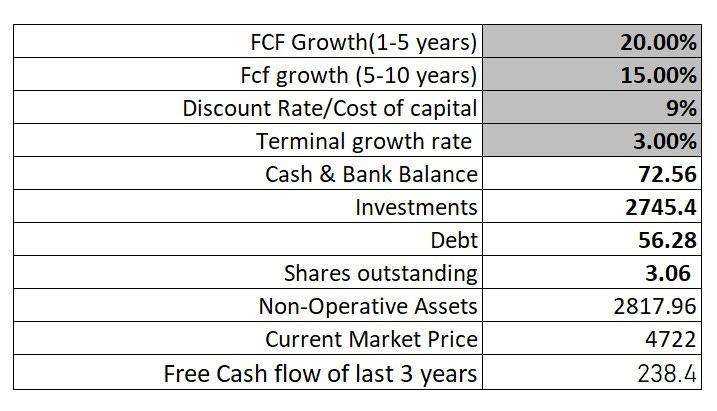

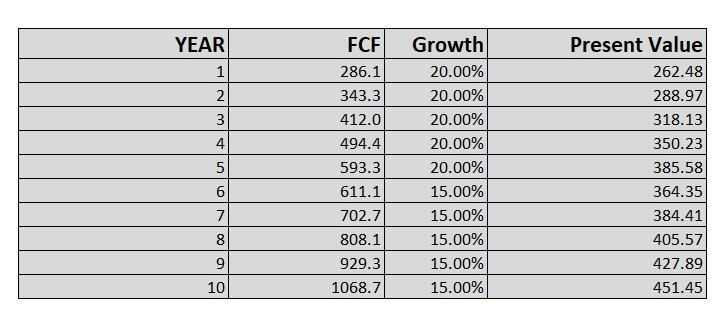

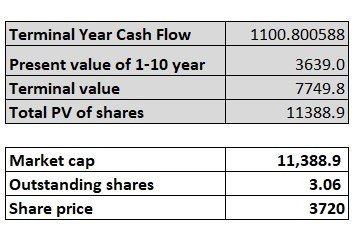

DCF valuation-

• Negative working capital and low capex requirements generate robust free cash flow (FCF), and I expect capex to remain minimal and the company to generate healthy cash flow going forward as well.

• This is the reason I have chosen to do DCF.

• Fair value comes around 3720, but it’s all about assumptions. You can try it with your own assumptions, keeping in mind management’s guidance on a conservative basis.

• Not a buy, hold, and forget kind of business, these kind of businesses needs continuous evaluation.

Promoters-

• Dinesh Agarwal and Brijesh Agarwal started IndiaMART in the late 1990s, tried various experiments, and pivoted the business a couple of times before reaching the current stage. For example, some of his experiments included determining the price of the deal using an auction-based model (during 1999) and providing logistics support through Tolexo.com.

• Highly educated and experienced promoters running a tech business in a successful manner, as far as I could sense, they have expertise in both tech as well as running a successful business.

Dinesh Chandra Agarwal – Managing Director and CEO

• He is founder of IndiaMart, and has worked previously with HCL America, CDot, CMC Co. He holds a B.Tech (HBTI), from Kanpur.

Brijesh Agarwal – Whole-Time Director

• He is the co‐founder of IndiaMart, and has worked previously at Miebach Logistics India Pvt .Ltd. He holds an MBA, from Lucknow University, and a PGDM New Delhi University

Disclaimer-

• This is not investment advice, nor do I have any position in the stock, I was personally studying the company and thought why not share it with everyone! I have just done level-one research, which can be used as a starting point for studying the company.

Sources-

• Annual reports.

• Investor presentations and concalls.

• Research reports.

• Vp threads and reports.

Ps - i wrote this long back company has done a bonus issue after that,