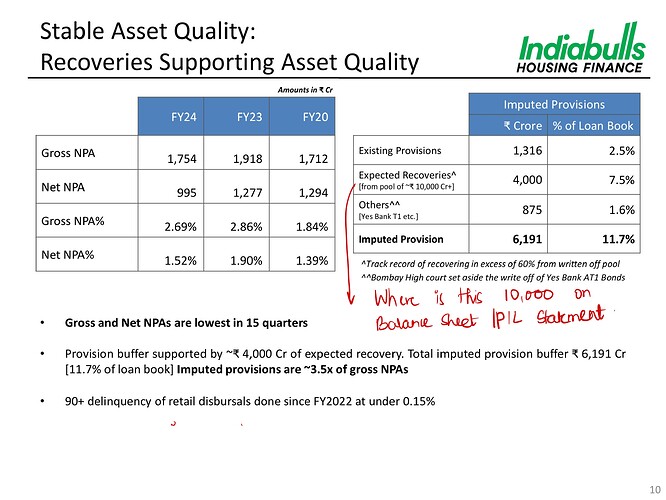

@ Guys can someone explain me this slide please.

10K is legacy loan. 4K recoveries are expected. So going forward provisions will be 6K. But where are these 10K on balance sheet - PNL?. Are they still in assets and not classified as NPA’s. Want to ask as not able to gauge how much of the old skeletons are factored in present BS- PNL and what will be additional surprises.

If you see in notes (just above your notes), it says “written-off” nothing in balance sheet but they expect to recover 40% at least so 4000 crs. Thanks!

Thanks Value V

Does it mean that whatever 4K recovery is done will be like bonus as already 10K is written off??

TIA.

Also Santosh- the legacy book as they define is - loan book as of Dec 2022 or FY22 - need to check the concall as i was listening while sleeping. any thing prior to that is called as legacy loan book - they plan to reduce that to 5000cr by FY27.

The 10000 which you mentioned is not in balance sheet - its already written off, but trust me, whatever is being recovered - is being further utilized towards creating provisions on legacy book.

Like they did for AIF provision reversal this quarter.

Hope this helps

i dont this divestment is needed, they are already operating at 1.5-2x levels of gearing and hence ROEs are suppressed, they are well capitalized with a CAR of 30% and above, if in case they are raising further equity, it only means , they need more CAR to wipe off bad loans.

so wahatever book value is there - it will be depleated due to provisioning, however, if they keep providing only rationally every quarter and keep diverting all the recovery amount to provisioning, there is till hope that it can attain book value multiples as mentioned by many boarders in above posts.

my best guess is - of the 19-20kcr book value - market is already factoring a default of 10-12kcr. of loan book. (As of March 22 - loan book was around 60k cr) - right now the AUM is 65k - waiting for breakup details in filings and concall transcript.

Yes, it will be bonus but I would not consider it in my investment thesis as sep 2020 presentation, they mentioned that we should have received 58 rs as dividend for FY24. This is why it trades at half of book value and if you see they also use creative accounting for writeoff as they move money to reserve then debit to write-off hence not in PnL. You can see how they did for AIF.

disc: holding it in my portfolio.

2019-2020 was a different world for them, it was a different business model and cant be compared. That dividend proposition was based on party going on, which eventually stopped after ILFS. And most of their developer loans got stuck.

Hence cleanup, and change of business model.

Yeah but it was a way after ILFS crisis (around 2018) and this guidance was given in Sep2020 (after covid) besides my point was not regarding any specific details but was to highlight that we need to take whatever they mentioned in IP with a lot of salt. Thanks!

Disc. Has holding. may be biased.

Hi @Vineet_Bhatia have you analyzed the filings. Looking forward to your views on this, if you could share. Also, based on your experience followings banks and NBFCs how would you look at the risk-reward ratio for IndiaBulls Housing?

The risk in IB housing is writeoffs of old loan book… Which market is factoring by giving discount to book value.

Considering the dividend stream has started, the recovery in IBHFL looks plausible

As per the filings and company guidance, the next two years roe etc looks conservative to me(i think its already factoring further writeoffs) , any bad hiccups can be severely punished though. They have not been fulfilling their name change dreams, been listening since 3 quarter concalls, but the name remains same.

Risk reward looks favourable at 120-100 per share, however the price has already gone up and hence any further jump from here will be linked to company performance. Dont expect a quick re-rating.

Disclaimer: invested with good allocation.

just some facts already 9500 crore is provided for & 1000 crore more is provided by aif exposure, we can expect more recovery from this pool which can come in p&l again. the market is not giving its valuation because of growth I think and Street would want to see it. hopefully in 2-3 years, they can at least get there roe above 12% to 15% then the street may rerate it will eventually.

Here is a filing regarding Allotment of Equity Shares to exercise of stock options under ESOP. Can someone shed some light on how it will affect the existing shareholders or minority shareholders of Indiabulls Housing Finance Ltd? Should the management seek rewards other than stock options? Why not just increase the pay or does the ESOP add skin in the game for the employees/stakeholders?

They have issued approximately 35.8 lakh shares to employees as ESOP. After allotment the number of shares of the company is approximately 49.60 + 24.62 crore shares. This amounts to approximately .5% of total shares outstanding.

Following is the calculation for your reference:

In [24]: 3579035 / (496032064 + 246226515)

Out[24]: 0.004821816953361209

In [25]: _ * 100

Out[25]: 0.4821816953361209

_

Typically ESOPs being issued should increase total diluted shares outstanding. It doesn’t matter wrt there being skin in the game if it is at the cost of existing investors getting diluted. Companies that approach management with an ownership mindset usually buyback shares to offset any shares issued. Either way, I would argue a 0.5% increase is not much in the longer term as long as it is a one off thing.

Over the last couple of years, diluting shareholders to reward management and employees has been marketed as a move towards ‘ownership’ but we have seen cases like Lyft where the CEO was giving himself hundreds of millions every year in stock and like Musk with Tesla holding shareholders hostage for a billion dollar payout.

They should earn 71.6 lakh from this as they issued these for 2 rupees per share for eligible employees to buy, the money is usually reflected under cash on the balance sheet for most issuances.

Any examples of a good ESOP plan that worked well for a company and its shareholders?

Can’t speak for the Indian markets, but in American and Chinese equities the examples are dime a dozen. ESOP is not the issue, but they still dilute the shareholders, what you need for the ESOP to be really viable are buybacks, that way not only the shareholders but also the employees who have become shareholders will be incentivized in the long run as the value of their shares grow. Tencent is one good example, massive buybacks. AZO, NVR, ORLY are some good US examples, bought back more than 50% of the company in some cases, total cannibals.

As long as the ESOPs are not excessively dilutive, they shouldn’t be a concern. 0.5% is not much imo and there are companies that dilute twice that even after accounting for buybacks.

Hi friends! ![]()

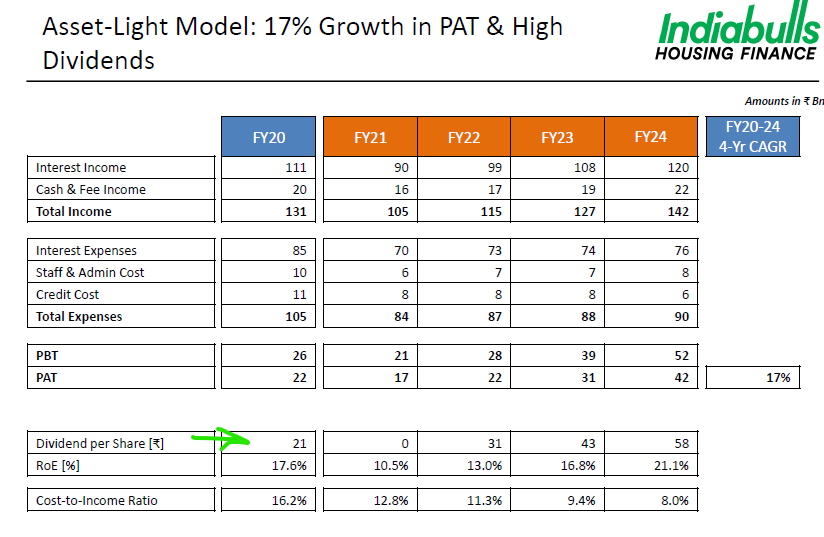

Here’s a short simple straightforward Back Of Envelope (BOE) on Indiabulls hsg fin’s potential return by the year 2027

The management has provided;

Networth target of 23K crores by FY27

Incremental ROE on retail disbursements at 18% by FY27

(1 lac crore additional retail disbursements and 5k crore legacy book)

Let’s assume same ROA on entire book thus full 18% ROE on entire 23K networth

Expected profit = 23K crore*18% = 4,140 crore

Assuming 50% dividend payout

Dividend payout = 2,070 crores

Total shares outstanding= 73,86,79,545 (FV 2₹)

24,62,26,515 party paid shares of paid value 0.67₹

49,24,53,030 fully paid shares of 2₹

(Current and future ESOP’s given are not considered, management expects to give 10% of total current outstanding shares as ESOP’s in coming years based on achievement of certain targets)

Total share capital as on 31/03/2024

₹114,98,77,825.05

(114.99 crores or 73.87 crore shares of FV ₹2 O/S)

Earnings per Share = ₹56.04

(4,140 crores/ 73.87 crore shares = ₹56.04)

Dividend per share = 28.02₹

(At 50% expected payout ₹56.04*50% = ₹28.02)

Assuming 2% dividend yield

Stock price = 1,410.15₹

Implied PE of 25 times

Assuming 5% dividend yield

Stock price = 560.46₹

Implied PE of 10 times

Assuming 10% dividend yield

Stock price = 280.23₹

Implied PE of 5 times

.

.

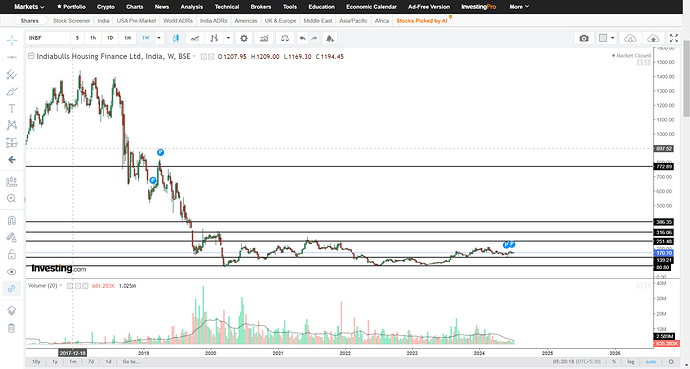

Technical chart for Indiabulls hsg fin

Levels for upside breakout from this consolidation phrase are;

1st level; 252

2nd level; 316

3rd level; 386

.

.

Points of concern:

1st

Dilution of Book value by issuing shares through rights issue

2nd

Complex borrowing instruments;

They had complex instruments issued such as FCCB. They were repaid right after they received the Rights issue money. these bonds were convertible to equity shares at around ₹242 level

(Refer FY23 annual report for details)

3rd

Latest resolution proposing power to board to raise additional ₹3.5K crores through equity-oriented instruments.

They should’ve bought back the shares at these valuations and not dilute more shares.

Generally, in India NBFC’s and banks don’t do buyback because of SEBI rule stating maximum allowable debt/equity ratio of 2 post buyback…

Since this company has and would have D/E ratio below that level, with stock trading at deep discount to book value they should’ve gone for buyback of shares, they won’t get this opportunity once again once they start gearing up and raising D/E ratio)

4th

Indiabulls brand & Corporate governance issues.

They were a nifty50 company, now they aren’t even in F&O segment.

However, the management is now professional, name change to Sammaan capital done also focus is seen in improving corporate governance.

5th

No promoter;

Maximum shareholding with individual and retail shareholders

Most DII’s have sold out

However, there is still some substantial DII and FII holding, if these shares are offloaded it would create pressure for stock price for the near term.

6th

Incorrect, misleading Targets for ROA, ROE and Leverage

They are adding Co-lending business in their own AUM and using it for ROA computation while in reality it won’t be on their Balance sheet, thus their Target figures for ROE, ROA, leverage won’t match if you do the maths. To keep it simple, just focus on ROE

(Refer pg no. 13; Q4 concall for FY24. Please go through entire transcript to make sense of this point)

.

.

Personal Opinion

Stock looks attractive, my personal target for stock by 2027 is around ₹700-₹900 On the basis of targets management has set, and also on the expectation of valuation re-rating of the stock in upcoming years.

.

.

Disclaimer:

Do your own study, analysis and due diligence before investing or trading.

I currently own 0 shares.

Views invited for discussion😊

.

.

Sources;

Q4 presentation (pg no.7)

Q4 concall link

Refer Q4 result update

Call for the final amount of PP shares

The company called for the remaining amount on the pp shares. Record Date: Monday, July 22, 2024