Hi I have shares around 30 for IIFL Finance so I was allotted 3 shares as rights issue, I applied through ASBA online, so within how much days those shares should get added to my portfolio?

They got credited to my DP today

How to apply through ASBA I am not seeing option in my DP site.

for rights issues, you need to fill a form and submit at any of the ASBA certified banks mentioned in the form. i dont think rights issue applications can be done online through broker app/website.

Rights issue has already closed on May 14, it was open from April 30, 2024 to May 14, 2024. If someone missed to sell the Rights Entitlements and also didn’t apply then nothing can be done now.

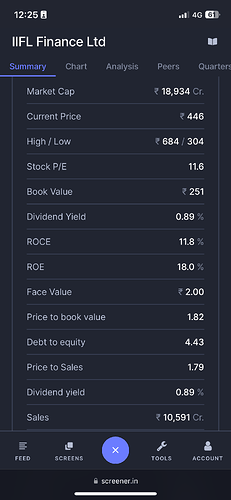

IIIFL’s current market cap of ₹1,538 Cr appears undervalued with a PE of 5.5 and PB ratio of 0.78. Strong growth in their NBFC segment, high asset quality, and promising management outlook suggest potential for re-rating.

IIFL FINANCE: Company inform that the Reserve Bank of India (RBI), through its communication has lifted the restrictions imposed on the gold loan business of IIFL Finance Limited (“the Company”).

**IIFL Finance - **

Q1 results and concall highlights -

Loan book @ 69.6 k cr, up 2 pc YoY ( due sharp contraction in Gold Loan book post the Ban on further disbursement of Gold loans by RBI )

Breakdown of loan book, Avg Yield, Gross NPAs -

Home loan book @ 28.1 k cr, up 23 pc YoY, Avg Yield @ 11 pc, Gross NPAs @ 1.29 pc

Gold loan book @ 14.7 k cr, down 33 pc YoY, Avg Yield @ 19.6 pc, Gross NPA @ 2.93 pc

Micro fin book @ 12 k cr, up 17 pc YoY, Avg Yield @ 24.5 pc, Gross NPAs @ 2.32 pc

LAP book @ 8.4 k cr, up 23 pc YoY, Avg Yield @ 18.9 pc, Gross NPAs @ 3.59 pc

Digital loans @ 4.6 k cr, up 59 pc YoY, Avg Yield @ 21.4 pc, Gross NPAs @ 3.26 pc

Construction and RE loans @ 1.4 k cr, down 46 pc, Avg Yeild @ 16.5 pc, Gross NPAs @ 1.45 pc

P&L account -

NII - 1012 vs 937 cr, up 8 pc

Other income - 380 vs 487 cr, down 22 pc

Operating expenses - 746 vs 633 cr, up 18 pc

Pre-Provisions operating profits - 647 vs 792 cr, down 18 pc

Provisions - 251 vs 190 cr, up 32 pc

PBT - 436 vs 618 cr, down 29 pc

PAT ( after minority interest ) - 287 vs 425 cr, down 32 pc

Cost of funds @ 9.1 vs 9.1 pc YoY

RBI has lifted the ban of disbursement of Gold Loans wef 19 Sep !!!

As on 05 Aug ( day of concall ), Gold loan portfolio has run down to 12.1 k cr from 26 k cr on 04 Mar ( date of ban on disbursements ). Company has returned jewellery of the customers and returned 13.5 k cr to the Banks. The acid test of quality of a portfolio is when it liquidates - here the company’s Gold loan portfolio has passed with flying colours

Company has not laid off any employees nor has closed any branches

Consol GNPAs @ 2.2 pc vs 1.8 pc YoY

Consol NNPAs @ 1.1 pc vs 1.06 pc YoY

Company’s provision coverage ratio for Net NPAs stands @ 128 pc

Company’s MFI portfolio has behaved far better than the Industry. They started tightening their lending norms in the MFI space, way back in Jan 24 ( which the Industry started doing post Mar - Apr - ie when the stress started to appear ). Also, company’s exposure to Punjab is lower - where the stress is higher

Also, because of their caution on MFI loans, the MFI book is down QoQ - it looks like a great decision - in hindsight

Banks have been a little hesitant in lending to IIFL post the RBI ban. Ex- If the company is asking for say 500 cr, banks are only releasing 100 cr. However, their caution is now seeing signs of abating

While disbursing loans in MFI segment, company doesn’t lend to a customer borrowing from > 4 sources. They also don’t lend if the customer has borrowed > 2 lakh / household

Slippages in MFI portfolio in Q1 were around 100 cr. That’s about 3.3 pc - annualised - this looks okay considering MFI is a very high margin/spread business

Disc: was holding a tracking position, intend to add more - now that the RBI’s ban has been lifted, not SEBI registered, not a buy/sell recommendation, biased

Was anyways looking to add / buy into some NBFC stocks to play the impending rate cut cycle

But this below article says about layoffs.

Looks like NDTV profit wants to keep the stock price suppressed.

Update: The article is written without knowing RBI lifting gold loan restrictions.

It was a hit piece that came out (market hours) on the same day of RBI announcement (during after market hours). Clearly someone’s toying with the media to crash the share price so they can buy it before RBI announcement and reap the benefits of the price bump. SEBI should probe.

My Notes on IIFL Finance Q2FY25 Performance.pdf (335.5 KB)

![]() Unlocking Insights into IIFL Finance’s Q2FY25 Performance!

Unlocking Insights into IIFL Finance’s Q2FY25 Performance! ![]()

![]()

Dive into the financial journey of IIFL Finance as they tackle challenges and embrace opportunities:

![]() Gold Loans: Back on track post-RBI embargo, aiming to reclaim their ₹26,000 Cr AUM goal by Q4FY25!

Gold Loans: Back on track post-RBI embargo, aiming to reclaim their ₹26,000 Cr AUM goal by Q4FY25!

![]() Affordable Housing: Leading the way in sub-₹20L loans with growing demand and Govt. support via PMAY.

Affordable Housing: Leading the way in sub-₹20L loans with growing demand and Govt. support via PMAY.

![]() Digital & MSME Loans: Leveraging tech to empower small businesses with robust credit solutions.

Digital & MSME Loans: Leveraging tech to empower small businesses with robust credit solutions.

![]() Microfinance Recovery: Tackling industry stress with proactive measures and hope for stabilization.

Microfinance Recovery: Tackling industry stress with proactive measures and hope for stabilization.

![]() Strategic Resilience: Strong liquidity, solid capital adequacy (26.3%), and a focus on compliance and growth.

Strategic Resilience: Strong liquidity, solid capital adequacy (26.3%), and a focus on compliance and growth.

![]() Check out the PDF attached below to see how IIFL Finance is transforming challenges into growth opportunities.

Check out the PDF attached below to see how IIFL Finance is transforming challenges into growth opportunities.

hashtag#Finance hashtag#IIFLFinance hashtag#GoldLoans hashtag#AffordableHousing hashtag#Microfinance hashtag#DigitalTransformation hashtag#GrowthStrategy hashtag#Q2FY25 hashtag#MarketInsights

IIFL Finance -

Q2 results and Concall highlights -

Loan book @ 66.9 vs 70.01 k cr, down 8 pc YoY

On book assets @ 44.5 vs 44 k cr, up 1 pc YoY

Off book assets @ 22.4 vs 29 k cr, down 23 pc YoY

NII @ 995 vs 1000 cr, down 1 pc

Total Income - 1464 vs 1599 cr, down 8 pc

Pre Prov operating profits - 731 vs 922 cr, down 21 pc

PBT - 446 vs 638 cr, down 35 pc

Exceptional items - 586 cr ( RBI mandated 100 pc provisioning against 100 pc of all AIF investments which are not liquidated within 30 days of issuance of RBI circular. Company was holding such investments worth 586 cr and hence made the provisions to comply with RBI regulations )

PAT - (-) 157 vs 474 cr

Gross NPAs @ 2.4 vs 1.8 pc

Net NPAs @ 1.1 vs 1.0 pc

The embargo on company’s Gold loan business ( imposed on 04 Mar 24 ) has now been lifted ( wef 19 Sep 24 )

Segmental review -

Home Loans - AUM @ 29.1 k cr, up 21 pc YoY. Company mainly focuses on affordable and non-metro segments. Company has 387 dedicated home loan branches across India. Gross NPAs @ 1.25 pc

Gold loans - AUM @ 10.7 k cr, down 54 pc YoY and down 27 pc YoY ( due to the embargo placed on the company against sanctioning of any further Gold Loans ). Company provides Gold loans through its wide network of 2745 branches. Gross NPAs @ 2.4 pc

Microfinance - AUM @ 11.3 k cr, flat YoY, down 6 pc QoQ. Company has 1645 dedicated micro finance branches across the country. Gross NPAs @ 3.43 pc

LAP - AUM @ 8.5 k cr, up 28 pc YoY. Gross NPAs @ 3.52 pc

Digital loans - AUM @ 5.4 k cr, up 53 pc YoY

Company’s cost of funds in Q2 @ 9.2 vs 9.0 pc YoY

Avg Yeild on Gold Loans @ 20.6 pc, Avg ticket size @ 1.09 lakh

Avg Yeild on Home Loans @ 12.5 pc, Avg ticket size @ 15.15 lakh

Avg Yeild on Microfinance Loans @ 24.2 pc, Avg ticket size @ 0.50 lakh

Company’s Gold loan book on 30 Sep was 10.7 k cr ( down from a peak of 26k cr ). As on the day of concall, it’s already back up @ 12 k cr. Company has started applying for credit lines from the banks ( post lifting of RBI’s embargo ) and the liquidity situation is now steadily improving

Demand for Gold loans continues to remain strong

One positive change that’s happening in the gold loan industry is that it is becoming cashless. Earlier, there was a fear that if NBFCs go cash less while giving out gold loans, customers may go back to local money lenders. But as RBI has forced all NBFCs to go cash less, such fears are now abating and ppl are not going back to money lenders

Company believes, their MFI book should see lesser stress going forward into Q3 and Q4 ( vs Q2 ). They believe that peak MFI stress for them is already behind however same may not be true for the industry

The digital loans that the company gives out are targeted at MSME customers. Demand for these loans continue to remain healthy

Company is guiding for a credit cost of 3.5 - 4 pc for the MFI business for full FY 25

Most of the stress in the unsecured loans in the Industry is in the personal loan space. Whereas, company’s unsecured loans are mostly given as unsecured business loans to MSMEs. These unsecured loans for business purposes are also covered by Insurance schemes launched by GoI. Company has got an approval for the same and will apply for the same wef Q3. Secondly, banks generally struggle to meet their lending targets to MSME. Here, the company gets into a co-lending model with the banks and the risk is distributed. In a bad cycle, NPAs in this segment can be as high as 4-5 pc but the lending rates are also high @ 20-24 pc which gives them enough cushion + the GoI’s Insurance scheme is an added safety valve

Total provisioning done by the company in the MFI segment in H1 is @ 300 cr. They expect to provide ( or provision ) another 200 cr in H2. Company is seeing better collection efficiency in this segment in Oct vs Q2

Guiding for a consolidated credit cost of 2-2.5 pc for FY 25

Disc: holding, added recently, not SEBI registered, not a buy/sell recommendation, biased