Long read on IDFC both raising money and announcing a dividend at the same time

–

The idea of a company giving out a dividend is that it has “excess cash” that it can return to its shareholders. The company is presumably doing well, has invested in whatever assets it needs for the next few years, is earning a healthy profit, and wants to make investors happy by returning some of their money.

The idea of a company raising money from investors is the opposite. It needs money to do things. It could be to get more customers, move into new business lines, etc. Giving out a dividend and raising money from investors are ideas at odds with each other. A company can’t both have excess cash and need external money to be able to do stuff.

Last month IDFC First Bank announced a fund-raise:

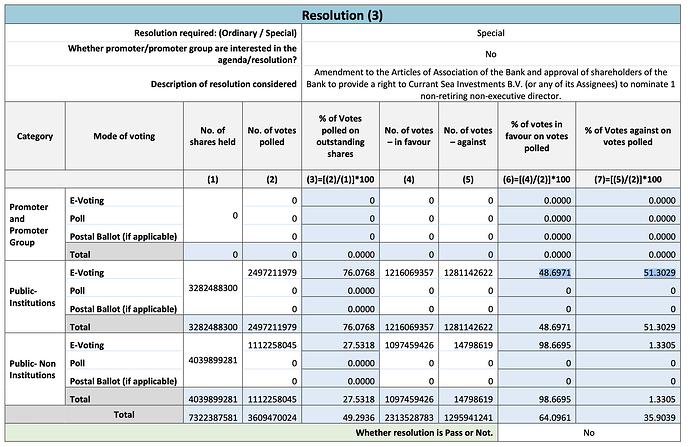

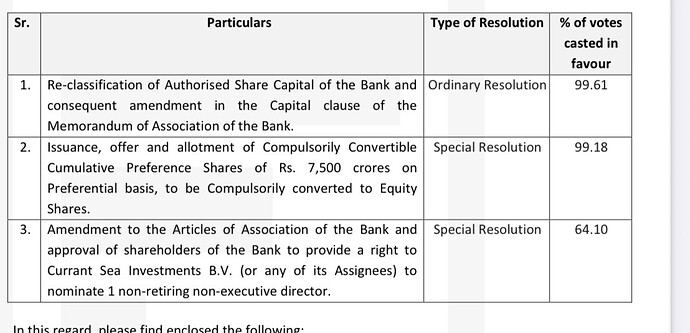

Private equity major Warburg Pincus and sovereign fund Abu Dhabi Investment Authority (ADIA) have agreed to invest ₹7,500 crore in IDFC First Bank for close to 15% stake, delivering a capital boost for the private lender accelerating its credit cards and wealth management businesses.

The bank will issue compulsorily convertible preference shares (CCPS) worth ₹4,876 crore to a Warburg Pincus affiliate, and shares worth ₹2,624 crore at ₹60 each to an ADIA subsidiary. While the Warburg affiliate will hold 9.48% stake, the ADIA unit will hold 5.10%.

And almost immediately after that, the bank came back announcing a dividend:

[…] recommended dividend of ₹ 0.25/- (2.50% of face value) per equity share…

IDFC is raising ₹7,500 crore ($900 million) from investors and turning around and giving away ₹183 crore of that to its shareholders. [1] Warburg Pincus and the Abu Dhabi Investment Authority (ADIA) are the ones buying the shares paying ₹60 per share for a combined 14.5% stake in IDFC First.

The market price at the time of announcement of this deal was ₹63, so the two investors got about a 5% discount. That’s not a lot! Anyone buying a stake as large as this would expect a discount, and 5% is on the lower end of what would be reasonable.

But there are two unknowns:

- Why would the two new investors be okay with the company flipping cash they’ve just raised over to the rest of the shareholders?

- The last time IDFC gave out a dividend was 7 years ago. Why would IDFC want to randomly give out a dividend right now even though it needs the cash?

For (1) I really don’t know. Maybe they weren’t okay with it but IDFC didn’t care? They probably would’ve wanted to negotiate a larger discount had they known that the bank would be distributing money.

For (2) there’s a clue.

Boring Money is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Warburg and ADIA didn’t buy IDFC’s shares. They bought a special type of preference shares which will eventually convert to regular shares. These are the kind of shares that VC investors in startups usually like. I mean, they do invest a lot on vibes and need a bunch of conditions and safeguards to go with their investment. Stuff like “you can’t just sell your company and exit, and if you do then you have to give us at least 3X our money back”. Investors in listed companies can just read the company’s financials. More regulations, less vibes.

Anyway so the two investors have preference shares which will eventually convert to regular shares. When these shares convert is conditional. Here’s IDFC’s CEO V Vaidyanathan from the bank’s meeting with analysts last month:

The terms of the contract are that if the stock stays above Rs. 60 for a period of 45 trading days, then it automatically stands converted. So to make it clear, therefore, we don’t have to really exactly wait for 18 months and all that stuff. If all goes well, within 45 days of allotment, it might just stand converted. And in the interim, they will get an 8% return.

If IDFC’s average share price remains above ₹60 for 45 days, Warburg and ADIA’s preference shares convert to regular shares right away. If it doesn’t, the two get an additional 18 months to convert their shares and the bank will have to pay them an interest at 8% pa until they do. [2] That’s an additional ₹900 crore ($105m) over 18 months, a lot of money!

Now, from a company’s valuation perspective, dividends don’t make a lot of difference. A company is, for the most part, valued based on its earnings. Dividends are issued post-earnings, they don’t affect the company’s profit figure. So they don’t make a company inherently more or less valuable. In general though shareholders like dividends. If you do nothing and money hits your bank account, there’s a nice, warm, fuzzy feeling to it. Shareholders seem to give this feeling some value, [3] and it’s basically a thing that a dividend can cause a temporary bump in the company’s stock price. Especially if it’s come after a 7-year gap.

A temporary bump is exactly what IDFC needed. And that’s what they got. It’s been more than 30 days now and its stock price has been safely above ₹60. Of course, it was also affected by the fact that two prominent investors were taking a large stake in the bank. But an additional push never hurt. After all, spending ₹183 crore to save ₹900 crore seems like a great deal.

Footnotes

[1] Technically, this money comes from its profits and not from the money it’s raised. But yeah, we know.

[2] I find it funny that this interest is actually referred to as a dividend just because it comes from preference “shares”. In this particular situation, it’s definitely an interest.

[3] I was, of course, being a little facetious. There are legitimate reasons for why shareholders might like a dividend. Earnings for retirees and pension funds, which have to give out money every year, etc., need dividends to survive. But then again, these are not the folks who would’ve invested in a bank that hasn’t paid out a dividend in the last 7 years.

Original Source: Why Is IDFC First Bank Raising ₹7,500 Cr and Handing Out Dividends?