Coming to the state of the markets, I think Indian markets have crossed a lot of walls of worries in past few weeks and months.

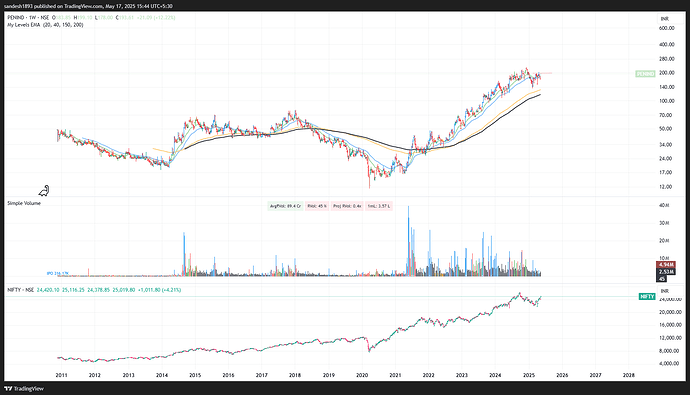

We had formed a sort of double bottom below 22000 (at 21800-900 to be precise) and the intervening peak was at around 23800. Once markets cleared that level in April 2025, it went quickly up to post a swing high of 25200 and since then has been consolidating below that level, and has posted a higher low at around 24450. Last week we managed to cross and close confidently above previous swing high of 25200. This opens the way to much higher levels going ahead. ( I dont pay too much attention to absolute levels of where markets can go, because it can be anyone’s guess where it goes. ) But if I have it clear in my mind that the trend in the overall market is up, I can go ahead with selecting sectors and riding them and try to make decent money. (Having said all this, I can still be wrong and markets can go down from here or slightly higher, but investing is all about taking calculated bets and take action accordingly)

The worries that markets crossed consist of the geopolitical risk in form of wars in India-Pakistan, Russia-Ukraine, Israel-Iran etc… Besides the other bigger worry that markets cleared was tarrrifs and their associated disrputions. With all these worries, Indian markets and most of the global markets also have shown good uptrends after brief corrections.

Domestically speaking we are in a interest rate cut cycle, which is always good news for markets ( unless rate cuts are made in desperation to tide over crises). Crude has cooled off big time and that provides cushion to Indian economy which is dependent on imports for most of its crude needs. Indian economy macro things also seem to be gradually showing improvements ( though I am not a big fan of macro analysis). Dollar index and dollar itself vs rupee is weakening. Which again supports bullish arguments.

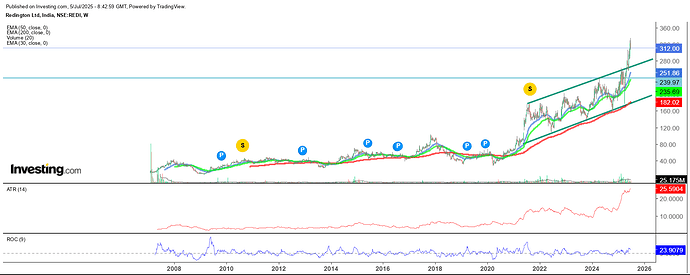

On sectors that I feel should be looked at , I think financials seem to be announcing themselves. Now financials seem to be a big sector with a lot of subsectors. My guess is we will see strength in most of these sub sectors, say 2-3 sub sectors at a time, or one after other or something else. These sectors are like private banks, public sector banks, NBFC ( even here there are micro finance cos, vehicle finance cos, real estate financiers, other broad basket lenders etc) , public sector NBFC, brokerages, insurance cos, wealth management cos, so on and so forth.

The other sectors would be interest rate dependent sectors like real estate, autos, etc.. And if the overall markets are to rally and we have a broad based rally, most of the sectors will ultimately rally at varying times going ahead.

So idea should be to work hard and try to identify companies with good growth triggers going ahead and ride them. Happy investing.