All are requested to move discussion to relevant threads & not clutter this thread.

@hitesh2710 sir i have some concern like if you are following William O Neil,Ivayly Ivanov and Minervini etc all of them are in to momentom or growth investing in this approch how are you going to ride maximum (according to growth investing there will be a pull back after 20-25 % mean while will exit from the stock).

kindly give some insight with 1 or 2 example ?

similarway how are you going to choose the stocks for growth investing ?

Momentum investing in any form and following anyone you learn from will involve putting trailing stop losses to your positions at an appropriate parameter/support etc. This is to protect your profits if you are in a profitable position once you have bought, or limit your losses in any fresh position you have taken.

Growth investing is a totally different kettle of fish. Here you have to do your fundamental analysis and if you are into technicals, apply some knowledge of that to fine tune entry points. You can go through the threads of multibagger stocks, or read few books to get better at how to choose growth stocks.

@hitesh2710 Dear Hitesh Sir, do you pick stocks based on sectoral tailwinds or stocks benefiting from the current popular themes ( like EV, Infra, Green Energy, Capital Goods, Tourism etc. ) , would be interesting to know the future themes that you are bullish on…

Sectoral tailwinds ( in case of cyclicals) often last for a few quarters, whereas the current ongoing theme can run for slightly longer duration. Non cyclical (or lesser cyclical) sectoral tailwinds often last much longer. Sometimes the picture is very clear and other times its hazy.

As of now there are no clear cut future themes visible to me. It’s more stock specific these days, and I keep posting stocks that I am interested in (with disclosures) in relevant threads.

@Rahul_Bhardwaj I don’t use either tradingview or angel one so no idea about your query.

Hello, Hitesh sir,Both Muthoot and Manappuram seem poised for a potential breakout. Considering gold is also at an all-time high, do you perceive this as a technical breakout? I’m eager to hear your insights.Thank you, Mahesh

Hello Sir, who, according to you, is a leader in a group?

- Stock A who broke out early from Stage 1 to Stage 2.

- Stock B who took long to broke out from Stage 1 as compared to Stock A but reach new high ground (all time high) early.

- Stock C who broke late reached all time high late but leading from all-time high.

Both Manappuram and Muthoot finance charts indicate strong uptrend. Both stocks prices are within shooting distance of their previous all time highs. Muthoot has given a cup and handle like breakout above 1537, but has posted weekly doji this week so need to watch next week. Manappuram had a breakout above congestion zone of 180-185. Overall both structures are appearing bullish.

Usually a stock that breaks out into 52 weeks high or all time high coming out of correction (within the sector) is the leader. This is according to the theory mentioned in books. But we know the basic rule of stock markets, and that is it follows no rules.

The possibilities you mentioned are of academic interest. Practically speaking, we have to consider each case individually and derive our own conclusions.

What I have seen is that usually sector leaders ( big dominant companies usually) tend to breakout the first, and then second rung companies start their run. The laggards begin their bull runs last, but often run the farthest. ( based on sugar sector rally we saw a few quarters back. Balrampur chini was first to cross ATH, and then moves started in Dhampur, Triveni engg, Dalmia sugar etc… Finally Renuka, Bajaj Hind started moving and in terms of percentage returns provided best returns. This does not mean this pattern will be followed each time in sectoral runs, but we can use this knowledge while looking at the sectoral runs. )

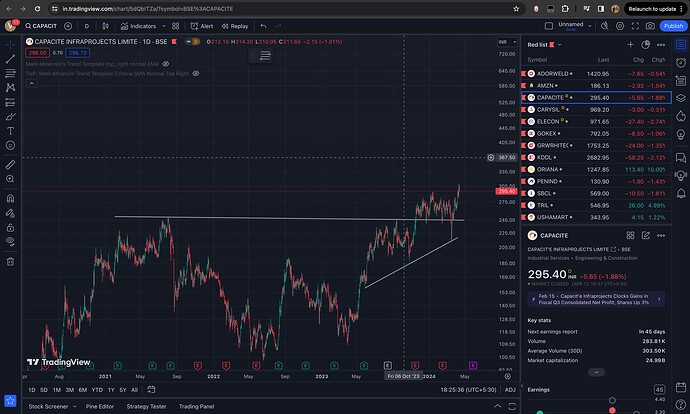

@hitesh2710 sir whats your view on charts of Capacite infra, Carysil and Pennar industries? All broke 52 weeks high and making tight sideways range.

Charts of both Capacite and Carysil look bullish and are consolidating after crossing key resistances. Pennar Inds has corrected sharply after a strong rally. I think it might consolidate for a while after such an up and down move.

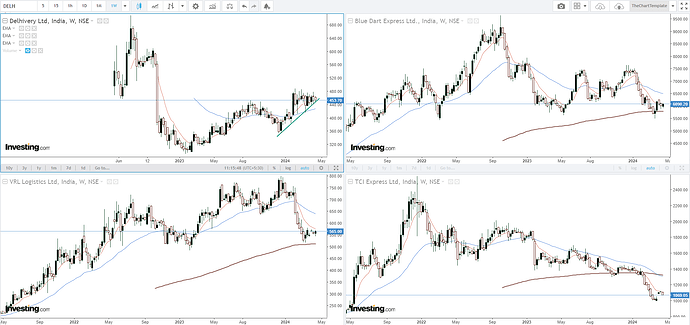

Hi Hitesh Bhai: How does the sectoral bearish or consolidation trend affect the individual stock prices that are in an uptrend after a good base formation? For instance, in the logistics sector all the major listed names are either in downtrend or taking support at 40MMA whereas Delhivery stock price is honoring the uptrend after a good base (Cup-N-Handle) formation. Appreciate your thoughts. TIA.

Disc: Hold an old position in Delhivery.

Sectoral bearish (or bullish ) trends in a sector with a lot of representative stocks of a similar nature will be important to watch. In case of Logistics sector there are only a handful of stocks in the sector worth talking about. Among those too business is quite different from one company to other. So I don’t think the sectoral chart theme applies too much to Delhivery. Delhivery broke out above crucial resistance of 450 in Feb 2024 and since then has been consolidating above and around it.

Hitesh bhai, what’s your take on the whole ‘Decadal renewable’ theme? Valuations have gone up through the roof in Waaree, KPI Green, Oriana (new kid on the block) and their ilk. Some of these are hitting UC’s every other day and seems to have priced in FY25 earnings already. I’ve stayed on the sidelines and just watched them zoom for the past 6 months but the story just doesn’t seem to end!

Renewables is the latest flavor of the season since past few months. As you said, valuations have gone through the roof and the narratives being built are as if this is a very high moat business. Personally I feel it is not so.

I think all this started in the backdrop of the Ukraine war. Because of the war energy costs across the Western economies started shooting trough the roof. And that brought about the fancy for renewable theme.

Every story has an initial phase of rejection/resistance, then it finds acceptance and finally ends in froth. My gut feel is that in this space we are well beyond the acceptance phase and heading towards (or are actually in ) frothy phase.

Once the cookie crumbles, we have no idea how much things can go south.

The one philosophy that has worked very well for me over the past few years is finding multi year breakouts and if these are in companies with cheap valuations ( on conventional parameters), then there can be very good upsides with limited risks. Financials ( dont ask me to name them ![]() ) in some pockets offer such opportunities.

) in some pockets offer such opportunities.

RUMOURS/NEWS versus EVENT.

We have had the expectations/rumours of a retaliatory action from Israel from the time Iran released some missiles. In expectations of that we have faced correction in our markets since past few days. Today morning there was actual event where Israel responded. ( We don’t know what damage they did bcos both sides will have their own versions and we do not know who to trust and how much to trust. )

The sequence of events that usually happen is

-

There is uncertainty related to a situation. ( Here it is Iran-Israel situation. Earlier it was Ukraine war)

-

In days of these uncertainty rumours, newsflow are rampant and investors and even institutions are scared. Markets undergo correction of varying degree depending upon the impact the event will have on stocks and markets.

-

Actual event happens. If it happens when markets are closed, then during pre opening, there will be lots of Whatsapp forwards, and some perennial half baked experts ( whose job it is to opine on anything and everything under the sun including the sun) will try to advise to do this or that… Usually advice is to sell/stay away etc… That sort of thing. And markets open weak in a knee jerk reaction… And start showing signs of recovery quickly within an hour or two. In between there are a lot of gyrations in index of ups and downs within that correction. Volatility in that phase is high.

-

Importance for us… What to do and how to react… Best thing is to observe the kind of stocks that have not corrected too much during the preceding weakness in overall markets. How do they behave during this knee jerk reaction. If they do not breach the previous lows convincingly and recover quickly they merit special attention. Keep observing price action in these kind of stocks. If these start recovering and rallying , then they are worth studying and maybe buying if there is conviction. ( for this kind of thing homework has to be done beforehand. Our mind will not function rationally in the face of sea of red )

If we are fully invested, we have no option but to sit on the sidelines and watch the show unfold. If we have partial cash, it can be handy to deploy in above kind of strong stocks. If in a lot of cash, there will be problem of plenty and it requires discipline in deploying the funds.

I have penned this down because this is fresh from memory and might be useful for future reference in a similar kind of situation. This whole logic can be used in an inverted form too for some extremely positive expected event.

PS. There is always an alternative path the markets and stocks might follow in contrast to what is alluded to above. Because markets do not follow any rules. But we should have atleast a set of rules/SOPs to face such situations. Whether it works out well or not is something that time will tell, but we should atleast have a process in place.

@hitesh2710 ,I am undisclosed beneficiary of wisdom and knowledge from Theequitydesk(before it got closed) and Valuepickr.

I started investing in 2002-2003 while I was working in Mumbai (lived above a brokerage house , so picked up a bit)

Before 2011-2012 my investments in capital markets were based on news and trends, some were hits some were misses, but market was kind enough on an amateur.

Only after I stumbled upon on Theequitydesk in 2011/12 or around there, I learnt from the forum a disciplined way of investing , and I have been very regular on Valuepickr since, may be- 2014.

Fortunate to be living in US for 17 years and in the middle of tech world, so I follow financial markets very closely by reading, listening, watching wide variety of sources.

*But yet, I always keep looking forward for your notes , a great deal of learning always , and I thoroughly enjoy reading them, I must say.

Long story short, please continue doing so for us …

Hitesh Bhai (@hitesh2710): Any thoughts on Trent? From a fundamental aspect, I have always stayed away from this name. However, continuous price strength on the chart whispers a big gap in my belief about this business. Hence, looking for thoughts of a better and far thinking mind. TIA.

@hitesh2710 as far as financials sector is concerned….sir they are changing their name so no problem in naming now ![]()

sir, with regards to homework beforehand, how do we know beforehand which stocks will be resilient during the knee jerk reaction - or the homework should be more around observing the price action for stocks in our watchlist? asking because sometimes the reaction is completed in just 2-3 hours and we are unable to keep track unlike reactions that last more than a day so that we can research end of the day