What about RBL?? Bandhan and other NBFCs like equitas n ujjivan ??

Dear Hiteshji,

Wanted to know your views on Magma Fincorp. I remember you sold it off some time back and were of the view that since financials have led the recent bull run, they are less likely to outperform. The company has been able to do reasonably well in the Dec quarter inspite of the challenging situation.

Another question I had was - would it be less likely to have misdemeanors like the recent ones in companies where no single entity has considerable influence. I feel Magma fits this description.

Thanks

Hello Hitesh Ji,

Wanted to know if you still track Astral Poly and how do you see the current business and sector views for next 3 years along-with the Valuation Astral is commanding currently ?

Hiteshbhai

What is your maximum limit of PE(ttm) for purchase of share ?

Beyond that PE ,u will not purchase share of any company .

Hitesh sir,

Please share your thoughts on PE and how much importance you give to PE as valuation indicator.

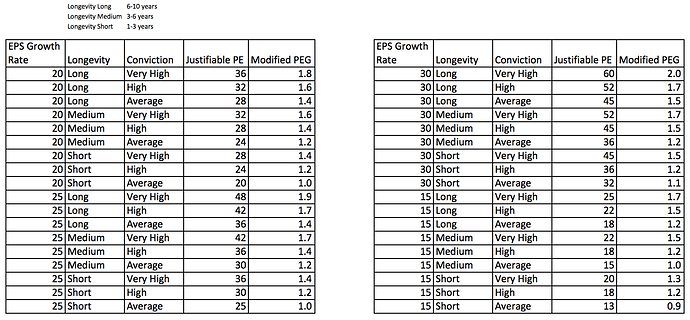

For me, maximum justifiable PE is a function of EPS growth rate, Longevity of EPS growth rate, my conviction of EPS growth rate & its longevity, and of course prevailing & expected Interest rates.

Let me elaborate my thought process of how I try to make sense of PE.

PE is Price to Earning ratio (Price per share / Earning per share). It tells how many years (multiple) of current annual earnings you are willing to pay to get a slice of this company.

The lower PE company will look a better bargain then higher PE company.

The limitation of PE is that it doesn’t recognize the potential of growth in Earning per share (EPS growth).

Hence people accommodate EPS growth in PEG ratio which is PE / EPS Growth rate.

Again, a lower PEG company will look a better bargain then higher PEG company.

Example:

Company A has PE of 20 and EPS growth of 15, hence PEG of 1.33.

Company B has PE of 25 and EPS growth of 20, hence PEG of 1.25.

Based on PE, Company A would be preferred.

Based on PEG, Company B would be preferred.

The limitation of PEG I feel is that it doesn’t take into account the faster shrinkage of PE with each year of good EPS growth rate

So I am willing to pay high PE or PEG for a company with higher EPS growth than a low PEG for a company with lower EPS growth. Now for how high I am willing to pay depends upon the following three factors:

Longevity - How many years will the company will be able to maintain high EPS growth (before the mean reversion kicks in or competition catches up).

Conviction - How confident I am in my prediction of high EPS growth rate and its longevity.

Interest rate (cost of equity or opportunity cost) - This acts like gravity. Lower the Interest rate, higher the justifiable PE, PEG, modified PEG.

The below screenshot captures my rough reference of maximum justifiable PE. (I have excluded Interest rate variable.)

ps: For some stocks, latest EPS are transient/cyclical. So the ready “off the shelf" PE will look too high or too low for them. Hence we have to normalize them i.e. what would be their regular EPS and EPS growth rate in steady state.

I still stick to my view that once the story gets over for a particular sector it takes a long long time before the sector makes a comeback. That applies to most NBFCs. You can see how inspite of generalised consensus in case of Bajaj Finance and inspite of fantastic numbers reported by the company it still cannot regain its previous top.

In such theories there can be a few exceptions but the base rate of success of swimming against the tide is very low. Hence I have stayed away from most NBFCs. A recent buy has been Chola which looks good in valuation terms but there too conviction and hence allocation is not too high.

Excellent summary of the PE conundrum.

Adding to your inputs, I think high PE can sustain if ROE and free cash flows are very strong inspite of lower growth rates. Especially if the longevity of even this slower growth is obvious to all.

Another thing affecting the PE ratio is the phase of markets. In roaring bull markets which we had till Jan 2018, anything goes and PE can reach stratospheric levels. In such cases there are clear signs of bubble which are visible and inspite of such signs the bubble keeps expanding till it bursts. (its like riding a tiger, where you are scared to get off and you are scared to keep seated.)

So just to encapsulate the things,

PE is a function of market perception of following factors

Visibility of growth. (Past, near term and future)

Longevity of growth (extent of runway) and sector dominance. Market leaders tend to attract higher PE.

Predictability (markets pay high price for high level of predictability of earnings.)

Consistency of earnings. (if earnings are lumpy PE will not go up beyond a point).

ROE, ROCE, free cash flows.

Interest rates. (Low interest rates attract higher PE)

Phase of markets. (currently we are in the process of PE contraction for a lot of companies. E.g Page, Eicher)

Liquidity. (high liquidity usually leads to roaring bull markets and hence is a factor for the above point i.e phase of markets)

Another thing to remember,

High ROE (increasing ROE preferably) with high consistent growth leads to enduring multibaggers)

High ROE with high growth for few years leads to big multibaggers in a short period of time. (and then these tend to give up all their gains and more)

Low ROE with high growth (for short period of times ) leads to multibaggers (though these may not go up as high as previous category) and then at some point of time growth falters and it converts to low ROE with degrowth which leads to wealth destruction.

Low ROE and Low growth needs no explanations.

Hitesh Bhai,

I think, PE is also affected (downrated) if management action is not shareholder friendly (no dividend, pledging of shares, guidance not attained and other cases of bad corporate governance). Would like to know if the opposite ever happens if management if found to be investor friendly, transparent, walks the talk, aggressive but allocates capital prudently etc.)

Hitesh Sir,

What’s your view on decent to high RoE companies, but with lower growth rates. I have a couple in my watchlist - FirstSource Limited and Cyient, while the former has increasing RoEs in mid-teens, Cyient metrics are much better. But the growth rates are not looking great in the near term. Please share your thoughts on investing in such companies, both being good dividend payers too.

Thanks!

Vinod

Hiteshbhai

Thanks for detailed reply.

But i want to know that if u find good company@Roe>15-20,growth@20-25%,then u will buy stock @ pe25-30

OR

U strictly never purchase beyond certain pe like pe of20 or pe of25?

Hitesh Bhai ,

Bajaj finance though a NBFC is a proxy play on the growing Indian consumer business. Even if one compares the performance of Bajaj finance vs the index or midcaps or small caps , it has outperformed most of the quality names around. The basic thesis of investing is earnings and earnings only. Here I am willing to stick my neck out and say that Bajaj finance has the capability and ability to do so for extended period of time. In fact the NBFC crisis is a boon for it as the period of cheap capital and easy business is over and Bajaj finance is already hinting at incremental business flowing towards them. The conservative management in last concall said they will increase increase their balance sheet size at a faster pace next year.

Disc… Invested and willing to add more around 2200 levels

Hitesh bhai,

What are your thoughts on companies that provide encryption, crypto or cyber security products. As we go more digital we can counter lot of data theft and more companies will need to use these and huge money will be made via IP. I know in USA , black berry is pushing itself to become the crypto provider and has big list of patents in their name to provide encryption technologies. The current breach in Aadhar got me more curious

"Aadhaar numbers, names, email and physical addresses, phone numbers, and photos of almost 1.1 billion Indians were found susceptible to data breach. "

Hi Hitesh sir,

What’s your views on some of the high divided yield paying public sector companies for next 2-3 year ? Do you think they are available at a cheap valuation ? For example IOCL P/E is 7.5 , Coal India p/e is 10 and REC Ltd p/e is 4. Many of the retailer Investor don’t like Public Sector companies due to lot regulatory reason. But do you see any deep discount/value in any PSU after considering the divided yield ?

Thanks,

Bikram

Hitesh,

What do you think last few days promoters buying across multiple mid,small cap stocks increased drastically. Is it indication of we are reached some value zone for mid and small caps stocks?. And price drop in many small and mid caps stop falling. Anything you are infer from this ?

Regards,

Sathish

Sir what are your thoughts on jk paper, do you think that this trend will going to continue?

The PSU companies with high dividend yield have to be seen in context of continuity of such high dividend being paid out. A few years back a lot of psu banks were quoting at high div yields and now we see how things have panned out.

The OMC/oil refineries space is dependent a lot on movement of crude and the dividend payout also would depend upon fortunes of oil prices. For the sake of argument one can argue that these companies no longer have subsidy burdens and hence are independent of oil prices. But if tomorrow govt decides to make a u turn then the whole thesis falls flat.

Some recently listed companies in the govt space like RITES, IRCON etc seem interesting though I dont have positions in it.

@1.5cr MOIL again would depend upon the cycle of underlying commodity. If the commodity prices crash, its difficult to see how the stock could survive a bear hug. Its very difficult to predict these cycles for those with no expertise.

I am not a big fan of looking at companies with big dividend yields unless I see some other triggers besides dividend yields lined up.

I dont attach too much importance to promoter buying unless other things too fall in place. The view promoters have about their company could be vastly different from the view a retail investor has about the company.

In some companies like Laurus Labs, Max India etc if someone had followed promoters and bought the stock based only on that premise, he would be sitting on losses.

But if promoters are buying in a company where we can unearth other triggers for investment then it adds to the investment thesis.

Coming to my view on small-midcap segment some posts back I had mentioned that it was time to atleast start nibbling at small and midcaps where one finds good prospects and comfortable valuations.

I think with the events with Pakistan in last few days, the political equation may have turned slightly favourable for the ruling party although it is too early to get a clear sense of how things will pan out.

But I have observed that since past few trading sessions, the small midcap space has shown a lot of resilience/strength and maket breadth seems to have improved. When we ourselves start seeing green ticks in our own portfolio after a long long time, its time to sit up and take notice. Maybe some risk-on behaviour has started.

I think time to loosen the purse strings in a calibrated manner is on us and it would make sense to buy albeit gradually. Ultimately where the markets go is anybody’s guess but some times we have to take an educated guess and act accordingly.

Hi Hitesh bhai,

Whats your view on carborundum universal, lakshmi machines and tube investments?

Thanks

Hiteshbhai

I have read your various posts and i think u invest in quality stocks rather than value (cheap)stocks.

I want to know that at how much max PE ,u buy stock if u like company and buisness?

In the past I had been guilty of buying poor quality and in some I even made decent money but those were times of a mad bull and sooner or later everything flies. e.g kamat hotels, lt foods, electrosteel castings, ekc etc. But these companies have a definite sell time and price.

But in current market scenario and most of the times in market usually, its always better to stick to good (atleast) if not great companies to avoid severe market related burns.

About how much to pay for a business, many a times its not about the PE. Its more about changes taking place in a business and if I find that the earnings growth is going to be ballistic say around 50% cagr, then paying a higher price also would be okay. But while paying high PE we have to be absolutely certain about the growth prospects. In the past I have bought Page at 50-60 PE and recently Grindwell at around 35 PE. One cannot look at PE in isolation.

About buying quality companies, I think some time or other you are going to get your investment thesis wrong or atleast wrong for some time (and you have to wait longer for things to play out) and its going to make you worried.

Its always more comfortable to cry in a BMW than in a Maruti 800.