Transcript of concall

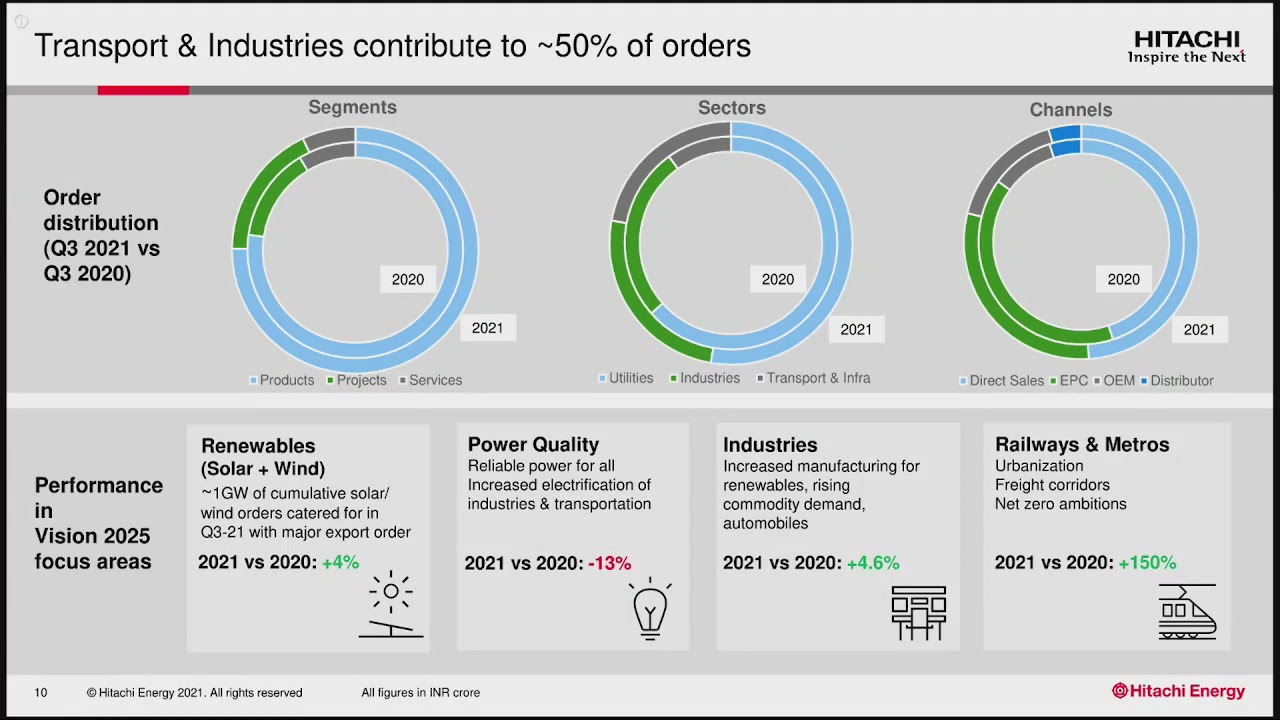

Capability / Focus Areas

- Grid Automation

- Grid Integration

- High Voltage Products

- Transformers

- Power Quality

- Renewable Integration

- E-Mobility (Charging stations and setting up the entire infra. )

- Power Management for Hyper scale Datacenters

- Cyber Security solutions around the grid network

Green Energy Solutions

- Installing Ester Oil Transformers (As against traditional SF6 gases that generate more pollution

Technology Capabilities

- EconiQ in action – Eco-efficient High Voltage Products

- Implementing SCADA framework - Watch here for brief understanding , more on wiki SCADA - Wikipedia

- LUMADA

- PowerREC

Opportunities

Railways

- Government target of electrifying the remaining 27,000kms by 2023 ( opportunities for our transformers and the power quality solutions over there)

- High-speed trains

- Metro rail projects

- One in 3 or one in 4 Shatabdis you board, it is powered through our transformers in that

Datacenters

- Hyperscale datcenter demand more energy than tradition data centers so lot of opportunities there and last quarter signed up a big customer

Competitors

- Siemans and Schneiders

Technology Moat Compared to competitors

- Have the capabilities of enterprise software and we are able to bring digital and energy platforms together

Key Learnings

“Generation, Transmission, Distribution and Infrastructure, but it is extremely important that these new sectors which are basically you know the future of Energy System what we call, whether it is a Datacenters, Electric Mobility, Renewable Energy, Power Quality, are extremely important and we have the broadest portfolio to serve across these segments. And they are the segments, which are growing much higher than the market average, so all in all, we are Make in India for India and the world for over 6 decades. More than 80 percent of our portfolio today is locally manufactured, including catering to these kinds of high growth segments in that”

“In April this year, we had the global launch of EconiQ, a portfolio of products, services and solutions, that will contribute toward a carbon neutral future and accelerate the green energy transitions. As the big step forward, the EconiQ High Voltage Portfolio contains no SF6 gas. It has been proven to reduce more than 50 % of carbon footprint throughout total lifecycle, so this is also very interesting in, when we are looking to build back better. And how would we ensure that we will build back better in our own industry”

“One of the things we looked at quickly, you know offering our enterprise software solution, be it the Asset Management or you know Enterprise Asset Management, Asset Performance Management or Field Service Management, which are part of our Grid Automation businesses, and to offer in Lumada IoT Platform of Hitachi. And customers will be able to leverage Hitachi industry leading IoT platform, analytics, data capabilities and more while retaining all the capabilities of our proven solutions, with no impact to current installed base but a clear migration path when they are ready”

“We will continue to Make in India for India and rest for the world ou. In this year, we made investments in portfolio expansion in our Savli in the GIS space, in feeder factory, module assembly and in traction transformer line expansion, my other projects. We have also been expanding our factory for power quality products to integrate all presently fragmented operations under one roof to serve an ever growing power quality market, both domestically as well as overseas.”

“In addition to this, the launch of our remote monitoring and the maintenance center in Bangalore,

PowerREC. For us these investments will bring operational efficiencies and improve our market

competitiveness. They will also generate additional value and the margins for Hitachi ABB

Power Grids in that.”

The proof of the pudding is in eating!!

The opportunity needs to be converted into hard numbers… where it is lagging so far… Had hopes from March 21 Qtr, but alas… Both on new orders booking and actual revenues there was disappointment. Cost profile is high. 5%+ payments to parent and sisters. IT support payments to ABB additional… Hitachi presence yet to be seen… Management and Board is from the legacy ABB side

AGM very well managed. Shareholders asked very insightful and meaty questions. Replies were at surface level though.

Stock running at good clip though. Maybe market knows better!!!

Invested

Q2 CY22 declared. QoQ Impacted due to Wave 2 & deferment of some contract/projects.

Good Bussiness presentation & update

Disc - Invested

One amazing thing is "Reliable power can be transmitted in either direction depending on demand "

If any power experts are there @hack2abi @MyCapitalNotes please enlighten us more on this.

Few links that I have come across

This is fascinating technology.

IEX management explained in one of the concall , Wind Energy is generated in India (peak) from May to Mid of August ( I have posted some key learnings from the concall here

Basically the advantage of UHVDC is you can transmit the power for long distances without having additional substations ( I don’t know how many transmission substations are required for a length mentioned above 1,800 km)

From the recent analyst call Mr Venu said it reduces the amount space needed by 1/3 ( that means less number of substations ? )

On a given month if one part of the country is producing Wind energy then the same energy can be transmitted (this is the most cheapest way of producing energy among all other sources ) , so basically you can switch the supply from B (wind ) to A (Coal based )

I am assuming the conventional powergrid transmission do not allow this kind of reverse supply

Please correct me if my understanding is not right.

abb power.pdf (90.2 KB)

Name change update…

This name sounds better and resonates well. I hope it will generate some better brand recall with Hitachi.

Any idea on the trading symbol also? Will that be affected due to this?

I maybe wrong here, but Hitachi Energy stock seems to be undergoing a PE rerating to finally trade at similar valuations of other leading MNC Infra Technology companies (I like to see them more as tech companies rather than capital goods) like Siemens India and ABB India…It is still not run its full course of rerating if thats true. Insights welcome!

If this rerating is really happening then are the margins and growth profile of Hitachi energy comparable to ABB India and Siemens India? Thanks

Disc: Small Investment, maybe biased. Not a buy/sell recommendation

Rev were a miss because of lag due to COVID.

OPM improved because of better product mix.

Most interesting point for me was that they are planning to be fossil fuel independent by next year and carbon neutral by 2030. Does it mean more foreign funds focussing on ESG as a theme would be taking interest in this company?

Link to con-call :

Hi, possible to share the full concall or share link from where i can download… thx

I have shared concall link.Check the above comments. Or go to Trendlyne’s Youtube channel.

Power India - Hitachi Energy - A Technical Analysis View:

Respecting the 100ma on Daily TF.

Respecting the 20ma on Weekly TF.

Taking support at the rising trendline on weekly chart. Good volumes coming in as well…

Decent Results for Dec Qrtr.

Growth in all aspects.

FY being changed from Jan - Dec to Apr - Mar, consequently this FY will be of 5 Qrtrs ending 31 Mar 22.

New orders of 931 Crs in current qrtr

Press Release:

Investor Presentation:-

Exchange Disclosure: -

Disc :- Invested