Pursuant to the provisions of Regulation 30 of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015 read with the circular no. SEBI/ HO/ CFD/ CFD-PoD-1/ P/ CIR/

2023/ 123 issued by SEBI on July 13, 2023, and further to the intimation sent by the Company on

July 23, 2023, we hereby wish to inform you that GPCB, vide communication dated August 5, 2023,

has revoked the closure direction dated July 21, 2023 issued by GPCB, for an initial period of 3

months, as per the procedure.

More drama ! Don’t see any direct monetary repercussions but the sooner this gets resolved the better for Hikal, as it takes away the focus of the management and is an unnecessary distraction.

The management eluded questions on any clear guidance in Q2 FY 24. Took a cue from past, not to focus more on guidance. Viraj Mehta’s question were good. too which the management have had hardly any clear answers.

Highcourt has disposed of the writ petition, filed by the Company challenging the jurisdiction of the principal bench of NGT, as not maintainable and granted liberty to the Company to seek remedies as available under law.

Total financial liability will be around 18cr.

cbd10010-33e5-4d26-951c-123461aa356b.pdf (557.9 KB)

Hikal Ltd -

Q1 FY 25 results and concall highlights -

Revenues - 407 vs 388 cr, up 5 pc

EBITDA - 58 vs 50 cr, up 16 pc ( margins @ 14.3 vs 13 pc )

PAT - 5 vs 7 cr, down 30 pc ( due to elevated depreciation and interest costs )

Current Debt on books @ 759 cr

R&D spends @ 4 pc of sales

Segmental revenue breakup -

Pharma -

Sales - 229 vs 225 cr

EBIT - 9 vs 10 cr ( margins adversely affected by scheduled plant maintenance )

CDMO : Own products @ 37 : 63

Crop Protection -

Sales - 177 vs 163 cr

EBIT - 21 vs 17 cr

CDMO : Own products @ 70 : 30

Company has 05 manufacturing sites @ -

Bengaluru - APIs and advanced intermediates - US FDA approved

Mahad - fungicides, herbicides, intermediates

Taloja - fungicides, insecticides, intermediates

Panoli - has 02 manufacturing sites for Pharma and Agrochemicals. Pharma site is US FDA approved for KSMs and APIs. Agrochemicals site makes fungicides, insecticides and intermediates

Their R&D center and a mini plant is located @ Pune

Company has already commercialised 27 APIs and 22 AIs in addition to several Pharma and Agro Intermediates

Company has completed development and validation of 05 animal healthcare products. Company is on track to validate several other products by end of current FY. These will then be submitted for registration and eventual commercialisation

Company is seeing increased customer enquiries in both their Pharma and Crop Protection - CDMO businesses

Company has got regulatory approvals for its APIs from LATAM, SE Asia and ME’s regulatory bodies and is steadily improving its customer base in these areas

In crop protection business, challenges like overcapacity, overstocking continue to exist

Increased depreciation and interest costs in Q1 ( combined to the tune of 10 cr ) are because of capitalisation of new manufacturing assets. As these assets get utilised, profitability should improve significantly

Company’s API development pipeline is robust at 9 products. Expect to launch 02-03 products / yr - going forward

Company’s Pharma CDMO business has 02 products in commercial stages. Their volumes are expected to ramp up over next 02 yrs. Additionally, 02 of their advanced intermediates for NCEs are currently undergoing phase - 3 trials

In the generic agrochemicals, the Chinese dumping of oversupply is severe. In the patented space, that’s obviously not the case. However, the problem of overstocking exists in both spaces. This should correct by Q3/Q4 and should then aid company’s volumes and margins in their Agro - CDMO business

In the Pharma Space, the effect of China + 1 can be clearly felt via increased customer enquiries

Once the animal healthcare products go commercial ( say in next 12-15 months ), they can be clocking 300-400 cr / yr kind of sales inside next 3-4 yrs ( ie - once the ramp up is complete )

Guiding for 10-15 pc CAGR growth on topline for next 3-4 yrs with improved EBITDA margins ( in the vicinity of 18 pc or so ) - the management admitted that it is a conservative guidance

Disc: not holding, not SEBI registered, not a buy/sell recommendation

I am sharing view of Aditya Khemka on Hikal

Please watch the timeline for 57 minutes.

Also, the views of Sajal Kapoor on Hikal’s promoters’ issue

Please watch the timeline for 1 hour and 12 minutes.

dr.vikas

Awaiting your analysis of Q2 results & guidance. ![]() )

)

Series of resignation…

Disclosure: Invested

Hikal has received a settlement order to the tune of 43 Lakhs from SEBI for their case involving lack of adequate and timely disclosures. This is without the admittance of guilt. Relatively, it’s just a slap on the wrist but removes an overhang over the stock. This could possibly be the reason.

dd8da4b1-2aaa-47b7-9a8d-aa25bacfe1a4.pdf (250.0 KB)

Disc: Invested

Net Profit Up 6.8% At ₹17.2 Cr Vs ₹16 Cr (YoY)

Revenue Flat At ₹448 Cr (YoY)

EBITDA Up 11.4% At ₹72 Cr Vs ₹64.7 Cr (YoY)

Margin At 16.1% Vs 14.5% (YoY)

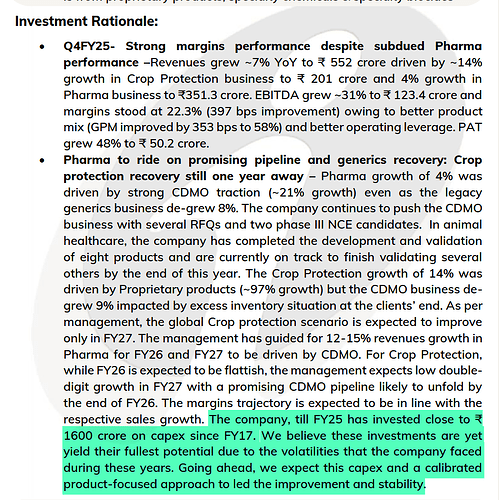

Hikal is 4Q FY25 earnings validation (walk the talk) results outlook and unlikely to cause material surprises (either positive or negative) in 3Q FY25 as key shipments are scheduled that way.

Very optimistic on Hikals CDMO pipeline.

Hikal has created capacities and innovative capabilities using Debt and OCF.FY26 could play out well. Capacities will begin to go commercial in FY26. Hikal has had 0 equity dilution with size still increasing wrt Gross block.

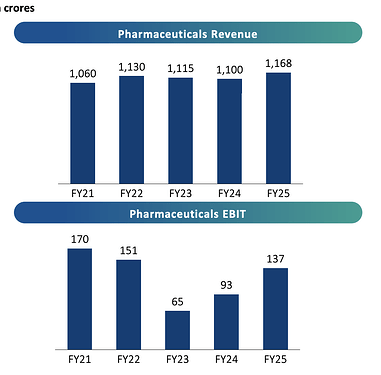

- FY25 : Only Pharma was able to make inroads and could be termed as the sole engine

- FY26 : Crop protection should 2x ite EBIT contribution YoY over FY25

- FY27 : You should see everything firing for them. Animal pharma should give them thrust too (they can be clocking 300-400 cr / yr kind of sales)

They also appointed head of CDMO. Dr.Raghavendar Rao seems to have very rich experience in CDMO spanning across Sai life, Piramal, Syngene, Navin Molecular.

I think Animal Health contributing 300-400 crores of sales per year would be closer to FY28 when scale up begins. FY27 may see green shoots of commercialisations.

going by their Q3 concall, for FY29 expecting ~3500 cr sales @ 25% ebidta margin (900 cr ebitda)…

Hikal – Q3 Concall Highlights

- API Business: Recovering with steady volume growth and new market entries.

- CDMO: Multiple projects moving towards validation & commercialization with a strong pipeline.

- Animal Health: 7 product validations completed under long-term agreements.

- Crop Protection: Stabilizing with rising domestic demand & increased RFP inflows.

- Competition: Facing pricing pressure from China, but focusing on NCEs & new technologies in crop & pharma.

- Expansion: New multipurpose facility at Panoli capitalized last month; ramp-up expected in 2-3 years.

On new CDMO head appointed recently

Long gestation workflow in CDMO invariably means that new energy will take a few years to make any material impact. NCEs take their own time, but they are sticky cash flow generators if/when they go commercial or even late Ph3. Dr. Rao’s resume is indeed very rich in experience and a good find!

- Crop protection business will remain flat in FY26- 27 and deliver growth in FY27,

- Pharma business expected to grow at 15% in FY26

- Company is opening a lab in Q3 FY26 for high potent chemistry

- They have opened sales offices in North America and Europe in the last 6 months.

I believe the stock may go through another year of consolidation. The company appears to be undergoing a quiet transformation. The pharma segment’s EBITDA is gradually improving, even without any significant increase in sales, indicating a shift towards the higher-margin CDMO business. Being honest, I am disappointed with the Pharma sales numbers. They have been stagnant. The good thing is stock is trading at low valuations, so there might not be a very heavy downside.

Anyone here knows how much is the revenue contribution from jigani facility and any new product launches which will get impacted because of Usfda OAI??