Continuing with this line of thought about the power of the pen, see the recent episode regarding CobraPost’s “investigation” on Dewan Housing. As per the company, they asked for clarification on the same day via email on 8:44 am and they called the well publicized press release during market hours at 3pm. They could have very well waited 30 minutes till the markets closed and had time to digest the “story”.

All analysts while writing stock reports have to certify that they have no conflict of interest etc. But media can write anything without such certification. How many people/institutions/speculators had early access to the report? How many had short positions in the company prior to this release? Do they wash their hands off by just publishing this report or do they take this to the logical conclusion and follow-up with Govt/investigation agencies by keeping it alive ?

This is a very dangerous trend and SEBI should ensure all such media people are investigated for conflict of interest.

Mr Anil Agarwal does it again, following a playbook that has been repeated by him often - getting listed companies he controls to buy private companies he owns.

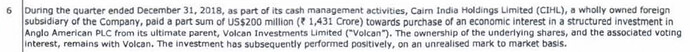

It is disclosed as an innocuous footnote in item no 6 in Notes to accounts:

To add, no prominent media has reported it as accurately as Moneylife, by a long distance, I would add. Here is what a search on news on Vedanta gave me:

So never shoot the messenger because the message is not palatable. You don’t know what you will lose. Just encourage them to freely bring as many messages possible.

Very interesting and insightful panel discussion

Brief Synopsis:

- There was a change in after 2000 to go after the corporation rather than the executives with the ultimate responsibility of a fraud. It was misguided policy change which punished the shareholders instead of the management.

- Humiliating or disrespecting a short-seller will only make them more aggressive in trying to uncover any wrongdoings (Echoes the sentiments of Marc Cohodes in his Real Vision Interview ). This is beside the additional point that this kind of behavior is not expected from a honest management.

- With the increasing reliance of quant strategies, an investor can get an edge by doing the donkey work of scuttlebutt and getting out of the office.

Several question comes to mind -

- Very little information in disclosures to retail investor. We are almost always lurking in dark.

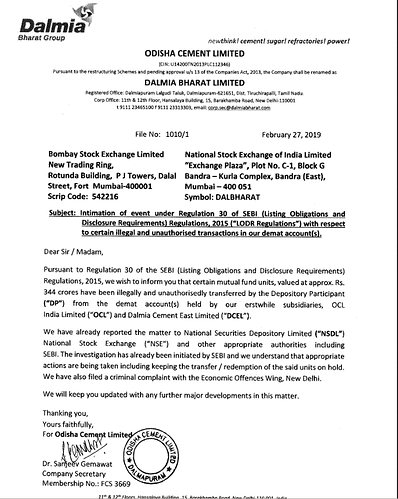

- Who is the DP? How did s/he sell the shares?

- What are the shortcoming and what steps should be taken to prevent re-occurrence?

their is always paper trail of any dp transection. i think company is hideing something. what i think that in many case they keep their securities in dp as security against loan or trading account and wich has power of authoritygiven to use it in case of any shorfall in loss or paymnet. and they ususally sell for that.

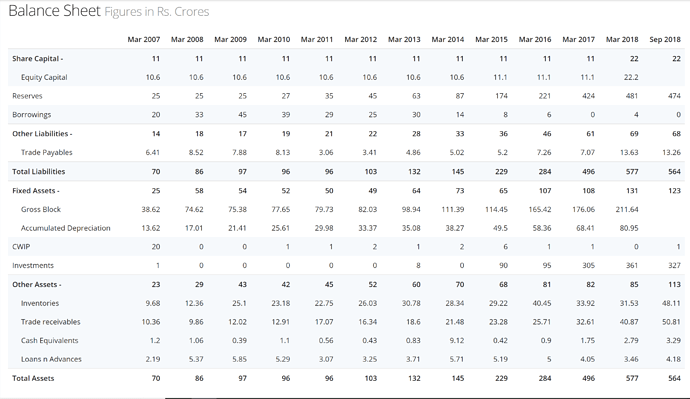

This is the balance sheet of La Opala. As you can see in the image above the total assets has reduced from 574 to 564. The company has earned profits of 14.49 and 21.53 crore in june and september quarter. They only reduced their liabilities from march to septemer quarter by 5 crore. Value of final dividend paid for year 2018 was 11 crores. So where has 14.49+21.53-11(Approx for dividends)-5 crore for reducing liabilities=20 crore gone. Since assets reduced by 13 crore around 20+13 = 33 crore is missing. I might be missing something obvious(Still a beginner) and would really appreciate the community’s feedback.

What is the depreciation value (for 6 months from Mar to Sep 2018)? Considering FY value in 2018 is 81 Cr.

The depreciation value is already calculated in the profit and loss statement and the profits I have give are the final profits

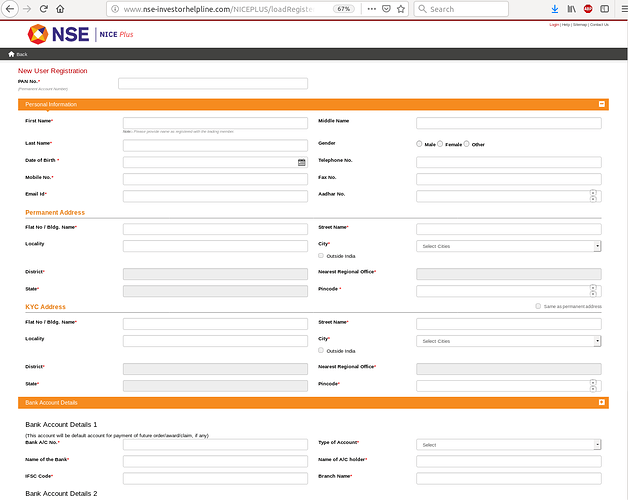

NSE E-complaint portal send information like PAN Card, mobile number and bank details over world wide web without https.

Wrote a blog on similar lines taking one of parameters to study

Hi Saurabh, I am trying to understand from your analysis if its the correlation or the causation. It does make sense that retail investors tend to catch the falling knife but the counter point seems difficult to infer i.e companies that haven’t fallen much but are more likely to fall on account of larger retail shareholding.

Agreed this is just one of the data point, but trying to understanding the learnings from your analysis.

Hi @suru27, Very good insights. Did you ever do a reverse analysis? What happened to stocks where <1 Lakh shareholding retail holding came down significantly over a specific period? What percentage of stocks appreciated and what are the names in them. It would be interesting to see and correlating to data here.

Chilling story of what happened in Odisha Cement Limited here.

Is anyone investing without giving power of attorney to Broker/DP?

Update 08-Mar-2019

Time to redeem investors’ confidence in keeping shares in e-form

Update 31-Mar-2019

ILFS Securities files case against Delhi Police’s Economic Offences Wing

You can use upstox and choose not to sign PoA. Choose e-DIS instead. When you want to sell, you get a OTP on phone. Daily limit of selling is 20 lakh. However, no PoA so no margin funding.

Alankit Assignments does'nt insist on PoA if you don't trade online. Give orders on phone or visit them.