The alleged fraudster is a close relative of an influential leader of the ruling party, the latter denies that the fraudster was wrong.

The fund has to say this,

“It is simply ridiculous that the Indian system can move so slowly,” Singh, whose assets under management have slumped to less than $1 billion from $14 billion in 2008, said in an email interview. “The entire country’s reputation will suffer badly”

This is such a fantastic piecing of the Singh brothers highlighting the inner workngs of their empire, intertwined with a Godman and ultimately leading to ruin.

Absolutely brilliant story and tragic at the same time.

Watched it along with the story on Valeant and VW. Simply brilliant, thank you for recommending.

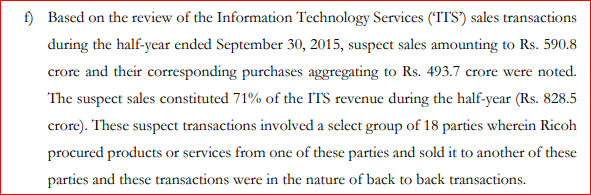

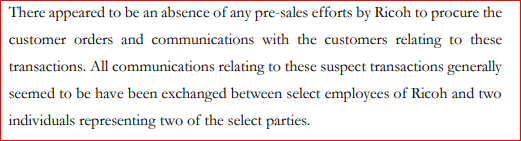

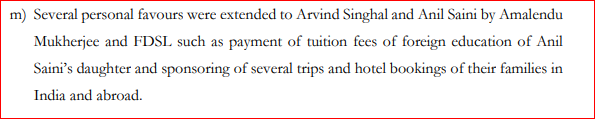

SEBI came out with its order on Ricoh India Ltd essentially summarizing the findings of the forsensic audit by PwC.

I have always been looking for a detailed forensic audit report, but this one come really close. The details are so revealing that I can almost imagine the CFO telling his co-conspirators, " what kind of morons we have for shareholders"

For instance,

Happy reading, here

Hi everyone,

When I was scouting for budding new companies in my area of knowledge, I came across a company. It manufactures bearings. The company name is Galaxy bearings. I started reading Annual Reports.

I have a doubt here. In the first available annual report they appointed 4 independent directors.

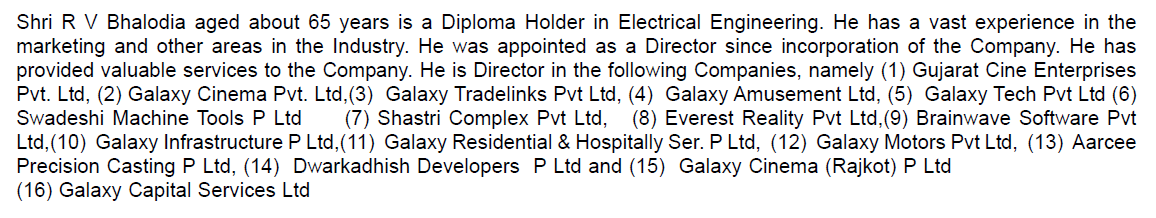

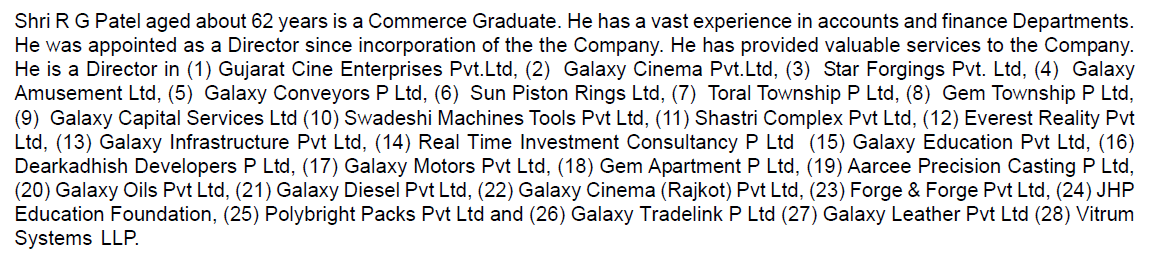

In the explanatory statements it is understood that two of these independent directors have multiple directorships in very small companies ( the company in consideration it self is very small).

Please see the Snapshots below.

1)

My concern is whether this is a good sign or can be ignored. What could be their motive in starting/ owning that many companies and not concentrating their efforts in one company. You might have come across such situations.

Please enlighten me.

Disc: Not invested, just starting.

I am not sure any good or bad can be concluded from such ‘related party’ Independent Directors. IDs are rarely independent in India, and rarely act independently, although the presence of one vested with such a duty may be a deterrent to wrong doing, albeit very mild. This is irrespective of size and in larger firms, there is a quid pro quo, or proxies of third parties indirectly controlling, nominated as IDs.

Small firms may just want to have a few trusted relationships leveraged across many firms, so just get the same ones.

This reminds me of a certain Suresh Talwar who used to be on the Boards of 54 firms. In one AGM a shareholder asked whether he even had the time to read the annual reports he signed on

@varadharajanr I think with the recent series of events in Manpasand, vakrangee, PCJ, 8K Miles, etc expert forum members should give their insight in this thread for the benefit of all forum members.

An absolutely stunning $ 500 million heist from the Central Bank in Angola, and how it almost slipped away, and subsequently foiled.

I recall a smaller amount siphoned from Central Bank of Bangladesh a few years ago.

The $500 Million Central Bank Heist—and How It Was Foiled - WSJ.pdf (1.3 MB)

@vivekbothra has done a wonderful analysis on LEEL Electricals, and how management / promoter used their magic wand to make cash dissapear.

Minority investors lose, and the template is a standard one that I have seen used elsewhere too. Studying this will help us uncover such traps (which I have often fallen into), but never fails to stun me

PFA, a presentation I had done in Goa. I think forensics is about understanding the underlying brics of the bs/pl and triangulating it with real numbers that often form a verifiable trail (like the hansel and gretel story) often makes for a well rounded view of the numbers and hence the management’s intentions.

The presentation is only for educational purposes and there no stock specific recommendations in it. I have no interest in discussing any specific companies for obvious reasons. Basics of forensic.pdf (1.1 MB)

veteran members of this forum are sharing valuable tools to sharpen our weapons. In this moment of carnage in the market we should hone our skill and then start buying very selectively to built a life time portfolio.

the beauty of this forum is that even if you do not earn in the market you tend to learn a lot from the valuable postings in this forum.

Thanks Vardharajan and all those who are voluntarily sharing their knowledge and insights in this forum for the benefit of all…

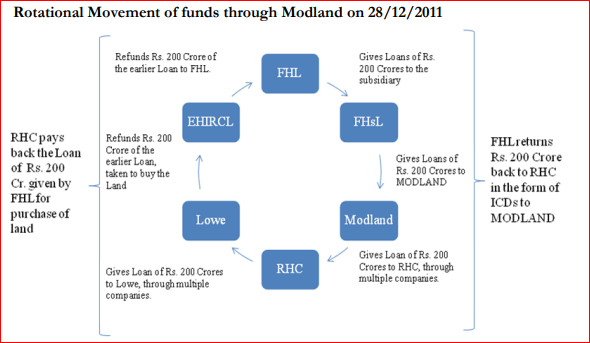

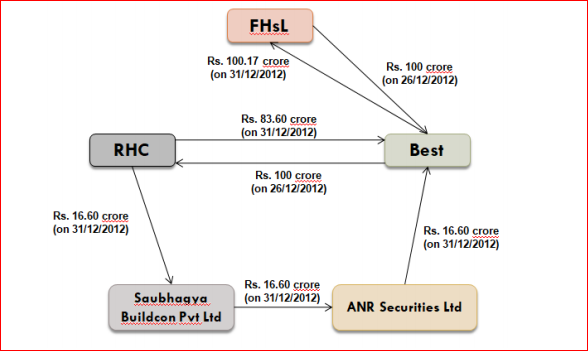

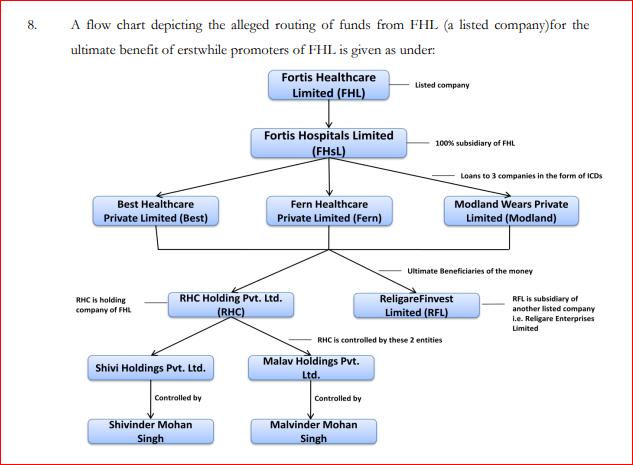

SEBI’s order “in the matter of Fortis Healthcare Limited” is very instructive of how corporates use cash from a listed company and move it to Promoter entities while skirting rules on related party transactions.

Fortis moved Rs 400 crores as Inter Corporate Deposits to seemingly arm’s length entities, who then through a series of transactions gave it to promoter entities for purchase of land etc. SEBI has done well to hire a forensic agency to unearth how these things work, and the order is for us to learn, spot and avoid.

The full order can be found here SEBI order on Fortis and the Singhs.pdf (619.4 KB)

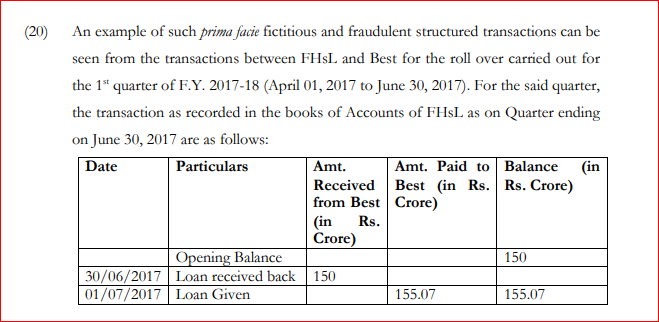

Apparently, “These loans were given in the beginning of each quarter and returned by the companies by the end of the quarter and thereby never reported in the balance sheet as the

outstanding amount at the end of the quarter was NIL. This has been happening from

the FY 2013-14 onwards.”

Some interesting transaction are extracted and depicted below:

Loans taken from Fortis shown as repaid by taking another loan in a rotational manner:

A sample loan transaction (page 7) that indirectly gives loan to RHC (a promoter company) via some intermediary company (likely filled with proxies/benamis). FHsL is Fortis Hospitals

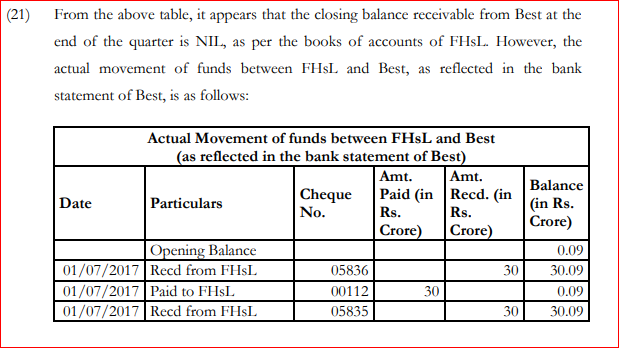

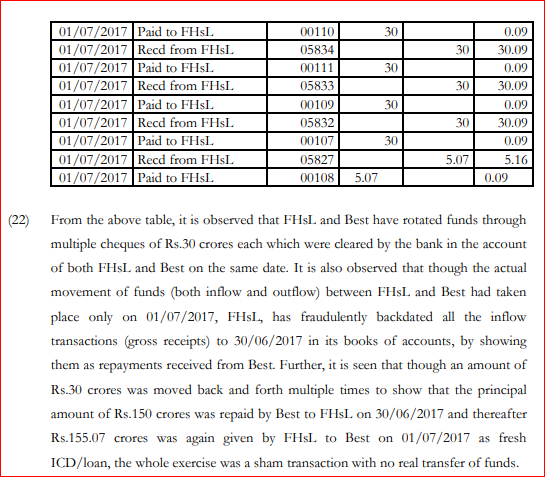

But what took the cake was how ICDs were shown as repaid when actually the same amount was presented 5 times and cleared 5 times to the same Axis Bank!!!

And, finally, how the ultimate promoters, the Singhs are all linked:

I feel such a chart should be provided for all listed family owned firms :)))

Hats off to SEBI!!!

Why Mr. G N Bajpai resigned from the newly constituted board of IL&FS?

https://t.co/8JYvr6t4pR and the video of my presentation.

Just read good articles on various wrong doing by company. So shared a link

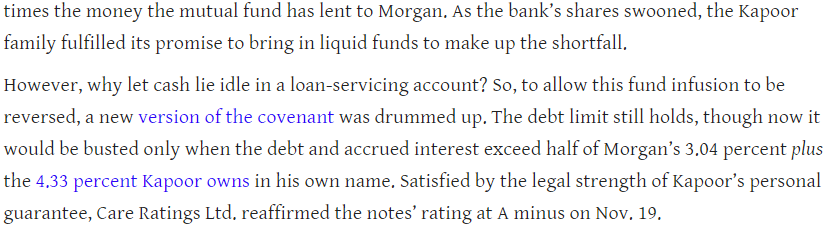

Andy Mukherjee of Bloomberg does a bit of digging up and he found that Yes Bank Promoters have effectively borrowed against their shares legally circumventing the pledge rule disclosure.

Morgan Credits Pvt Ltd, a Yes Bank Promoter is raising / has raised Zero Coupon NCDs worth up to Rs 1160 crores, by promising that it will keep its shares at a 50% margin to market cap and its Yes Bank shares unencumbered. CARE report says _"… while the debt cap (i.e. ratio of total borrowings of MCPL to market value of Yes Bank Ltd (YBL) shares held by MCPL) shall not exceed 0.5x at all times"_ In substance it is loan against shares though not in form. The report does not say if there is a recourse to Yes Bank shares in case Morgan Credits defaults on its NCDs.

Andy’s tongue in cheek style makes it interesting reading.

The more important point Andy makes is that the lenders are Mutual Funds and says that they do not seem to have learnt from the IL&FS bustup. In fact as Yes Bank shares went below 50% of its peak price, Rana Kapoor’s personal stake came into play!

Digging-up such a thing must require amazing amount of work. The amount of financial engineering here is mind-boggling.

That a mutual funded has lend the money without collateral based on some if-else conditions in my opinion is quite risky. Lending money in this way has made mutual funds equivalent to banks/nbfc except they are not regulated by RBI.

I imagine it would also be important to know for what purpose the money has been used.

Dear Sir

Please provide link of your other presentation or similar presentations by other.

Regards